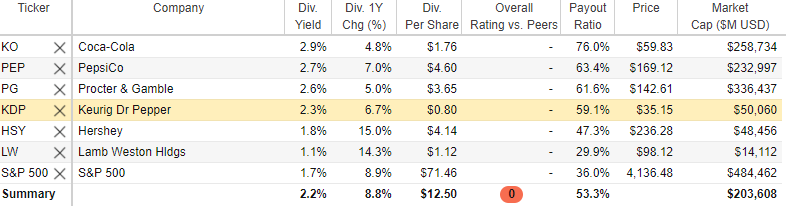

Six Dividend-paying Consumer Staples Stocks to Purchase

By: Paul Dykewicz,

Six dividend-paying consumer staples stocks to purchase as recession shields feature proven brands.

Five of the six dividend-paying consumer staples stocks to purchaser feature the food and beverage category, while the other one offers cleaning and personal care products. BofA Global Research rated beverage stocks as its favorite consumer staples sub-sector, but household, beauty and personal care companies followed closely.

Multinational consumer staple stocks such as Atlanta’s Coca-Cola (NYSE: KO) and Cincinnati’s Procter & Gamble (NYSE: PG) will be helped by peak U.S. dollar and interest rates, BofA wrote. Investors eyeing quality can rely on Harrison, New York-based PepsiCo (NASDAQ: PEP) and Hershey, Pennsylvania’s Hershey (NYSE: HSY), while those seeking a consumer staples stock in the mid-cap and small-cap category can choose frozen potato provider Lamb Weston Holdings, Inc. (NYSE: LW), of Eagle, Idaho.

Courtesy of www.StockRover.com. Learn about Stock Rover by clicking here.

Six Dividend-paying Consumer Staples Stocks to Purchase Enjoy Inelastic Demand

Consumer staples food and beverage companies have shown “surprisingly inelastic” demand for their products, according to BofA. The investment firm foresees upside for gross margins, along with upgraded earnings revisions, as input inflation plateaus and the U.S. dollar weakens.

Unlike last quarter, BofA broadly expects earnings estimates for fiscal year 2023 to be in-line or move up due to the factors previously mentioned.

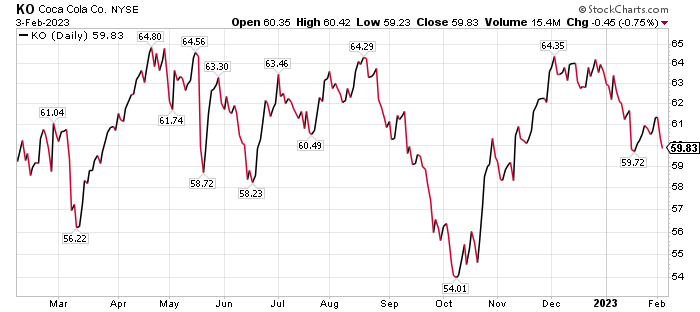

Coca-Cola is recommended both by BofA and Mark Skousen, PhD, who heads the Forecasts & Strategies investment newsletter. Coca-Cola is among the Flying Five stocks that Skousen recommends by choosing five Dow Jones Industrial Average positions that have the lowest price from a list of the 10 highest-yielding companies in the index.

Mark Skousen, a scion of Ben Franklin and head of Fast Money Alert, meets Paul Dykewicz.

Coca-Cola’s total returns have reached 46.8% since Skousen recommended it on July 31, 2017.

Chart courtesy of www.stockcharts.com

Coca-Cola Headlines Six-Dividend-paying Consumer Staples Stocks to Purchase

BofA projects “solid organic sales growth” from Coca-Cola aided by price hikes and strong demand. The investment firm set a $74 price objective on the stock, giving it a premium to non-alcoholic-beverage peers.

“In our view, a premium multiple is warranted by balanced and resilient organic sales growth,” BofA wrote in a recent research note.

An outperformance could occur with strong growth in developed and emerging markets, a weakening U.S. dollar compared to other currencies and improved free cash flow conversion. Risks to meeting that price target include volatility in developed and emerging markets, earnings per share (EPS) headwinds if the U.S. dollar strengthens and consumer concerns about sugar and calories, the investment firm wrote.

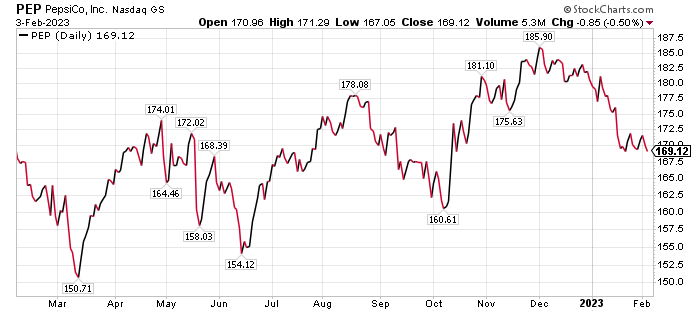

Six-Dividend-paying Consumer Staples Stocks to Purchase Include PepsiCo

PepsiCo is another major beverage stock top phase. The company owns the popular Frito-Lay brand of snack foods. BoA put a $205 price target on PepsiCo., along with a buy recommendation.

“We expect PEP is set up for another quarter of strong organic sales growth, modeling 4Q22 organic sales growth of +8%,” BofA wrote.

PepsiCo received a premium valuation to its non-alcoholic-beverage peers that is “justified” based on the stock’s positioning to deliver against its long-term algorithm and return cash to shareholders via dividends and share repurchases, the investment firm wrote. Further pluses for PepsiCo include low-to-moderate foreign exchange headwinds, growth opportunities and improving volume/price/mix in soft drinks.

Risks to reaching the price target stem from foreign exchange becoming a drag on results and Frito-Lay North America incurring a decline in volumes due to price hikes.

Chart courtesy of www.stockcharts.com

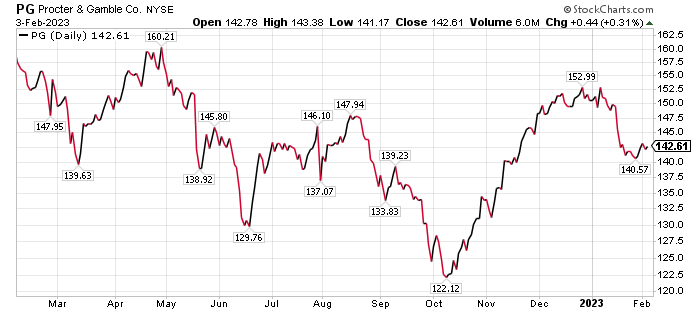

Six-Dividend-paying Consumer Staples Stocks to Purchase Clean up with Procter & Gamble

Procter & Gamble is a pick of Jim Woods, who concurrently leads the Intelligence Report investment newsletter and the Bullseye Stock Trader. The latter service recommends stocks and options, while Intelligence Report newsletter features stocks that typically pay dividends.

Paul Dykewicz meets with Jim Woods, head of Bullseye Stock Trader.

Woods recommends Procter & Gamble in the Income Multipliers Portfolio in his Intelligence Report investment newsletter.

BofA forecasts favorable tailwinds for Procter & Gamble with its market share trend improving since the start of fiscal year 2023, while inflation and currency headwinds moderate. Market expectations for organic sales have crept up recently to 5%, but the company has a favorable setup over the next few quarters, forecast BofA, which gave the stock a price target of $170.

Portia Capital Chief Predicts Procter & Gamble Will Shine

Michelle Connell, chief executive officer of Dallas-based Portia Capital Management, also recommends Procter & Gamble. Even though inflation has caused many consumers to trade down with their consumer staple purchases and buy cheaper products, Procter & Gamble has not felt this pressure, Connell commented.

Michelle Connell leads Dallas-based Portia Capital Management.

In its last quarter, the company had revenue growth of 5% due to its ability to increase its sales prices, Connell said. For its core categories, the company boosted prices 8-13%, she added.

Consumers are less willing to compromise regarding PG’s product categories, Connell counseled. The stock has three tailwinds that should assist in returning growth to its bottom line in the form of earnings per share, she said.

Procter & Gamble is expected to continue to increase its U.S. market share for the categories of family care and fabric care, Connell continued. The economic reopening of China will be a huge lift for Procter & Gamble, as the world’s most populous nation accounts for 10% of the company’s revenues, Connell added.

Procter & Gamble Has Upside of at Least 16%

The estimated upside for Procter & Gamble is more than 16%, Connell counseled. The stock also is offering a current dividend yield of 2.6%.

BofA’s price objective is affected by potential slowing in sales momentum, adverse competitive responses from private label brands in the coming months and a return to “risk-on” investing that would make Procter & Gamble’s defensive qualities less attractive.

Chart courtesy of www.stockcharts.com

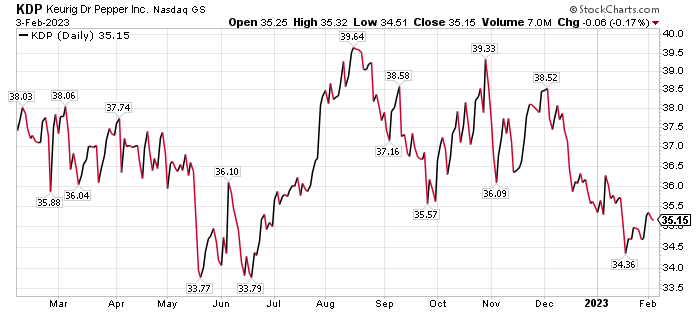

Keurig Dr Pepper Is Among Six-Dividend-paying Consumer Staples Stocks to Purchase

Keurig Dr Pepper (NASDAQ: KDP), of Burlington, Massachusetts, is another recommendation of BoA. The investment firm placed a $45 price objective on the stock. The valuation takes into account KDP’s “attractive portfolio” of products that is equipped to grow sales and earnings, particularly with the addition of the C4 energy drink brand, BofA wrote.

Potential outperformance to the price target could come from additional synergies, reduced volatility in the coffee business, increased adoption of Keurig brewers and pods, as well as attractive mergers and acquisitions (M&A) candidates.

Several risks could create headwinds to attain the price objective, according to BofA. They include any industry shifts away from single serve coffee, which could lead to slower than anticipated de-leveraging, along with weak consumer spending around the holiday season that could negatively impact sales of the Keurig brewers.

Chart courtesy of www.stockcharts.com

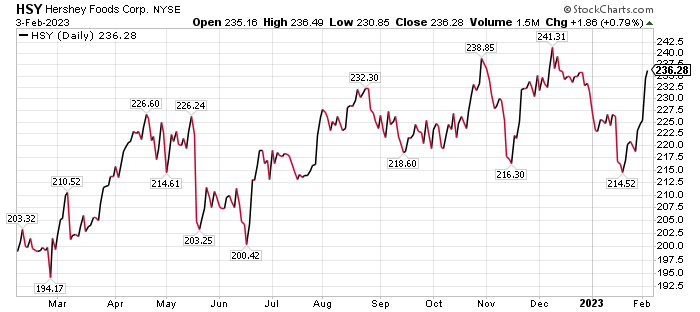

Hershey Is the Sweetest of Six-Dividend-paying Consumer Staples Stocks to Purchase

The Hershey Co. received a buy recommendation and a $270 price target from BofA. With some slack in capacity, Hershey is in a better position than recent years to service demand upside if it materializes, BofA wrote in a research note.

For fiscal year 2023 guidance, HSY provided perspective on sales, pricing and inflation, causing BofA to write that it did not expect much surprise one way or another with earnings. Hershey is executing on its pricing actions and has seen lower-than-expected elasticities across its portfolio as consumers spend on sweet treats and snack in an inflationary environment, BofA wrote.

“In addition, HSY has been able to maintain share in its categories with the lowest private label exposure in its peer set,” BofA continued.

Potential outperformance could come from continued market share gains in a low private label exposure environment, faster moderation of inflation, low elasticity persisting and volume gains offsetting any pricing decelerations, BofA opined. Risks to reaching the price target include elevated inflation taking longer than expected to taper off, competitors grabbing market share from HSY and negative surprises on packaging, logistics or special ingredient costs that aren’t traditionally hedged by Hershey.

Chart courtesy of www.stockcharts.com

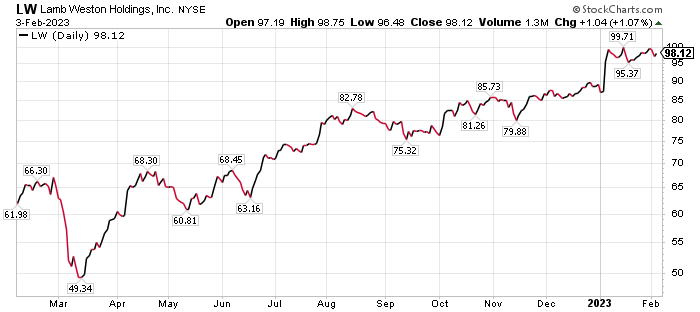

Six Dividend-paying Consumer Staples Stocks to Purchase: Lamb Weston

Lamb Weston Holdings, Inc. (NYSE: LW), of Eagle, Idaho, supplies frozen potato, sweet potato, appetizer and vegetable products to restaurants and retailers worldwide. For more than 60 years, Lamb Weston has introduced inventive products that are distributed to more than 100 countries.

The company has manufacturing operations in the Pacific Northwest, arguably in the world’s best potato-growing region, the Columbia River Basin. Lamb Weston employs more than 7,000 people worldwide in sales offices, manufacturing plants and corporate offices.

BofA gave Lamb Weston Holdings a price objective of $115, a premium to the packaged food index. The investment firm wrote that the premium is warranted, since Lamb Weston is poised to approach pre-COVID levels with upside potential to improve demand trends and margin potential in fiscal year 2023 and 2024.

Chart courtesy of www.stockcharts.com

Potential Risks Could Weigh on Lamb Weston

Potential outperformance for Lamb Weston to surpass its $115 price target could come from demand rebounding faster than expected and category growth staying above 3% to allow tight industry supply to continue in the medium- to long-term. Tight industry supply allows for further price increases across both global and food service customers, BofA wrote.

Risks to reaching the $115 price target include higher-than-expected potato costs for 2022, struggling to push through additional pricing to cover inflation and restore margins, influx of new industry capacity and slowdown in on-premises activity if the consumer has less spending power.

Bryan Perry, the leader of the Cash Machine investment newsletter and the Breakout Options Alert trading service, recommended Lamb Weston call options in the latter service. The trade is almost up by 10% since the recommendation and the stock is up 11.78% so far this year.

Russia’s War Against Ukraine Intensifies

The six dividend-paying consumer staples stocks to purchase are mostly insulated from the fierce fighting currently occurring in Bakhmut, Ukraine, where Russian forces are trying to gain control of a key highway and disrupt supplies. Russian airborne units have joined Wagner mercenary fighters in the battle for the city.

Russia’s troops are “leveling Bakhmut to the ground, killing everyone they can reach,” Pavlo Kyrylenko, a Ukrainian prosecutor and politician who also is the current Governor of Donetsk Oblast, wrote on Telegram. Russia claimed on Tuesday, Feb. 1 to have captured a village just to north of Bakhmut as it seeks to surround the city itself and seize control.

The U.S. State Department accused Russia of violating a key nuclear arms agreement by refusing to allow inspections of its nuclear facilities. The only agreement left to regulate the nuclear arsenals of the United States and Russia is the New START treaty, but inspections have been on hold since 2020 due to the COVID-19 pandemic.

Russia is sustaining its onslaught of increased strikes that began in October, targeting Ukraine’s energy and civilian infrastructure. Meanwhile, Ukraine is seeking and receiving additional tanks by its allies to fend off Russia’s unrelenting attack.

COVID Deaths Rise, But President Biden Plans to End COVID Public Health Emergency Declaration in May

President Biden announced earlier this week that he planned to end the current U.S. public health emergency declaration due to COVID-19 this May. However, worldwide COVID-19 deaths rose to 6,840,062 people, with total cases of 671,502,472, Johns Hopkins reported on Feb. 3. COVID-19 cases in the United States totaled 102,586,687, while deaths reached 1,111,485 as of Feb. 3, according to Johns Hopkins University. Until recent reports that China had 248 million cases of COVID-19, America had ranked as the nation with the most coronavirus cases and deaths.

The U.S. Centers for Disease Control and Prevention reported that 269,064,626 people, or 81.0% the U.S. population, have received at least one dose of a COVID-19 vaccine, as of Feb. 1. People who have completed the primary COVID-19 doses totaled 229,719,115 of the U.S. population, or 69.2%, according to the CDC. The United States has given a bivalent COVID-19 booster to 49,078,211 people who are age 18 and up, equaling 19% as of Feb. 1, compared to 18.8% as of Jan. 26, 18.5% on Jan. 18, 18.2% on Jan. 11, 17.7% as of Jan. 4, 17.3% on Dec. 28, 16.8% the previous week, 16.3% the week before that one and 15.5% the preceding week.

The six dividend-paying consumer staples stocks to purchase offer tempting investment opportunities in beverages, food and personal care products.

Connect with Paul Dykewicz

Connect with Paul Dykewicz