Dominion Energy Midstream Partners Offers 5% Dividend Boost, 7.9% Dividend Yield (DM)

By: Ned Piplovic,

Dominion Energy Midstream Partners, LP (NYSE:DM), has offered its shareholders a dividend boost every year since initiating dividend distributions in 2015.

In addition to its third consecutive annual dividend boost, the company currently offers its shareholders a dividend yield of nearly 8%. Unfortunately, nearly half of that yield is a function of a significant share-price drop in the first half of 2018. Without that price decline, the dividend yield would be approximately 4.5%, which roughly matches the average for the Gas & Oil Pipelines industry segment and is nearly twice the average for the entire Basic Materials sector.

Existing shareholders might have to hold on to their shares and wait to see whether they might be able to recover their recent losses. However, new investors might consider the recent price drop as a buying opportunity. Dominion Energy Midstream Partners’ share price has continued to rise and appear to be unaffected by the substantial market corrections over the past few weeks. The share price’s current uptrend might continue a little longer and the above-average dividend income payouts are significant enough to partially mitigate risk of additional price declines in the near term.

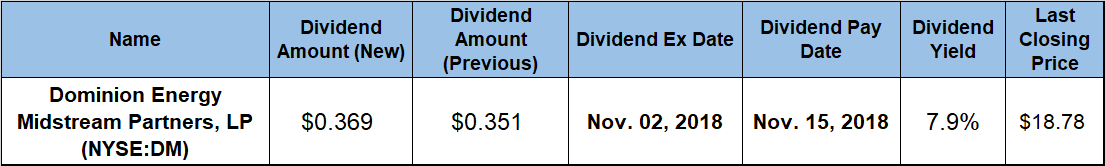

However, new investors who wish to receive the next round of dividend distributions on the Nov. 15 pay date must take a position prior to the upcoming ex-dividend date, which will occur on November 2, 2018.

Dominion Energy Midstream Partners, LP (NYSE:DM)

Headquartered in Richmond, Virginia, and founded in 2000, Dominion Energy Midstream Partners, LP is a Delaware limited partnership formed by Dominion Energy, Inc. (NYSE:D). The partnership owns liquefied natural gas (LNG) terminalling, storage, regasification, and transportation assets. Additionally, the company owns and operates an LNG terminalling and storage facility located on the Chesapeake Bay in Lusby, Maryland. Furthermore, Dominion Energy Midstream Partners also operates an interstate pipeline in South Carolina and southeastern Georgia comprising natural gas system consisting of approximately 1,500 miles of transmission pipeline and 5 compressor stations with approximately 34,500 installed compressor horsepower. In the Northeast, the company owns and operates more than 400 miles of interstate natural gas pipeline from the Canadian border at Waddington, New York to Hunts Point, Bronx, New York. This pipeline provides service to local gas distribution companies, electric utilities and electric power generators, as well as marketers and other end users through interconnecting pipelines and exchanges. Additionally, DM operates 2,200 miles of natural gas transportation pipelines in northeastern and central Utah, northwestern Colorado, and southwestern Wyoming. Dominion Energy Midstream GP, LLC serves as the company’s general partner.

The share price entered the trailing 12-month period near the one-year peak and advanced 1.7% higher to reach its 52-week high of $38.80 by December 1, 2017. After peaking at the beginning of December 2017, the share price reversed direction and began its decline slowly at first. However, after plunging more than 40% in the second half of March, the price continued to decline and hit its 52-week bottom of $12.80 on May 30, 2018. However, the share price reversed its down trend and has already gained nearly half its value since bottoming out at the end of May 2018. The share price closed on October 24, 2018 at $18.78, While still more than 40% lower than it was one year ago, that closing price was 46.7% above its 52-week low from the end of May 2018 and continues to rise.

The company’s current $0.369 quarterly dividend payout corresponds to a 5.1% dividend boost over the $0.351 distribution payout from the previous period. This new quarterly payout translates to a $1.476 annualized payout and a 7.9% forward dividend yield. Compared to the industry averages, DM’s current yield is 225% above the 2.42%,average yield of the overall Basic Materials sector and more than 70% above the 4.6% simple average yield of the company’s peers in the Oil & Gas Pipelines industry segment.

Since its first annual dividend boost in 2016, the company has more than doubled its total annual dividend payout amount over the past three years. On average, each annual dividend boost translates to an average growth rate of 28.2% per year.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic