Fastenal Company Rewards Shareholders with 3% Dividend Yield, Continues Dividend Payouts Growth (FAST)

By: Ned Piplovic,

The Fastenal Company (NASDAQ:FAST) — a distributor of industrial and construction supplies — continues to reward its shareholders with a 3% dividend yield and rising dividend payouts.

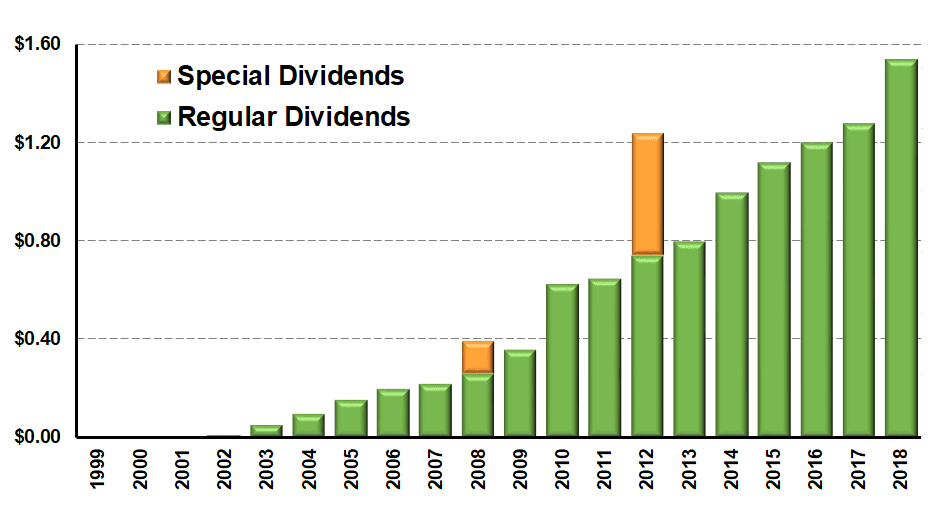

Over the past two decades, the company managed to avoid dividend cuts and advanced its dividend payouts twice in 2018. The company’s current 3% dividend yield is the third-highest yield in the General Building Materials market segment, the current yield is 256% higher than the 0.82% average yield of all companies in the segment and outperforms industry average by significant margins. In addition to the steadily rising dividend payouts, the company also provides a moderate share-price growth for a combined double-digit-percentage total return over the past 12 months.

On October 10, 2018, the company reported a 13.3% revenue increase from $1.13 billion in the same period last year to the current $1.28 billion, which was marginally higher than the $1.27 billion consensus estimate. The company’s operating income of $262.30 million was an improvement of nearly 15% year-over-year. Additionally, the company saw a 38% jump in net income to $192.6 million, which corresponds to earnings per share (EPS) of $0.69 for the quarter. This EPS figure beat analysts’ estimates of $0.67. The company attributed more than 60% of the earnings increase — $0.12 per share — to the favorable provisions of the Tax Cuts and Jobs Act passed by Congress in December 2017.

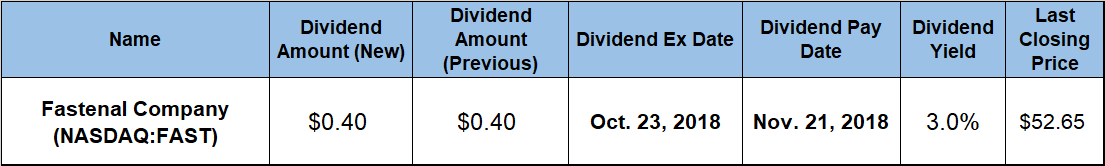

While the share price experienced a pullback despite the positive results, the price has more than 10% room on the upside before it reached the analysts average price target level. The company will distribute its next dividend payouts on the November 21, 2018, pay date to all eligible shareholders prior to the October 23, 2018, ex-dividend date.

Fastenal Company (NASDAQ:FAST)

Headquartered in Winona, Minnesota and founded in 1967, the Fastenal Company engages in wholesale distribution of industrial and construction supplies in the United States, Canada and 19 other countries. The company offers fasteners such as bolts, nuts, screws, studs and related washers, as well as miscellaneous supplies and hardware, including various pins and machinery keys, concrete anchors, metal framing systems, wire ropes, strut products and rivets. As of September 30, 2018, Fastenal has more than 21,000 employees, nine manufacturing locations and 12 industrial services locations, as well as a distribution network of 1,966 branches in the U.S., 185 in Canada and 110 in the rest of the world.

The company’s share price reached its 52-week low very early in the trailing 12-month period. After bottoming out at $6.64 on October 10, 2017, the share price reversed direction and gained more than 30% before reaching its 52-week high of $60.87 on August 21, 2018. However, the share price pulled back after peaking and closed on October 17, 2018, at $52.65, which was more than 13% below the August peak. The Oct. 17 closing price was 8.7% higher than it was one year earlier, as well as nearly 13% above the 52-week low from October 2017.

Fastenal hiked its quarterly dividend twice in 2018. The current $0.40 quarterly dividend payout is equivalent to a $1.60 annualized dividend and a 3% yield, which is 8.5% higher than the company’s own 2.8% five-year average yield. Additionally, the current 3% yield is double the 1.49% average yield of the overall Industrial Materials sector, as well as 185% higher than the 1.07% simple average yield of the companies in the General Building Materials industry segment. Furthermore, Fastenal’s current yield is also more than 55% above the 1.94% average yield of the segment’s only dividend-paying companies.

The company increased its regular dividend every year for the past two decades. Since the 2009 financial crisis, Fastenal enhanced its annual dividend payouts more than four-fold, which corresponds to an average growth rate of nearly 17% per year. Over the past 20 years of increasing dividend payouts, the company’s total annual payout advanced 40-fold, or an average of 20.3% each year.

Over the past 12 months, the company’s share-price growth and rising dividend payouts combined for a 13% total return on shareholder’s investment. Total return over the past three years exceeded 50%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic