3 Real Estate Investment Trusts Offer 3%-Plus Dividend Yields and Double-Digit Asset Growth

By: Ned Piplovic,

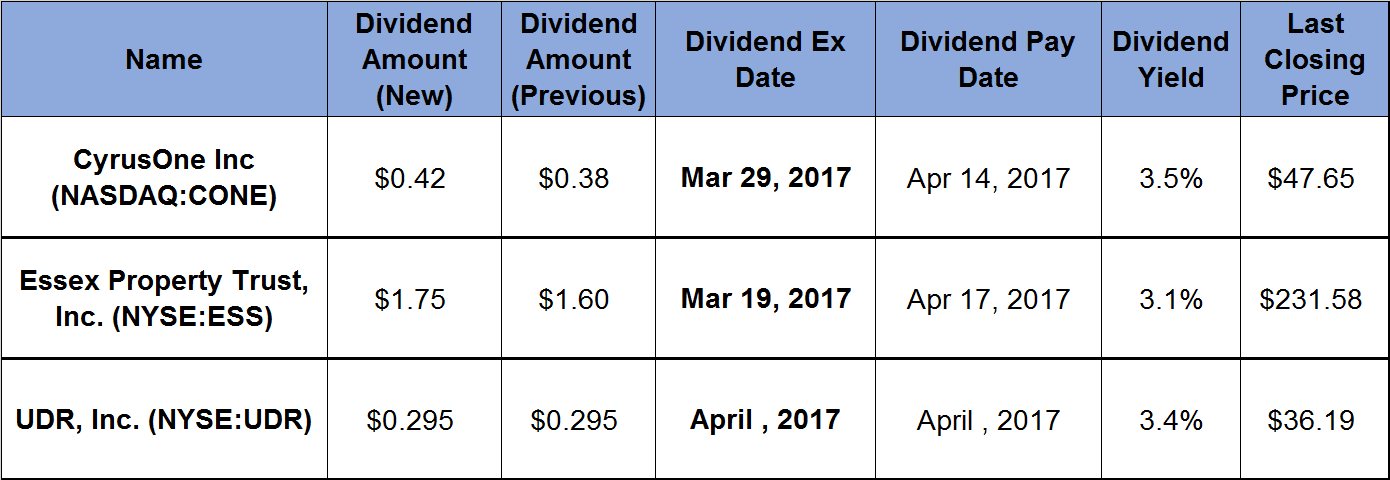

Three real estate investment trusts (REITs) provide 3%-plus yields and have rewarded their shareholders with double-digit percentage share price increases over the last year.

All the trusts also have records of boosting dividends between four and 19 consecutive years. Two of the three REITs announced their dividend increases of around 10% to be paid in mid-April with ex-dividend dates in late March.

The third trust should announce its next quarterly payout soon. The ex-dividend date is expected to be in early-April, which should be followed by a late April pay date.

CyrusOne Inc (NASDAQ:CONE)

CyrusOne Inc., owns, operates, and develops enterprise-class, carrier-neutral and multi-tenant data center properties. As of December 9, 2016, the company owned and managed approximately 35 data centers in the United States, Europe and Asia.

The current quarterly dividend of $0.42 is 10.5% higher than the amount paid in previous quarters. The annualized dividend of $1.68 yields 3.5%. Over the past four years, the trust has boosted its dividend payout every year at an average annual rate of 36.7%. Consequently, CONE’s current annual payout is three-and-a-half times higher than the amount paid in March 2013.

The share price appreciated 39% between February and the end of June 2016. It hovered around the $55 level throughout July and reached its 52-week high on August 2, 2016. After that high, the price lost all those gains on its way towards the 52-week low on November 14, 2016. Since the November low, the stock rose to $47.65 by the closing on February 23, 2017, which is still 16.4% short of the August price peak but 23% higher than the November low and 18.7% higher than the share price from February 2016.

Essex Property Trust, Inc. (NYSE:ESS)

Essex Property Trust, Inc. operates as a self-administered and self-managed real estate investment trust in the United States. The company owns, operates, develops and manages apartment communities and commercial properties. Most properties are concentrated in the Los Angeles, San Francisco and Seattle metropolitan areas.

The company boosted its quarterly dividend by 9.4% from the previous period and the annualized dividend yields 3.1%. Since 1997, the company managed to bump its annual dividend payout every year by an average rate of 8.6%. Therefore, the current annual payout is five times higher than the payout 20 years ago.

In March 2016, the share price rose 11.4% and then experienced some volatility. The price plunged more than 10% in early May but recovered quickly and traded in the $220 to $230 range through late September. After September 22, 2016, the share price lost 15.5% of its value and plunged to its 52-week low on October 25, 2017. Since then, the price regained most of its value and closed at $231.58 on February 23, 2017. That price is only 2.5% below the peak price level from May and 16% higher than the price from February 2016.

UDR, Inc. (NYSE:UDR)

UDR, Inc. is an independent real estate investment trust that invests in the real estate markets of the United States. The trust owns, operates, develops and manages multifamily apartment communities. The firm was founded in 1972 as United Dominion Realty Trust, Inc.

At the end of January, UDR paid the dividend for the first quarter of 2017. The company has a record of bumping up its dividend payout in the second quarter for the past six years. Based on the past results, the trust should announce a dividend boost of approximately 6.5% versus the most recent payout. This should make the quarterly dividend approximately $0.315 for the last three quarters of 2017. The total annual dividend would be $1.24, which converts to a 3.4% yield. Over the last 20 years, the company lowered its dividend payout only in 2010 following the collapse of the housing market bubble. Since 2010, UDR, Inc. boosted its annual dividend for seven consecutive years at an average annual rate of 8% and enhanced its total annual payout 71% since 2011.

The company’s share price rose 12.5% in March 2016 before experiencing a fair amount of volatility for the rest of the year. After several up-and-down cycles, the price reached its 52-week low of $32.79 on October 25, 2016. Since bottoming out in late October, UDR’s share price rose steadily, with only one minor correction in late January 2017. As of February 23, 2017, the current price of $36.19 is 6.3% below the April high, 10% above the October low and 5.4% above the share price from February 2016.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic