5 Monthly Dividend Payers Offer 8%-Plus Yields to Usher in 2017

By: Ned Piplovic,

By Ned Piplovic

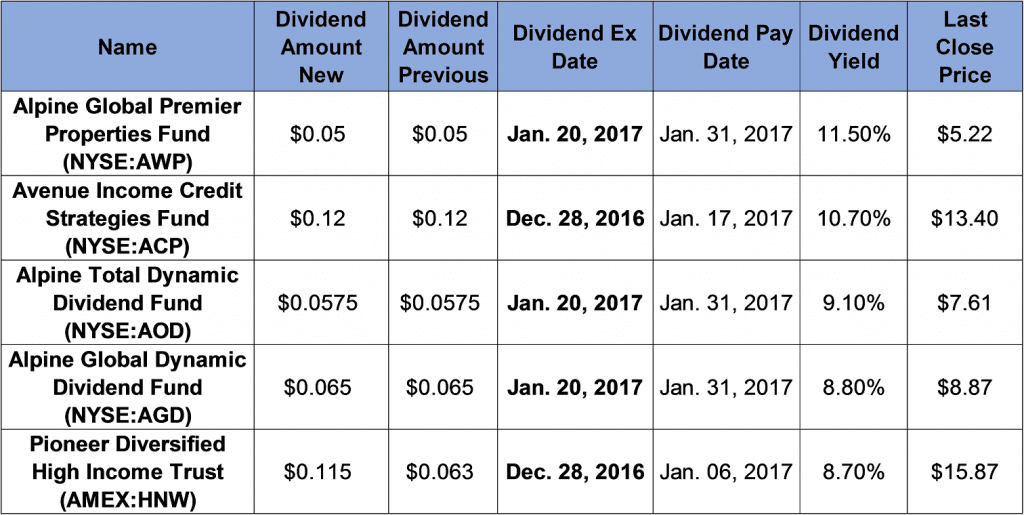

Each of the following five investments provides enticing monthly dividend payouts that currently yield more than 8.5%.

All five of the funds have delivered share-price appreciation of 20% since January 2016. Plus, the diversified nature of these funds should help investors to avoid excess volatility, since the 52-week price range between the low and high of each one is just 25% or less.

Alpine Global Premier Properties Fund (NYSE: AWP)

Alpine Global Premier Properties Fund invests in companies and securities with exposure to real estate. Its annual dividend payout has remained steady over last five years at $0.60. The fund’s current dividend yield is 11.50%, which is 20% higher than its five-year yield average of 9.6%.

Its stock price fluctuated during the 12 months from a low of $4.63 on February 11, 2016, and a high of $5.90 on September 2, 2016. The price is currently trading in the middle of that range. It closed on December 19, 2016, at $5.22. That is 12.7% above the 52-week low and 11.5% under the 52-week high.

As a mutual fund, AWP reports its holdings at the end of each quarter. As of the end of September 2016, the fund consisted of 109 holdings spread across diverse segments of the sector – industrial, office, residential, lodging, retail, financials, etc. The fund’s objective is to balance its main goal of long-term capital appreciation with a secondary objective of high current income.

Avenue Income Credit Strategies Fund (NYSE: ACP)

The Avenue Income Credit Strategies Fund invests in global credit securities. Unlike the previous example, this fund’s primary goal is high current income, with potential capital appreciation as a secondary goal.

Its monthly dividend payout is $0.12. The annual payout of $1.44 translates to a 10.7% dividend yield. The current yield is almost 20% higher than the five-year average.

This share price has the largest variation between the 52-week high and the 52-week low of the entire group. However, that is positive in this case. Current share price is 43.6% higher than the $9.33 low from February and virtually even to its high price of $13.46 that was achieved on December 12, 2016.

With the ex-dividend date less than a week away on December 28, 2016, there is not much time to waste for investors interested in cashing in on this opportunity.

Alpine Total Dynamic Dividend Fund (NYSE: AOD)

Alpine Total Dynamic Dividend Fund uses a highly diversified investment approach to achieve its main goal of high dividend payout. Fund managers employ growth, value, special dividends and dividend capture rotation strategies to maximize dividend distribution. Capital appreciation is a secondary goal.

Monthly $0.0575 dividend translates to a $0.69 annual payout. With the share price currently at $7.61, dividend yield is 9.1%. While 9.1% is a significant yield, it is lower than the five-year average of 14.5%.

After going down to almost $7.00 in the beginning of November, share price increased 7.5% in just over a month and is currently only 3.1% below the 52-week high from August 19, 2016. As of December 19, 2016, the price of $7.61 is 16.7% higher than the 52-week low on February 11, 2016.

Alpine Global Dynamic Dividend Fund (NYSE: AGD)

Alpine Global Dynamic Dividend Fund’s target is high current dividend income with long-term capital growth as an ancillary goal. The fund uses dividend capture, value and growth strategies to “maximize the amount of distributed dividend income that is qualified for reduced Federal income tax rates.” As of September 2016, and excluding cash equivalents, the top three holdings were Syntel, Inc., Apple, Inc. and Samsung Electronics Co., Ltd.

An annual dividend of $0.78 is paid in $0.065 monthly increments, which translates to an 8.8% dividend yield. The annual dividend has been increasing incrementally from $0.768 in 2014 to $0.776 in 2015 before it reached its current level.

Its share price increased almost 20% since the 52-week low on January 20, 2016, and is only 1.8% lower than the 52-week high on December 14, 2016.

Pioneer Diversified High Income Trust (AMEX: HNW)

Pioneer Diversified High Income Trust is a mutual fund that invests in global fixed income markets. The fund seeks high-yield asset classes such as high yield bonds, leveraged bank loans and event-linked bonds.

The current dividend yields 8.7% on a $1.38 annual payout of its regular monthly dividends. In addition to the regular monthly dividend, the trust declared a special dividend of $0.063 in December to be paid at the end of the month. Its dividend yield increases to 9.1% when the special dividend is included.

Share price was $15.87 as of December 19, 2016. That is 17.8% higher than the 52-week low on January 20, 2016, and only 5.7% lower than the 52-week high on September 2, 2016.

Its regular dividend pay date is January 6, 2017, merely nine days after the ex-dividend date of December 28, 2016. This makes for a quick cash payout opportunity for investors that are not interested in holding this security for the long term.

———

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily.

To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic