2 Equities Offer Opportunity for a Quick 4% Yield

By: Ned Piplovic,

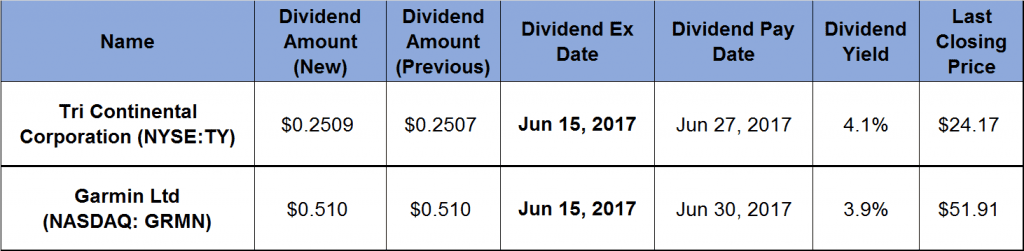

Two equities with ex-dividend dates this week yield a 4% dividend and have returned 18% or more in asset appreciation over the past 12 months.

Additionally, the two equities have performed well over the longer term, returning 60% and 67% asset appreciation over the last five-years. Investors considering these equities for income and asset growth should act quickly as both equities go ex-dividend on June 15, 2017.

Tri Continental Corporation (NYSE:TY)

Tri Continental Corporation is a closed-end fund managed by Columbia Threadneedle Investments, which was created through a 2015 merger of Columbia Management and London-based Threadneedle Investments. Despite changing management companies a few times, the fund has been in existence since 1929 and has paid a dividend for the last 73 years. Half of fund’s assets are allocated in three sectors – Information Technology, Financials and Healthcare. As of April 2017, Microsoft, Inc (NASDAQ:MSFT), Bank of America (NYSE:BAC), AT&T (NYSE:T), Merck & Co. (NYSE:MRK) and Cisco Systems (NASDAQ:CSCO) were the fund’s top five holdings.

Scheduled to be paid on June 27, 2017, the fund’s latest quarterly dividend is only marginally higher – 0.08% – than the previous quarter’s amount. The quarterly distribution of $0.2509 converts to a $1.0036 annual payout and a 4.1% yield, which is 12.2% higher than the fund’s five-year average yield of 3.7%.

The fund boosted its annual dividend payout and an average rate of 23% for the past eight consecutive years. Over that period, the total annual distribution amount rose five-fold.

Since the end of June 2016, the share price rose 23.4% from its 52-week low to reach its 52-week high on June 8, 2017. Over the last five years, the share price grew 60%. The share price’s 50-day moving average (MA) was going down for more than a year between July 2015 and the end of November 2016, when it came close to crossing the 200-day moving average (MA) in a bearish manner. However, the 50-day MA reversed course and has been growing since December 2016, which could indicate that the share price has more upside potential and could keep rising, at least in the short turn.

Garmin Ltd (NASDAQ: GRMN)

Garmin Ltd., develops, manufactures and sells a range of navigation, communication and information devices. Through one of its segments, the company makes global positioning systems (GPS), infotainment solutions, action cameras, light control systems, hazard avoidance devices, weather radars, radar altimeters, automated logbooks, chartplotters, multi-function displays and fish finders for the automotive, aviation, marine and outdoor industries. Through its fitness business segment, the company manufactures multi-sport watches, cycling computers, cycling power meters, cycling safety products and activity tracking devices. Additionally, it makes Garmin Connect and Garmin Connect Mobile, which are Web and mobile platforms for users to track and analyze their fitness and wellness data. Founded in 1989, the company is headquartered in Schaffhausen, Switzerland.

The company raised its annual dividend payout five years in a row between 2011 and 2016 and paid the same $2.04 annual distribution in 2017 as it did in 2016. That current annual payout is paid in $0.51 quarterly installments and returns a 3.9% yield. Since 2011, the annual dividend payout increased at an average rate of 3.5% every year.

The share price rose almost 40% in June and July 2016 to reach its 52-week high of $59.19 at the end of July 2016. After that brief spike, the share price dropped slightly and has been trading in the $48 to $52 range since August 2016. As of closing on June 8, 2017, the share price was about 7.5% below the peak from July 2016. However, the current price is 28.8% above the June 2016 price level and 67% higher than it was five years ago.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic