Sonoco Products Boosts Quarterly Dividend Payout Amount 5% (SON)

By: Ned Piplovic,

Featured Image Source: Sonoco Products Company Corporate Site

After boosting its annual dividend every year for more than two decades, the Sonoco Products Company (NYSE: SON) has rewarded its shareholders with a quarterly dividend hike of nearly 5%.

The Sonoco Products Company offers its shareholders strong overall returns on their investments. Shareholders enjoy a dividend yield above the industry average, as well as steadily rising dividend income distributions and asset appreciation. The rising share price and growing dividend income distributions have combined to produce a double-digit percentage total return over the past 12 months, as well as over the past several years.

Sonoco’s current 53% dividend payout ratio indicates that the company uses a little more than half of its earnings to cover its dividend distribution payouts. This payout ratio is just slightly above the 30% to 50% range that investors generally consider as sustainable. However, the current ratio is lower than the company’s 60% ratio average over the past five years. This indicates a move in the right direction.

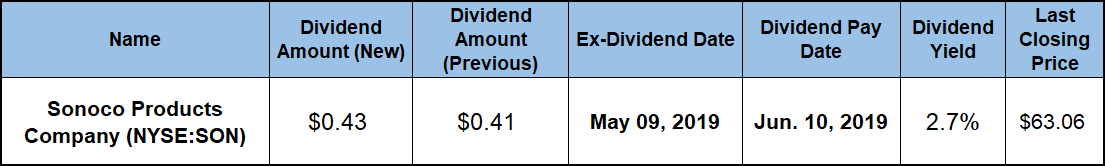

The Sonoco Products Company’s steady capital gains and dividend income growth might convince some interested investors to conduct their own analysis and consider taking a long position in the company’s stock. The Sonoco Products Company will distribute its next round of dividend distributions on the June 10, 2019, pay date. To receive a dividend distribution payment on the upcoming pay date, investors must claim stock ownership before the company’s next ex-dividend date, which is set for May 9, 2019.

Sonoco Products Company (NYSE:SON)

Founded in 1899 and headquartered in Hartsville, South Carolina, the Sonoco Products Company manufactures and sells industrial and consumer packaging products. The company operates through four business segments. The Consumer Packaging segment offers composite and thermoformed plastic containers and trays, extruded and injection-molded plastic products and brand artwork management. Additionally, the company’s Display and Packaging segment manufactures and distributes point-of-purchase displays, retail packaging and other paper products, such as coasters and glass covers. This segment also offers supply chain management services comprising of contract packing, fulfillment and scalable service center services. Furthermore, the Paper and Industrial Converted Products segment provides paperboard and fiber-based construction tubes and forms, recycled paperboard, corrugated medium and recovered paper, as well as wooden, metal and composite wire for cable reels and spools. The Protective Solutions segment provides paperboard-based and expanded foam protective packaging and components, as well as temperature-assured packaging products.

The Sonoco Products Company extended its current streak of 22 consecutive annual dividend hikes with a 4.9% quarterly dividend boost. The current increase raised the quarterly dividend payout from $0.41 in the previous period to the current $0.43 distribution. This new quarterly dividend payout amount corresponds to a $1.72 annualized dividend distribution and a 2.73% forward dividend yield.

Despite the streak of dividend hikes, the current yield is 4.6% below Sonoco’s own 2.86% average dividend yield over the past five years. While dividends continued rising, the share price growth advanced faster than the quarterly dividend payouts did, which suppressed the current yield below the five-year average. However, while slightly below the company’s own five-year average, Sonoco’s current dividend yield is more than twice the 1.83% average yield of the overall Consumer Goods sector. Furthermore, the company’s current 2.73% dividend yield outperformed the 2.46% simple average yield of Sonoco’s peers in the Paper & Paper Products market segment by almost 55%.

Since the company’s most recent stock split in 1999, the Sonoco Products Company enhanced its annual dividend payout amount by 130%. This level of dividend advancement corresponds to an average growth rate of 4.2% per year over the past two decades. However, the company accelerated the pace of its quarterly dividend payout growth over the last few years. The quarterly dividend growth of 18% over the past three years corresponds to a 5.6% average annual growth rate. Additionally, the dividend payout has advanced 35% over the past five years, which is equivalent to an average growth rate of 6.25% per year.

The share price recovered from a 16% pullback in December 2018 and then delivered a double-digit percentage growth over the past year. This level of asset appreciation, combined with the constantly rising dividend payouts, rewarded shareholders with a 26% total return over the past 12 months. Additionally, shareholders have enjoyed total returns of more than 45% over the last three years. The total return from capital gains and dividend income reached 67% for the trailing five-year period.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic