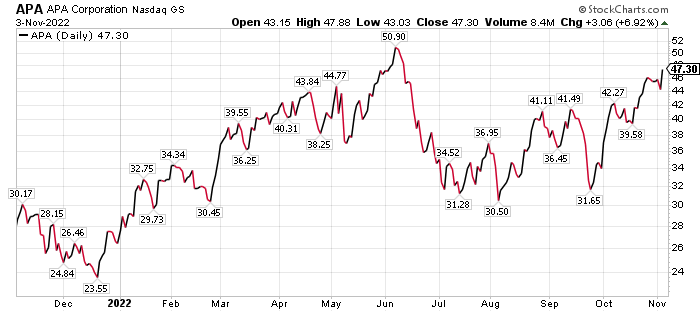

Four Dividend-paying Oil Stocks to Purchase as OPEC+ Trims Production

By: Paul Dykewicz,

Four dividend-paying oil stocks to purchase as OPEC+ trims production feature companies that have been on the rise lately.

The four dividend-paying oil stocks to purchase as OPEC+ trims production to the lowest amounts since the start of the COVID-19 pandemic have climbed along with petroleum prices as Russia President’s Vladimir Putin proceeds with his military invasion of Ukraine and attacks on his neighboring nation’s power plants, residential areas and civilians. Led by Saudi Arabia and Russia, the 23 oil-producing countries known as OPEC+ sparked criticism from President Joe Biden and other leaders in Washington who expressed worries about rising energy prices and their economic impact.

However, members of the oil-producing bloc defended their decision by warning a weakening economy could depress oil demand. Even though the “easy money” for many of the “old energy,” oil-weighted stocks has been made three years after a “generational recovery” began in 2020, BofA Global Research wrote in a recent research note that exceptions include the recognition of value through asset quality, growth in sustainable free cash flow or balance sheet rehabilitation.

Despite natural gas-weighted exploration and production (E&P) companies offering the greatest absolute value opportunity in the U.S. energy industry, large-cap oil stocks should benefit from future price increases. The recent intervention by OPEC+ may be an early sign of firm oil price support, BofA added.

Macro-Economic Trends Show Inflation Weighing on Markets

Interest rates are rising rapidly, with mortgage rates close to 7%, according to the Forecasts & Strategies investment newsletter led by Mark Skousen, a presidential fellow in economics at Chapman University. The 10-year Treasury rate is 4.24%, topping the 30-year rate of 4.15% and showing the beginning of a negative yield curve that is “bad news for the economy,” Skousen wrote in his latest edition.

Mark Skousen, Forecasts & Strategies chief and Ben Franklin scion, meets Paul Dykewicz.

“The Fed is famous for overdoing it, both when fighting recession by sending rates too low and fighting inflation by sending rates too high,” cautioned Skousen, who also heads the Five Star Trader advisory service that features both stock and option recommendations.

The U.S. central bank is largely responsible for the boom-bust cycle in the economy and on Wall Street, Skousen warned. The latest employment report was especially robust, adding 263,000 jobs as the unemployment rate slid to a multi-decade low of 3.5%, he added.

“This labor report confirmed what I have been saying with my gross output (GO) statistic, arguing that the United States is not in a recession quite yet, but it’s moving in that direction,” Skousen wrote.

The Fed is seeking to clamp down on high inflation that has topped 8% in the past year. Those who initially may have been inclined to trust the Fed’s previous view that price hikes were “transitory” should note that the U.S. money supply rose 40% during the pandemic. Plus, Social Security payments will rise 8.7% in January 2023, boosting the buying power of 70 million American retirees but exacerbating inflation.

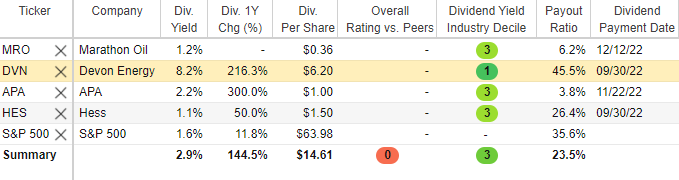

Marathon Oil Makes List of Four Dividend-paying Oil Stocks to Purchase as OPEC+ Trims Production

Marathon Oil Corporation (NYSE: MRO) has benefited from the recent rally in the price of oil to become the top commodity recommendation in Skousen’s Five Star Trader advisory service. In early November, dividend-paying Marathon Oil is expected to report annual earnings of $4.75 per share, up more than 200%, on revenues of $8.3 billion, climbing 52%, Skousen wrote to his subscribers.

Courtesy of www.stockrover.com; Learn about Stock Rover Research.

Houston-based Marathon Oil is “dirt cheap,” selling for a price-to-earnings (P/E) ratio of 7.2, Skousen wrote. It has a price-to-earnings to growth ratio (PEG) of only 0.61. compared to the U.S. Oil and Gas industry’s 0.51, according to Zack’s Research. Anything less than one is considered excellent, Skousen added.

A trailing 12-month (TTM) PEG ratio equals the P/E ratio divided by its growth for the past 12 months. The PEG ratio is aimed at giving a more complete picture of a company’s prospects than just a P/E ratio alone.

Marathon Oil is up 15.78% since Skousen recommended the position in his Five Star Trader advisory service on Aug. 14. BoA Global Research wrote that risks to Marathon Oil shares include oil and gas prices, a possible correction in refining profit margins, significant delays to the company’s new upstream projects that are critical to its production targets, as well as other factors.

Chart courtesy of www.stockcharts.com

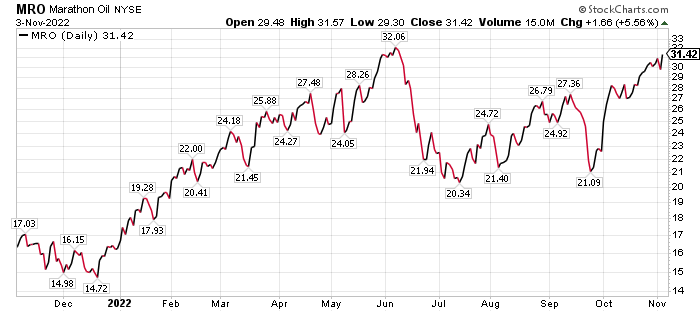

Devon Energy Forges Ways into Four Dividend-paying Oil Stocks to Purchase as OPEC+ Trims Production

President Biden put a little bullish fuel into the energy sector with comments that have been called the president’s “put.” His pledge that the federal government would buy crude oil for the U.S. Strategic Petroleum Reserve (SPR) near $70 a barrel was bullish from a “price floor” standpoint, according to Jim Woods, who leads the Bullseye Stock Trader advisory service.

Paul Dykewicz meets with Jim Woods, head of Bullseye Stock Trader.

President Biden’s announcement gave oil traders a new reason to take long positions in the sector, Woods said. From his momentum-oriented analysis, one of the best stocks in the energy space is Devon Energy Corp. (NYSE: DVN), a large independent exploration and production company headquartered in Oklahoma City, Oklahoma.

The company’s asset base is spread throughout onshore North America and includes exposure to the Delaware, Eagle Ford, Powder River Basin and Bakken sites. At year-end 2021, Devon’s proved reserves totaled 1.6 billion barrels of oil equivalent. Furthermore, net production that year was 572 thousand boe per day, of which oil and natural gas liquids made up 74% of production, with natural gas accounting for the remainder, Woods wrote.

Chart courtesy of www.stockcharts.com

“Devon is a stock displaying all the qualities I look for in a Bullseye Stock Trader play,” Woods wrote to his subscribers. “It’s got fantastic earnings growth in the top quintile compared to all other stocks. Last quarter, the company grew earnings per share by 332%. It’s also near the top of the list in terms of relative price strength — its 79% gain over the past 52 weeks puts it in the top 2% of all stocks on a relative strength basis. The company also is one of the top companies in the strongest industry on the market right now.”

Although BofA’s last update on Devon rated it neutral, Bryan Perry, chief of the Cash Machine investment newsletter, has been recommending the high-income stock profitably since May.

Paul Dykewicz interviews Bryan Perry, head of the Cash Machine newsletter.

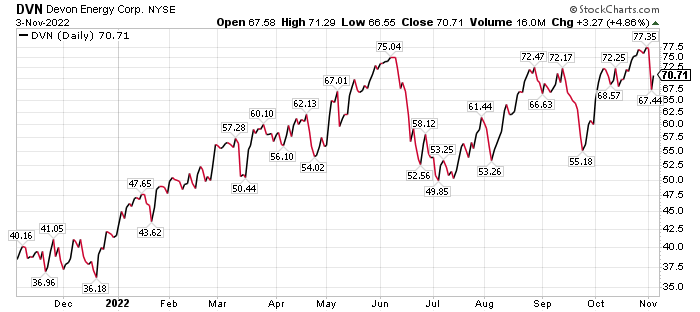

APA Corporation Added to Four Dividend-paying Oil Stocks to Purchase as OPEC+ Trims Production

BofA has a buy recommendation and a $65 price objective on Houston-based APA Corporation (NASDAQ: APA), an exploration and production company for oil and natural gas in the United States, Egypt and the United Kingdom, as well as offshore Suriname and in the Dominican Republic. Potential ways to outperform the BofA price target for APA include 1) higher commodity prices, 2) exploration success in Suriname and 3) exploration inroads and increased drilling activity in Egypt.

On the other hand, those potential strengths may not be manifested, BofA acknowledged in a recent research report. Risks to achieving the BofA price objective are 1) lower commodity prices, 2) Egyptian political uncertainty and 3) exploration challenges in Suriname.

APA scheduled a conference call to discuss its third-quarter 2022 results at 11 a.m. Eastern time, Thursday, Nov. 3. Earlier in October, the company gave guidance that it expected to be above the high end of the third-quarter range it provided in August of 212 Mboe per day.

International volumes are expected to be below the low end of the third-quarter guidance range of 171 Mboe per day. With respect to international volumes, the shortfall is related to North Sea production, which was approximately eight Mboe/d below guidance due to significant unplanned downtime in August and September, the company reported.

Chart courtesy of www.stockcharts.com

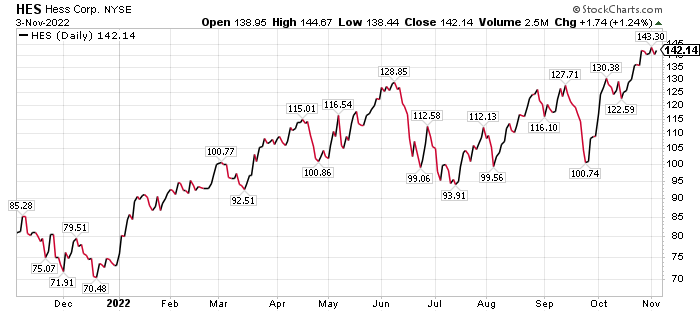

Hess Fuels Its Way into Four Dividend-paying Oil Stocks to Purchase as OPEC+ Trims Production

The fourth entrant among the dividend-paying exploration and production oil stocks to purchase is BofA recommendation Hess Corp. (NYSE: HES). The New-York-based company’s share price has begun to rise again.

Its risks are similar to those of Exxon Mobil (NYSE: XOM), except that the news flow around HES’ exploratory and appraisal drilling activities could hurt the stock. BofA’s outlook for the stock could be fueled by rising oil and gas prices.

Hess reported 3Q22 results on Wednesday, Oct 26, with net income of $515 million, or $1.67 per common share, compared with net income of just $115 million, or $0.37 per common share, in the third quarter of 2021. The company’s free cash flow outlook is the only growth story among the U.S. E&Ps, BofA wrote in a recent research note. While the near-term multiple on Hess is high versus its peers, it is not high enough, according to BofA. The investment firm has a price objective on the stock of $175.

Chart courtesy of www.stockcharts.com

Bivalent COVID-19 Booster Vaccines Could Help Sustain Oil Demand

A new bivalent COVID-19 booster in the United States gives increased protection against the omicron BA.5 variant, now the predominant strain of the virus. As a resident of Maryland, I sprang into action after receiving an Oct. 11 phone call from the state’s health department advising me of the booster’s availability at pharmacies near my house. I arranged to receive the vaccine on Oct. 16. Nonetheless, there are still an additional 200-plus million Americans, who are eligible, but have not yet gained the protection offered by the latest booster.

COVID cases and deaths can hurt supply and demand for oil stocks, so availability of a new booster to enhance the vaccine’s efficacy could help fend off the virus, if people receive the vaccine. Cases in the country totaled 97,423,583, as deaths hit 1,070,138, as of Oct. 28. America has amassed the most COVID-19 cases and deaths of any nation.

Worldwide COVID-19 deaths totaled 6,587,818, as of Oct. 28, according to Johns Hopkins. Global COVID-19 cases reached 629,740,541.

Roughly 80.1% of the U.S. population, or 266,031,472, have received at least one dose of a COVID-19 vaccine, as of Oct. 27, the CDC reported. People with at least the primary doses total 226,933,827, or 68.4%, of the U.S. population, according to the CDC. The United States also has given a bivalent COVID-19 booster vaccine to 22,197,891 people who are age 18 and up, accounting for 8.6% of the U.S. population in that age range.

The four dividend-paying oil stocks to purchase are ascending after the OPEC+ countries chose to trim oil production. Despite high inflation, Russia’s continued attacks in Ukraine and rising recession risk after 0.75% rate hikes by the Fed in June, July and on Sept. 21, the four dividend-paying oil stocks to purchase should climb further amid geopolitical uncertainty and the prospect of further rate increases in the months ahead.

Connect with Paul Dykewicz

Connect with Paul Dykewicz