Canadian Bank Hikes Dividend 2.3%, Returns a 3.7% Yield

By: Ned Piplovic,

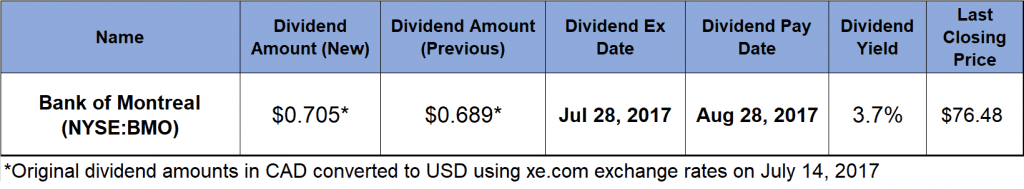

The Bank of Montreal (NYSE:BMO) boosted its quarterly dividend 2.3% versus the previous period and offers a 3.7% dividend yield, which exceeds the financial sector average by almost 15%.

In addition to the most recent dividend hike and a long-standing record of paying rising dividends, the bank enhanced its share price by a double-digit percentage over the past year. The next ex-dividend date is coming up on July 28, 2017. All shareholders of record, as of that date, will receive their dividend distribution payouts on August 28, 2017.

Description of the Bank of Montreal

Founded in 1817, the Bank of Montreal provides diversified financial services through its 1,500 branches and operates through three groups – Personal and Commercial Banking, Wealth Management and BMO Capital Markets.

The bank’s personal banking products and services include checking and savings accounts, credit cards, mortgages, creditor insurance and financial and investment advice. Business deposit accounts, commercial credit cards, business loans, commercial mortgages, cash management solutions, foreign exchange and specialized banking programs are part of BMO’s commercial banking products portfolio. Additionally, the bank offers wealth management products and services, insurance, corporate banking services, trading services, and funding and liquidity management services to its clients.

In addition to the Canadian market, the bank has offered services in the United States since 1882. The BMO’s fully owned U.S. subsidiary – BMO Harris Bank – currently has more than 600 branches and 1,300 ATMs in eight states. While the United States and Canada account for a majority of the its operations, the bank has expanded its presence to all continents. In addition to the United States and Canada, BMO currently has branch offices in western Europe, east and southeast Asia, United Arab Emirates, Brazil and Australia.

Market Performance

The bank boosted its quarterly dividend distribution 2.3% from $0.689 last quarter to the current $0.705. The current quarterly dividend distribution is equivalent to a $2.82 annual payout and yields 3.7%. Compared to its industry peers, BMO’s current dividend yield exceeds the financial sector’s average yield by 14.9%.

The Bank of Montreal started paying dividends 188 years ago in 1829. During the most recent financial crisis that began in 2008, many banks were forced to drastically cut or eliminate dividends altogether. However, the Bank of Montreal was able to weather the crisis without dividend cuts and merely paid a flat $2.19 (CA$2.80) annual dividend from 2008 to 2011.

After four years without hikes, the bank resumed boosting its dividends in 2012. Over the last six years since then, the annualized dividend rose at an average rate of 3.7% every year. Analysis of the bank’s rising dividends over the past two decades reveals that the annual distribution grew at an average annual rate of 7.4% over that period.

The share price lost almost 5% on a downward trend between mid-July and October 31, 2016, when the price reached its 52-week low. However, the price reversed its course, gained more than 25% and achieved a new all-time high by February 23, 2017. After another trend reversal and a 13.2% percent drop through the end of May, the price rose again, recovered all those loses and closed on July 14, 2017, at $76.61. That price is just 1.8% below the February all-time high and almost 17% above the mid-July 2016 level.

Leadership change and outlook

Despite BMO’s long history of financially sound performance, some analysts expressed doubts about Bank of Montreal’s future success when it was announced in April that Bill Downe – the bank’s chief executive officer (CEO) of the past 10 years – will retire at the end of October 2017. However, Darryl White, the current chief operating officer (COO) and the successor named to replace Bill Downe when he retires at the end of October, stated that the company will continue its current course. In a July 5, 2017, interview with Francine Lacqua on “Bloomberg Surveillance,” Down emphasized that at least for the near future, the bank’s business strategy “will look reasonably similar to the one that we’ve seen… in the last 10 and 20 years.” Dawn also mentioned that in terms of new opportunities, he sees the fastest expansion in the United States.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic