2 Stocks Boost Dividends for 35-Plus Years, Pay 3.1%-Plus Yields

By: Ned Piplovic,

A regional bank from Kentucky and a company that designs and distributes footwear offer their investors a track record of more than 35 consecutive years of steady dividend growth and current yields of slightly above 3%, which are 77% and 196% higher than the average yields of these two companies’ respective industries.

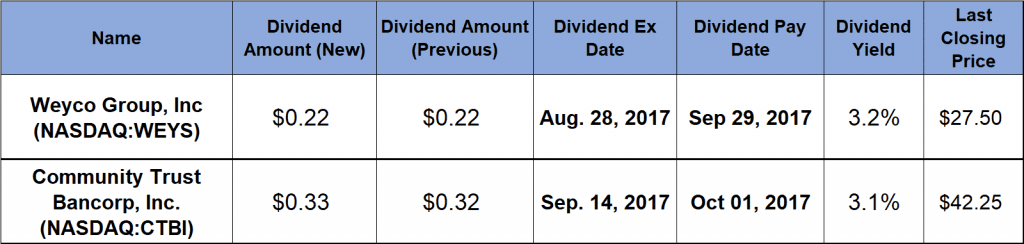

In addition to the steady and rising dividend income, these two companies reward their shareholders with moderate asset appreciation as well. While the Weyco Group, Inc (NASDAQ:WEYS) will pay its current quarterly dividend on Sept. 29 to all shareholders of record before its Aug. 28, 2017, ex-dividend date, Kentucky-based Community Trust Bancorp, Inc. (NASDAQ:CTBI) has its ex-dividend date on September 14, 2017, with an Oct. 1 pay date.

Weyco Group, Inc (NASDAQ:WEYS)

Founded as the Weyenberg Shoe Manufacturing Company in 1896, Weyco Group, Inc., designs and distributes footwear through its retail and wholesale segments in North America. While some shoe enthusiast or investors might not be familiar with the Weyco company name, the company designs and markets footwear for men, women and children under well-known brands like Florsheim, Nunn Bush, Stacy Adams, BOGS, Rafters and Umi. The company’s market offerings are mid-priced leather dress shoes, sandals, outdoor boots and casual footwear of man-made materials or leather. While the company distributes most of its products through its wholesale channels, Weyco owns and operates 13 retail stores in the United States and operates a website. Additionally, the company has licensing agreements with third parties who sell its branded apparel, accessories and specialty footwear in the United States, as well as its footwear in Mexico and few additional markets internationally. The company changed its name to Weyco Group, Inc. in April 1990 and is based in Milwaukee, Wisconsin.

The share price encountered some volatility over the past year with two clearly discernable trends. First, the share price rose 26% from $25.59 in mid-August to $32.30 at the end of December 2016. After peaking on December 26, 2016, the share price reversed trend and lost 17.7% by August 15, 2016, when the price closed at $27.50, which is still 7.5% higher than it was 12 month ago.

The company pays a current quarterly dividend of $0.22, which translates to an $0.88 annual dividend and a 3.2% yield. While the current quarterly dividend is the same as it was for the last quarter, it is 4.8% higher than the quarterly payout one year ago. Over the past 20 years, the company enhanced its annual distribution amount more than eight-fold by growing the annual dividend at an 11.1% average annual rate over the last two decades. However, that 20 years of consecutive dividend hikes is just slightly more than half of the company’s current streak for successive years of dividend boosts, which currently stands at 35 years.

Community Trust Bancorp, Inc. (NASDAQ:CTBI)

Founded in 1903 and headquartered in Pikeville, Kentucky, the Community Trust Bancorp, Inc. operates as the bank holding company for Community Trust Bank, Inc. The bank provides commercial and personal banking services to small and mid-sized communities mostly in eastern Kentucky, with a few additional locations in West Virginia and Tennessee. Through its network of 80 banking locations and five trust offices, the bank provides time and demand deposit banking services, Keogh plans, commercial and personal loans, cash management and funds transfer services. The company acts as a trustee of personal trusts, executor of estates, trustee for employee benefit trusts and a pay agent for bond and stock issues, as well as an investment agent and depositor for securities. Additionally, the bank offers annuity and life insurance products, a full-service securities brokerage and trust and wealth management services.

The total annual dividend payout of $1.32 yields 3.1% and is distributed as a $0.33 quarterly dividend payout, which is 3.1% higher than the previous quarter’s $0.32 distribution. This most recent dividend boost marks the 37th consecutive hike of the annual dividend distribution. Just over the past two decades, the company managed to triple its annual dividend distribution by raising the annual payout at an average rate of 6.1% every year.

The share price traded relatively flat between mid-August and the end of October 2016. However, the share price jumped 36% between early November and the end of 2016 when it reached its all-time high of $51.35. Since that peak, the price declined slightly and closed on August 15, 2017, about 15% lower at $42.25. However, that price level still represents a 7.2% gain over the August price from one year ago.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic