Xerox Offers Investors 3%-Plus Dividend Yield (XRX)

By: Ned Piplovic,

After suspending its dividend distributions in 2001, the Xerox Corporation (NYSE:XRX) reintroduced rising dividend distributions in 2008 and currently offers investors a dividend yield of more than 3%.

The company increased its quarterly dividend payout amount six-fold from 1972 to 2000. After cutting the quarterly payout 75% for the first two periods of 2001, the company eliminated the dividend payouts completely after the second quarter distribution. However, following a six-year absence, the company reintroduced its dividend distributions for the first quarter 2008.

After paying the same flat quarterly dividend through the last quarter of 2012, Xerox boosted its quarterly dividend payout more than 80% before a four-for-one reverse stock split in the second quarter of 2017. The company has maintained a steady $1.00 annual dividend distribution since then.

This annualized dividend supported a rising share price to deliver to its shareholders a total return of more than 7.5% over the past 12 months. The company’s current dividend payout ratio of 72% is above the 50% upper limit considered as sustainable. However, the payout ratio is declining and is already 11% below Xerox’s own 81% average payout ratio over the past five years.

The share price has experienced some sideways movements over the past few years and the dividend distributions remained flat over the past nine quarters. However, a moderate dividend yield, a positive technical indictor for extended share price growth and a corporate reorganization as a wholly-owned subsidiary of a new holding company should allow Xerox increased strategic, financial and operational agility in the near future.

After a detailed evaluation of Xerox’s financial and operational potential, interested investors might consider including the stock as part of their investment portfolio. This might be an option particularly for investors with higher risk tolerances looking to invest a small portion of their portfolio in a higher-risk and higher potential return equity. However, any interested investors should act before the upcoming March 28, 2018, ex-dividend date to secure eligibility for receiving the next round of dividend distributions on the April 30, 2019, pay date.

Xerox Corporation (NYSE:XRX)

Headquartered in Norwalk, Connecticut, and founded in 1906 as the Haloid Photographic Company, the Xerox Corporation designs, develops and sells document management systems and solutions worldwide. The company’s core business comprises desktop monochrome and color printers, multifunction printers, copiers, digital printing presses, light production devices, graphic communications and commercial printers and inkjet presses. Additionally, the company also offers software solutions for the automation and integration of print jobs through its FreeFlow Digital Publisher cloud-based software portfolio. Furthermore, the company also provides workplace services, including managed print services, digitization services and digital solutions, such as workflow automation, personalization software and content management. The company also sells paper products, wide-format systems and network integration solutions, such as Xerox Business Solutions. With demand reduction for traditional printing and scanning services, Xerox is looking to reduce the share of its core markets revenue to nearly half by expanding its current offering of software and other digital services, as well expanding into new markets. Xerox’s new expansion target markets comprise digital packaging, 3D devices, Internet of Things (IoT) sensors and services, as well as Artificial Intelligence (AI) workflow assistance technology.

The current $0.25 quarterly dividend distribution is equivalent to a $1 annual dividend payout amount and a 3.1% dividend yield. Because of the flat dividend payout and a rising share price, Xerox’s current dividend yield is approximately 30% lower than the company’s own 4.54% average dividend yield over the last five years.

While trailing the company’s own five-year average, Xerox’s current 3.07% dividend yield is nearly 60% higher than the 1.95% simple average yield of the entire Consumer Goods sector. Additionally, Xerox’s current dividend yield also outperformed the 2.63% average dividend yield of the overall Business Equipment industry segment by nearly 20%.

Xerox enhanced its quarterly dividend payout nearly 50% during a streak of four consecutive annual hikes between 2013 and 2017, which is equivalent to a 10% average annual growth rate. Even extending that same growth across a longer time horizon to include the last nine consecutive quarters of flat dividend payouts corresponds to an average growth rate of 6.6% per year.

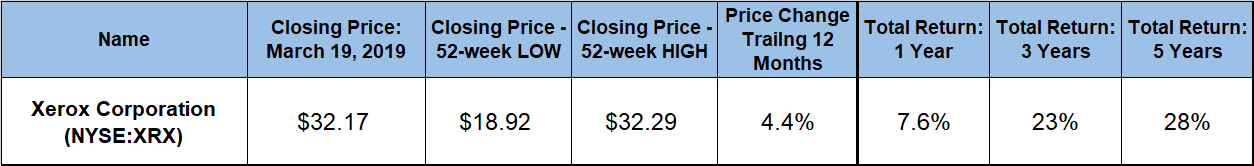

The Xerox Corporation’s dividend distributions complemented the asset appreciation to reward the company’s shareholders with a 7.6% total return over the past 12 months. The company also delivered 23% and 28% total returns over the extended periods of the past three and five years, respectively.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic