Matson, Inc. Hikes Quarterly Dividend Payout 5% (MATX)

By: Ned Piplovic,

Featured Image Source: Company Website

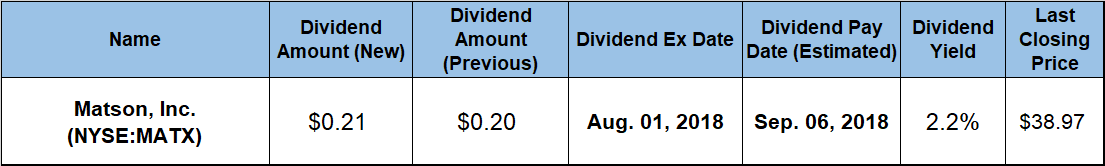

Matson, Inc. (NYSE:MATX) rewarded its shareholders with a 5% quarterly dividend boost and currently offers a 2.2% dividend yield.

This quarterly dividend hike is company’s sixth consecutive boost since 2012. The company’s share price experienced a little volatility but increased by a double-digit percentage to combine with the dividend distributions for total return of more than 30% over the past 12 months.

Investors convinced that the share price and the quarterly dividend might continue rising, should do their research and take a position prior to the company’s next ex-dividend date on August 1, 2018. Buying shares prior to that ex-dividend date will ensure eligibility for the next round of dividend distributions on the September 6, 2018, pay date.

Matson Inc. (NYSE:MATX)

Headquartered in Honolulu, Hawaii and founded in 1882, Matson, Inc. provides ocean transportation and logistics services. The company’s Ocean Transportation segment offers ocean freight transportation services to the domestic non-contiguous economies of Hawaii, Alaska, and Guam, as well as to other island economies in Micronesia. This segment also operates an expedited service from China to Long Beach, California and various islands in the South Pacific, as well as Okinawa, Japan. The Logistics segment offers domestic and international rail intermodal service, long haul and regional highway brokerage, supply chain services and less-than-truck-load (LTL) transportation services. Furthermore, this segment provides third-party logistics services that include warehousing, distribution, less-than-container-load (LCL) consolidation and international freight forwarding. Additionally, this segment offers cargo shipping services, inland transportation, container equipment maintenance and other terminal services in Hawaii and Alaska. In addition, it offers ship management services. Matson Terminals, Inc. – a subsidiary of Matson, Inc. – provides container maintenance and other terminal services supporting Matson’s ocean shipping operations in Hawaii and Alaska. Matson also owns 35% ownership share in SSA Terminals, LLC – a joint venture with a subsidiary of Carrix, Inc. – which provides terminal services to various carriers at 10 ports on the U.S. West Coast, including Matson’s terminals in Long Beach and Oakland, California and Seattle, Washington. Formerly known as Alexander & Baldwin Holdings, Inc., the company changed its name to Matson, Inc. in June 2012.

The company boosted its quarterly dividend amount 5% from $0.20 in the previous period to the current $0.21 quarterly distribution. This new quarterly payout amount corresponds to an $0.84 annualized payout and currently yields 2.2%, which is 2.6% above Matson’s own five-year average yield. Additionally, the company’s current 2.6% yield also outperformed the 1.91% average yield of the entire Service sector.

Since reorganizing under its new name in 2012, the company boosted its annual dividend every year. Over the past six consecutive years, Matson advanced its total annual dividend payout amount 40%, which is equivalent to an average growth rate of 5.8% per year.

The company’s share price traded flat for the first month of the trailing 12-month period and then dropped nearly 25% in just three trading sessions to reach its 52-week low of $22.79 on August 18, 2017. However, immediately after that steep drop, the share price reversed direction and ascended more than 65% before reaching nearly $38.00 in late January 2018. Unfortunately, that uptrend came to a halt as the share price reversed direction again and declined along with the overall market pullback that started in the first week of February 2018.

By early April, the share price resumed its uptrend and continued its rise towards its 52-week high of $39.02 on July 2, 2018. After peaking at the beginning of July, the share price pulled back marginally below the $39 level and closed on July 6 at $38.97. This closing price was 28.3% higher than one year earlier, 71% above the 52-week low from August 2017 and 37% higher than the share price from five years ago.

Because of a share price decline between late 2015 and August 2017, the shareholders experienced a 1.4% total loss on their investment over the past three years. However, the one-year performance was much better with a total return of nearly 34%. Additionally, the total return over the past five years was more than 64%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic