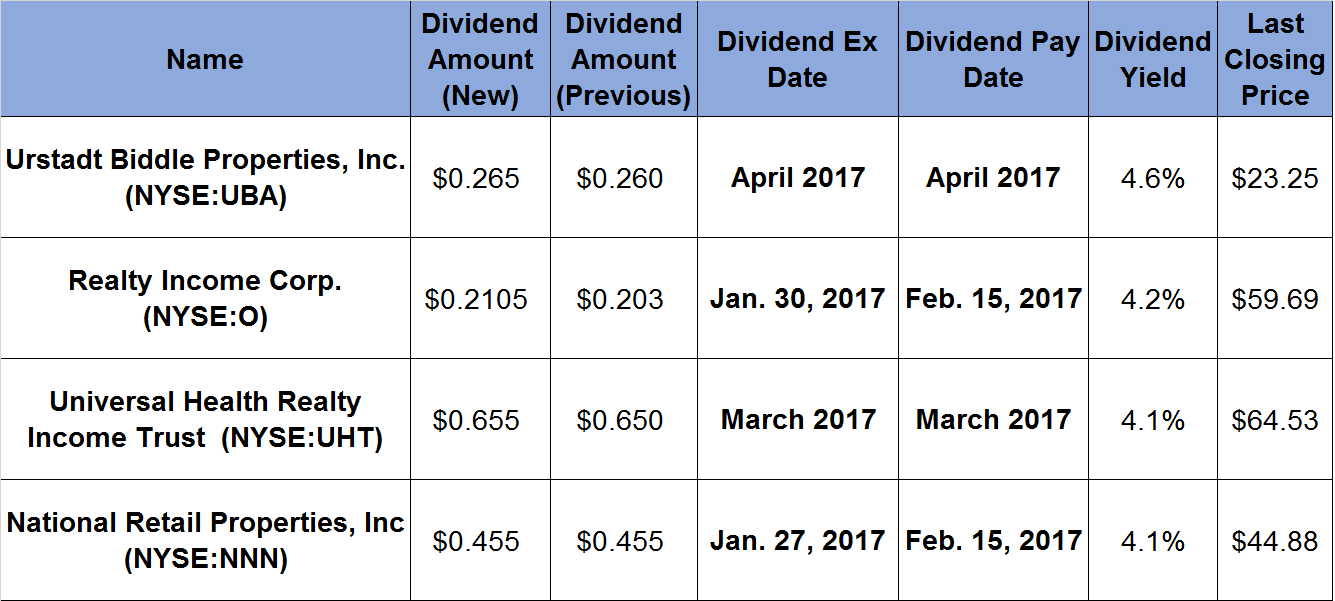

4 REITs Pay Rising Dividends for Two Decades, Offer 4%-plus Yields

By: Ned Piplovic,

With yields in excess of 4% and two decades of rising dividends, these Real Estate Investment Trusts (REITs) could provide investors with reliable long-term income streams.

To distribute most of their taxable income, as required by law, these four REITs have been increasing their annual dividends for 20 years. Two of the four REITs have ex-dividend dates coming up at the end of January, so investors need to act quickly if they want to capture the next dividends.

National Retail Properties, Inc. (NYSE: NNN) pays quarterly dividends and has an ex-dividend date of Jan. 27, so investors who want the next payout need to buy NNN by Jan. 26. Realty Income Corp. (NYSE: O) pays its dividends monthly and has an ex-dividend date of Jan. 30, requiring investors who want that payout to make the purchase by Jan. 29.

Urstadt Biddle Properties, Inc. (NYSE:UBA)

Urstadt Biddle Properties owns, redevelops and operates high quality retail shopping centers predominantly located in the suburban area surrounding New York City.

The company has been publicly traded since 1969, has a 46-year record of paying uninterrupted dividends and has been raising dividend payouts for the past 18 years in a row. Its current quarterly dividend of $0.265 is 1.9% higher than last period’s payout. Annual dividend of $1.06 yields 4.6%.

The company’s share price rose 32.5% from a 52-week low in January 2016 to mid-July. After declining 20% between July and the beginning of November, its share price reversed course and increased throughout December and January. During trading on December 16, 2016, its share price reached a new 52-week high of $25.43, but closed five percent lower at $24.16 at the end of trading that day. As of January 20, 2017, the most recent share price is 8.6% lower than the 52-week high. However, that price is still 23% above the January low.

Realty Income Corp. (NYSE:O)

Realty Income Corp. was formed in 1969 and started trading publicly on the New York Stock Exchange (NYSE) in 1994. The company provides investors with monthly dividends that increase over time.

Realty Income Corp has paid consecutive dividends since its founding and increased dividend payouts every quarter over the last 19 years. Its current monthly dividend is 4% higher than the December 2016 payout. The annual dividend of $2.53 yields 4.2%, which is 5% higher than the Equity REIT IndEx Dividend yield and double the average yield of S&P 500.

The company’s share price increased 34% between January and the 52-week high on August 1, 2016. However, the company’s stock lost 37% of its value between its August high and November 10, 2016, when it reached a new 52-week low. Its share price recovered a little in late-December 2016 and January 2017. As of January 20, 2017, the most recent share price of $59.69 has increased 13% from the November low.

Universal Health Realty Income Trust (NYSE:UHT)

Universal Health Realty Income Trust is a real estate investment trust that specializes in health care and human service related facilities.

Quarterly dividends of $0.665 convert to an annual dividend of $2.62 and a 4.1% dividend yield. The company has been paying dividends since 1990 and has increased the dividend payout every year for the last 20 years in a row.

The company’s share price increased steadily throughout the year. From the 52-week low in February, its share price rose 45% to reach a new 52-week high of $66.25 on January 4, 2017. The most current closing price of $64.53 on January 20, 2017 is 3.5% below than the recent high.

National Retail Properties, Inc (NYSE:NNN)

National Retail Properties was created by the owners of the Golden Corral restaurant chain in 1984 to reward their employees with stock.

Its current quarterly dividend of $0.455 yields 4.1% and translates to a $ 1.82 annual dividend per share. National Retail Properties has a record of boosting annual dividends for 27 consecutive years. Only three other publicly traded REITs in the United States have a better consecutive dividend increase record than NNN.

After rising 24% between the beginning of 2016 and the end of July to reach a 52-week high, share price lost 35% of its value on the way to a new 52-week low on November 10, 2016. The most recent share price rose 13% above the year’s minimum and closed at $44.88 on January 20, 2016.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily.

To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic