Six Dividend-Paying Gold Investments to Purchase Amid a Falling Dollar

By: Paul Dykewicz,

Six dividend-paying gold investments to purchase amid a falling U.S. dollar give investors an opportunity to profit despite an economic recession during the COVID-19 crisis.

The price of precious yellow metal reached an all-time end-of-day high of $1,975.90 and a new intraday peak of $2005.40 per ounce on July 31 to boost the six dividend-paying gold investments to purchase. The rise has been aided by investors seeking a refuge from the U.S. dollar’s fall of more than 10% since March 19, inflationary federal spending and the threat of tax hikes if Democrats win the next election to gain control of both the White House and Congress.

Gold’s ascent is shown by the precious metal skyrocketing to a new all-time high during four of the past five trading days ending July 31. Despite the golden performance of the yellow metal, investors should remember that the shiny investment does not have the 100% protection bank deposits provide through the Federal Deposit Insurance Corporation (FDIC), topping out at $250,000 for each person per bank.

CARES Act Inflated Money Supply and Lifted 6 Dividend-Paying Gold Investments to Buy

The multi-trillion-dollar Coronavirus Aid, Relief, and Economic Security (CARES) Act signed into law by President Trump on March 27 to provide subsidies and bailouts to struggling businesses and individuals committed funds that the federal government did not have, said Tom Coulson, owner of Lansing, Michigan-based Liberty Coin Service, the state’s largest rare coin and precious metals dealership. Consequently, inflating the money supply to pay for it would hurt the purchasing power of the U.S. dollar, he added.

“Since this law was enacted, the value of the dollar has fallen against most world currencies and has plummeted against gold and silver,” Coulson counseled.

Not only has gold set an all-time record high price, silver also reached a new peak since April 12, 2013, more than seven years ago, Coulson said. Demand among Liberty’s customers for bullion-priced precious metals is the strongest Coulson said he and his staff have witnessed in more than seven years.

6 Dividend-Paying Gold Investments to Purchase Lifted by Federal Policies

The strong current monetary stimulus from the Federal Reserve Bank will benefit the markets more than the economy, said Bob Carlson, leader of the Retirement Watch advisory service. As chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, Carlson seeks to protect the money of investors and he described gold as a hedge against future inflation.

“I’ve been recommending gold for about two years,” Carlson said. “Even before the pandemic, the Federal Reserve made clear that it wasn’t going to tighten monetary policy for some time. It didn’t want to risk a recession by prematurely tightening and was willing to risk letting inflation get a little high. Easy monetary policy generally is bullish for gold.”

Since the pandemic spread to the United States early this year, the Fed established a policy of ensuring the economy and markets would have all the money they needed to function, Carlson continued. There has been a historic expansion of the Fed’s balance sheet, and that is likely to continue, he added.

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz during an interview before social distancing became the norm after the outbreak of COVID-19.

Mining Companies Join 6 Dividend-Paying Gold Investments to Purchase

Investors who want heightened returns can invest in stocks of gold mining companies directly or through Carlson’s recommended method of using a mutual fund or an exchange-traded fund (ETF) that holds a diversified portfolio of stocks. Keep in mind that investing in the stocks carries additional risk, he opined.

“You’re making a bet on the management of the company and risk the company might incur labor problems,” Carlson said. “Some companies contract to sell their gold at fixed prices in advance, which can reduce gains in the stock. Companies also carry different levels of debt, which can increase returns or cause problems for the entity.

“In the short term, I expect a softening of gold’s price. A number of investors were selling gold short. They didn’t believe central banks would expand monetary policy as much as they did or successfully offset deflationary trends. Short covering by some of these investors is part of the reason for the recent surge. Once the short sellers have covered their positions, gold buying will decline for a bit before resuming.”

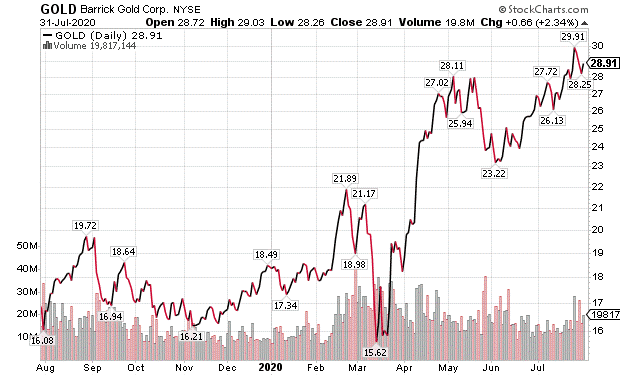

Barrick Gold Ranks as 1 of 6 Dividend-Paying Gold Investments to Purchase

Toronto-based Barrick Gold Corp. (NYSE: GOLD), the second-largest mining company in the United States, became a recent recommendation in the Five Star Trader advisory service and it gained 38.59% in just under two months before an order to take profits came from its leader Mark Skousen, PhD, a Presidential Fellow at Chapman University. Skousen, named one of the 20 most influential living economists and the recipient of the inaugural Triple Crown in Economics award in 2018, also advised the purchase of Sept. 18 $20 call options in Barrick Gold before choosing to sell them in three segments for a 118.49% gain on half, 213.20% on a quarter and 161.50% on the remainder to average 152.92% in 49 days.

Analysts project Barrick Gold will grow its earnings 69% this year, well ahead of the industry average. The stock also pays a dividend yield of 0.99%. The chart below shows the stock’s jump in the past year.

Chart courtesy of www.StockCharts.com

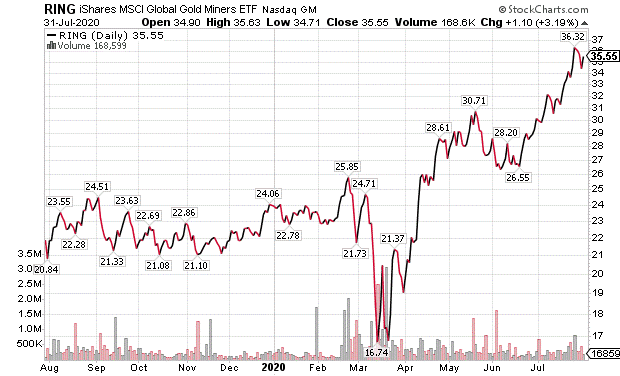

Trend-Tracking Guru Calls RING 1 of 6 Dividend-Paying Gold Investments to Purchase

The powerful surge in gold and precious metals mining stocks is the result of several key drivers operating in the market today, said Jim Woods, editor of the Intelligence Report, Successful Investing and Bullseye Stock Trader advisory services. The confluence of bullish gold factors has probably never been this complete, he added.

“First off, we now have ultralow interest rates nearly around the globe,” Woods said. “Then we have governments essentially flooding the world with stimulus. Low interest rates make owning gold more attractive for yield-seeking investors.”

Woods cited mining stocks in the iShares MSCI Global Gold Miners ETF (NASDAQ:RING) as one of his favorite “safety trades.” The ETF has risen 17.72% in the last month, 48.25% for the year to date and 70.57% for the past year. It also offers a modest dividend yield of 0.18%.

Chart courtesy of www.StockCharts.com

RING is an ETF that features an array of major gold stocks. Investors who buy shares in RING can gain exposure throughout the sector by investing in just one fund.

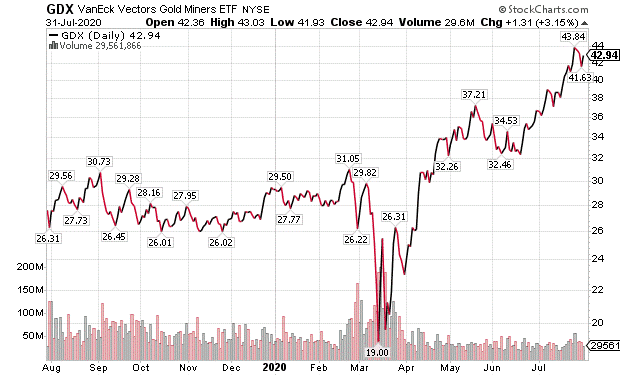

GDX Secures Spot Among 6 Dividend-Paying Gold Investments to Purchase

Big gains also flowed from VanEck Vectors Gold Miners ETF (GDX). The mining stocks that make up this ETF have been surging. GDX rose 17.07% in the last month, 46.65% for the year to date and 63.15% for the past year. Plus, GDX offers a current dividend yield of 0.52%.

Chart courtesy of www.StockCharts.com

Paul Dykewicz meets with Jim Woods before COVID-19 to discuss new investment opportunities.

Gold traders expect the government stimulus and spending ultimately to force a spike in consumer prices beyond any interest-rate increases that banks may pay depositors. That result would cause inflation and hurt the U.S. dollar’s purchasing power.

But it would lift the value of gold because additional dollars would be needed to purchase bullion. The price of an ounce of gold bullion then would rise and boost the value of gold mining stocks, as shown with the jump in share price for mining ETFs such as the iShares MSCI Global Gold Miners ETF (RING) and the Direxion Daily Gold Miners Index Bull 2X Shares (NUGT).

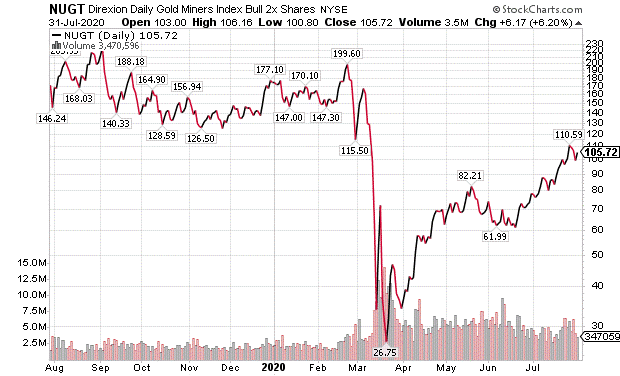

Double Leveraged Fund Listed Among 6 Dividend-Paying Gold Investments to Purchase

NUGT is double leveraged with the plan of rising twice as much as the gold miners index. NUGT previously had been tripled leveraged but the fund scaled back to double leveraged as gold surged. The leverage turns NUGT into a volatile investment that can jump as it did when rising 35.23% in the past month or plunge as occurred when falling 39.31% year to date and 27.74% for the last year. As a bonus, NUGT pays a current dividend yield of 0.91%.

Chart courtesy of www.StockCharts.com

Falling real interest rates, calculated by subtracting inflation from reported or expected interest rates, are supporting the inflationary expectations of investors, while steady bond yields provide a key fundamental tailwind for gold. If that stays intact, precious metals should keep climbing.

Money Manager Picks Newmont as 1 of 6 Dividend-Paying Gold Investments to Purchase

The “most remarkable” part of the precious metals boom is the way the miners have outperformed commodity prices, said Hilary Kramer, host of a national radio program called “Millionaire Maker.”

Kramer, who also leads the Value Authority and GameChangers advisory services, said investors recognize both the defensive value in the reserves these companies have in the ground that remain to be mined and strong earnings growth when every ounce extracted is worth 20-25% more than during the previous year.

“Forget for a moment that we’re talking about those beautiful shiny metals that serve as a reservoir of value when the world looks unsettled and central banks deliberately invite inflation,” Kramer said. “Gold miners are tracking at least 20% earnings growth this year. That’s spectacular.”

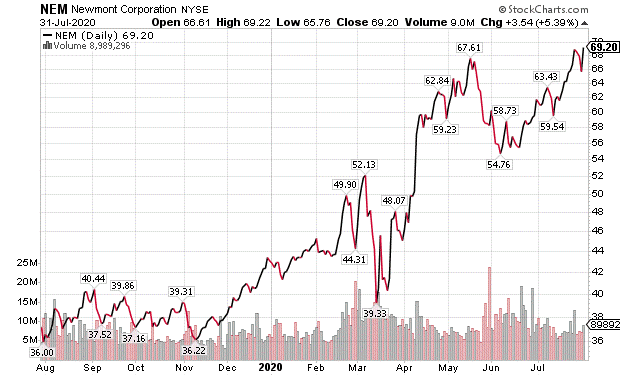

Newmont Grows More Than 20% During Each of the Past 2 Quarters

Gold mining company Newmont Corp. (NYSE:NEM) just reported its second quarter in a row of 20%-plus growth and Kramer said it would not surprise her if that expansion rate triples by the end of the year. Yet NEM does not even trade at 27 times anticipated earnings.

Aside from the defensive nature of gold, investors understandably are bidding up the share price of miners that are growing 60% this year and priced at 27 times earnings, rather than a technology company such as Microsoft with growth of 7% and trading at a lofty 38 times earnings.

Chart courtesy of www.StockCharts.com

“I’d rather have the hard assets than the software,” Kramer said. “We see this throughout the group. Gold stocks are collectively cheaper than the S&P 500 as a whole. Unless you can find a faster-growing business at a comparable multiple, go for the gold. After all, the Fed is unlikely to quit printing money for the foreseeable future. This bullion boom has legs.”

Newmont zoomed 12.08% in the last month, 60.16% for the year to date and 91.32% for the past 12 months. The gold mining company further offers a dividend yield of 1.52% that income investors should appreciate.

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services included 2-Day Trader, IPO Edge, Turbo Trader, High Octane Trader and Inner Circle.

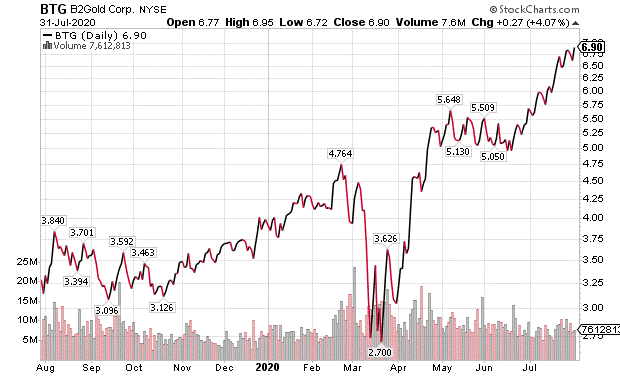

Skousen recommended that his Forecasts & Strategies investment newsletter subscribers buy B2Gold (NYSE:BTG). He previously predicted gold would reach $2,000 by year-end and it now looks like it will rise well beyond that mark.

B2Gold has jumped 21.27% during the past month, 72.82% year to date and 118.24% in the last 12 months. In addition, it offers a 1.18% dividend yield.

Chart courtesy of www.StockCharts.com

The COVID-19 crisis has caused 17,406,644 cases and 675,213 deaths globally, along with 4,541,016 cases and 152,922 lives lost in the United States, as of July 31. America has more cases and deaths of any nation, including China, where COVID-19 first arose.

The six dividend-paying gold investments to purchase have been rocketing upward and are expected to keep doing so as long as the conditions powering them remain intact. For investors who are worried about missing the opportunity, gold should keep gleaming in the months ahead.

Connect with Paul Dykewicz

Connect with Paul Dykewicz