2 Securities Boost Dividends and Provide Asset Appreciation

By: Ned Piplovic,

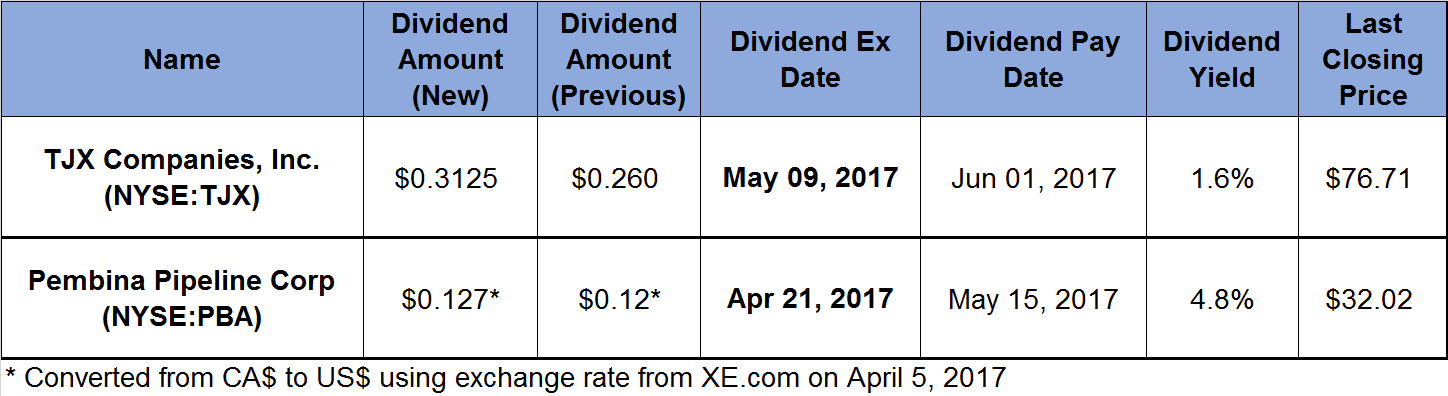

A U.S.-based discount retailer and a Canadian energy transport company announced dividend boosts of 20% and 6.25%.

With these dividend hikes, the two companies extended their streak of paying rising dividends to 20 years and 7 years, respectively. In addition to the benefit of dividend income, one of the investments rewarded its shareholders with asset appreciation of 24% over the past year.

TJX Companies, Inc. (NYSE:TJX)

The TJX Companies, Inc. operates as an off-price apparel and home fashions retailer in the United States and internationally. It operates through four segments: Marmaxx, HomeGoods, TJX Canada and TJX International.

The company sells apparel, home fashions, seasonal items, jewelry and other merchandise under the T.J. Maxx, Marshalls, HomeGoods, Winners, HomeSense, T.K. Maxx and Sierra Trading Post brands. Additionally, TJX runs three e-commerce sites. As of January 2017, the company operated more than 3,800 stores in the United States, Canada, Europe and Australia.

The company declared a 20% dividend boost, which brings the quarterly dividend to $0.3125 per share. This quarterly payout converts to a $1.25 annualized distribution with a 1.6% yield. The company has boosted its dividend by an average rate of 23.3% every year for the past 20 years. The current annual dividend payout is more than 65-fold higher than the annual payout in 1997.

The share price experienced some volatility during the last year. After gaining 10% between April and the 52-week high in August 2016, the price dropped 17% and reached its 52-week low by early November. Since the November low, the share price rose 7.3%. The closing price on April 4, 2017, was about 8% below the August price peak and about even with the price from April 2016.

During March 2017, the share price has struggled to break through the $80 resistance level. If it manages to break through that resistance, the share price could see a significant growth in the short term. While many retailers are struggling, closing stores and filing for bankruptcy protection, TJX has continued to post steady gains in sales and earnings.

Pembina Pipeline Corporation (NYSE:PBA)

Pembina Pipeline Corporation provides transportation and midstream services for the energy industry in North America. Through its four segments – Conventional Pipelines, Oil Sands & Heavy Oil, Gas Services and Midstream – the company operates more than 6,000 miles of pipelines throughout Alberta, British Columbia, Saskatchewan and North Dakota, 14 truck terminals, 34 pipeline connections, ground storage in Edmonton with approximate capacity of 900,000 barrels and two natural gas liquids (NGL) operating systems. Pembina Pipeline Corporation has its headquarters in Calgary, Canada.

The company boosted its annual dividend for the seventh consecutive year. In Canadian currency, the current dividend hike of 6.25% raises the monthly dividend payout from CA$0.16 to CA$0.17. Converted to U.S. dollars, the $0.127 monthly distribution equals a $1.52 annual dividend and a 4.8% yield. Over the last seven years, the company enhanced its annual payout by an average of almost 4%.

The share price experienced relatively stable growth with only minor volatility since its 52-week low in April 2016. The current share price of $32 is only 3.7% below its 52-week high from February 17, 2017, and 24% above the 52-week low from April 2016.

The company invested $3 billion in building additional capacity that is scheduled to come online fully by the middle of 2017. Based on volume estimates and the current commodity price environment, Pembina Pipeline plans for the beefed up capacity to generate an additional $450 million to $700 million of earnings before interest, taxes, depreciation and amortization (EBITDA) for fiscal 2018. The benefits of the largest capital investment program in Pembina’s history are on track to achieve the company’s strategy to double its 2015 adjusted EBITDA by 2018.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic