Eight Great Day-Trading Paths for Profiting with a Signal

By: Paul Dykewicz,

Eight great day-trading paths for profiting when receiving a signal can put people on a positive path if they are prepped to pursue it.

An advisory service called DayTradeSpy Signal uses indicators to provide its subscribers with three-to-five trade recommendations each week, said Hugh Grossman, a seasoned options trader and trainer who founded DayTradeSpy Signal, the Ultimate Training Workshop, the DayTradeSpy Trading Room and the Pick of the Day advisory services. Grossman’s advice is to “take control” and trade options on the SPR S&P 500 ETF Trust (NYSE ARCA SPY: SPY) by following the instructions of a seasoned guide.

The SPY fund tracks the top 500 stocks in America. Three key advantages of SPY are that it is diverse, liquid and affordable, Grossman said.

Eight Great Day-Trading Paths for Profiting: 1. Little Time Required

The DayTradeSpy Signal advisory service is designed for busy people who have money to invest but little time to do so. Subscribers can use the service even if they have a full-time job, Grossman said.

“So, you’re still working for the man, trying to pull out of the nine-to-five grind and looking to get into the stock market?” Grossman asked rhetorically. “You hear of the many opportunities, but are not sure how to go about getting started? You have no idea how much to invest or where and when to sell? You wonder why all these good things happen to someone else, and why not you?”

For those who relate to those feelings, Grossman said he created the DayTradeSpy Signal advisory service. Subscribers are informed either by a text to their cellphones or an email with a trade recommendation that generally occurs in the morning.

When the signal arrives, subscribers are advised to purchase the recommended SPY option within the next two minutes. Recommendations typically average three to five per week.

“Check back at the market close to chalk up your gains or sell it at the market price,” Grossman said. “If it got any easier, we would be placing the trades for you.”

Eight Great Day-Trading Paths for Profiting: 2. Aim for 5% Gain

Grossman suggests that subscribers seek a 5% gain per trade. But certain subscribers who have time to watch their trades during the day may aim for heightened returns.

“However, we realize not everyone has that luxury of being able to watch the prices all day, so we recommend 5% as a standard by which to measure success,” Grossman said. “This way, the most basic, novice neophyte into the trading world can make money using this relatively simple methodology.”

If a trade has not triggered a 5% profit by the end of the day, sell if for the market price at the close, Grossman said. The SPY option should never go to zero, since there is ample time left before it expires, he added.

For people who pay attention to the market’s moves, as many DayTradeSpy Signal subscribers do, they can earn much more than the suggested profit target, Grossman said. Some subscribers collect double-digit-percentage gains, he added.

Eight Great Day-Trading Paths for Profiting: 3. Quick Income Source

The DayTradeSpy Signal strategy also serves as a source for quick income. Many income-loving investors would be pleased with a stock or fund that pays at least 5% as an annual dividend but this option strategy is designed to produce that much profit in a day.

Rather than wait a full year to collect the same amount of income, Grossman said he prefers a quick return on investment for his subscribers. Some trades can produce a 5% return or higher in just minutes, he added.

“Recent trades include the $519 calls on May 9 for its 5.1% gain in 25 minutes,” Grossman said. “The day prior, it was another 5.1% gain on the $516 calls in a mere 10 minutes. Sometimes you’re in the trade for minutes, other times you could be holding for a couple hours; it doesn’t really matter.”

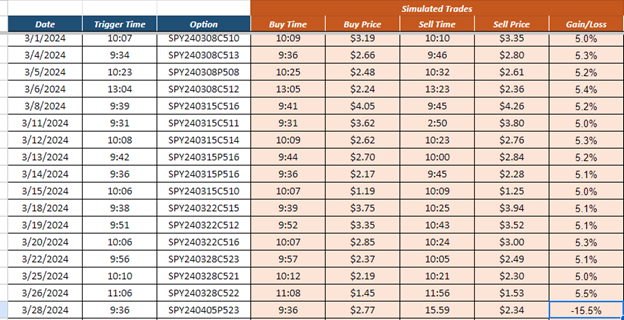

Even though the DayTradeSpy Signal advisory service has averaged 86% winning trades since it launched last fall, it achieved an impressive 16 successful trades out of 17 attempts in March 2024. That 94.12% success rate in March 2024 let the service’s subscribers collect at least a 5% gain 16 times, with the only loss involving a 15.5% pullback.

Source: Hugh Grossman

Eight Great Day-Trading Paths for Profiting: 4. 86% Success Rate

Since the DayTradeSpy Signal launched in November 2023, the option trading advisory service has turned profits in 74 of its 86 trade recommendations, or an 86% success rate as of May 9.

