2 Equities Offer 3% Yields and 10-Plus Consecutive Years of Dividend Boosts

By: Ned Piplovic,

A well-known consumer products corporation and a regional natural gas utility company offer their stockholders consecutive dividend boosts over the past dozen years and 3% yields.

Both companies have records of paying a dividend for more than 90 years and neither company has lowered its annual dividend amount over the last two decades. With moderate asset appreciation and steady dividend boosts, these two stocks are worthy of considering.

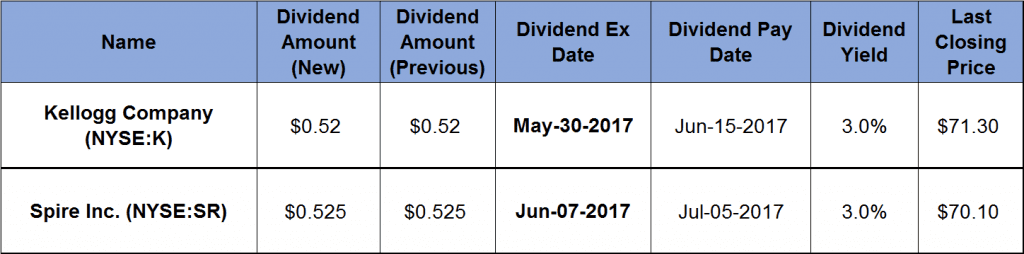

Mid-June and early-July pay dates are scheduled just a few weeks after the late-May and early-June ex-dividend dates, which is an easy way to pick up 3% dividend yield while taking a long position in these stocks.

Kellogg Company (NYSE:K)

Kellogg Company operates through U.S. Morning Foods, U.S. Snacks, U.S. Specialty, North America Other, Europe, Latin America and Asia Pacific segments to manufacture and market ready-to-eat cereal and convenience foods. The company’s principal products include cookies, crackers, savory snacks, toaster pastries, cereal bars, fruit-flavored snacks, frozen waffles and vegetable foods. Additionally, the company offers an assortment of protein beverages, as well as health and wellness bars. The Kellogg’s Company distributes its products through direct sales, brokers and distributors under multiple brand names, which include Kellogg’s, Keebler, Pop-Tarts, Cheez-It, Eggo, Pringles, Famous Amos and more. The Kellogg Company was founded in 1906 and is headquartered in Battle Creek, Michigan.

The current quarterly dividend of $0.52 is equivalent to a $2.08 annual payout and a 3% yield, which is 4.2% higher than the company’s average yield over the last five-year. The company has been paying a dividend for the past 94 years and has failed to raise it only three times in the past 20 years when the dividend remained the same amount for three straight years between 2002 and 2004. Since 2004, the company rewarded its shareholders with 13 years of consecutive annual dividend boosts. Over those 13 years, the annual dividend amount grew at an average 5.7% per year.

The share price experienced some volatility and lost 5% of its value over the past 12 months. However, the share price should grow in the long-term as the company figures out how to adjust its operation through already announced layoffs and facility closings, as well as reformulating their products to meet the changing customer tastes.

Kellogg Company’s Chairman and CEO John Bryant used the company’s annual conference in April to inform shareholders that he is confident in the company’s cereal and snack businesses’ long-term performance, while eyeing future areas of growth in technology and emerging markets Additionally, Mr. Bryant addressed consumers’ changing definition of health and wellness food by saying, “You go back to times and it was defined as low-fat, low-calorie, defined as added vitamins, qualifications, etc. Now, increasingly, health and wellness means the absence of negatives. It could be GMO-free, gluten-free, any number of definitions along those lines. Simple, simple foods.”

While this stock might not be the first choice for investors looking for fast, high asset appreciation, it is well suited for anyone looking for long-term asset growth paired with a steady dividend income.

Spire Inc. (NYSE:SR)

Spire Inc. engages in the purchase, retail distribution and sale of natural gas to residential, commercial and industrial users in Missouri and Alabama. It operates through two segments, Gas Utility and Gas Marketing. The company also is involved in marketing natural gas and related activities on a non-regulated basis to utility transportation customers, as well as to retail and wholesale customers. Additionally, the company engages in the transportation of propane through its propane pipeline, compression of natural gas, risk management and other activities. Spire Inc. was founded in 1857 as the Laclede Gas Light Company. The company was the eighth oldest stock listed on the New York Stock Exchange (NYSE) and one of the original 12 industrial companies that made up the Dow Jones Industrial Average. The company changed its name to Spire Inc. in April 2016 and is headquartered in St. Louis.

The current annual dividend amount of $2.10 is distributed quarterly and yields 3%. The 7.1% quarterly dividend hike at the beginning of the year is just the most recent dividend increase in a line of 14 consecutive annual dividend boosts. Over the past 20 years, the company failed to boost its dividend only once.

After a quick 15% rise in May and June 2016, the share price peaked slightly above $70, before reversing trend and dropping 20% to reach its 52-week low in early October 2016. Since the October low, the share price fully recovered and is currently trading again above the 52-week peak level of $70, which is 13.4% above the share price from May 2016.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic