3 High Dividend Stocks Owned by Bill Gates

By: Jonathan Wolfgram,

Three high dividend stocks owned by Bill Gates are worth assessing due to his recent divorce announcement with his wife Melinda Gates, leading to questions about the joint estate of the multi-billionaires.

While the duo will continue to work together as business partners at the nonprofit Bill & Melinda Gates Foundation, the end of their marriage signals a split in their private investment accounts. The foundation itself, however, will likely maintain many of its current holdings.

Bill and Melinda Gates have the plurality (45.23%) of their foundation’s investment account vested in Berkshire Hathaway (NYSE:BRK.B), a company that has only paid a dividend once in the history of its existence. Many of their other holdings, however, pay regular dividends and can be worthwhile additions to many income investors’ portfolios.

We vetted the ex-husband and wife’s most recent portfolio and picked out 3 high dividend stocks owned by Bill Gates. Here are our picks, listed below, in order of weight in Bill Gates’s portfolio.

3 High Dividend Stocks Owned by Bill Gates #3

Coca-Cola Femsa SAB (NYSE:KOF)

Percent of Bill Gates’ Portfolio: 1.37%

Coca-Cola Femsa SAB (NYSE:KOF) is the largest franchise bottler of Coca-Cola in the world, operating primarily in the Mexican and Brazilian markets. These two countries dominate approximately 80% of Coca-Cola Femsa’s sales, but the company also distributes to Argentina, Uruguay, Panama, Guatemala and much of the rest of Central and South America.

The company is a strong value stock, outperforming the S&P 500 in several metrics. Coca-Cola Femsa’s gross margin — which is one indicator of the overall profitability of a company — reaches 44.8%, beating the S&P 500’s 29.2% gross margin by over 15%. Similarly, the company’s operating margin is a noteworthy 14.3%, 1.6% higher than the average operating margin in the S&P 500. Both of these values, when combined with Coca-Cola Femsa’s low cost of goods sold and high sales, mark the franchise as a profitable and efficient stock buy.

These high margins are likely to increase in the near future. Analysts project Coca-Cola Femsa will sustain 4.2% sales growth in the next year with 9.6% earnings per share (EPS) growth over the same period. The company itself is projecting its earnings before income tax, depreciation and amortization (EBITDA) will grow 30% in one year.

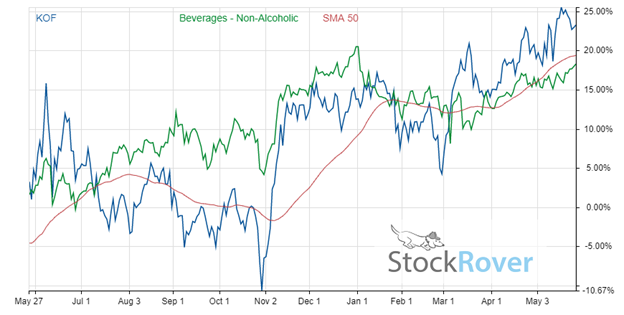

The one-year returns for Coca-Cola Femsa show a 23.3% increase in stock price — the chart below shows these returns after adjusting for dividend growth. Plotted in the same chart are also a 50-day moving average for KOF and the industry dividend-adjusted growth over the same period.

Chart provided by Stock Rover.

Comparing Coca-Cola Femsa to its industry peers shows that while the company suffered a major price pullback in October 2020, its quick recovery has allowed its share price to continue growing at a faster rate than the industry norm. While the non-alcoholic beverage industry has effectively leveled off since the start of 2021, KOF has grown an additional 8.4%.

Coca-Cola Femsa yields 5.1% and pays a semiannual dividend of $1.24 per share, giving investors an annual total of $2.49. Its most recent dividend was announced on April 30 and paid two weeks later on May 14. The announcement gifted investors with a 6% increase over the prior dividend paid near the end of 2020. But with a payout ratio of 93.5%, it is unclear how much more Coca-Cola Femsa can afford to increase its dividend.

3 High Dividend Stocks Owned by Bill Gates #2

Crown Castle International (NYSE:CCI)

Percent of Bill Gates’ Portfolio: 4.18%

Crown Castle International (NYSE:CCI) is a specialty real estate investment trust (REIT) owning and leasing cell towers to wireless service providers. The company owns nearly 100,000 miles of fiber and allows major wireless carriers to build small-cell network infrastructure on top of it.

It is worth mentioning that Crown Castle International is directly tied to a very small number of clients. The “big four” wireless service providers — AT&T (NYSE:T), T-Mobile (NASDAQ: TMUS), Verizon (NYSE:VZ) and Sprint — account for 73% of the company’s revenue. As a result, the REIT very much depends on the collective success of these companies, regardless of their competition with each other.

With this risk in mind, Crown Castle International has the potential for a lot of growth in a short timespan. Projections of the company’s earnings for the next 12 months predict 25.6% EPS growth, more than 10% higher than what is expected of the S&P 500. Sales have historically increased at a fast rate. The company’s sales growth per year averaged 9.8% in the last five years. While sales growth in the coming year is expected to be lower, analysts still predict a healthy 6% rise.

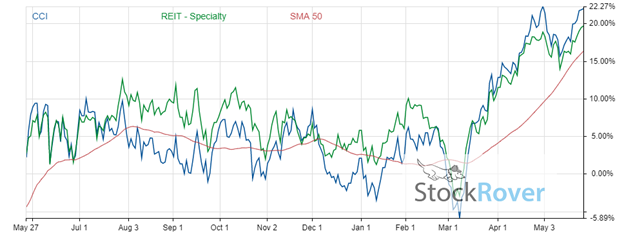

Crown Castle International’s steadily rising earnings and sales are well reflected in its stock price. In the trailing 12-month period, CCI has grown 22%. In the trailing three-year period, the stock grew 105.4%. Both the 50-day moving average and industry norm are plotted in the chart below.

Chart provided by Stock Rover.

A quick look at the trends in the last year show that while CCI’s growth has been stellar, it mirrors the specialty REIT industry almost exactly. While this likely points to a low beta for the stock and decreased volatility, it also diminishes the likelihood of “sky-high” returns by Crown Castle International.

The growth of the company alongside its industry is impressive, but the low volatility and overall safety of the stock are what many income investors are looking for in a dividend stock. With a dividend yield of 2.8%, Crown Castle International pays a quarterly dividend of $1.33 — a value it set in the final quarter of 2020 and has kept level since then. This $1.33 per share payout corresponds to an annualized dividend of $5.32, a number that grows in a direct relationship with CCI’s rising stock price.

As a REIT, the company’s payout ratio is 239.9%. For more information on how REIT’s sustain dividend payout ratios over 100%, read our article Why Do REIT’s Have High Dividend Payout Ratios?

3 High Dividend Stocks Owned by Bill Gates #1

Caterpillar (NYSE:CAT)

Percent of Bill Gates’ Portfolio: 11.24%

Caterpillar (NYSE:CAT) is a well-known, worldwide manufacturer of heavy machinery and construction equipment. With over 15% of the global market share, CAT is the largest heavy equipment manufacturer in the world, operating in more than 2,000 branches with 168 dealers.

The company itself is divided into four segments: resources, energy and transportation, construction and Caterpillar Financial Services. The final segment is a subsidiary-company operating within CAT that provides retail financing to customers purchasing large equipment.

While its growth is likely more limited than the other two stocks on this list, CAT is heralded for its financial strength and overall efficiency. The company has a return on equity of 20.7% and a gross margin of 29.4%, both of which are some of the top values in its industry. High efficiency combined with its level of brand dominance make CAT both highly profitable and — perhaps more importantly — stable in its profitability.

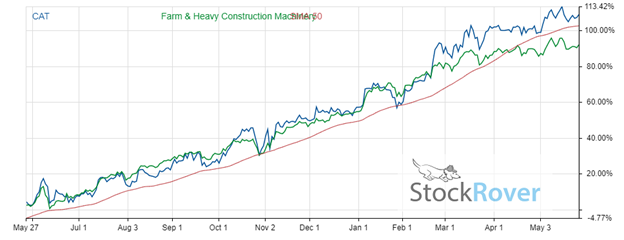

The company has grown at an almost constant rate in the trailing 12-month period, totaling returns of 108.9%. The dividend adjusted returns are plotted with a 50-day moving average and the industry average for heavy construction machinery.

Chart provided by Stock Rover.

Both CAT and the heavy construction machinery industry have increased at a functionally linear rate, only diverging from each other in March 2021. Comparing CAT to its industry average, however, may not be the most productive analysis — as the company maintains such a high market share, its individual performance is a major determining factor in the performance of the industry as a whole. Most other construction equipment companies, in turn, seem to follow CAT.

Revisiting Caterpillar’s stability, the company is a reliable dividend payer among the ranks of both the dividend aristocrats and dividend champions. The dividend aristocrats are an elite group of companies who have increased their dividend for more than 25 consecutive years. There also are a few other requirements, such as a minimum market capitalization and membership in the S&P 500, but the dividend champions forgo these requirements and comprise every stock with more than 25 years of consecutive dividend increases.

CAT has increased its dividend every year for the last 27 years. It yields 1.7% and has a healthy, sustainable payout ratio of 65.3%. These metrics open CAT up to further dividend increases and a continuation of its streak of boosting annual payouts. The company currently pays a quarterly dividend of $1.03, annualizing to a dividend distribution of $4.12, and is due to increase its dividend sometime in the next two quarters to maintain its status as a dividend aristocrat.

The three high dividend stocks owned by Bill Gates featured in this write-up are worth considering for purchase by any investors who are interested in receiving payouts to supplement rising share prices to boost total returns.

Related Articles:

3 Best Dividend Stocks to Buy Now

3 Dividend Growth Stocks to Buy Now

Top 10 Best Screening Tools for Investors

25 High Dividend Stocks in 2020 to Consider Buying

10 High Dividend Stocks Under $20

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Jonathan Wolfgram

Connect with Jonathan Wolfgram