The way it works is simple, Grossman said. Once notified to make a trade, buy the suggested option, using a limit order for the ask price, and try to do so within two minutes, he added.

“As soon as you buy it, immediately put it up for sale for a 5% gain,” Grossman said.

In the case of the only losing trade in March 2024, the option did not reach the 5% profit goal by the end of the day. To adhere to the DayTradeSpy Signal strategy of closing each trade before day’s end, the order to sell the position at the market price led to a loss of about 15%.

Almost all the trades recommended in DayTradeSpy Signal involve options of the SPDR S&P 500 ETF Trust (SPY), the largest and first U.S.-listed exchange-traded fund (ETF).

Eight Great Day-Trading Paths for Profiting: 5. Apply ‘Excellent Strategy’

Statistically, DayTradeSpy Signal has proven to be an “excellent strategy,” Grossman said. The advisory service’s trades are driven by algorithms, he added.

The use of algorithms takes the guess work out of the recommendations, Grossman said. The DayTradeSpy Signal is managed by Grossman and his team, based on a “complex formula” designed to facilitate trading without needing to monitor markets all day, he continued.

“Let the market work its magic,” Grossman said. “Our success rate is over 85% winners, considered excellent in this industry ripe with empty promises, charlatans and expensive programs that get you nowhere.”

Eight Great Day-Trading Paths for Profiting: 6. Astute Analysis

This strategy is “ideal” for those unable or unwilling to do the analysis themselves, Grossman continued.

“Many of our busy subscribers like this program, as it provides the work for them; they just have to follow through,” Grossman said.

Even though DayTradeSpy Signal has an 86%-plus success rate thus far, Grossman mentioned that options trading is risky and requires a certain amount of analysis. That analysis is provided by his team with the price of a subscription, Grossman added.

Eight Great Day-Trading Paths for Profiting: 7. Successful Signal

DayTradeSpy Signal advises its subscribers whether to pursue each trade, the market direction and strength, which option to trade and how to trade it. The DayTradeSpy Signal does the “heavy lifting” for its subscribers, Grossman said. Simply buy the recommended option, put it up for sale and come back later to reap their rewards or cut bait, he added.

The sole loss in March 2024 was sold at the end of the day, according to the trading service’s system, Grossman said. The ‘algorithm “kicked in” but just couldn’t reach the targeted price. That final day, SPY took a ride to the upside at about 2:45 p.m., only to collapse just minutes from the end of trading, but just not enough to take profit on the puts.

“Some days, you’re the dog,” Grossman said. “Other days, you’re the hydrant.”

Hugh Grossman leads DayTradeSpy Signal, Trading Room and Ultimate Training Workshop.

Seven Tips to Day-Trade with a Signal: 8. Geopolitical Protection

Short-term trades of just minutes or hours in a single day limit the fallout from crises like wars and natural disasters. Long-term investors face those perils, but day-traders are insulated from the worst effects of those calamities.

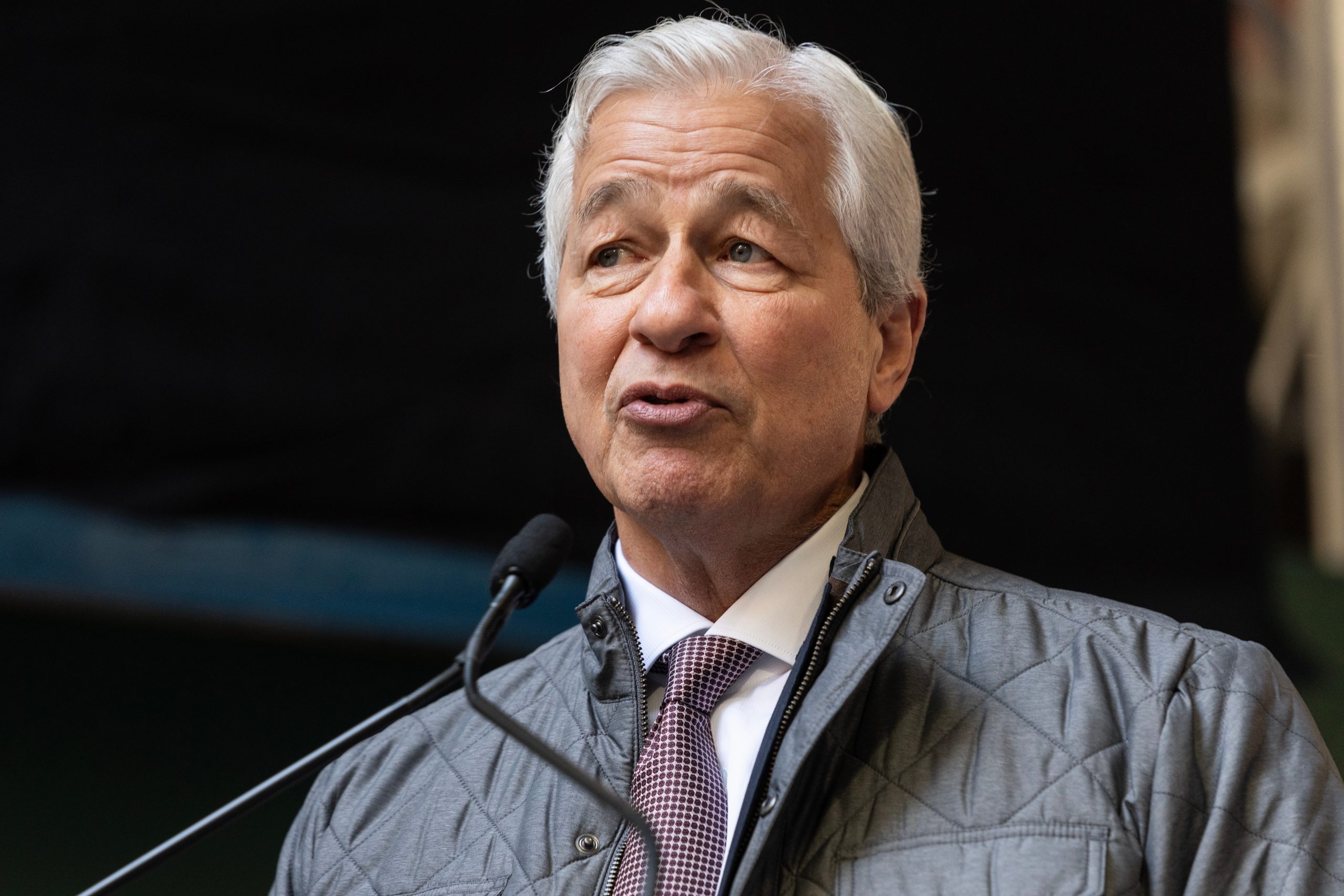

J. P. Morgan Chase Chairman and Chief Executive Officer Jamie Dimon recently warned that “significant challenges” across the globe in 2023 are carrying over into 2024 and could worsen. In a J. P. Morgan shareholders’ letter, Dimon wrote that the terrible ongoing war and violence in the Middle East and Ukraine, mounting terrorist activity and growing geopolitical tensions, especially with China, pose threats to investors.

“Almost all nations felt the effects last year of global economic uncertainty, including higher energy and food prices, inflation rates and volatile markets,” Dimon wrote. “While all these events and associated instability have serious ramifications on our company, colleagues, clients and countries where we do business, their consequences on the world at large — with the extreme suffering of the Ukrainian people, escalating tragedy in the Middle East and the potential restructuring of the global order — are far more important.”

Jamie Dimon, chairman and CEO of JP Morgan Chase.

America’s Global Leadership Role Under Threat, JP Morgan CEO Cautions

“America’s global leadership role is being challenged outside by other nations and inside by our polarized electorate,” Dimon wrote in his letter to JP Morgan Chase’s shareholders. “We need to find ways to put aside our differences and work in partnership with other Western nations in the name of democracy. During this time of great crises, uniting to protect our essential freedoms, including free enterprise, is paramount.”

America, “conceived in liberty and dedicated to the proposition that all men are created equal,” serves as a shining beacon of hope to citizens around the world, Dimon wrote. JPMorgan Chase, a company that historically has worked across borders and boundaries, will do its part to ensure that the global economy is safe and secure, he continued.

Despite an “unsettling landscape,” including last year’s regional bank turmoil, the U.S. economy remains resilient, with consumers still spending, and the markets expecting a soft landing, Dimon wrote. However, the economy is fueled by large amounts of government deficit spending and past stimulus, he added.

“There is also a growing need for increased spending as we continue transitioning to a greener economy, restructuring global supply chains, boosting military expenditure and battling rising health care costs,” Dimon wrote. “This may lead to stickier inflation and higher rates than markets expect. Furthermore, there are downside risks to watch. Quantitative tightening is draining more than $900 billion in liquidity from the system annually — and we have never truly experienced the full effect of quantitative tightening on this scale.”

The “ongoing wars” in Ukraine and the Middle East have the potential to disrupt energy and food markets, migration, military and economic relationships, in addition to their “dreadful human cost,” Dimon wrote. These significant and somewhat unprecedented forces warrant caution, he added.

Dimming Economy?

The eclipse of the sun that occurred above much of the United States on Monday, April 8, may be symbolic of a gradual dimming of the economy later this year, wrote Mark Skousen, PhD, who heads the Forecasts & Strategies investment newsletter.

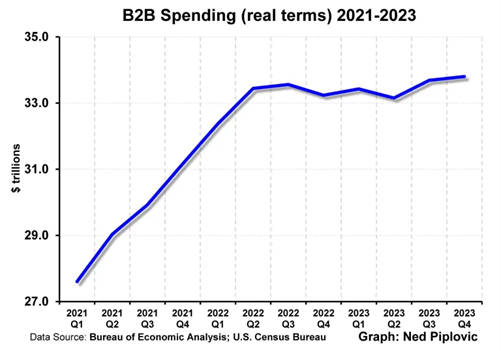

The U.S. Bureau of Economic Analysis (BEA) recently released its third estimate of real gross domestic product (GDP) growth at a 3.4% annual rate for the final quarter of 2023, as well as 2.5% for the full year. But BEA also reported gross output (GO), which is a much broader measure of total economic activity, including the all-important supply chain, which showed an economic slowdown, said Skousen, who also is a Presidential Fellow in economics at Chapman University.

Mark Skousen, head of Forecasts & Strategies, meets with Paul Dykewicz.

“Real GO was a full percentage point below gross domestic product in the fourth quarter, 2.4%,” Skousen reported.

“Worse, business-to-business spending actually fell slightly, by 0.3%… and has been virtually flat since the start of 2022, as this chart shows,” Skousen wrote.

“GO and business spending are leading indicators, suggesting a slowdown and perhaps even a recession in 2024,” Skousen cautioned. Click here to read Skousen’s op-ed about GO and the risk of a recession in the April 4 edition of the Wall Street Journal.

Geopolitical Risk Rises With Death of Aid Workers and Gaza Civilians

Geopolitical risk unfortunately is rising. Israel is continuing its efforts to find and destroy an extensive tunnel system in neighboring Gaza that has been used to stockpile weapons, as well as hide the Hamas leaders and militants who were responsible for the Oct. 7 attack that killed an estimated 1,200 people and took 240 hostages.

However, the Gaza Ministry of Health estimates that a total of nearly 35,000 Hamas fighters and civilians have lost their lives there since the war began Oct. 7. Those civilians include aid workers, such as seven World Central Kitchen food providers who perished when the three vehicles that they were using were fired upon by Israel Defense Forces (IDFs) who reportedly mistook them for hostile militants.

Chef José Andrés, World Central Kitchen’s leader, called for an independent investigation and said the three-vehicle convoy was clearly marked with a sign of his charity, which reported its planned movements to the IDF in advance. The IDF announced that two senior officers were dismissed as a result of its probe of the incident.

U.S. President Joe Biden warned Israel’s Prime Minister Benjamin Netanyahu that the United States would start to withhold weapons from Israel if its plans to conduct military operations in Rafah inside Gaza are pursued. Netanyahu has said he is responsible for protecting his citizens from attacks, gaining the freedom of its hostages and eliminating the threat from Hamas. Plus, hundreds of IDF soldiers have lost their lives since entering Gaza to carry out their military mission in response to the Oct. 7 raid of Israeli communities near its border with Gaza.

In another international hot spot, Russia’s military forces keep advancing in eastern Ukraine. Long-term shortages of artillery shells and other arms have stymied Ukraine’s efforts to fend of Russia’s unrelenting attacks as the U.S. Congress needed time to reach a bi-partisan agreement to provide foreign aid.

Ukraine officials reported Friday, May 10, that a Russian armored attack in the northeastern Kharkiv region was beaten back, after Moscow’s forces launched an incursion across the border and sought to breach front lines. In the town of Vovchansk, 75km, or 45 miles northeast of Kharkiv, a local leader said it faced a heavy attack in the early hours May 10, forcing the evacuation of civilians. Among the 3,000 people who live in Vovchansk, at least one person was killed and five others injured in the barrage, the local leader said.

The use of SPY options in the DayTradeSpy Signal advisory service serve as an alternative to traditional stock investing. The alternative strategy may gain interest among traders, if the risk of recession and geopolitical conflicts grow.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Special Sale! Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for reduced pricing on multiple-book purchases.

Connect with Paul Dykewicz

Connect with Paul Dykewicz