Five Dividend-Paying Health Care REITs to Purchase for Post-Pandemic Potential

By: Paul Dykewicz,

Five dividend-paying health care REITs to purchase for post-pandemic potential could entice income investors who seek to profit from a COVID-19 recovery.

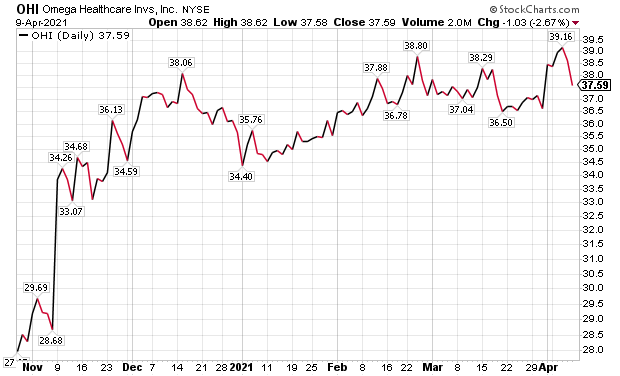

The five dividend-paying health care real estate investment trusts (REITs) to purchase are headlined by Hunt Valley, Maryland-based Omega Healthcare (NYSE:OHI), a personal favorite of mine that I bought less than 11 months ago. Since then, it has soared 44.2%, withstanding the threat from COVID-19 and positioned to benedit from quickly expanding vaccine distribution across the United States.

With OHI offering a dividend yield of more than 10% at the time I purchased it and 7.1% as of April 9, the REIT seems poised to serve as a good income investment in an industry with demographics on its side, since people in the “baby boomer” cohort born between 1946 and 1964 increasingly will need Omega Healthcare’s skilled nursing and assisted living facilities. Despite the REIT’s positive performance metrics, investors seemed to panic last spring when the stock market crashed as the global pandemic worsened so alarmingly that I began to update the total COVID-19 cases and deaths in the United States and worldwide in every column I wrote.

Five Dividend-paying Health Care REITs to Purchase Feature Omega Healthcare

Omega Healthcare received bad publicity early last year as it became one of the first health care REITs to report dozens of cases of COVID-19 among its patients and staff. However, I researched Omega Healthcare for a December 2018 column in which I noted that the REIT had been addressing and resolving credit quality problems among its tenants and should be achieving much improved financial performance in the next year or so.

That prediction proved prescient as Omega Healthcare reported profit margins of 37% prior to the pandemic. Mark Skousen, PhD, editor of the Forecasts & Strategies investment newsletter, introduced me to Omega Healthcare years ago when he recommended the REIT profitably for income investors.

Mark Skousen, PhD, a descendant of Benjamin Franklin, meets with Paul Dykewicz in Philadelphia.

Omega Healthcare reached $42 a share in January 2020, then quickly fell in half as many shareholders chose to sell amid rising COVID-19 cases and deaths. Nonetheless, Omega Healthcare spiked nearly 50% in one day on Thursday, March 19, 2020.

Five Dividend-paying Health Care REITs to Purchase Show Resilience to the Pandemic

I assessed the steep drop in Omega Healthcare’s stock as an overreaction by nervous shareholders, so I bought shares in May 2020 at what I considered a discounted price amid investor uncertainty caused by the COVID-19 crisis and the risk of what may happen in Omega Healthcare-owned senior facilities.

Chart courtesy of www.StockCharts.com

So far in 2021, OHI is up 9.17%, while the health care REIT sector has jumped 5.34%. A current chart shows how the stock has jumped.

Skousen, who also leads the Home Run Trader, TNT Trader, Five Star Trader and Fast Money Alert advisory services, prefers income-paying investments and wrote to his subscribers about the 67-cent dividend of Omega Healthcare, whose motto is “Doing Well by Doing Good.” Its management recently announced that more than 90% of people in its facilities have either been vaccinated or are in the process of becoming so as the company seeks to restore normal operations, he added.

The Best of Five Dividend-paying Health Care REITs to Purchase Acquires Connected Living

Omega Healthcare management showed a willingness to invest for the future with its March 10 announcement that it was acquiring Connected Living, a technology platform that improves communication and connection in senior adult communities. The acquirer’s Chief Executive Officer (CEO) Taylor Pickett said Connected Living will help senior care centers connect residents with staff, family and friends to provide an “enhanced experience” for everyone.

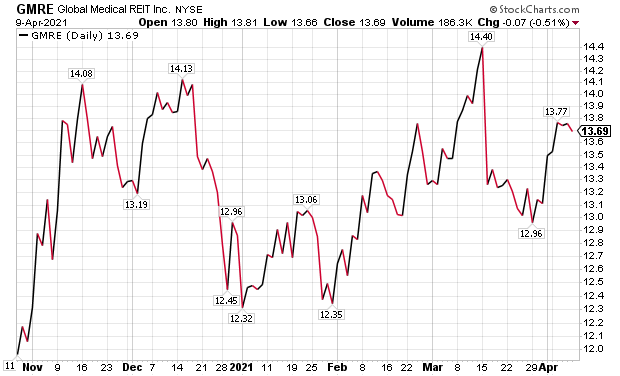

Even though money manager Hilary Kramer admits she loves biotech, investors looking for stocks poised to bounce back with the post-pandemic economy should consider medical REITs, which fell under a cloud when some non-essential procedures were cancelled last year due to the risk posed by the virus, she commented. Omega Healthcare remains her top choice among senior housing names, but she also suggested investors consider Bethesda, Maryland-based Global Medical REIT Inc. (NYSE:GMRE).

The Global Medical chief executive officer bought a few thousand shares of the company’s stock for close to $14 apiece for a projected 6% dividend yield, said Kramer, who also hosts the nationally aired “Millionaire Maker” radio program and heads the GameChangers and Value Authority advisory services. The CEO knows more than most of us how easy it is to defend that dividend and evidently sees no reason not to benefit himself, she added.

Paul Dykewicz conducts a pre-COVID-19 interview with Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.rover

Paul Dykewicz conducts a pre-COVID-19 interview with Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.rover

Global Medical REIT Ranks Among Five Dividend-paying Health Care REITs to Purchase

High-income expert Bryan Perry, who heads the Cash Machine investment newsletter, recommended Global Medical REIT in March. The REIT is offering a current dividend yield of 6.0% and should benefit as U.S. health care spending is expected to rise 5.8% per year during the next decade, based on estimates from the Department of Health and Human Services.

Global Medical REIT, mainly engaged in the acquisition of licensed, state-of-the-art, all-purpose health care facilities, also provides use of its properties to clinical operators under long-term, triple-net leases in which the tenant pays not just rent but property taxes, building insurance premiums and maintenance and repairs. The company is taking full advantage of positive industry trends for future growth.

Chart courtesy of www.StockCharts.com

In terms of dollars, health care expenditures are projected to grow from $3 trillion in 2014 to $5.4 trillion by 2024, accounting for 19.6% of gross domestic product (GDP) four years from now, Perry wrote to his Cash Machine subscribers. The 65-and-over age group is expected to double between 2015 and 2060 and the 85-and-over age group is forecast to triple between 2015 and 2060. In addition, changing health care trends are spurring new real estate investment trust structures like Global Medical, Perry added.

“Outpatient procedures are rapidly on the rise as patients demand this option,” Perry continued. “Technological advances make it possible, and physician groups are breaking away from hospitals to form their own outpatient solutions. Global Medical’s widely diversified portfolio of properties is comprised substantially of off-campus medical office buildings, specialty hospitals, in-patient rehabilitation facilities and ambulatory surgery centers.”

Paul Dykewicz interviews Bryan Perry, whose advisory services feature Premium Income, Quick Income Trader, Breakout Profits Alert and Hi-Tech Trader.

BoA Global Research Identifies Three of the Five Dividend-paying Health Care REITs to Purchase

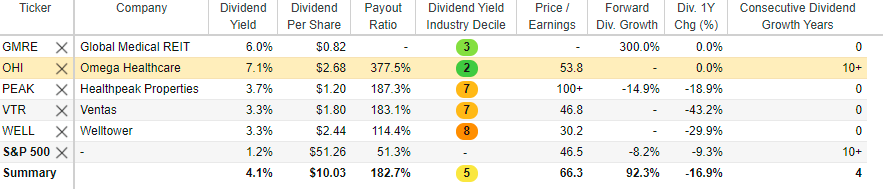

Three of the five dividend-paying health care REITs to buy include Healthpeak Properties, Inc. (NYSE:PEAK), Welltower Inc. (NYSE:WELL) and Ventas, Inc. (NYSE:VTR), according to BoA Global Research. The investment firm recently analyzed health care REITs and specifically recommended PEAK, VTR and WELL.

Each member of the trio offers a dividend yield of at least 3.3%, but the payouts are only about half what OHI and GMRE offer their shareholders. BoA recently upgraded PEAK and WELL to Buy from Neutral, while retaining its Buy recommendation on VTR.

Source: Stock Rover. Click here to sign up for a free, two-week trial for Stock Rover charts and analytics.

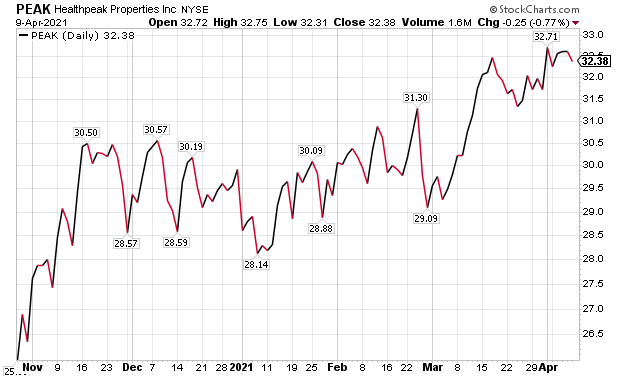

Healthpeak Properties Gains Place Among Five Dividend-paying Health Care REITs to Purchase

As for Denver-based Healthpeak Properties, BoA raised its rating to Buy and boosted its price objective on the stock to $35.50 from $34.00 due to its progress in exiting the senior housing market. BoA wrote that it sees light at the end of the tunnel as Healthpeak Properties has made “significant progress” on its $4 billion exit from the senior housing market by closing on $2.5 billion so far and has the balance under letters of intent or purchase agreements.

Plus, BoA described the 2021 guidance from Healthpeak Properties management as conservative. The investment firm foresees upside, particularly within the company’s life science segment. Longer term, BoA wrote positively about PEAK’s development pipeline and its potential to create “significant value.”

BoA identified several sources of upside for REITs: (1) additional Health and Human Services (HHS) funds to assisted living facilities, (2) a faster pace of occupancy growth and (3) a quicker return to pre-pandemic margins. Thus, BoA is overweighting health care holdings within REITs.

Chart courtesy of www.StockCharts.com

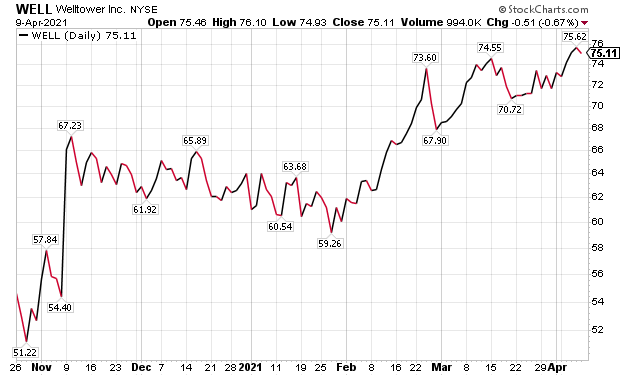

Welltower Gains Place Among Five Dividend-paying Health Care REITs to Purchase

Toledo, Ohio-based Welltower gained an upgrade in its rating by BoA to Buy from Neutral that included raising its price objective to $78 from $73 with the REIT expected to become a “net acquirer” in 2021. Previously, BoA rated WELL as Neutral due to its large 2020 disposition program and management comments about looking at broken development deals or senior housing assets still seeking lessees that would be a near-term drag on earnings.

“We were also concerned that WELL would continue to be a net seller in 2021,” BoA wrote in its health care REITs research note.

“Those concerns have now been dispelled given: (1) cap rates on recent acquisitions have been trending well above our prior expectations, and (2) management noted on the 4Q earnings call that they are likely to be net acquirers this year,” BoA wrote. “We now expect acquisitions to be accretive to the bottom line, unlike our prior view that near-term accretion would be very limited given their focus on broken development deals/projects in lease up.”

Chart courtesy of www.StockCharts.com

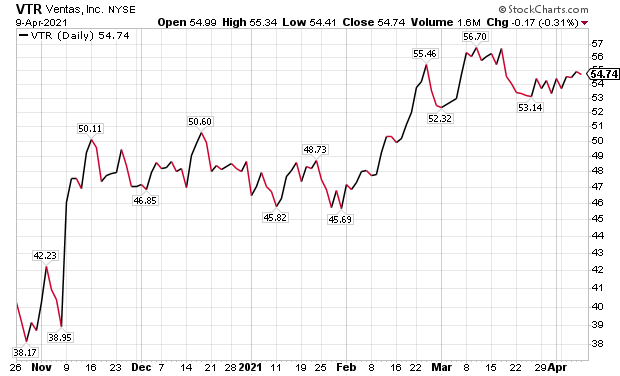

Ventas Gains Nod from BoA as One of Five Dividend-paying Health Care REITs to Purchase

BoA affirmed its Buy rating on Chicago-based Ventas, Inc. (VTR) but lowered its price objective to $59.50 from $63 after factoring in higher capital recycling. The continued COVID-19 vaccine rollout remains positive for near-term demand, while demographic trends are changing from a headwind to a tailwind to stoke medium to long-term demand amid a reduced number of new starts for senior housing, according to BoA.

The investment firm’s reduced price target for VTR is driven by an updated outlook on the stock’s external growth. VTR management offered guidance of $1 billion in asset dispositions in the second quarter of 2021. Given elevated leverage and the strong private market demand for health care assets, BoA now predicts a larger capital recycling program for VTR of $1.1 billion in 2021 and $1.1 billion in 2022.

The net result is slightly weaker growth in 2022 before stronger growth follows, according to BoA. During the next four years, BoA expects VTR to produce annualized funds from operations (FFO) growth of 7.6%, compared to 5.4% for the market.

Chart courtesy of www.StockCharts.com

Pension Fund Chairman Addresses Five Dividend-paying Health Care REITs to Purchase

“Health care is the second-largest REIT sector in my recommended REIT mutual fund, Cohen & Steers Realty Shares (CSRSX),” said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. “The fund’s managers anticipate a recovery in the sector as vaccines are more widely administered. They also believe the sector generally is undervalued after a weak 2020.”

The top holding in the health care sector for Cohen & Steers Realty Shares is Healthpeak Properties, said Carlson, who also leads the Retirement Watch investment newsletter. The fund recently trimmed its position in Welltower (WELL), which had been one of its 10 largest holdings for some time, he added.

“Healthpeak has been diversifying away from the senior housing sector,” Carlson said. “The sector is crowded and overbuilt in many areas. It also is at risk from advances in technology that could allow more seniors to stay in their homes longer even though they need some assistance with activities of daily living.

Ventas had a tough time in 2020 because of its portfolio of senior housing properties but its medical office business did well, Carlson counseled. The company reported that residents in most of its senior housing properties are fully vaccinated and that it anticipates the sector returning to normal profitability as vaccine administration advances, he added.

Pension fund and Retirement Watch leader Bob Carlson answers questions from Paul Dykewicz prior to COVID-19-related social distancing.

COVID-19 Fails to Wreck Five Dividend-paying Health Care REITs to Purchase

COVID-19 vaccination progress in recent weeks offers optimism that new cases and deaths caused by the virus may begin to slow, despite a rise in 27 states led by Michigan, Florida, Pennsylvania, New Jersey and New York during the past week. Another positive recent step is the Food and Drug Administration (FDA) approving a third COVID-19 vaccine to allow additional people to be vaccinated.

U.S. COVID-19 cases have reached 31,079,167 and led to 560,996 deaths, as of April 9. COVID-19 cases worldwide have soared to 134,479,645, while the virus has claimed 2,873,821 lives, according to Johns Hopkins University. America has the dreaded misfortune of becoming the country with the most COVID-19 cases and deaths.

The five dividend-paying health care REITs to purchase provide investors with a handful of ways to profit from the $1.9 trillion federal stimulus package, rising COVID-19 vaccine distribution and an ongoing economic reopening. Those catalysts likely will build further momentum for health care REITs in the coming months.

Want more? Read our related articles:

The Ultimate Guide to Investing in REITs

Why Do REITs Have High Dividend Payout Ratios?

The 13 Types of REIT Stocks and How to Invest in Them

Investing in REITs: Pros and Cons

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

Connect with Paul Dykewicz

Connect with Paul Dykewicz