2 Stocks Continue Decades-Long Trend of Hiking Annual Dividends

By: Ned Piplovic,

Two major equities maintained their record of boosting annual dividend payouts for more than a decade, while offering their shareholders dividend yields around 4.5%.

Share prices of both stocks have declined during the last 12 months. However, under the right circumstances, both companies could easily reverse the downtrends and turn the current share-price dip into a buying opportunity.

Verizon Communications Inc. (NYSE:VZ)

Verizon Communications Inc. provides communications, information, and entertainment products and services to consumers, businesses and governmental agencies worldwide. Verizon Communications Inc. was founded in 1983 and is headquartered in New York City, New York.

The stock price rose 6% between March and early July 2016 when the price reached its 52-week high. After dropping almost 24% between the July 2016 peak and early November of that year, the price recovered some of its losses. As of March 23, 2017, the share price was $49.64, which is 7.3% below its price during March 2016.

The current annual dividend of $2.40 per share is distributed quarterly and equates to a 4.6% dividend yield. Verizon has been paying a dividend since 1984 and has raised its dividends for the last 13 consecutive years. Over that period, the annual dividend payout grew at an average annual rate of 3.2%. The current yield is 8.2% higher than the five-year average yield of 4.3%.

Some of Verizon’s meager performance over the past year could be attributed to the recent competition from other providers that reintroduced unlimited data plans for their mobile phone services. However, now that Verizon is offering unlimited data plans as well, the company should be able to compete for customers by leveraging its wide service coverage and network reliability. If the company resumes growth and the share price follows the trend, the current price drop could be a good opportunity to take a long position in the stock while enjoying the benefits of a steady dividend income.

Target Corporation (NYSE:TGT)

Target Corporation operates as a general merchandise retailer. It offers household essentials, apparel, home furnishings, small appliances, home improvement and automotive products, music, movies, books, computer software, sporting goods and toys. In addition, it offers in-store amenities, including Target Café, Target Photo, Target Optical, Starbucks, and other food service offerings. Target Corporation sells products through its stores; and digital channels. As of March 20, 2017, the company operated 1,806 stores in the United States. Target Corporation was founded in 1902 and is headquartered in Minneapolis, Minnesota.

Like most of the brick-and-mortar retailers, Target has struggled a little over the last 18 months. The result was a stock price volatility and a general downward trend. Target’s current share price as of March 23, 2017 was $53.14, which is 35% lower than one year ago.

While the share price underperformed, Target’s dividend performance has exceeded the retail sector average by a wide margin. The company has been paying a dividend for 52 years and increasing its dividend for the last 45 consecutive years.

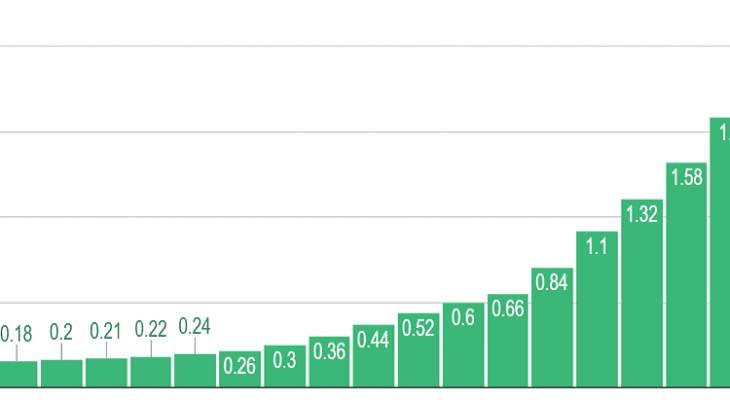

The current quarterly dividend of $0.60 converts to a $2.40 annual distribution and a 4.5% yield. Over the past 20 years, the company has boosted its annual dividends by an average of 16% per year. Consequently, the current annual payout is almost 20-fold higher than the payout two decades ago.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic