4 Securities Offer Double-Digit Capital Growth and 5.9%-Plus Dividends Yields

By: Ned Piplovic,

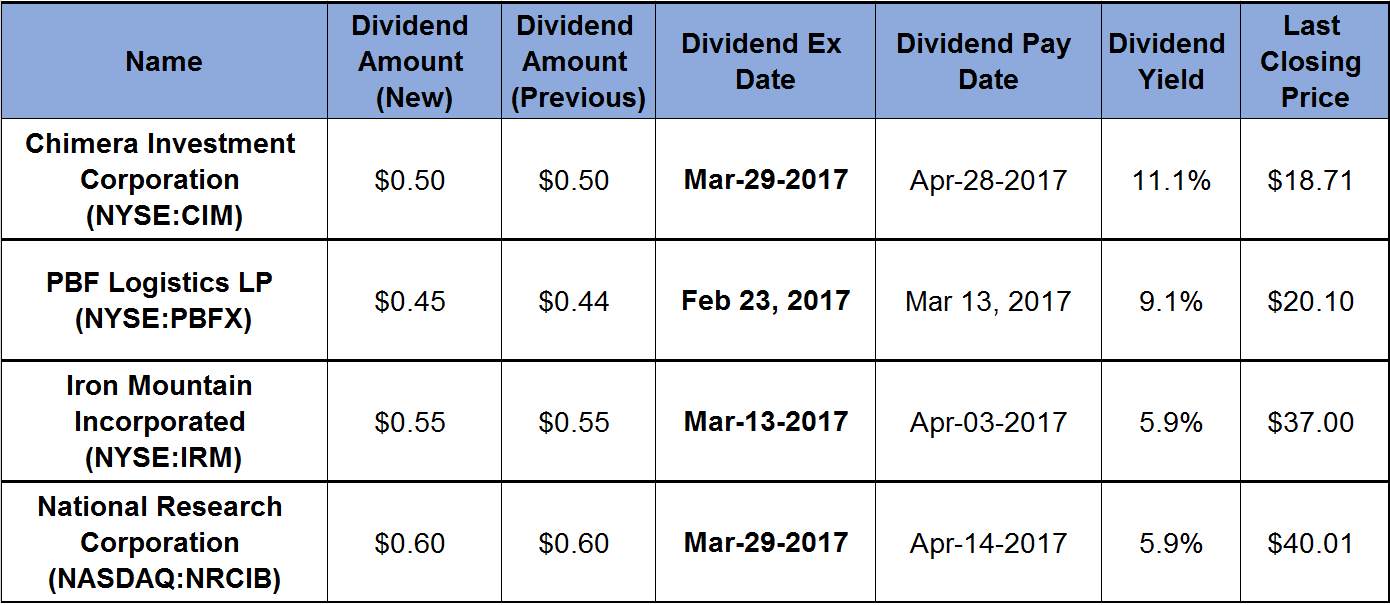

Four diverse companies provided double-digit capital appreciation to their shareholders, as well as a 5.9%-plus dividend yield.

An energy logistics company, a real estate investment trust (REIT), an information management and storage company, and a customer experience analytics firm increased their valuation between 11% and 50% over the last year. Additionally, the companies offer dividend yields in the 5.9% to 11.1% range.

One company’s ex-dividend date is on February 23, 2017, and the other three equities have ex-dividends in March 2017.

Chimera Investment Corporation (NYSE:CIM)

Chimera Investment Corporation operates as a REIT in the United States. The company invests in residential mortgage-backed securities, residential mortgage loans, commercial mortgage loans and real estate-related securities.

The current annualized dividend payout of $2.00 converts to a hefty 11.1% yield. Excluding a special dividend of $0.50 that was paid in March 2016, the total payout for 2017 is 4% higher than the 2016 regular dividend. This is the second consecutive boost of the company’s annual payout.

The company’s share price increased 37% between its 52-week low on February 17, 2016, and the beginning of August, before reversing the trend and losing 13% by early October. Since October, the share price rose 26% and closed at its new 52-week high of $18.71 on February 16, 2017. That price represents a 50% capital gain from the 52-week low in February 2016.

PBF Logistics LP (NYSE:PBFX)

PBF Logistics owns, leases, acquires, develops and operates crude oil and refined petroleum product terminals, pipelines, storage facilities, and other logistics assets in the United States. The company’s assets include a light crude oil rail unloading terminal, several crude oil truck unloading terminals and a 30-tank facility for storing crude oil, refined products and intermediates.

The current quarterly distribution of $0.45 converts to a $1.80 annual payout and a 9.1% dividend yield. The company has been paying a dividend since August 2014. Since then, the company boosted its dividend for 10 consecutive quarters at an average growth rate of 11%. Therefore, the current payout is almost triple the initial quarterly payout of $0.14 in 2014.

Between the share price’s low in February 2016 and the 52-week high on June 8, 2016, the share price rose 53%. The price lost 25% between June and late November but then reversed its trend and closed at $20.10 on February 16, 2017, which is only 14.4% short of the year’s peak and 30% above the February 2016 low.

Iron Mountain Incorporated (NYSE:IRM)

Iron Mountain provides information management and storage services for physical records, master audio and videotapes, film, X-rays and blueprints, including health care information services, vital records services, etc. Additionally, the company offers document and information destruction services.

The company’s quarterly dividend of $0.55 is equivalent to a 5.9% yield. Assuming the same quarterly payouts for the remainder of 2017, the total annualized payout of $2.20 is projected to be 9.7% higher than the 2016 total. However, the company has boosted its quarterly payout in the fourth quarter for the last two years. If the company continues that policy, the total dividend boost for 2017 could be even higher.

The share price grew steadily in the first half of 2016. It rose 45% above its February low and reached its 52-week high on August 1, 2016. In the second half of 2016, the price fluctuated considerably and lost as much as 24% of its value by mid-November. Since November, the share price reversed its trend and rose 18% to close at $37.00 on February 16, 2017. That price is merely 11% below of its 52-week high and 30% higher than the 52-week low from February 2016.

National Research Corporation (NASDAQ:NRCIB)

National Research Corporation provides patient and employee experience analytics and insights for health care providers, payers and other health care organizations in the United States and Canada. The company offers solutions for measurement of community perception, brand tracking, advertising testing, patient and resident experience, physician engagement, etc.

National Research Corporation’s regular quarterly dividend for 2017 of $0.60 is 25% higher than last year’s payout. The annualized distribution of $2.40 is equivalent to a 5.9% yield. The company has boosted its regular quarterly dividend for the last two years.

The share price rose 17% between February and May 2016. During the following two months, the share price lost all those gains and continued to drop towards its 52-week low of $32.18 on July 20, 2016. Since the July low, the company’s share price regained all its losses and increased 44% on its way to the 52-week high of $46.37 on December 12, 2016. The current price closed on February 16, 2017 at $40.01, which is 13.7% below the December high, and 24% higher than the 52-week low from July.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic