5 High Dividend Stocks to Buy Now

By: Jonathan Wolfgram,

Five high dividend stocks to buy now are perfect for income investors looking to stabilize their portfolios and retirees seeking regular cash flow each quarter.

These five high dividend stocks to buy now were found and analyzed using two programs: our very own Dividend Screener on the Dividend Investor website and Stock Rover, a rigorous, technical screener designed for te most diligent of investors. By combining each of these platforms, we assembled a proprietary screener to filter from over 16,000 North American stocks down to only the very best.

High dividend stocks included on our list had a number of criteria to meet — all stocks satisfied a minimum dividend yield requirement, have been growing their dividends, maintained a reasonable payout ratio, had a stable market capitalization, demonstrated sales growth, and kept price-to-earnings ratio (P/E ratio), return on invested capital (ROIC) and volume at stellar levels. Less than 40 stocks made it through our screening process.

Among those few dozen high dividend stocks, we selected five high dividend stocks to buy now.

5 High Dividend Stocks to Buy Now #5

Rio Tinto (NYSE:RIO)

Rio Tinto (NYSE:RIO) is an industrial metals and mining company extracting minerals worldwide but operating primarily in North America and Australia. Its most popular commodity is iron ore, but Rio Tinto makes a large share of its revenue from diamonds, copper, gold, aluminum and other materials.

The company has outperformed the S&P 500 in the trailing 12-month period, an incredible feat considering the massive economic spike that occurred in the form of COVID recovery. Rio Tinto has grown its share price by 98.5% in the last year and 278.1% in the last five years. Its trailing 12-month returns are charted below alongside a 50-day moving average.

Chart created using Stock Rover. To activate your free trial, click here.

Alongside its rapid economic growth, the company pays out an uber-high dividend, distributing $3.09 to its shareholders semiannually. This payment yields 5.4% and is not limited to twice-yearly payments, since Rio Tinto is known for frequently paying out special dividends, the most recent of which was a $0.93 distribution the same day as its regular dividend. With this trend in mind and based on historical evidence, it is likely the company will pay an annual dividend totaling $7.50 or $8.00 per share, rocketing the dividend yield higher still.

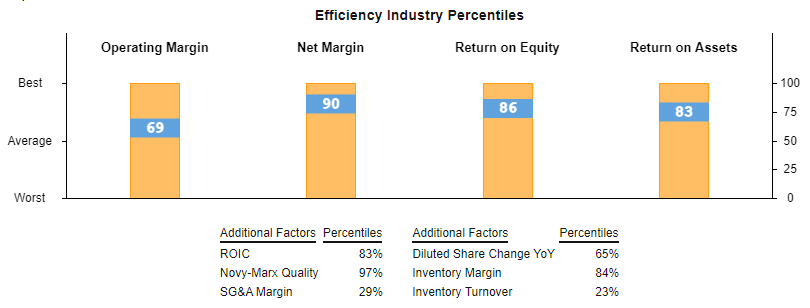

But beyond growth and dividend distributions, Rio Tinto is notably efficient, scoring in the 97th percentile in the mining industry and ranking as the fourth most efficient company among 123 of its peers.

Chart provided by Stock Rover.

The company is a top performer particularly when analyzing an underused and underappreciated metric, Novy-Marx Quality. This quality metric is another title for gross profits-to-assets and has historically predicted the relative performance of companies. It does so by citing their overall efficiency rather than the more commonly analyzed price-to-book ratio and other similar metrics — Rio Tinto scores in the 97th percentile here as well.

With all of these things in mind, a discounted cash flow analysis (DCF analysis) done via Stock Rover values the company at $93.04, an 8% hike from the stock’s current market value.

5 High Dividend Stocks to Buy Now #4

Vale (NYSE:VALE)

Vale (NYSE:VALE) is the largest miner of iron ore in the world and competes closely with Rio Tinto for the title of largest diversified mining company. Like Rio Tinto, Vale generates the majority of its profit from iron ore and iron ore pellets, also making a great deal of revenue off manganese, coal and base metals such as nickel and copper.

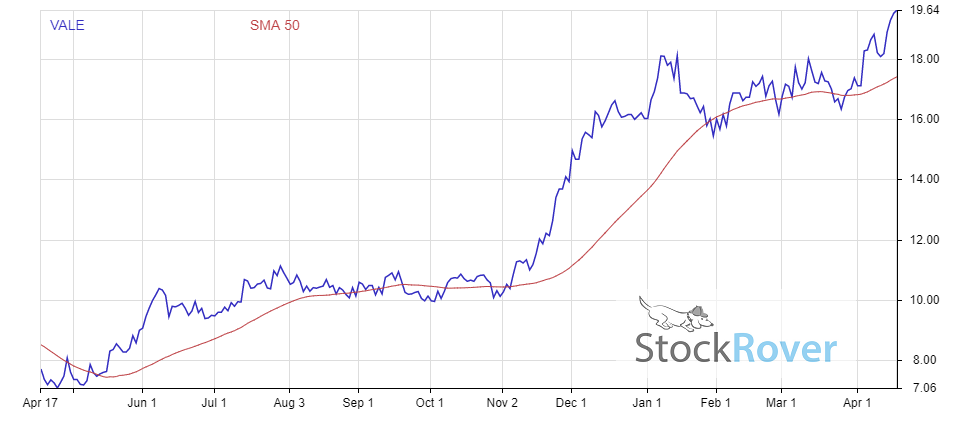

The mining company has seen its share price increase exponentially in the trailing 12-month period, growing by 162.5% and more than doubling the invested capital of many income investors in just one year. Its five-year returns are just as remarkable, having grown more than 350%. The one-year returns are plotted below with a 50-day moving average to outline the overall trend.

Chart created using Stock Rover. To activate your free trial, click here.

In addition to its rapid growth, Vale has maintained a dividend yield of 6%, distributing its dividend annually with its most recent payment at $0.76. The company tends to pay its annual dividend at varying times in the year but has the potential to return to its historic semi-annual dividend in the future. For now, the trailing amount for this year was $1.19 and it is unclear when the next dividend distribution will surface.

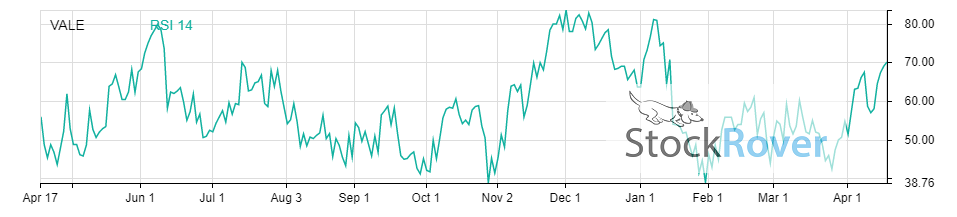

While Vale is a top performer in both dividend distributions and overall returns, the popularity of this company must be taken into consideration. Vale shares frequently are bought and sold in the market, giving the stock a surge of momentum and potentially driving its share price higher than its fair value. Charted below is the relative strength index (RSI) of the equity, which takes recent price fluctuations and market transactions into account to try and determine if a stock is overbought or oversold.

Chart provided by Stock Rover.

With an RSI value of 70.1 (as a rule, 70 is considered to be a high value), Vale appears to be excessively purchased and likely overpriced — this makes the equity a good candidate for a price pullback in the near future. Smart investors should continue to watch Vale and wait for the right moment to enter. Its growth trend and strength as a dividend payer make the stock a solid addition to any portfolio.

DCF analysis using Stock Rover pins the fair value of the company as 2% lower than its current trading price, agreeing with the warning signs shown by momentum indicators such as RSI. Buy at the very next pullback to acquire an excellent high dividend stock at a discount.

5 High Dividend Stocks to Buy Now #3

General Mills (NYSE:GIS)

General Mills (NYSE:GIS) is a dominant food company specializing in snacks, cereal, yogurt, baking ingredients, pet food, ice cream and countless other products. A few of its most notable brands include Nature Valley, Cheerios, Yoplait and Haagen-Dazs, among others. The majority of its revenue comes from operations in retail stores rather than direct to consumer, but a small portion of General Mills’ profit comes from distributing to food-service businesses and commercial bakers.

General Mills is by no means a growth stock, but the company has been a powerhouse in its industry since its initial public offering (IPO) nearly 70 years ago. Presently, it is more focused on maintaining capital while distributing profits to its shareholders. In turn, the company has only grown 4.6% in the trailing 12-month period. In the last three years, however, General Mills has rocketed 53.8%.

The overall returns of GIS are plotted below with a 50-day moving average.

This chart was generated using Stock Rover.

The attractiveness of GIS comes in its power as a dividend-payer. Just last year, the company increased its quarterly dividend from $0.49 to $0.51, a 4% increase that is nearly double the five-year average dividend growth rate of 2.1%. General Mills pays a reliable dividend yield of 3.3% and has a stable payout ratio of 48.1%.

General Mills has an unbroken streak of dividend payments lasting 122 years, making it one of the longest-standing dividend payers in history. While the company does not necessarily increase its dividend every year, the general trend is consistently on the rise and dividend decreases are almost nowhere to be seen in the company’s history.

While a DCF analysis of the company has GIS stock 6% overvalued for the time being, analysts are more bullish, with the average target price of $63.00 being 2.66% higher than the stock’s latest closing price. Regardless, GIS is not a stock to be purchased for quick growth — its consistency and reliable dividend payments make it one possibly to hold forever and reap the benefits year after year.

5 High Dividend Stocks to Buy Now #2

Lazard (NYSE:LAZ)

Lazard (NYSE:LAZ) is a financial services company earning revenue in two primary business segments: asset management and financial advisory. The asset management side of the business has the vast majority of capital invested in equities, largely those housed overseas. These operations are targeted at institutional clients in North America but service a wide variety of investors across the globe.

Lazard has seen a remarkable 70.9% growth in the trailing 12-month period. While the majority of that growth is due to its post-COVID-crash recovery, the stock has grown nearly 30% from its peak pre-pandemic level in early 2020, rewarding both long-term investors and those who entered at the bottom in April 2020. The company’s one-year returns are plotted below with a 50-day moving average.

Chart created using Stock Rover. To activate your free trial, click here.

As a dividend payer, Lazard has maintained a level $0.47 quarterly dividend since its last increase in 2019. This rate corresponds to an annual dividend distribution of $1.88, barring any special dividends — the company typically pays out one large special dividend per year after the first quarter, but the timing and amount vary.

Lazard maintains a dividend yield of 4.2% and a payout ratio of 50.9%. Its dividend growth rate in the trailing five years averages 6.1% per year.

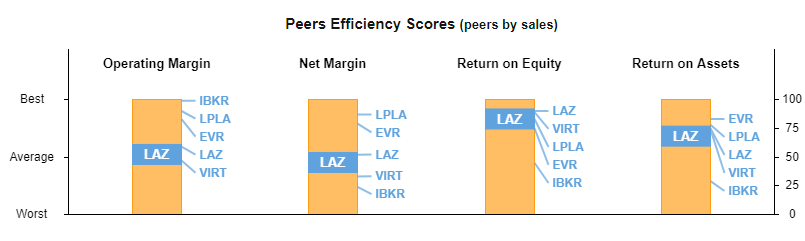

The overall efficiency of Lazard makes it a candidate for any investor’s portfolio. While the company has a fair net margin and operating margin, the return on assets is commendable and the return on equity is stellar. Its return on equity of 43.3% is one of the highest in its industry. Lazard also is highly skilled at using its investors’ money to generate strong returns. A comparison between Lazard and its peers is charted below.

This chart was generated using Stock Rover.

Due to the nature of the business as a financial services stock, companies of its kind often have liabilities and sources of income that cannot be effectively captured by a discounted cash flow analysis. Rather than looking at the fair value, then, we can have some degree of confidence in the stock due to the consensus average analysts’ target price — $46.14, almost 3% higher than LAZ’s current trading value.

5 High Dividend Stocks to Buy Now #1

Hercules Capital (NYSE:HTGC)

Hercules Capital (NYSE:HTGC) is a financial services company engaged primarily in mortgage finance, providing loans to steady-growth, venture capital-backed companies in a variety of industries. Its first mode of investment is structured debt but also invests in companies using senior debt and equity investments.

Hercules Capital has a portfolio largely made of technology companies, but it is also known to invest in projects concerning drug development, biotechnology, renewable energy, life sciences and health care.

The company’s stock price has skyrocketed in the last year — HTGC went up 110.6% in the trailing 12-month period, doubling the money of investors who purchased shares during the April 2020 dip. The share price fluctuation has been relatively minimal since then to retain a steady upward trend outlined by the 50-day moving average line charted below.

Chart provided by Stock Rover.

Throughout the financial hardships of 2020, Hercules Capital continued to pay its full dividend, which has been level at a quarterly $0.32 for the last two years. The company frequently pays small special dividends, bringing the annual distribution to approximately $1.38 and yielding an astronomical 7.6%.

Luckily, this high dividend payment appears stable, as the company is within a healthy range for its payout ratio of 63.4% and its dividend coverage ratio of 157.8%. As high as the dividend is, especially when taking the recent growth into account, its projected dividend growth is minimal — Hercules Capital has grown the dividend at a rate averaging just over 1% per year in the last three years. Investors can hope for the share price to continue going up but should anticipate the dividend staying level in the near future rather than increasing alongside the stock price.

While it is difficult to come up with an accurate valuation using DCF analysis for the same reasons as it is with Lazard, a rough approximation leads investors to be bullish on HTGC. Stock Rover software values the stock 16% higher than its latest closing price, meaning investors have a great opportunity to purchase this high-growth, high-dividend stock for their portfolios.

The five dividend stocks to buy now offer income investors a handful of ways to be paid while also seeking capital appreciation from rising share prices.

Related Articles:

3 Best Dividend Stocks to Buy Now

3 Dividend Growth Stocks to Buy Now

Top 10 Best Screening Tools for Investors

25 High Dividend Stocks in 2020 to Consider Buying

10 High Dividend Stocks Under $20

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Jonathan Wolfgram

Connect with Jonathan Wolfgram