3 Investments Yield 7.5% and Deliver Generous Capital Growth

By: Ned Piplovic,

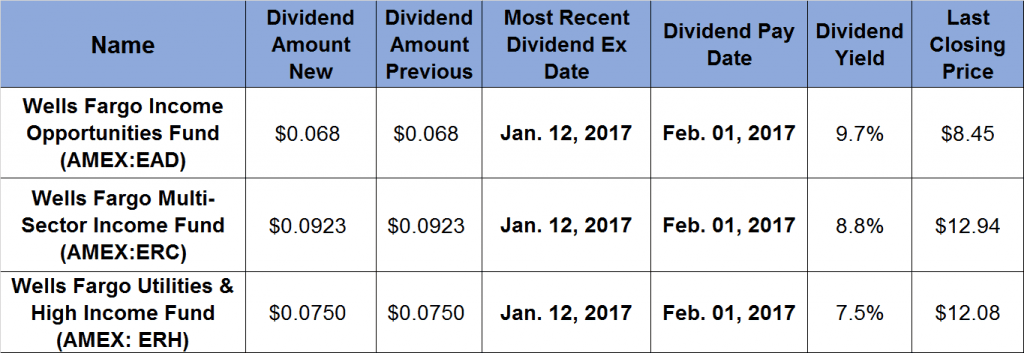

Among many new and exotic investment vehicles, these three mutual funds from Wells Fargo averaged more than 20% capital growth over the last year and pay monthly dividends that yield at least 7.5%.

The ex-dividend date for all three funds was on Jan 12, 2017, so now may be an opportunity to buy at a slight discount after investors waiting to receive the payout may have sold their shares. In addition, some dividend-capture investors tend to drive share prices higher as ex-dividend dates approach.

Therefore, in anticipation of next month’s dividend announcement, now might be a good time to invest in these funds.

Based on the past dividend schedule, all three funds should announce their next dividend at the end of January. Ex-dividend dates should be in mid-February with pay dates around March 1.

Wells Fargo Income Opportunities Fund (AMEX:EAD)

The Wells Fargo Income Opportunities Fund is primarily focused on generating a high level of current income. The fund’s secondary objective is capital growth.

As of January 13, 2017, the fund held $650 million in assets. More than half of total assets represented just three sectors – energy, telecommunication services and consumer staples.

Dividend payout declined every year from 2006 to 2014. However, the dividend yield remained relatively steady as the share price declined over the same period. Annual dividend has been steady over the last three years. Paid monthly, the current annual dividend is $0.816, which corresponds to a 9.7% dividend yield.

EAD’s share price rose almost 28% from the 52-week low in February 2016 to $8.50 per share by September 8, 2016. After reaching that peak, its share price declined almost 10% by mid-November. However, the share price since recovered and reached a new 52-week high on January 4, 2017. The most recent closing price on Friday, January 13, 2014, was $8.45 — only 1.2% below the Jan. 4 price peak.

Wells Fargo Multi-Sector Income Fund (AMEX:ERC)

Wells Fargo Multi-Sector Income Fund seeks a high level of current income, while limiting its overall exposure to domestic interest-rate risk. The fund invests in a mix of non-investment-grade corporate debt securities, such as bank loan securities, adjustable and fixed-rate mortgages, investment-grade corporate bonds and foreign markets debt securities.

As of January 4, 2017, the fund’s assets totaled almost $584 million. Its monthly dividend of $0.0923 translates to a $1.1076 annual dividend and an 8.8% dividend yield.

Between the 52-week low on January 20, 2017 and a 52-week high in September, its share price increased 28.4%. After declining 10% by mid-November, the share price recovered completely and returned to peak level. On January 4, 2017, the price was $12.98 — only 2% below the 52-week high in September.

Wells Fargo Utilities & High Income Fund (AMEX: ERH)

Wells Fargo Utilities & High Income Fund seeks to provide a high level of tax-advantaged dividend income and a moderate capital growth.

Smaller than the two previous examples, this fund held $115 million in assets as of January 4, 2017. The fund’s goal is to have at least 80% of its net assets invested in securities of utilities companies and in U.S. non-investment grade debt securities.

Its annual dividend of $0.90 is paid monthly and is equivalent to a 7.5% dividend yield. The fund has been paying the same $0.09 annual dividend since 2011.

The fund’s share price increased 31% between the 52-week low in January and the 52-week high in July. However, the stock lost 18% of its value by mid-November. Unlike both previous suggested funds, ERH recovered only half of its losses since November. As of January 4, 2017, the share price was $12.30 – 11% below the 52-week high.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily.

To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic