3 High Dividend Stocks to Buy Now

By: Paul Dykewicz,

3 High Dividend Stocks to Buy Now

Three high dividend stocks to buy now feature a business development company (BDC), a national real estate investment trust (REIT) and the owner of diverse middle-market businesses in North America.

The three high dividend stocks include companies that not only offer lofty current dividend yields but the chance for share price gains, too. The three high dividend stocks to buy now are championed by Bryan Perry, a seasoned Wall Street professional who leads the Cash Machine investment newsletter and the Premium Income, Quick Income Trader, Breakout Profits Alert and Hi-Tech Trader.

Kevin O’Leary, chairman of O’Shares ETFs and a wealthy panelist on the “Shark Tank” television program, is among those who has shifted money out of fixed income investments and into dividend-paying equities. The asset allocation for equities and fixed income in O’Leary’s family trust has switched from an even split between equities and fixed income to 70% and 30%, respectively.

Paul Dykewicz interviews Kevin O’Leary, chairman of O’Shares ETFs.

Ares Capital Is One of 3 High Dividend Stocks to Buy Now

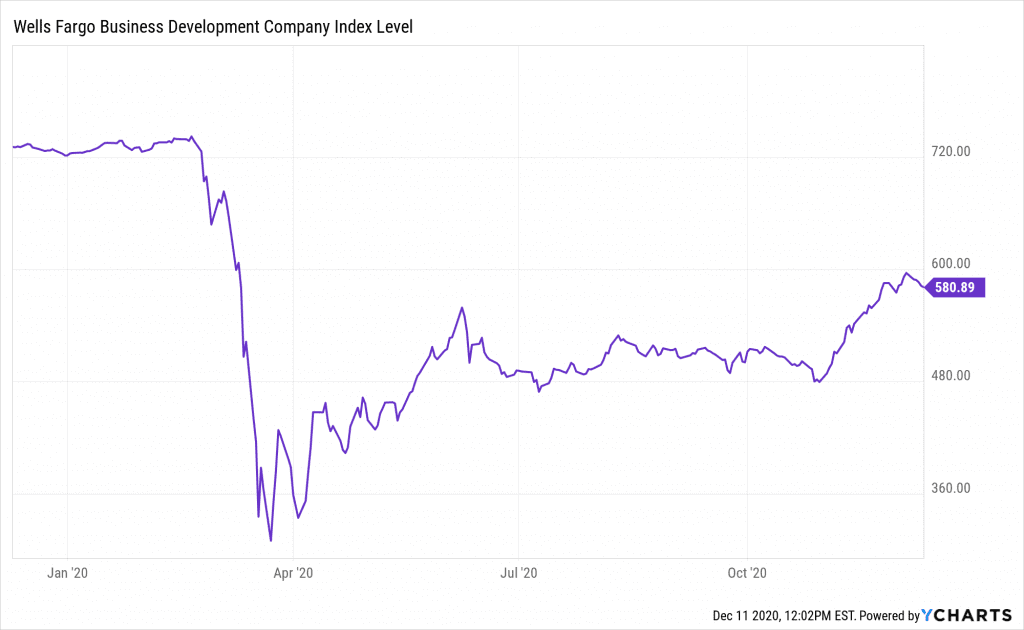

Ares Capital Corp. (ARCC), one of the three high dividend stocks to buy now, is leading a nascent recovery in the BDC sector. After eight months of bearish sentiment and price action, BDCs are starting to rise again.

The upward moves are not big yet but detecting and tapping into such stocks early during their recovery is good news for investors who do not want to miss out on their potential. BDCs are similar to real estate investment trusts (REITs) but have one very different feature — they can employ derivatives, meaning they can attach equity kickers to the loans they write to the borrowing companies.

Because BDCs are regulated investment companies (RICs), they must distribute more than 90% of their profits to shareholders. That RIC status means they do not pay corporate income tax on profits before they distribute them to shareholders.

BDCs lend money to small to medium-sized privately held companies that typically generate between $5-$50 million in sales. It is assumed that once companies start generating revenue above $50 million, they can negotiate more attractive terms than what the BDC market offers.

BDC Fills Vital Niche as 1 of 3 High Dividend Stocks to Buy Now

But if companies need immediate access to capital and want to avoid the lengthier process of bank credit lines and Small Business Administration (SBA) loans, then BDCs are a viable option to companies that need access to capital quickly. That money typically comes at a higher cost and is primarily in the form of floating rate loans that start at 8%-10% and typically are 11%-14%, depending on the borrowing company’s profile and financial strength.

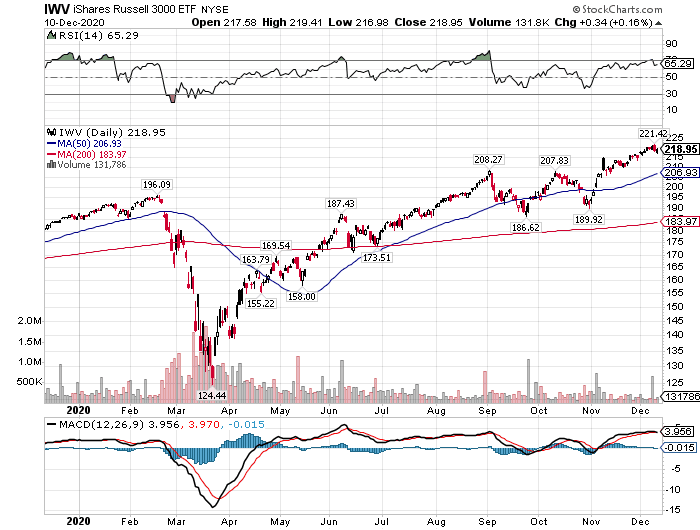

The BDCs loan to and invest in what can be described as micro-cap companies. The market tends to correlate the performance of the BDC sector to that of the Russell 3000 Index (RUA). And quite frankly, it is a very bullish pattern.

Most technicians would salivate over a chart like the Russell iShares ETF (IWV) below – a quintessential double-bottom, higher-low formation, with a high-tight flag handle.

Chart Courtesy of www.StockCharts.com

Chart Courtesy of www.StockCharts.com

BDCs are not going to climb like pure small-cap growth stocks, as they pay out most of their retained earnings in the form of dividends with yields in the range of 7%-15%. It should be well understood that these securities are structured where income takes priority over capital appreciation.

However, the timing of taking a hard look at BDCs is compelling. After the top five or 10 BDCs all posted third-quarter results, it became very clear that their loan portfolios are on solid ground.

Largest BDC Headlines 3 High Dividend Stocks to Buy Now

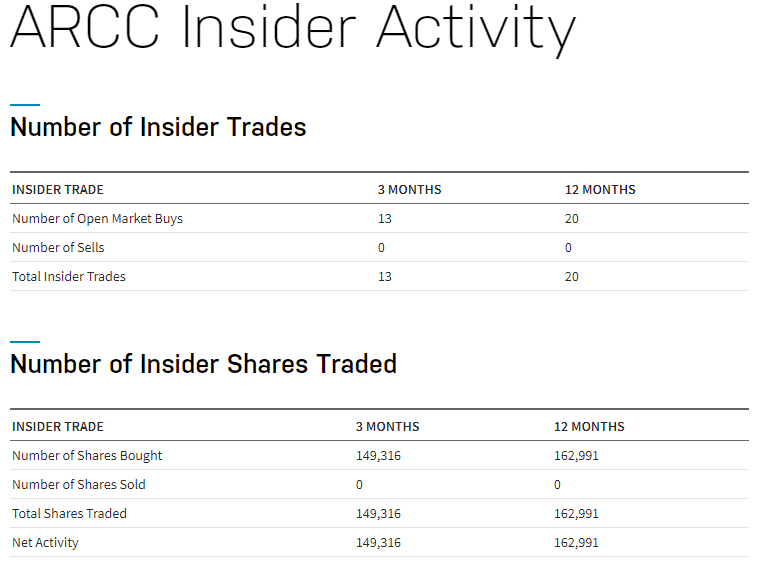

Ares Capital Corp. (ARCC), the largest BDC by Net Assets of $6.96 billion and a market capitalization of $6.58 billion, serves as a good barometer for the health of the sector, Perry opined. But in the past several months, insiders have made 13 open market purchases totaling 149,316 shares — the equivalent of just over $2 million — with no record of any stock sales, continued Perry, who added Ares Capital is a core holding in his Cash Machine investment newsletter’s model portfolio.

Source: www.nasdaq.com

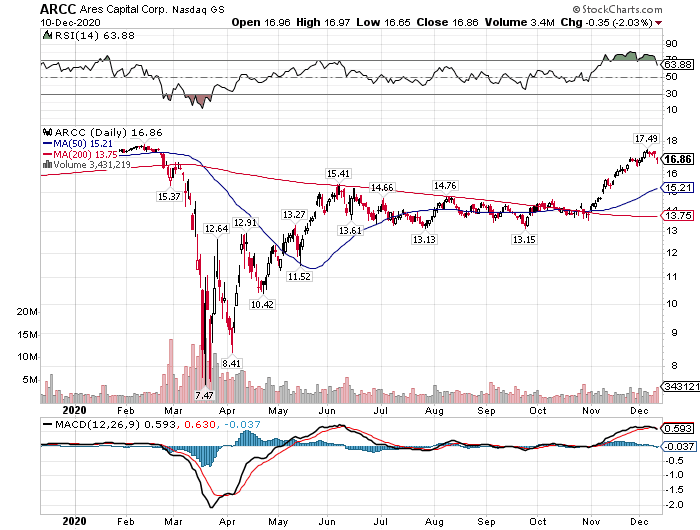

Shares of ARCC pay a dividend yield of 10.25% and have broken out to the upside.

Chart Courtesy of www.StockCharts.com

As 2021 begins, a COVID-19 vaccine now can be administered to the highest-risk people, a new stimulus package is expected, further Fed quantitative easing (QE) is forthcoming and the economy is recovering. After the 2020 downsizings, profits will flow to the bottom line when the broader economy gets back to normal, especially for the smaller companies that have had no margin for error and have withstood the trial by pandemic fire, Perry said.

For income investors who are wondering where the next great opportunity lies for locking in big-time dividend yields and serious cash flow, look no further than the highest quality BDCs. From the Q3 reports, forward guidance and insider activity, it shows that a great deal of the unknown risks clouding the sector for the past many months has been clarified – and the least path of resistance for the sector is up, Perry predicted.

Columnist and author Paul Dykewicz interviews Bryan Perry at a MoneyShow.

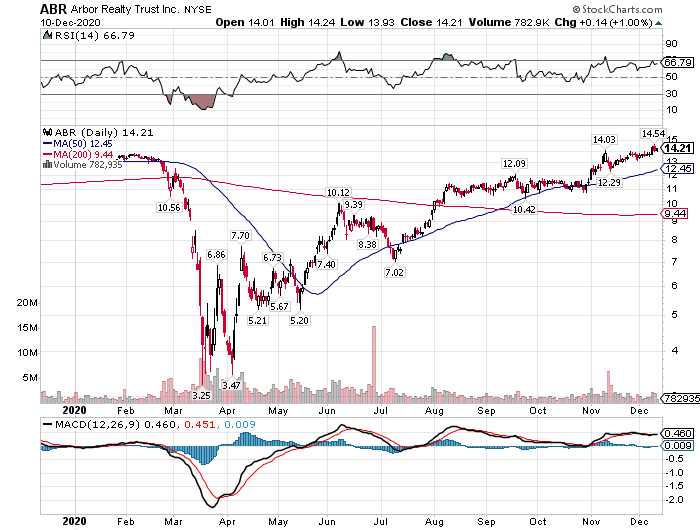

Arbor Realty Trust Is Another of the 3 High Dividend Stocks to Buy Now

Arbor Realty Trust, Inc. (ABR) is a nationwide real estate investment trust that originates and services loans for multifamily, seniors housing, health care and other diverse commercial real estate assets.

As the economy begins to recover from the pandemic in early 2021, Perry forecasts the rotation of capital into value sectors will dominate the investing landscape. In fact, there is evidence this shift has already started to occur following the elections – but it’s still early in the cycle. Real estate is on the receiving end of this sector rotation out of stay-at-home, work-from-anywhere and big-cap tech growth and into value assets, he added.

Arbor manages a multibillion-dollar servicing portfolio, specializing in government-sponsored enterprise products. The company is a Fannie Mae DUS(R) lender and Freddie Mac Optigo Seller/Servicer. Arbor’s product platform also includes CMBS, bridge, mezzanine and preferred equity lending.

Strong Financials Lift 1 of 3 High Dividend Stocks to Buy Now

For Q3, 2020 Arbor posted earnings per share of 50 cents, beating the 32 cents consensus analysts’ estimate and 37 cents from the year-ago quarter. Q3 net interest income jumped 35.19% to $43.8 million from $32.4 million.

Agency business generated revenue of $81.8 million in Q3 2020 vs. $81.1 million in Q2 2020; income from mortgage servicing rights reached $42.4 million, or 2.77% of Q3 2020 loan commitments, vs. $32.4 million, or 2.69% of Q2 2020 loan commitments.

Fee-based servicing portfolio totaled $22.56 billion as of Sept. 30, up 4.5% from June 30, primarily due to $1.48 billion in new agency loan originations. Structured business originated 13 loans totaling $291.8 million, consisting primarily of multifamily bridge loans of $235.1 million. In Q3 2020, the loan portfolio passed $5.00 billion.

Secondary Stock Offering Aids 1 of 3 High Dividend Stocks to Buy Now

Additionally, Arbor completed a 7 million share secondary stock offering on Nov. 10 to raise $94.5 million for business-related investments. Shares of ABR have pulled back from $14.40 to just prior to the stock offering and trade today right around $13. Earnings are forecast to come in at $1.01 for 2020 and increase sharply in 2021 to $1.52 per share.

Arbor pays an annual dividend of $1.28 per share, translating to a 9.35% current yield. Perry projected the stock has a “very good chance” to deliver a 20%-plus total return in the next 12 months. He advised putting the well-positioned financial company to work by purchasing its shares for less than $14 each.

Buy Arbor Realty Trust (ABR) under $14

Chart courtesy of www.StockCharts.com

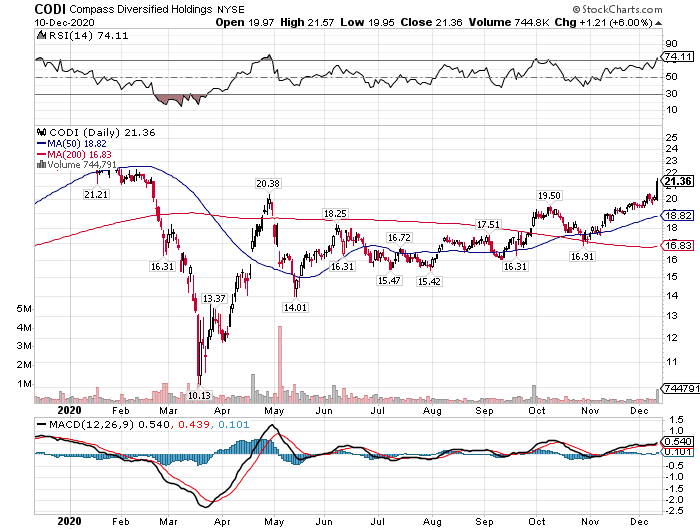

Compass Diversified Holdings Is 1 of 3 High Dividend Stocks to Buy Now

Compass Diversified Holdings (CODI) owns and manages a diverse family of established North American middle-market businesses. Each of its current subsidiaries is a leader in its niche market.

Branded consumer products with an emphasis on outdoor activities and social gatherings will make a sweeping comeback in 2021, Perry predicted. Compass is extremely well-positioned to benefit from rising demand, he added.

With a $1.15 billion market capitalization, CODI maintains controlling ownership interests in each of its subsidiaries to maximize its ability to impact long-term cash flow generation and value.

Unlike business development companies, which are primarily passive lenders, CODI only participates in transactions as a control equity investor. Additionally, CODI’s structure is significantly different in that it operates as a holding company, not a registered investment company, without debt restrictions or dividend payout requirements.

Chart courtesy of www.StockCharts.com

The company provides both debt and equity capital for its subsidiaries, contributing to its financial and operating flexibility. CODI uses the cash flows generated by its subsidiaries to invest in the long-term growth of the company and to make cash distributions to its shareholders.

CODI is not a lender. Instead, it provides the entire capital structure for target transactions with enterprise values of $100-$800 million that have positive and stable cash flows of at least $15 million per year in niche industrial and branded consumer industries.

Diversification Is Offered by 1 of 3 High Dividend Stocks to Buy Now

CODI’s 10 majority-owned subsidiaries are engaged in the following lines of business:

- The design and marketing of purpose-built technical apparel and gear serving a wide range of global customers (5.11);

- The manufacture of quick-turn, small-run and production rigid printed circuit boards (Advanced Circuits);

- The manufacture of engineered magnetic solutions for a wide range of specialty applications and end-markets (Arnold Magnetic Technologies);

- The design and marketing of dial-based closure systems that deliver performance fit across footwear, headwear and medical bracing products (BOA Technology);

- The design and marketing of wearable baby carriers, strollers and related products (Ergobaby);

- The design and manufacture of custom molded protective foam solutions and OE components (Foam Fabricators);

- The design and manufacture of premium home and gun safes (Liberty Safe);

- The design and manufacture of baseball and softball equipment and apparel (Marucci Sports);

- The manufacture and marketing of portable food warming systems used in the foodservice industry, creative indoor and outdoor lighting, and home fragrance solutions for the consumer markets (Sterno); and

- The design, manufacture and marketing of airguns, archery products, optics and related accessories (Velocity Outdoor).

Net sales for the third quarter were $418.9 million, as compared to $388.3 million for the quarter ended September 30, 2019. Net income for the quarter was $20.9 million. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) for the quarter ended September 30, 2020 was $73.9 million, compared to $63.8 million for the quarter ended September 30, 2019.

CODI’s earnings per share of $0.67 soared past estimates of $0.27. The company is forecast to finish 2020 with $1.29 per share and to earn $1.66 per share for 2021, equaling 28.8% profit growth.

1 of 3 High Dividend Stocks to Buy Now Projects a 90-100% Payout Ratio

CODI management expressed that it is comfortable it possessed adequate liquidity and capital resources to meet its existing obligations and quarterly distributions to its shareholders over the next 12 months. The projected payout ratio is 90%-100% of Capital Available for Distribution. The current quarterly dividend distribution is $0.36 or $1.44 per year.

As a tax partnership, Compass Diversified Holdings generally is not subject to federal or state income tax. CODI’s annual income, losses, deductions or credits flow through to the shareholders. A year-end K-1 tax package is issued to shareholders, so investors may find filing tax returns a bit more challenging for this investment than the norm.

The stock was trading at $26 prior to the pandemic and it can be purchased in the $21 range. The current dividend yield is 7.15%. Given the company’s future guidance, the stock can trade back up to $26, implying 35% potential appreciation, not including dividends, Perry projected.

The three high dividend stocks to buy now offer income investors a chance to be paid for their patience by purchasing these investments and allowing them time to rise.

Related Articles:

7 High Dividend Stocks to Buy Now

25 High Dividend Stocks in 2020 to Consider Buying

The 10 High Dividend Stocks Owned by Warren Buffet

5 High Dividend Blue Chip Stocks to Buy Now

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Paul Dykewicz

Connect with Paul Dykewicz