5 Dividend-Paying COVID-19-Proof Stocks to Buy

By: Paul Dykewicz,

Five dividend-paying COVID-19-proof stocks to buy mainly feature recreational vehicle (RV) manufacturers and component suppliers, as well as a company known for its cushy chairs and sofas.

The five dividend-paying COVID-19 stocks to buy dropped in price on June 11 when the major U.S. stock indexes plunged about 6%, a day after Federal Reserve Chairman Jerome Powell warned that the labor market may need years to overcome the pandemic and that millions of newly unemployed Americans might not be rehired for their former jobs. The market drop also stemmed partly from the June 10 announcement by the Organization for Economic Co-operation and Development (OECD) that the COVID-19 pandemic has triggered the “most severe recession” in nearly a century, may include a second wave of illnesses and cause huge damage to people’s “jobs and well-being.”

The negative outlook accompanied data that showed 1.5 million Americans applied for unemployment benefits in the week through June 6, continuing a decline from a recent peak of almost 7 million applicants in the week through March 28. Plus, the May U.S. jobless rate dropped to 13.3% with employers unexpectedly adding 2.5 million jobs to mark the largest monthly gain in new jobs since the U.S. Bureau of Labor Statistics began tracking the data series in 1939. The labor market surprised analysts by rebounding from April, when 20.7 million jobs were cut and the U.S. unemployment rate jumped to 14.7% as many U.S. businesses closed during the COVID-19 lockdown.

Recession Fails to Stop Five Dividend-Paying COVID-19-Proof Stocks to Buy

The five dividend-paying COVID-19-proofs stocks to buy have managed to rise even though the National Bureau of Economic Research declared that the U.S. economy peaked in February 2020 to end a 128-month expansion that began in June 2009. The research bureau explained that Q4 2019 marked the high in quarterly activity as the COVID-19 crisis caused the lockdown of non-essential businesses throughout much of the world.

COVID-19 has caused 7,709,523 cases and 427,210 deaths globally, along with 2,112,250 cases and 116,731 deaths in the United States, as of June 12. America has far more cases and deaths than any country, including China, where COVID-19 originated.

Paul Dykewicz meets with Jim Woods before COVID-19 to discuss new investment ideas.

5 Dividend-Paying COVID-19-Proof Stocks to Buy Include RV Makers

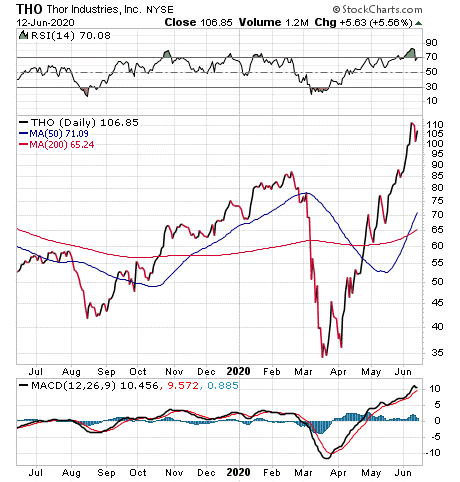

Before the opening bell on June 9, recreational vehicle (RV) maker Thor Industries (NYSE:THO), of Elkhart, Indiana, reported an unexpectedly strong fiscal third-quarter profit of 43 cents per share, even though its revenue fell 33% from the same quarter the prior year to $1.68 billion. But the results beat an expected loss of 40 cents per share, based on analysts’ consensus forecasts, on predicted revenue of $1.42 billion.

Thor Industries, recommended by the Fast Money Alert trading service led by Jim Woods and Mark Skousen, PhD, also has a strong backlog of orders that consists of $857.9 million for its North American towable products, $548.0 million for its North American motorized vehicles and $803.5 million for its European RVs. Bob Martin, chief executive officer of Thor Industries, issued a statement indicating every North American dealer he has spoken to in recent weeks expressed excitement about the sales pace of RVs.

“Many of our dealers are reporting a significant improvement in sales from April to May and are excited about the sales potential for June and beyond,” Martin said. “Because of this improved outlook and the relaxation of many stay-at-home restrictions, we began to restart production in the first week of May in North America. We have been successful in safely bringing our people back to work, and we are ramping-up production in a measured way in order to keep our team members safe and product quality high, while also fulfilling dealer orders as quickly as possible.”

Chart courtesy of www.StockCharts.com

Thor Industries Beats Estimates as 1 of 5 Dividend-Paying COVID-19-Proof Stocks to Buy

“In Europe, with over 1,200 dealer-partners in Germany and across the continent, our brands have one of the strongest dealer and service networks, and our long-term outlook for future growth in retail sales remains positive, Martin said. “More and more people are discovering RVs as a way to support their lifestyle of independence and individuality, as well as using the RV as a multi-purpose vehicle to escape urban life and explore outdoor activities and nature. While we are optimistic about the long-term growth of the RV market in Europe, the outlook for European RV retail sales for the remainder of the calendar year depends upon the economic conditions in the countries in which we do business.”

The COVID-19 crisis has hurt Thor Industries’ sales, but Martin said its outlook for the rest of the fiscal year and the calendar year has markedly improved.

“We’re seeing an influx of first-time buyers, which bodes well for the long-term health of the RV industry,” Martin said. “When the COVID-19 pandemic started, we saw many people start to work at home. One new trend we are seeing is an evolution from ‘work at home’ to ‘work from anywhere’ as RV buyers use their new RVs as their office wherever they are, or wherever they want to be. Our channel checks tell us that many of our independent RV dealers are seeing a significant resurgence in their sales, and their inventory levels, which were already down 20% year-over-year, are further declining.”

Amid strong demand for the company’s products, Thor Industries can quickly ramp up production, Martin said. The company also offers a dividend yield of 1.58%.

“We remain steadfast in our confidence in the long-term outlook for not only our business, but the entire RV industry, and we continue to look forward to a bright future.” Martin said.

Woods and Skousen recently opted to sell half of the September 2020 THO call options they recommended in Fast Money Alert for about a 200% profit, while boosting the stop price on the stock to preserve a double-digit-percentage gain. Woods, who also leads the Successful Investing, Intelligence Report and Bullseye Stock Trader advisory services, told me he likes to recommend stocks that are doing well and ride them as their share prices surge.

Winnebago Makes List of 5 Dividend-Paying COVID-19-Proof Stocks to Buy Now

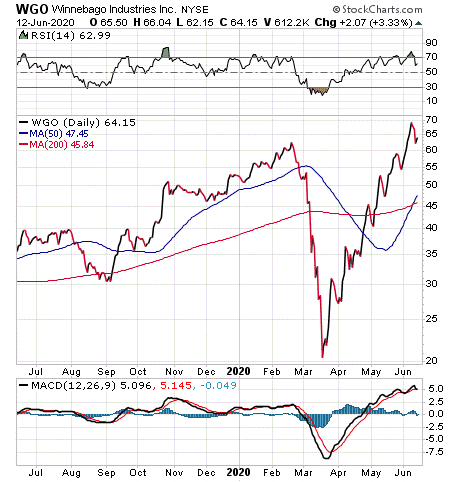

Winnebago Industries, Inc. (NYSE:WGO), of Eden Prairie, Minnesota, manufactures outdoor lifestyle products and commercial vehicles under the Winnebago, Grand Design, Chris-Craft and Newmar brands that primarily are used in leisure travel and outdoor recreation activities. The company, which offers a current dividend yield of 0.71%, produced $2 billion in revenue during fiscal year 2019 by building motor homes, travel trailers, fifth wheel products, boats and commercial community outreach vehicles.

Chart courtesy of www.StockCharts.com

Winnebago’s share price has soared, even after it was downgraded on April 29 by Sidoti & Company, LLC, a Wall Street equity research firm that generally focuses on companies with market capitalizations below $3 billion. Winnebago’s share price closed at $45.47 that day but leaped 49.74% through the end of trading on June 9. The company’s stock price zoomed 92.33% during that time, compared to 54.51% for the recreational vehicle industry, during the previous three months.

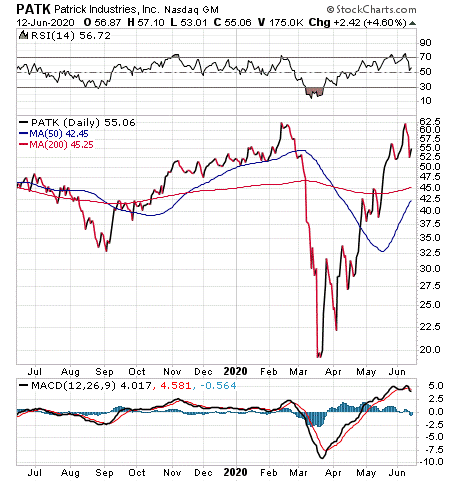

Patrick Industries Ranks Among 5 Dividend-Paying COVID-19-Proof Stocks to Buy

Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, cautioned that recreational vehicle stocks have “appreciated quite a bit” since the market’s bottom.

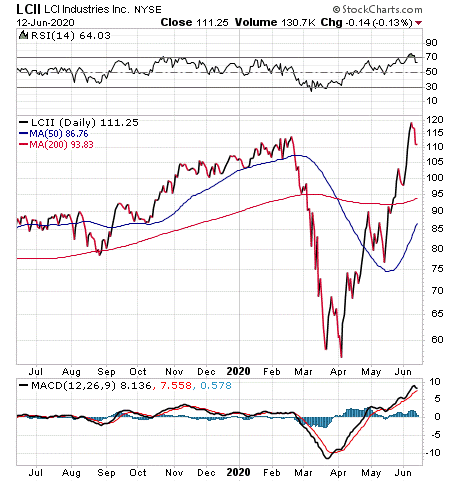

A “better bet at this point” is on the key component suppliers to all the RV companies: Patrick Industries (NASDAQ:PATK) and LCI Industries (NYSE:LCII), both of Elkhart, Indiana, said Carlson, who also leads the Retirement Watch advisory service. Both pay dividends, with Patrick Industries providing a current yield of 1.90%, while LCI Industries is offering 2.33%.

Chart courtesy of www.StockCharts.com

Chart courtesy of www.StockCharts.com

“Their stocks haven’t appreciated as much, but these companies will benefit from a continuing boom in RV sales,” Carlson told me.

Pension fund chairman Bob Carlson answers questions from Paul Dykewicz during an interview before social distancing became the norm after the outbreak of COVID-19.

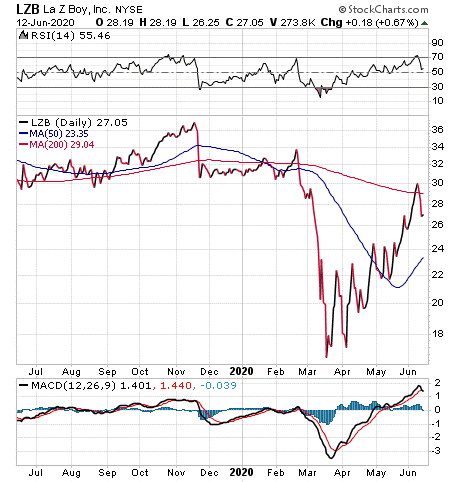

La-Z-Boy Is Another of the 5 Dividend-Paying COVID-19-Proof Stocks to Buy

“For the transition back to greatness on the consumer side, I’m a huge fan of La-Z-Boy Inc. (NYSE:LZB),” said Hilary Kramer, host of a national radio program called “Millionaire Maker” and head of the Value Authority and GameChangers advisory services. The company offers great products and has developed an “incredibly loyal customer base,” she added.

“Management has made the tough decisions and cut jobs as well as production to project the most efficient profile in a post-pandemic world,” Kramer said.

Chart courtesy of www.StockCharts.com

“We’ve seen how narrow margins can get. Last quarter, the company ran at a loss and the stock dropped below $16,” Kramer said. “Now, even if sales drop 10% in the next year, enough profit still flows to pay the 2% dividend. I don’t think sales will drop that much. When people are stressed and trapped at home, they need a comfortable chair more than ever. I’d rather have this stock than Peloton Interactive Inc. (NASDAQ:PTON).”

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include 2-Day Trader, Turbo Trader, High Octane Trader and Inner Circle.

These five dividend-paying COVID-19-proof stocks to buy offer opportunities for investors who may be unsure about what the market will do next. The Wall Street adage of “sell in May and go away” would have caused followers of that advice to miss out on a great month of returns for many equities in May, but these five dividend-paying COVID-19-proof stocks to buy should do well this summer and beyond.

Connect with Paul Dykewicz

Connect with Paul Dykewicz