3 Health Care Stocks Raise Annual Dividend Payouts Again

By: Ned Piplovic,

Three companies in the health care sector are extending their multi-year record of increasing annual dividend payouts and offer dividend yields that are three times higher than the industry’s average.

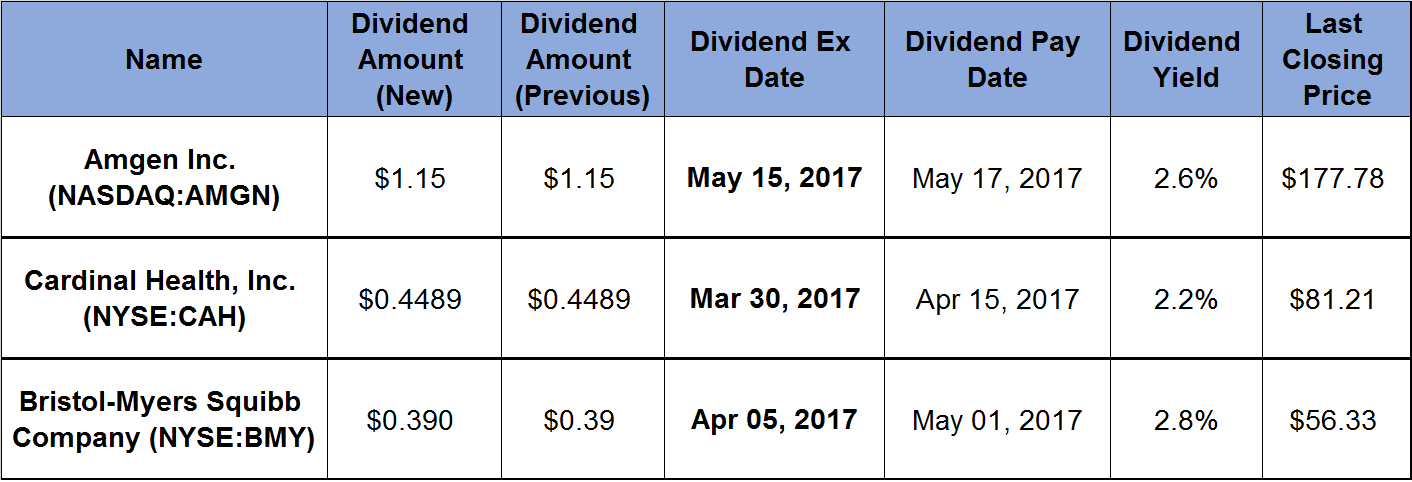

With a combined average dividend yield of around 2.5%, yields of these three stocks are triple the current health care sector average of 0.85%. Additionally, these investments have been raising their annual payouts between six and 20 consecutive years.

With ex-dividend dates ranging from March 30 to May 15, 2017, interested investors have plenty of time to evaluate these companies and decide whether to bet on their future performance.

Amgen Inc. (NASDAQ:AMGN)

Amgen Inc. develops and manufactures products for the treatment of illness in the areas of oncology/hematology, cardiovascular, inflammation, bone health, nephrology and neuroscience. The company has collaborative agreements with Pfizer Inc., UCB, Inc. and Bayer HealthCare Pharmaceuticals Inc. Amgen Inc. was founded in 1980 and is headquartered in Thousand Oaks, California.

The company’s share price rose16.5% in March and April 2016, before experiencing some volatility and dropping to its 52-week low of $133.64 by November 4, 2016. Fortunately for Amgen’s investors, the share price stabilized afterwards and rose 35% between the November low and March 3, 2017, when it reached its new 52-week high. Over the last five years, Amgen’s share price appreciated 164%.

The annualized dividend payout for 2017 is on track to be Amgen’s sixth consecutive year that the company boosted its annual payout. Since 2011, the annual distribution amount rose at an average 42% per year, which resulted in an eight-fold increase over the last six years. The $4.60 annual dividend is paid quarterly and yields 2.6%. Compared to the average industry yields, Amgen’s current dividend yield is more than three times higher.

Cardinal Health, Inc. (NYSE:CAH)

Cardinal Health, Inc. operates as a health care services and products company worldwide. The company’s Pharmaceutical segment distributes branded and generic pharmaceuticals, over-the-counter health care, specialty pharmaceutical and consumer products to retailers, hospitals and other health care providers. Through its Medical segment, the company distributes a range of medical, surgical, and laboratory products and services to hospitals, ambulatory surgery centers, clinical laboratories and other health care providers, as well as to patients in the home. In addition, Cardinal Health offers supply chain services, including spend, distribution and inventory management services to health care providers and post-acute care management.

Cardinal Health’s current share price is about 2% lower than at the beginning of March 2016. The share price appreciated 16% by April 21, 2016, and then went through several up-and-down cycles, including a 12% drop over two weeks leading up to November 8, 2016, when the price reached its 52-week bottom. Since the November low, the share price reversed to resume an uptrend. While the current price is still 7.6% short of the April peak, it has risen back to March 2016 levels.

The current annual dividend payout of $1.80 yields 2.2% and is Cardinal Health’s 20th consecutive annual dividend boost. Since 1997, the annual distribution grew at an average rate of 22% per year. The company has been distributing dividends since 1983.

Bristol-Myers Squibb Company (NYSE:BMY)

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets and distributes biopharmaceutical products worldwide. The company offers chemically synthesized drug or small molecule, and biologic in various therapeutic areas, such as oncology; cardiovascular; immunoscience; and virology comprising human immunodeficiency virus infection (HIV). Bristol-Myers Squibb Company, founded in 1887, is headquartered in New York, New York.

The company’s share price experienced a fair amount of volatility over the past year. It lost 27% since its July 2016 52-week high and is 15% lower than the March 2016 price. The 52-week low of $46.01 occurred on January 26, 2017. However, since the January low, the share price rose steadily and is currently 22% above the bottom price from January.

The company’s current annual dividend of $1.56 yields 2.8% and is 2.5% higher than the average dividend over the past five years. BMY started paying a dividend in 1900. The current record of consecutive annual payout boosts is eight years. Since 2009, Bristol-Myers Squibb hiked its annual payout by an average 3% every year. Including a few years of flat dividend payouts, BMY maintained a 5.2% average annual growth rate for its annual dividend for the last 20years.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily.

To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic