Discovering Dividend Dandies with Quarterly Dividend Payouts and 9 Percent-Plus Yields

By: Ned Piplovic,

Three dividend-paying dandies offering steady quarterly dividend income adn yields of 9 percent or higher now are newly available for income-seeking investors.

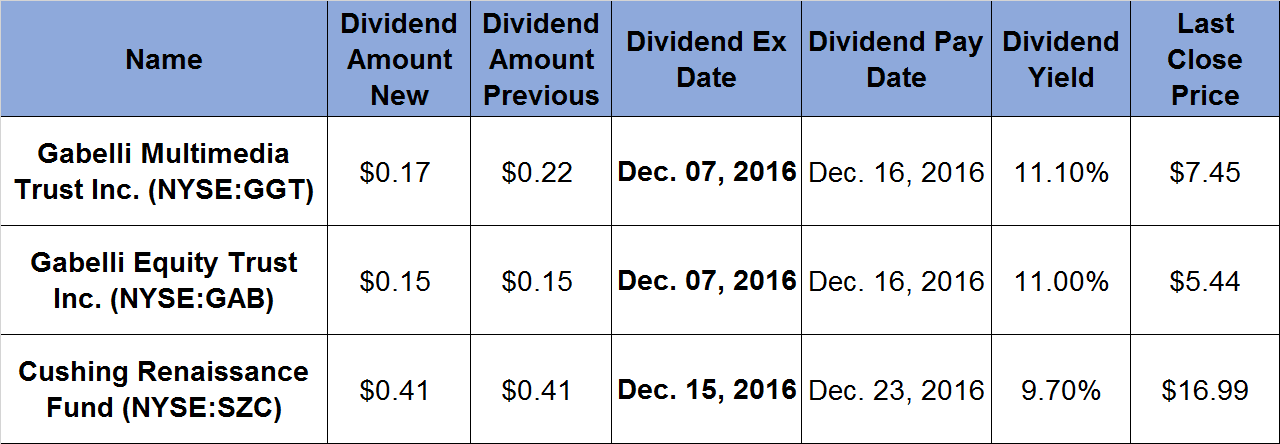

Instead of focusing solely on dividend-paying stocks, consider the following two trusts and a fund that announced new dividend payments on Friday, Nov. 18. None of the dividends rose but all have ex-dividend dates in December and payouts scheduled before the end of the year.

has total net assets of $239 million invested across 251 holdings. The fund’s top three investment sectors are entertainment, cable and computer software and services. Top three holdings are Sony Corp., Grupo Televisa SAB and YAHOO! Inc.

The trust has been paying dividends since its inception in 1994. The upcoming $0.17 quarterly dividend translates to a $0.68 annual dividend payout and an 11.1% dividend yield.

Even though its share price dropped more than 25% between an $8.17 high in December 2015 and the 52-week low of $6.05 on February 11, 2016, it has jumped since February and closed at $7.45 on November 17, 2016. As a result, GGT is less than 9 percent below its 52-week high in December 2015.

Gabelli Equity Trust Inc. (NYSE: GAB) has total net assets of $1.7 billion. Its top three sectors are food and beverage, financial services and entertainment. The trust’s top three holdings are Rollins Inc., Honeywell International Inc. and MasterCard Inc.

Its current quarterly dividend of $0.15 converts to an 11% trailing, 12-month dividend yield.

While the annual dividend payout of $0.60 is slightly lower than the $0.64 dividend paid in 2014 and in 2015, the 11% dividend yield is 5.8% higher than the five-year dividend yield average.

GAB’s stock price ranged over the last 52 weeks between $4.32 in early January and $5.89 on Aug. 23. Between the 52-week high and Nov. 3, GAB’s share price decreased 13% to $5.13. However, the price has been increasing since and recouped half of that loss by rising 6% to $5.44 by Nov. 17.

Cushing Renaissance Fund (NYSE: SZC) has more than 50% of its $101.5 million in assets allocated in bonds, 29.6%. Exploration and production of oil and gas accounted for 14.4% and refiners received 11.8%.

The current quarterly dividend of $0.41 contributes to a $1.64 annual dividend, which converts to a 9.7% dividend yield. While the dividend did not increase for the next quarter, the fund has been paying a dividend consistently since its inception in 2012. Indeed, the $0.41 quarterly dividend has been in place since the first quarter of 2014.

After reaching the all-time low of $11.11, the share price has been increasing and reached its 52-week high of $17.20 in late October. The fund’s share price pulled back prior to the U.S. election and dropped to $15.88 by Nov. 3. In the two weeks between Nov. 3 and the close of trading on Nov. 17, its share price rose 7 percent to $16.99.

Special dividend announcement

National Beverage Corp. (NASDAQ: FIZZ) announced a $1.50 per share cash dividend for shareholders of record on November 28, 2016. The dividend will be distributed because of a recent revenue increase and cash flow gains.

While National Beverage Corp. does not pay a regular dividend, it has distributed seven cash dividends – totaling $10.16 per share — over the past 12 years. The company’s board of directors also plans to reward its long-time shareholders by developing a program to increase the distribution of earnings in the future.

FIZZ’s share price declined from its 52-week high in early July to $42.67 by Sept. 28. However, FIZZ’s share price has increased 16% to $49.53 through Nov. 17.

———-

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily.

To make sure you don’t miss any important announcements, sign up for our e-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to e-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic