Fastenal Offers 3% Yield, Nearly Two Decades of Dividend Boosts (FAST)

By: Ned Piplovic,

The Fastenal Company (NASDAQ: FAST) currently offers its shareholders almost a 3% dividend yield, which is the highest yield in the company’s market segment.

In addition, while Fastenal’s share price declined slightly over the past few weeks, the company managed provide a double-digit-percentage share price increase for the trailing 12 months. Many other companies have seen their share prices decline below last year’s levels with the overall market sell-offs lately.

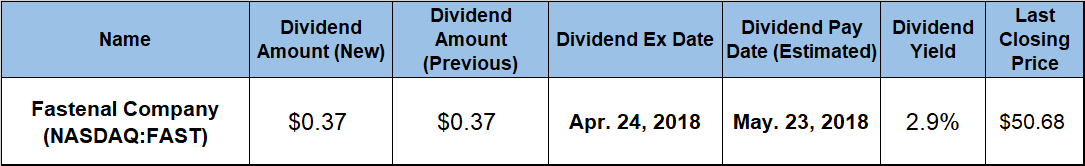

Investors who believe that FAST’s share price could continue its rising trend may want to do some quick research and take a long position in the stock prior to the company’s approaching ex-dividend date on April 24, 2018. Doing so will ensure eligibility for the next round of dividend distributions on the May 23, 2018 pay date.

Fastenal Company (NASDAQ:FAST)

Headquartered in Winona, Minnesota and founded in 1967, the Fastenal Company engages in wholesale distribution of industrial and construction supplies in the United States, Canada and 19 other countries. The company offers fasteners such as bolts, nuts, screws, studs and related washers, as well as miscellaneous supplies and hardware, including various pins and machinery keys, concrete anchors, metal framing systems, wire ropes, strut products and rivets. As of December 31, 2017, Fastenal had more than 20,000 employees, distributed its products through a network of approximately 2,400 company-owned stores and earned almost $580 million on $4.4 billion in net sales.

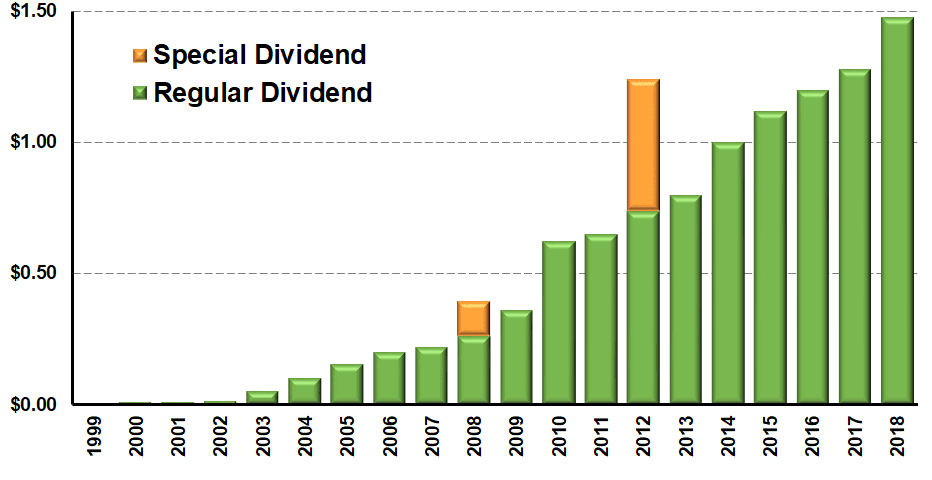

Fastenal’s current quarterly dividend of $0.37 per share equates to a $1.48 per share on an annualized basis and is 15.6% above the $0.32 quarterly dividend distribution from the same period in the previous year. The yield is currently 2.9%. Since the beginning of 2015, Fastenal’s trend has been to increase its dividend in the first quarterly payment of the year, so investors may have to wait for 2019 to see if there will be another dividend hike.

However, Fastenal’s historical trend says there is a strong chance of more continued dividend hikes, as the company has reduced its annual dividend only once in the past two decades — in 2009. In 2012, FAST paid an additional special dividend, so even though the 2013 annual distribution seems smaller, the regular distribution amounts still indicate a continuous upward trend over the years. Even including the 2009 dividend cut, the company has boosted its annual dividend at an average rate of 19.5% per year for the past two decades. Over those 20 years, the company enhanced its annual dividend payout amount almost 30-fold. Since the 2009 dividend cut, the company has enlarged its annual dividend at an average annual rate of 17%, which has more than quadrupled the total annual dividend payout over the last nine years.

Compared to the 1.11% average yield of the entire Industrial Materials sector, Fastenal’s current 2.9% dividend yield is more than 160% higher. Additionally, as the highest yield in the General Building Materials market segment, the current yield is 256% higher than the 0.82% average yield of all companies in the segment, and nearly double the 1.48% simple average yield of only dividend-paying companies in the segment.

FAST’s share price experienced significant volatility over the last few years and has been on a declining trend since early March of this year. After reaching a 52-week low of $39.97 on August 21, 2017, the share price reversed and rose 46% before it reached its 52-week high of $58.36 on March 16, 2018. The share price dropped approximately 13% after its March peak to close on April 18, 2018 at $50.68. While lower than the 52-week high, that closing price was still more than 10% higher than it was one year earlier and almost 27% above the 52-week low from August 2017.

The company’s share price increase and the total dividend income distributions combined for a 16% total return on shareholder’s investment for the past 12 months. Over the past three years the total shareholder return was just about double that rate at more than 34%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic