Double-Digit-Percentage Dividend Increases Tempt Investors

By: Paul Dykewicz,

Double-digit-percentage dividend increases tempt investors when offered by stocks on the rise, particularly after three recent big bank failures.

The double-digit-percentage dividend increases tantalize investors who seek both income and share-price appreciation. The bonus with these stocks is that each has growth prospects that should support the payouts and price-share increases that investors seek.

The three big bank closures in the past week should not affect any of these stocks that stand out for their recent double-digit percentage dividend increases. Santa Clara, California-based Silicon Valley Bank (NASDAQ: SIVB), New York’s Signature Bank (NASDAQ: SBNY) and La Jolla, California-based Silvergate Bank (NYSE: SI) each collapsed in the past week due to excess risk taking.

Not even an auditing firm like KPMG LLP fully recognized the risk. Silicon Valley Bank failed just 14 days after receiving a clean auditing report and cryptocurrency-focused Signature Bank collapsed 11 days after no red flags were waved about its finances after KMPG’s latest review, according to the Wall Street Journal.

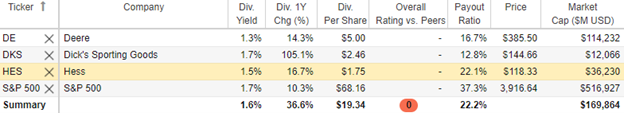

Courtesy of www.StockRover.com. Learn about Stock Rover by clicking here.

Double-Digit-Percentage Dividend Increases Occur Despite Bank Collapses

“When the Fed is openly supporting stock markets and economic growth, it’s easy to make money by taking a lot of risk,” said Bob Carlson, a pension fund chairman and leader of the Retirement Watch investment newsletter. “But when the Fed changes course, risk management is important to success and survival. SVB had weak risk management. Investors need to look beyond a firm’s financial numbers and try to determine if it has adequate risk management policies.”

Retirement Watch head Bob Carlson discusses investing with Paul Dykewicz.

As a pension fund chairman, Carlson is seasoned about managing investment risks. He has served on the Board of Trustees of the Fairfax County Employees’ Retirement System since 1992 and been elected to serve as its chairman every year since1995.

Another experienced investment guide who appreciates dividend-paying stocks is Mark Skousen, PhD, who recommended a profitable one in his Forecasts & Strategies investment newsletter when the overall market struggled during the pandemic. Dividend-paying and New York-based Pfizer Inc. (NYSE: PFE) rose 54.76% from December 2015 to July 2021, while Skousen recommended it.

Skousen, who also leads the Five Star Trader advisory service that features stocks and options, identified weakness developing in the stocks and the market when he informed his subscribers to take profits. As an economics professor, Skousen also tracks inflation and recession risk closely.

Deere Holds Double-Digit-Percentage Dividend Increases Near

Moline, Illinois-based Deere & Co. (NYSE: DE) has had a rising dividend policy since 1988, and it boosted its payout by 10.6% with a pair of increases in the past six months. Skousen, who recommended the stock during January to subscribers of his Five Star Trader advisory service, grew up on a 50-acre farm outside Portland, Oregon, where he drove the Deere tractor of his father, Leroy Skousen.

Skousen observed that Deere is selling under 16 times forward earnings and has a return on equity (ROE) of 37%. Skousen, who heads the Forecasts & Strategies

investment newsletter, further recommended specific call options in Deere, which can ascend much faster than the stock price.

Chart courtesy of www.stockcharts.com

According to Zacks Research, Wall Street estimates have been rising recently, with earnings growth expected to increase by 20% during fiscal year 2023.

Mark Skousen, a scion of Ben Franklin and head of Five Star Trader, meets Paul Dykewicz.

Double-Digit-Percentage Dividend Increases Interest Portia Capital

Deere has done an “excellent job” supporting its stock price by repurchasing 25% of its shares outstanding in the past 10 years, said Michelle Connell, head of Dallas-based Portia Capital Management.

The company is known for buying shares when valuations are low and using its cash for these purchases, Connell continued. There have been some concerns regarding Deere’s insider sales of approximately $4 million in 2022, she added.

“These don’t bother me,” Connell counseled. “Executives frequently have tight windows for the sales of their shares, and estate planning may also be part of the executives’ strategy. I like DE because it takes advantage of the fact that that as a population increases, the demand for affordable food increases as well.”

Michelle Connell leads Dallas-based Portia Capital Management.

Double-Digit-Percentage Dividend Increases Include Dicks’ Sporting Goods

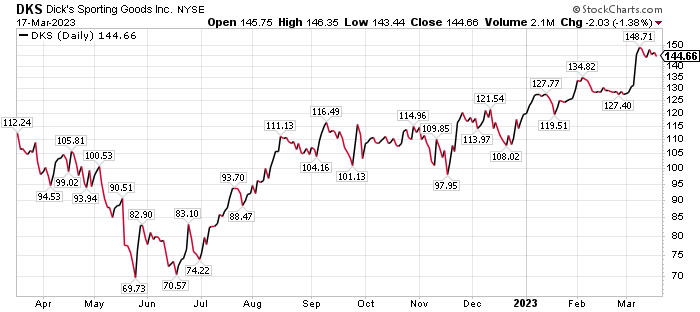

Dick’s Sporting Goods (NYSE: DKS), based in Coraopolis, Pennsylvania, recently received a buy rating and a $170 price objective from BofA Global Research, in-line with the recreation company’s historical average. The stock continues to benefit from the shift to solitary leisure activities, as well as an improving outlook for footwear allocations, BofA wrote in a recent research note.

Risks to attaining the price objective are potential weakening of the macro environment and rising gas prices. Secular headwinds in the golf category could come from weaker traffic trends, higher than-expected cost pressures and the risk of a more competitive pricing environment, the investment firm added.

Dick’s Sporting Goods is the largest sporting goods company in the United States and offers differentiated product lines and private label assortment, according to BofA. The company recently boosted its dividend payout by 104.9%.

Dick’s Sporting Goods sells virtually every imaginable athletic product. It also is where I bought my last softball glove.

Chart courtesy of www.stockcharts.com

Double-Digit-Percentage Dividend Increases Highlight Hess

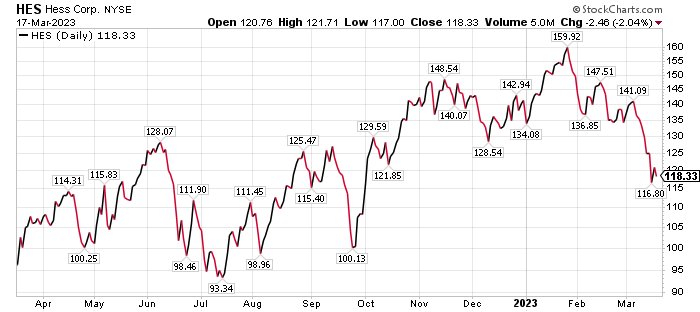

In addition, BofA recommends Hess Corp. (NYSE: HES), which recently increased its dividend payout by 16.8%. The New-York-based company faces similar risks to those of Exxon Mobil (NYSE: XOM), except that the news flow around HES’ exploratory and appraisal drilling activities could hurt the stock. Upside to the price objective include higher oil and gas prices, BofA wrote.

The company’s free cash flow outlook is the only growth story among the U.S. exploration and productions companies, BofA wrote in a research note. While the near-term multiple on Hess is high versus its peers, it is not high enough, according to BofA.

The investment firm sees price appreciation in the future of Hess. When that outlook is combined with a rising dividend policy, Hess offers an enticing opportunity for income seekers.

Chart courtesy of www.stockcharts.com

Micro-Cap Stocks Offer Alternative to Dividend Payers

An alternative to investing in dividend stocks is to put some money in fast-growing micro-cap stocks. That is the niche of futurist George Gilder’s Moonshots advisory service, which limits its circulation to enhance its exclusivity. Gilder and Moonshots’ Senior Analyst Richard Vigilante recently returned from a trip to Israel to conduct due diligence on prospective investments.

Investors interested in micro-cap alternatives may appreciate knowing Moonshots’ portfolio companies jumped an average of 84%, double the gains of the NASDAQ, from July 2019 to February 2023, counting only closed positions. I am reaching out to globe-trotting Gilder and his team as they search for companies developing the kinds of new paradigms that investors crave.

Russia Downs U.S. Surveillance Drone Above International Waters Near Ukraine

Investors should be aware that a Russian warplane struck a U.S. surveillance drone above the Black Sea near Ukraine on Tuesday, March 14, hitting the drone’s propeller and causing its American operators to bring it down in international waters, the Pentagon reported. Until that incident, Russia and the United States had managed to avoid a direct confrontation amid the war in Ukraine.

Pentagon officials said the unarmed and unmanned Reaper drone was on a routine reconnaissance mission when two Russian Su-27 fighter jets approached it about 75 miles southwest of Ukraine’s Crimean Peninsula, an area Russia has used to launch strikes against Ukraine. The Russian warplanes became aggressive, dumped fuel on the drone and one of Russia’s pilots maneuvered to strike the U.S. aircraft, forcing it down into the Black Sea. The midair clash is the first known direct contacts between the Russian and American militaries since the war in Ukraine started last Feb. 24.

America’s Defense Secretary Lloyd Austin said the latest incident was part of a “pattern of aggressive, risky and unsafe actions by Russian pilots in international airspace.”

Johns Hopkins Stops Round-the-Clock Updates of COVID Cases and Death

Worldwide COVID-19 deaths rose to 6,881,955 people, with total cases of 676,633,645, Johns Hopkins University reported on March 10, its last day of collecting data about the pandemic after three years of round-the-clock tracking. COVID-19 cases in the United States reached 103,804,263, while deaths hit 1,123,836 as of March 10, according to Johns Hopkins University. Until recent reports that China had more than 248 million cases of COVID-19, America ranked as the country with the most coronavirus cases and deaths.

The U.S. Centers for Disease Control and Prevention reported that 269,650,596 people, or 81.2% of the U.S. population, have received at least one dose of a COVID-19 vaccine, as of March 15. People who have completed the primary COVID-19 doses totaled 230,211,943 of the U.S. population, or 69.3%, according to the CDC. Also as of March 15, the United States has given a bivalent COVID-19 booster to 51,094,257 people who are age 18 and up, equaling 19.8%.

The double-digit-percentage dividend increases offered by stocks with favorable outlooks create tempting opportunities for investors, despite the failure of three big U.S. banks, Russia’s downing of a U.S. surveillance drone, inflation and recession risk.

Connect with Paul Dykewicz

Connect with Paul Dykewicz