Five Inflation-Shield Stocks to Purchase for Income Amid Putin’s War

By: Paul Dykewicz,

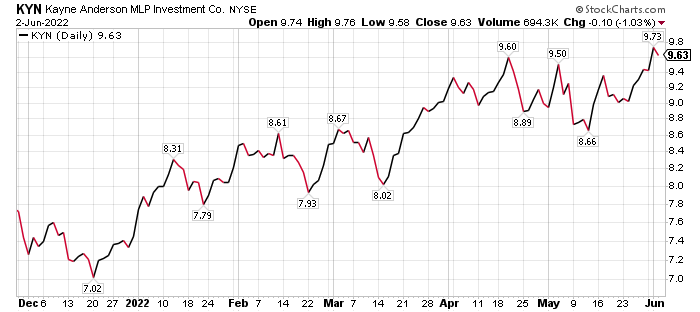

Five inflation-shield stocks to purchase for income provide paths for profiting amid Russia’s President Vladimir Putin ordering his troops to attack neighboring Ukraine, the highest inflation in 40-plus years, the Fed’s plan for further interest rate increases to slow price hikes and a rocketing national debt that has zoomed to $30.49 trillion.

The need for inflation protection is shown by a 7% surge in the Consumer Price Index (CPI) 2021, jumping to an annual rate of 8.5% in March before dipping slightly to 8.3% in April. The U.S. Bureau of Labor Statistics (BLS) reported that the biggest contributors to seasonally adjusted inflation in April came from indexes for shelter, food, airline fares and new vehicles.

The energy index leaped 30.3% in the past year, while energy commodities zoomed 44.71% during the past 12 months. The food index rose 9.4% to mark the largest 12-month increase since the end of April 1981. From March to April 2022, the food index increased 0.9%, while the food at home index added 1.0% for the same month, the BLS reported.

Five Inflation-Shield Stocks to Purchase for Income as EU Cuts Import of Russia’s Oil

The 27-nation European Union voted on Tuesday, May 31, to remove 90% of its Russian crude oil imports in 2022 to limit funds that could be used to sustain the nation’s ongoing attack of Ukraine. The vote exempted Hungary, the Czech Republic and Slovakia, as well as oil delivered by pipeline rather than ships.

To pressure Putin to withdraw his troops from Ukraine, Russia’s invasion spurred economic sanctions to be placed on it by an inter-governmental political forum known as the Group of Seven (G7), consisting of Canada, France, Germany, Italy, Japan, the United Kingdom and the United States, as well as the European Union and other countries that include South Korea and Australia. Since Russia is a significant producer of oil, natural gas, grain and other exports, the sanctions are aimed at swaying Putin to stop using his country’s military might and soldiers in violation of international law to thus far take control of one-fifth of Ukraine’s territory in the first 100 days of its attack that is estimated to have killed tens of thousands of civilians.

Commodity prices for products such as oil, natural gas and grains have risen since Russia’s Feb. 24 invasion of Ukraine that Putin, a former KGB officer who is seasoned in “disinformation” campaigns, has called a “special military operation” rather than announcing that he had started a war that would cause major economic disruption to his country. Nonetheless, the actions of Russian troops have included the shelling of hospitals, schools, residential areas, churches, nuclear power plants, oil refineries and a theater used as a shelter, along with reports of brutally raping, torturing and executing Ukrainian civilians.

Those acts caused leaders such as Ukraine’s President Volodymyr Zelenskyy, U.S. President Joe Biden, U.K. Prime Minister Boris Johnson, France’s President Emmanuel Macron and European Commission President Ursula von der Leyen to accuse Putin of war crimes. The UN General Assembly adopted a resolution on Thursday, April 7, calling for Russia’s suspension from the body’s Human Rights Council.

Even German President Frank-Walter Steinmeier, who previously had close ties with Russia’s leaders, said Putin and his Foreign Minister Sergey Lavrov should face a war crimes tribunal. President Steinmeier added that the invasion “shocks” him, as Putin risks the “total political, economic and moral ruin” of his country in an act of “imperial madness.”

Click here for a free two-week trial of Stock Rover.

Five Inflation-Shield Stocks to Purchase for Income as Oil Prices Climb

Even though the United States ranks as the world’s top oil producer, Russia and Saudi Arabia following closely behind. With Russia providing roughly 10% of the world’s oil, the price of WTI Crude climbed to $116.68 per barrel by Friday morning, June 3, following the EU’s May 31 vote to cut 90% of its Russian crude oil imports in 2022. For American oil users, the average price of regular gas hit a record $4.76 per gallon on June 3, rising 15 cents from $4.61 a week ago, on top of a 56.51% jump in the past year.

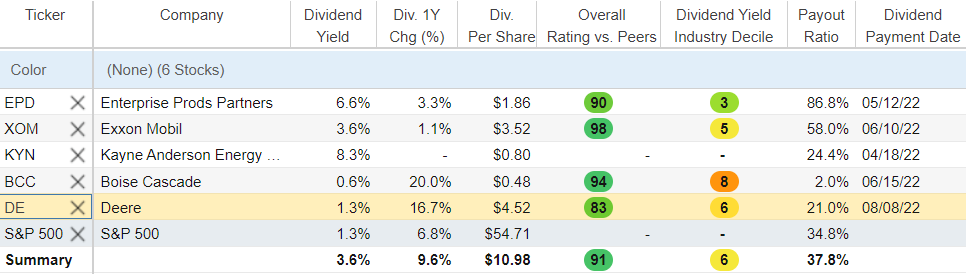

Investors can profit from the continuing rise of oil prices by purchasing shares of Houston-based Enterprise Products Partners (NYSE: EPD). The oil producer’s stock has soared more than 32.38% year to date through the close of trading on Thursday, June 2, to rank as the “best performer” during that time in the Forecasts & Strategies investment newsletter led by Mark Skousen, PhD.

Chart courtesy of www.stockcharts.com

Skousen, who also leads the Five Star Trader, Home Run Trader, Fast Money Alert and TNT Trader services, recently served as a featured speaker at the Vancouver Resource Investment Conference, where he recommended oil as an investment, especially for those seeking inflation protection. I bought shares of Enterprise Products Partners shortly after the 2020 stock market crash to benefit from what I viewed as an inevitable recovery.

Mark Skousen, a descendant of Benjamin Franklin, meets with Paul Dykewicz.

The stock is projected to keep climbing along with oil prices as Russia continues waging war in eastern Ukraine and seizing control of additional land in the industrial Donbas region in a breach of international law. News reports quoted Mayor Oleksandr Striuk of the eastern Ukrainian city of Sievierodonetsk as saying Putin’s forces are advancing block by block amid heavy street fighting with artillery barrages that are threatening the lives of an estimated 13,000 civilians taking shelter there. The city had a pre-invasion population of more than 100,000 people.

EPD Headlines Five Inflation-Shield Stocks to Purchase for Income

Enterprise Products Partners is one of the largest publicly traded partnerships and a key North American provider of midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, refined products and petrochemicals. In addition, the company’s services include natural gas gathering, treating, processing, transportation and storage.

The company further provides NGL transportation, fractionation, storage and import and export terminals. It also offers crude oil gathering, transportation, storage and terminals, along with petrochemical and refined products transportation, storage and terminals, as well as a marine transportation business.

Many other oil and natural gas companies offer inflation protection, too. They range from large to small public companies.

Exxon Mobil Joins Five Inflation-Shield Stocks to Purchase for Income

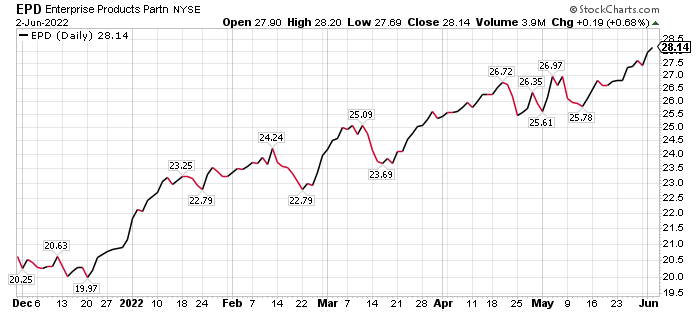

Irving, Texas-based Exxon Mobil (NYSE: XOM), another inflation-protection stock, is one of the biggest producers of oil and natural gas worldwide. The ascent of the stock has slowed in the past week, but it still gained 1.07% during that time, 14.05% in the past month, 22.38% in the past three months, 62.49% so far in 2022 and 66.03% in the past year, prior to the market’s open on June 3.

Amid an ongoing bull market in oil, Exxon Mobil became a recommendation in the Fast Money Alert advisory service co-led by Skousen and Jim Woods. Exxon Mobil is one of the biggest and best large-cap energy companies in the world, they wrote to their subscribers.

Paul Dykewicz talks to Jim Woods, head of Bullseye Stock Trader, Successful Investing and Intelligence Report.

In 2021, Exxon Mobil, the world’s largest refiner, produced 2.3 million barrels of liquids and 8.5 billion cubic feet of natural gas per day. At the end of 2021, its reserves reached 18.5 billion barrels of oil equivalent, 66% of which were liquids. The company’s global refining capacity totals 4.6 million barrels of oil per day and ranks as one of the biggest manufacturers of commodity and specialty chemicals.

As oil prices have soared due to a combination of robust demand dynamics and constricted supply partly stemming from Russia’s invasion of Ukraine, Skousen and Woods wrote that the “smart money” is betting on higher energy prices. Even smarter, faster money is betting on XOM, they added.

Chart courtesy of www.stockcharts.com

Five Inflation-Shield Stocks to Purchase for Income Include Kayne Anderson Energy

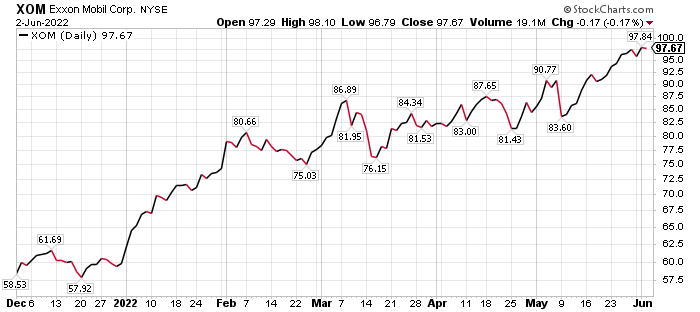

Houston-based Kayne Anderson Energy Infrastructure Company (NYSE: KYN), a closed-ended stock mutual fund launched and managed by KA Fund Advisors, LLC., provides the largest payout of the five high-income inflation-shield investments to purchase. KYN offers a current dividend yield of 8.3% and is a recommendation of Bryan Perry, a high-income aficionado who is a veteran of Wall Street firms and the editor of the Cash Machine investment newsletter.

Chart courtesy of www.stockcharts.com

The plan that Perry shared with his subscribers is to use KYN to increase the weighting of the newsletter’s model portfolio to ride a secular transition to natural gas from coal at America’s largest electric utilities. The mutual fund provides exposure to the rising demand for exporting natural gas to Europe and Asia through liquified natural gas (LNG).

Paul Dykewicz interviews Bryan Perry, head of Cash Machine, at a MoneyShow.

KYN seeks to provide high after-tax total return with an emphasis on giving dividend payouts to its stockholders. The fund intends to invest at least 80% of its total assets in securities of energy infrastructure companies.

Its investment focus spans the spectrum of North American energy infrastructure companies engaged in traditional midstream energy, natural gas infrastructure, renewable infrastructure and utilities. Renewable infrastructure companies and utilities tend to have reduced volatility and correlation to the broader equity markets, contracted or regulated cash flows, multi-year growth visibility and attractive environmental, social and governance (ESG) characteristics.

Kayne Anderson MLP Investment Co. (NYSE: KYN) has jumped 3.44% in the last week, 7.72% in the past month, 11.06% in the past three months, 29.11% so far in 2022 and 24.93% in the past year, as of the close of trading on June 2.

BCC Gains Place with Five Inflation-Shield Stocks to Purchase

Woods, who also heads the High Velocity Options advisory service, along with the Successful Investing and Intelligence Report investment newsletters, added a new recommendation to his Bullseye Stock Trader advisory service that is involved in another commodity sector sweet spot: lumber and wood. He chose Boise Cascade Co. (NYSE: BCC), of Boise, Idaho.

Boise Cascade is a producer of engineered wood products (EWP) and plywood. The company operates in two segments, Wood Products and Building Materials Distribution.

The Wood Products segment manufactures EWP, consisting of laminated veneer lumber (LVL), I-joists and laminated beams. The Building Materials Distribution segment is engaged as a wholesaler of building materials.

Boise Cascade distributes plywood and lumber items, along with siding, doors, metal products, insulation and roofing, EWP and others. The company generates a majority of its revenue from the Building Materials Distribution segment.

Chart courtesy of www.stockcharts.com

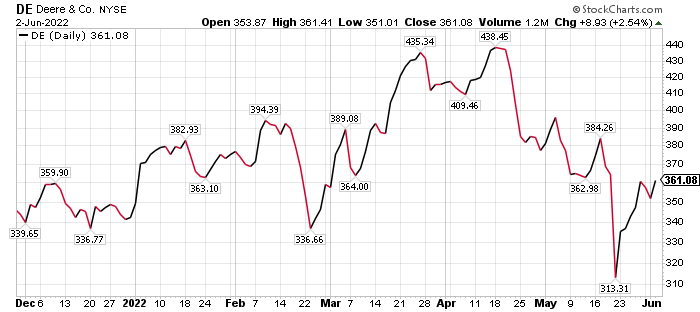

Deere Plows Among Five Inflation-Shield Investments to Buy

Farm machinery company Deere (NYSE: DE), of Moline, Illinois, offers an inflation hedge in the agricultural field. The stock’s double-digit-percentage share price drop after it recently reported earnings offers a discounted entry opportunity, Connell said.

Michelle Connell, CEO, Portia Capital Management

Deere’s key issues are supply-related, since demand for agricultural equipment remains robust, especially by making machinery that is more environmentally friendly than its rivals, Connell continued. The company also has a feature that can block the operation of the machinery if it is stolen. That has prevented Deere machinery, pilfered from Ukraine during Russia’s invasion of the sovereign nation, from operating for the thieves who stole it.

Wall Street analysts expect Deere to have a better story and performance in the second half of 2022 and in full-year 2023, Connell counseled. Among her reasons:

-If the war in Ukraine continues, U.S. farmers will benefit from higher prices for their crops.

-Increased agricultural profits mean that that farmers and farming corporations will be more likely to buy large, expensive farm equipment.

Deere has fallen back since its recent high on April 20, so investors can purchase shares at reduced prices, despite a budding rebound, Connell continued.

Chart courtesy of www.stockcharts.com

Five Inflation-Shield Stocks to Purchase as Russians Raid Ukrainian Wheat

With significant producers of grain such as Russia and Ukraine not providing their usual supply amid Putin’s war, farm machinery may be aided by increased demand. European Commission President von der Leyen cautioned this week that Russia is weaponizing food supplies as prices of grain, cooking oil and other food commodities rise after the Putin-ordered invasion of Ukraine, one of the world’s largest wheat producers.

In the industrial part of Ukraine that Russia is occupying and attacking to seize additional land, Putin’s army is confiscating grain stocks and machinery, von der Leyen said. Russian warships in the Black Sea are blockading Ukrainian ships from exporting full loads of wheat and sunflower seeds, she added during a May 24 address at the World Economic Forum in Davos, Switzerland.

Russia is hoarding its own food exports as a form of blackmail by holding back supplies to increase global prices, or trading wheat in exchange for political support for its invasion of Ukraine, von der Leyen said. In effect, Russian leaders are using hunger and grain to wield power, she added.

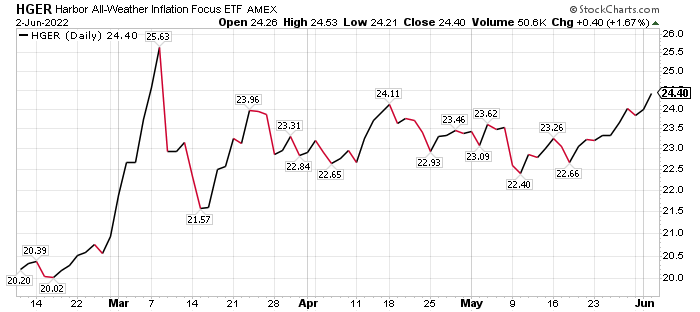

Fledgling Dividend-paying ETF Merits Monitoring as Inflation-Protection Prospect

The Harbor All-Weather Inflation Focus ETF (HGER), designed as a commodities futures exchange-traded fund (ETF) to hedge against inflation, is a recently launched fund that I learned about from Michelle Connell, a former portfolio manager who heads Dallas-based Portia Capital Management. The fund is sub-advised by Quantix Commodities LP, a commodities solution boutique firm of former senior Goldman Sachs traders.

HGER, intended to guard against the adverse effects of inflation, weighs multiple factors such as money supply, wage growth, supply chain constraints, surging demand for goods and chronic underinvestment in commodities. The ETF allows investors a way to protect themselves in an Inflationary environment by using commodity futures that have a proven record of providing diversification and a safe haven during rising prices.

In contrast, broad-based commodity indices are not designed with inflation protection as a targeted objective, according to HGER’s managers. To that end, Harbor All-Weather Inflation Focus ETF developed an inflationary hedging index with Quantix Commodities LP to help both institutional and retail investors pursue profits from rising consumer prices.

The ETF is worth considering at a time when the Consumer Price Index (CPI) has risen during the past year to levels not seen in recent history. Connell has been researching and monitoring the fledging fund as a possible inflation-protection strategy.

Chart courtesy of www.stockcharts.com

Supply Chains Should Recover as China Eases COVID-19 Curbs

China’s economic center of Shanghai faced renewed lockdowns of multiple neighborhoods on Thursday, June 2, just a day after city-wide restrictions were lifted. The quick reversal after the detection of seven new COVID-19 cases in the city’s Jing’an and Pudong districts shows that China’s stringent policy of seeking zero cases of the virus is hampering the financial hub’s return to business as usual.

Most of Shanghai’s 25 million residents now can leave their communities after the government lifted its two-month lockdown in the city this week but nearly 2 million people were still confined to their homes in areas that the government designated as “high risk.” Analysts had been forecasting that goods may start to flow normally again in the weeks and months ahead after the lifting of the lockdowns that affected an estimated 373 million people and roughly 40% of the country’s gross domestic product (GDP).

Disrupted supply chains are hindering the availability of products such as rice, oil and natural gas. Shanghai, home to the world’s largest port, has strained to unload cargo due to strict regulations that have caused shipping containers to stack up.

Some Shanghai residents posted videos online to complain about needing food during the lockdown, even though government officials tried to block such public expressions of frustration. Chinese authorities further drew public criticism for forcibly separating young children with COVID-19 from their parents in an attempt to stop the spread of the contagious subvariant of Omicron, BA.2. The variant also has caused new infections in European countries such as Germany, the Netherlands and Switzerland.

U.S. COVID Deaths Rise Past 1 Million

U.S. COVID-19 deaths have grown by more than 1,000 in the past few days to reach 1,008,045, as of Friday, June 3, according to Johns Hopkins University. Cases in the United States on that date hit 84,549,593, up more than 300,000 since May 31. America retains the dreaded distinction as the country with the highest numbers of COVID-19 deaths and cases.

COVID-19 deaths worldwide totaled 6,292,450 on June 3, rising more than 4,000 since May 31, according to Johns Hopkins. Cases across the globe have climbed to 530,982,578, up nearly 100,000 in the past few days.

Roughly 77.9% of the U.S. population, or 258,685,370, have obtained at least one dose of a COVID-19 vaccine, as of Thursday, June 2, the CDC reported. Fully vaccinated people total 221,406,167, or 66.7%, of America’s population, according to the CDC. The United States also has given at least one COVID-19 booster vaccine to 103.6 million people, up about 200,000 in the past few days.

Unclear is whether data released on May 24 about a high percentage of “long-haul” COVID patients enduring persistent symptoms may cause Medicare to relax requirements for seniors who contracted the virus to continue to receive physical therapy even if they need extra time to progress toward walking. The Northwestern Medicine Neuro COVID-19 Clinic found that most of the 52 patients monitored in its study reported “brain fog,” numbness or tingling, headaches, dizziness, blurred vision and fatigue, even 15 months after diagnoses of COVID-19.

The five inflation-shield stocks to purchase are intended to guard against rising prices and produce profitable exposure to equities. Despite the market’s volatility, the highest inflation in 40 years, the Fed’s plan for further interest rate hikes to limit price increases and rocketing federal deficits, investors still have viable ways to profit.

Connect with Paul Dykewicz

Connect with Paul Dykewicz