Automotive Parts Manufacturer Boosts Dividends Six Consecutive Years, Offers 12.65% Total Returns in the Last 12 Months

By: Ned Piplovic,

An automotive parts manufacturer rewarded its investors with 12.65% total returns over the past year and hiked its annual dividends at a double-digit compounded annual growth rate for six consecutive years.

Gentex Corp.’s current yield on dividends is higher than the yields of its peers in the consumer sector. Additionally, the company has a very low 29% dividend payout ratio, which indicates that the company should be able to sustain its rising dividend policy for the long term.

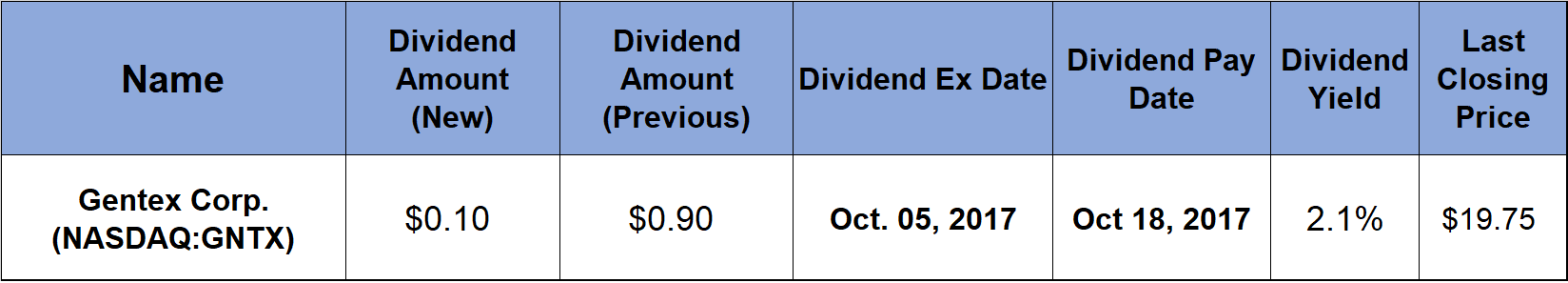

The ex-dividend is coming up shortly on October 5, 2017, with the pay date following about two weeks later on October 18, 2017.

Gentex Corp. (NASDAQ:GNTX)

Gentex Corporation designs, develops, manufactures and markets automatic-dimming rearview mirrors and electronics for the automotive industry, dimmable aircraft windows, as well as commercial smoke alarms and signaling devices for the fire protection industry worldwide. The company’s automotive products include interior and exterior electrochromic automatic-dimming rearview mirrors, automotive electronics, as well as interior and exterior non-automatic-dimming rearview mirrors with electronic features for original equipment manufacturers (OEMs), tier one automotive mirror manufacturers and various aftermarket and accessory customers.

Additionally, the company provides photoelectric smoke detectors and alarms, audible and visual signaling alarms, electrochemical carbon monoxide alarms, electrochemical carbon monoxide detectors and alarms, as well as bells and speakers for use in fire detection systems. Gentex Corporation sells its fire protection products directly, as well as through sales managers and manufacturer representative organizations to its corporate customers. Founded in 1974, the Gentex Corporation’s headquarters are in Zeeland, Michigan.

The company’s current quarterly dividend of $0.10 yields 2.1% and is equivalent to a $0.40 annual dividend distribution. Compared to dividends from the same period last year, the current dividend is 1.1% higher. Additionally, the current 2.1% dividend yield is 1.3% higher than the company’s five-year average yield. The company has been paying dividends for the past 14 years and has missed a dividends hike only once in 2010. Over the past seven years of boosting dividends, the annual dividend payout grew at an average rate of 15% per year and rose a total of 167% in that seven-year period.

The share price reached its 52-week low on November 3, 2016, after dropping 8% in October 2016. After the 52-week bottom, the share price rallied more than 38% and reached its new all-time high of $22.12 in mid-March 2017. However, by August 2, 2017, the price gave back most of its gains and fell to $16.89, which was just 5.4% above the 52-week low from November 2016. The trend reversed again and the share price has been rising ever since. As of closing on September 25, 2017, the share price was $19.75, which is more than 12% higher than the share price from one year ago and 23.3% above the November 2016 low. Including the dividend distributions, the total return was 12.85% over the past 12 months, 44.55% over the past three years and 140% over the past five years.

Because of the price drop between March and August 2017, the 50-day moving average (MA) dropped below the 200-day MA in late June and continued falling. However, the recent uptrend resulted in a reversal and the 50-day MA is increasing again as of September 14, 2017. Additionally, the closing share price on September 25, 2017, broke above the 200-day MA for the first time since mid-May 2017. These technical indicators suggest that the recent uptrend could continue for the next couple of quarters.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic