The New Unofficial History of Warren Buffett

By: Jonathan Wolfgram,

Warren Buffett is an icon among investors.

He has used a risk-averse financial strategy to amass one of the greatest fortunes ever. Known as the “Oracle of Omaha” — a moniker honoring his hometown in Nebraska where he lives and works today — Buffett has achieved legendary fame and defined much of the financial world to date. His unique market strategy not only made him an idol for investors and businesses across the world, but inspired the popular investing discipline “Buffettology.”

We researched Warren Buffett’s rise to amass the billion-dollar fortune he holds today. Here is the Unofficial History of Warren Buffett.

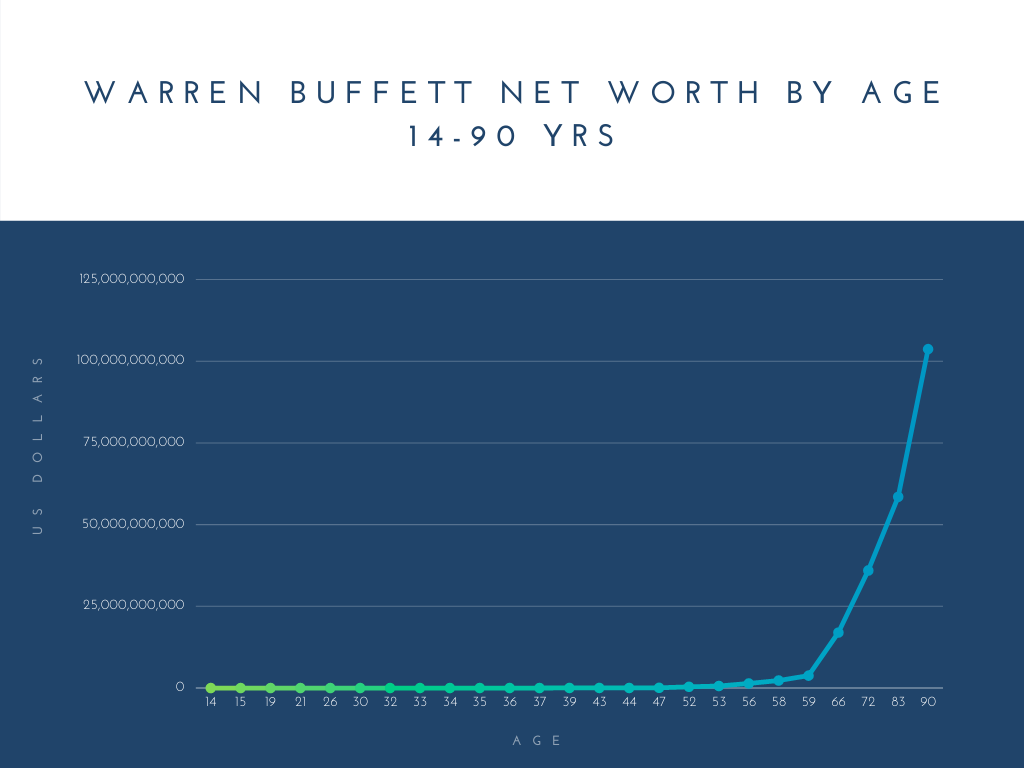

Warren Buffett made his first investment at age 11 and his first billion at age 56.

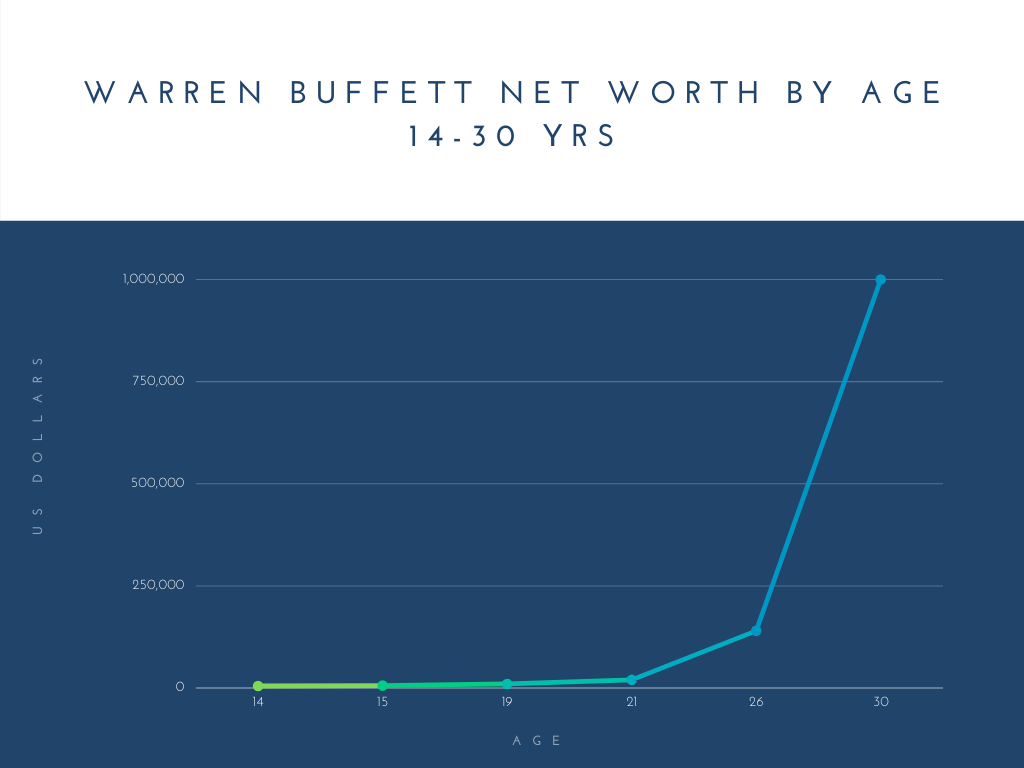

From a young age, Warren Buffett had more impressive savings habits than most adults. He made his first investment when he was 11 years old and by age 14 had built a net worth of $5,000. Initially, Buffett delivered newspapers during his boyhood and used his earnings to purchase local farmland. But young Warren had other means of income as well. Buffett started and ran a successful pinball machine business, which he sold while in high school. The added fortune brought his net worth to $10,000 by age 19.

At age 24, Buffett began working for Ben Graham. He saved the majority of his $12,000 salary and now had more liberty in his investments than when he was a boy. The investor was now worth approximately $100,000 and bolstered his investment portfolio greatly. Although it is unclear when his fortune surpassed the $1 million mark, Buffett achieved his childhood dream of becoming a millionaire before age 30.

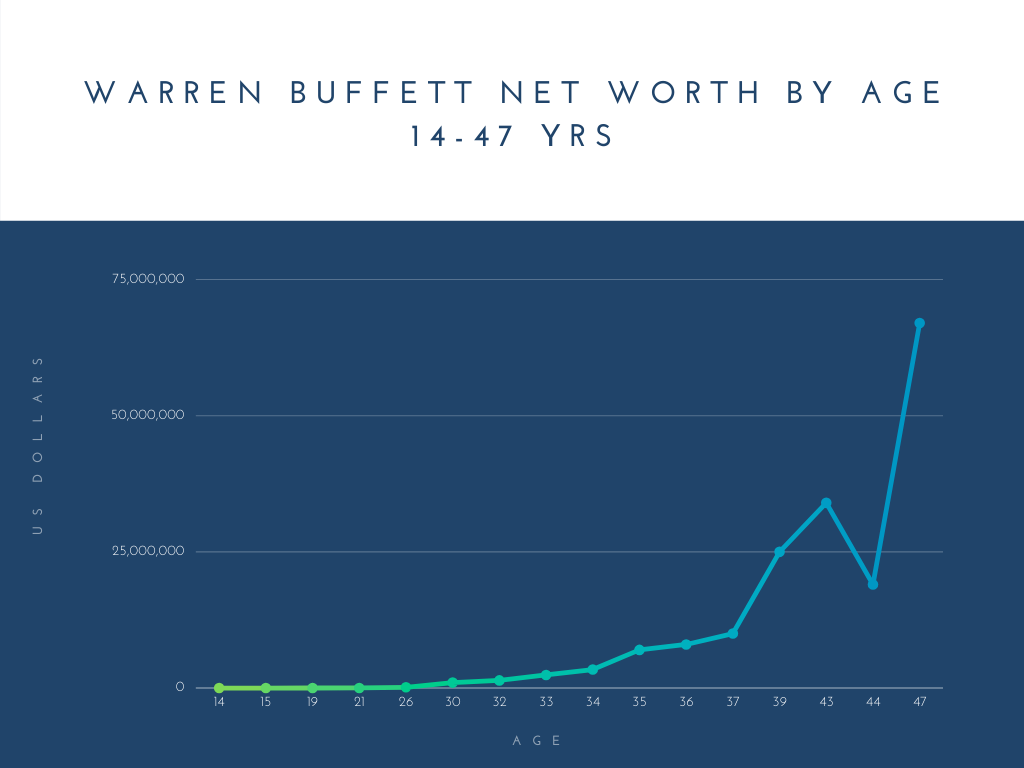

When he was 35 years old, Buffett’s partnerships had grown in value to $26 million. Just three years later, the Oracle of Omaha had tripled his fortune and was worth $104 million by age 38.

Buffett’s company Berkshire Hathaway (NYSE:BRK-B) had been very successful until he reached age 40, but soon thereafter entered a rough stretch. The share price collapsed and nearly half of Buffett’s wealth was lost when he was 44 — his net worth plummeted from $34 million at age 43 to $19 million a year later.

The investor did not stay down for long, however, and by age 47 he had recouped all of his losses and come back stronger than ever, bringing his personal net worth to $67 million.

As the head of Berkshire, Buffett took home a comparably meager $50,000 salary. Yet, within a few days of his 56th birthday, his wealth surpassed the coveted $1 billion mark. Shortly thereafter is when the Buffett fortune took off and grew to absurd heights.

While most 66-year-olds were thinking about retirement, Buffett’s fortune skyrocketed, surpassing $30 billion before he was 70 years old.

In 2019, the oracle was worth $82.5 billion, but his net worth took another dramatic fall with the COVID-19 pandemic, slipping to just $67.5 billion in 2020. Since then, Buffett has more than recovered, growing his wealth by almost $40 billion in the last year to its current all-time high of $105 billion. He is currently ranked by Forbes as the 9th richest person in the world.

Berkshire Hathaway was not always a financial giant.

Warren Buffett made much of his early fortune from managing a hedge fund. He later transitioned to running small banks, but shortly after regrouped into what became a far more profitable mode of institutional investing: buying an insurance company.

Dealing in insurance, Buffett and his business partner Charlie Munger had figured, meant their company would have access to the float — a pool of cash built by premiums the company took in but did not have to pay out right away — and could invest the massive sum freely. Better still and unlike hedge funds, they would be able to keep 100% of the profit.

But Berkshire Hathaway was not an insurance company. Although it later became their primary investment medium, when Buffett’s partnership acquired Berkshire Hathaway, it was a nearly defunct textile mill. He and Charlie Munger set out to purchase the company only because its stock price was cheaper than its carrying assets.

In his early purchase attempts, however, a rift between Warren Buffett and the then-leader of Berkshire caused him to lead a hostile takeover and purchase enough stock to have a controlling interest. He had the old Berkshire manager removed and Buffett began taking the company in a new direction.

In order to diversify, Berkshire Hathaway acquired National Indemnity Company and National Fire Marine Insurance Company, breaking into the insurance industry and turning it into the Berkshire Hathaway we know today. Warren Buffett since then has said purchasing Berkshire Hathaway was the greatest investment mistake of his life — by purchasing the two insurance companies (as well as later acquisitions) with Berkshire Hathaway instead of his own partnership, Buffett was denied an estimated $200 billion in compounded returns. Had things played out differently, he would now be the richest man in the world and worth more than $300 billion, nearly twice as much as the hypothetical second place.

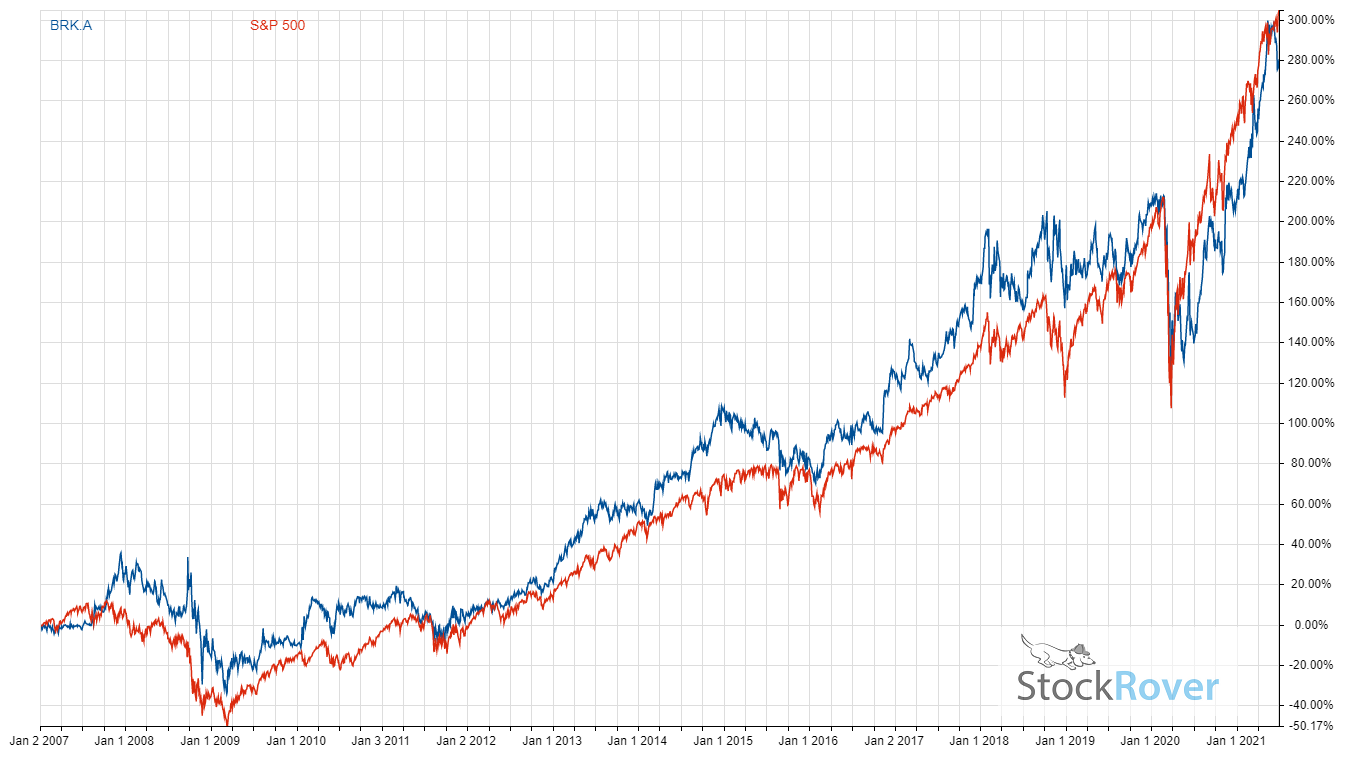

Shown below is the price growth of Berkshire Hathaway’s class A stock (blue) since 2007, plotted alongside the S&P 500 (red). Not only does Berkshire Hathaway have a reputation for outperforming the S&P 500 in the long run, but with an air of remarkable consistency: Warren Buffett has led the company into negative annual returns just four times in its history.

Chart provided by Stock Rover.

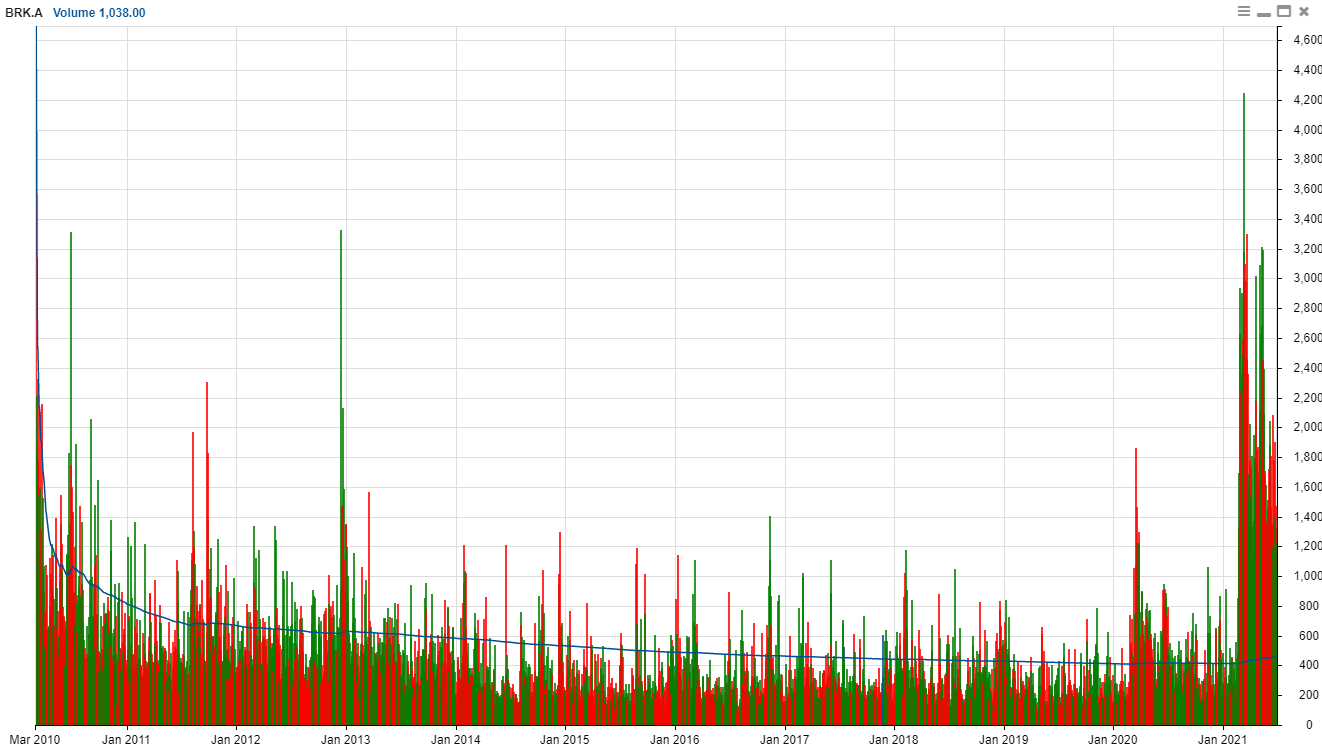

And shown below is the monthly volume since 2010, shortly after Berkshire Hathaway’s inclusion in the S&P 500.

Chart provided by Stock Rover.

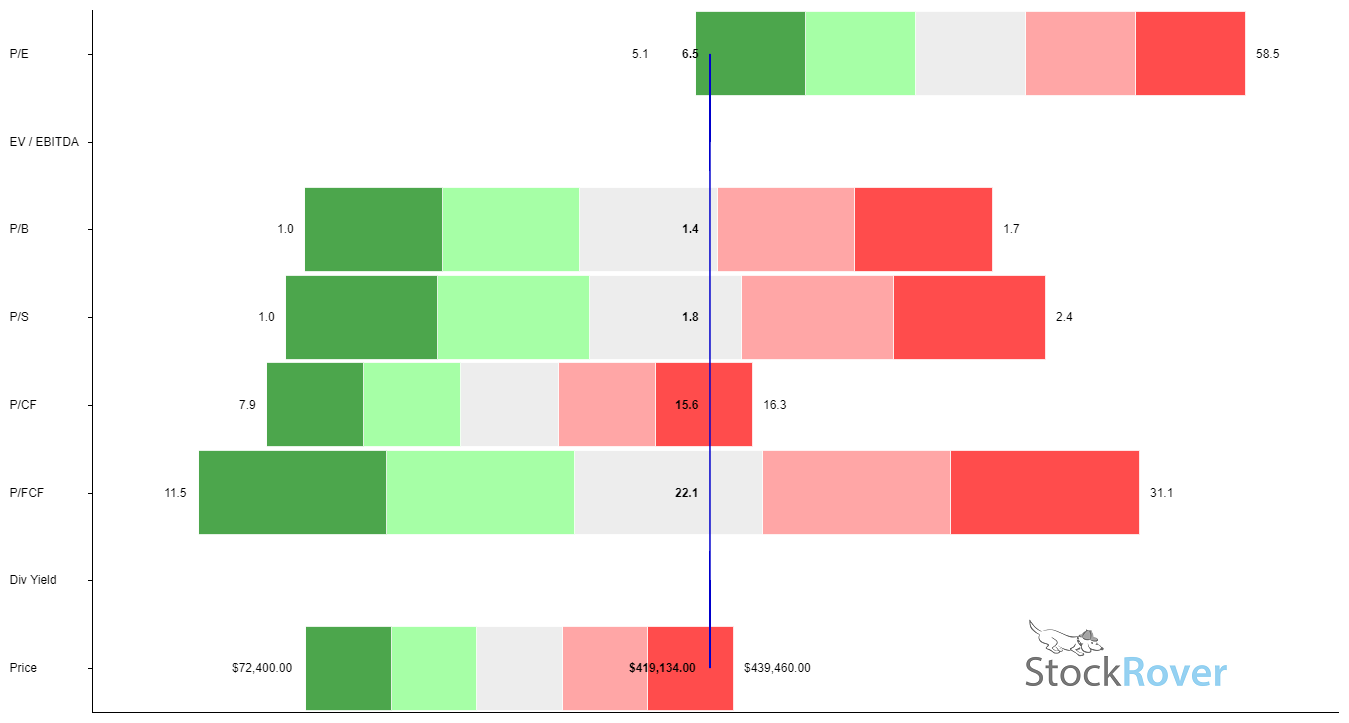

And here are the current key financial metrics of BRK-A when compared to their historical averages. The history of each is plotted as a range — those metrics with the central line in green are considered better than their norm, and those shown in red are considered worse.

Chart provided by Stock Rover.

Warren Buffett made over 70 acquisitions through Berkshire Hathaway.

The billionaire was well-known for taking massive stakes in the biggest dividend payers on the market. Despite Berkshire Hathaway having only ever paid one dividend, his investment philosophy prioritized cash-cows and high-yield dividend payers like Coca-Cola (NYSE:KO).

While accumulating shares of these mega-companies, Berkshire Hathaway also acquired several smaller operations, taking majority ownership in over 70 companies through the ages. A complete list of them is shown below.

| Company | Year of Acquisition | Acquisition Price |

|---|---|---|

| National Indemnity Company | 1967 | $6.8 million |

| See’s Candies | 1972 | $25 million |

| Wesco Financial | 1978 | |

| Precision Steel Warehouse, Inc. | 1979 | |

| Nebraska Furniture Mart | 1983 | $60 million |

| Fechheimer Brothers Company | 1986 | |

| Borsheim’s Fine Jewelry | 1989 | |

| H.H. Brown Shoe Group | 1991 | |

| Central States Indemnity | 1992 | |

| Helzberg Diamonds | 1995 | |

| RC Willey Home Furnishings | 1995 | |

| General Re | 1995 | $22 billion |

| GEICO | 1996 | $2.3 billion |

| FlightSafety International | 1997 | |

| Star Furniture | 1997 | |

| Dairy Queen | 1997 | $585 million |

| NetJets | 1998 | $725 million |

| NetJets Europe | 1998 | |

| Kansas Bankers Surety Company | 1998 | |

| Mid-American Energy Holdings | 1999 | |

| Jordan’s Furniture | 1999 | |

| CORT Business Services | 2000 | $467 million |

| Ben Bridge Jeweler | 2000 | |

| Acme Brick Company | 2000 | |

| Justin Brands | 2000 | $570 million |

| United States Liability Insurance Group | 2000 | |

| Benjamin Moore & Co. | 2001 | $1 billion |

| Johns Manville | 2001 | $1.8 billion |

| MiTek | 2001 | |

| XTRA Lease | 2001 | |

| Larson-Juhl | 2001 | |

| CTB Inc. | 2002 | |

| Shaw Industries | 2002 | |

| Fruit of the Loom | 2002 | $835 million |

| Northern Natural Gas | 2002 | $928 million |

| Garanimals | 2002 | |

| Pampered Chef | 2000 | |

| McLane Company | 2003 | $1.45 billion |

| PacifiCorp | 2005 | $9.4 billion |

| Medical Protective | 2005 | |

| Forest River | 2005 | |

| Russell Brands | 2006 | $600 million |

| Business Wire | 2006 | |

| Kern River Pipeline | 2006 | $960 million |

| International Metalworking Companies | 2006 | |

| Brooks Sports | 2006 | |

| SE Homes | 2007 | |

| TTI, Inc. | 2007 | |

| Richline Group | 2007 | |

| Clayton Homes | 2007 | $1.7 billion |

| BoatUS | 2007 | |

| Berkshire Hathaway Assurance | 2007 | |

| Cavalier Homes | 2008 | |

| Marmon Group | 2008 | $4.5 billion |

| Berkadia | 2009 | |

| BNSF Railway Company | 2010 | $34 billion |

| Lubrizol | 2011 | $9.7 billion |

| Omaha World-Herald | 2011 | $150 million |

| Oriental Trading Company | 2012 | |

| NV Energy | 2013 | $5.6 billion |

| WPLG-TV | 2014 | |

| AltaLink | 2014 | $3.24 billion |

| Charter Brokerage | 2014 | |

| Louis Motor | 2015 | |

| Van Tuyl Group | 2015 | |

| Precision Castparts Corp. | 2016 | $37 billion |

| Duracell | 2016 | $1.8 billion |

| Pilot Flying J | 2017 | |

| Ebby Halliday Companies | 2018 | |

| Dominion Energy | 2020 | $10 billion |

Warren Buffett defined much of the business world as we know it and continues to influence the next generation of investors.

The slide show below features videos of the Oracle and his continuous influence on the investing world. It includes many of the best speeches and video clips of his career.

Also included is the full documentary of Warren Buffett on HBO.

Buffett has donated nearly $50 billion to charity — and he’s only half done.

Warren Buffett’s signature can be found on the giving pledge, symbolic of his commitment to donate 99% of his lifetime fortune to charity. So far, the investor has given over $41 billion to a combination of four foundations run by his family members in tandem with the Bill and Melinda Gates Foundation, where he served on the board until only recently.

Buffett, one of the three founders of the Bill and Melinda Gates Foundation, announced his retirement from the board in June 2021. This came alongside a $4.1 billion donation that marked the halfway point for Buffett’s quest to give away 99% of his wealth. But even more than the sheer amount of money Warren Buffett has pledged to charity, his peers have admired him for the character and meaning behind his charitable work. Melinda Gates has said, “What made Warren’s extraordinary investment in the foundation so meaningful was not only its amount but what it represented: an unwavering belief that everyone deserves to live a healthy, fulfilling life and an optimism that a world like that is possible.”

Warren Buffett’s words of wisdom echo through the investment world today

A series of quotes from the philanthropist billionaire are shown below. Buffett’s simple wisdom shows a wealth of knowledge, and his words can both rock the investment world and guide a happy, fulfilling life.

- Opportunities come infrequently.

- When it rains gold, put out the bucket, not the thimble.

- Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.

- You can’t produce a baby in one month by getting nine women pregnant.

- Someone’s sitting in the shade today because someone planted a tree a long time ago.

- If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.

- The most important thing to do if you find yourself in a hole is to stop digging.

- The most important quality for an investor is temperament, not intellect.

- You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.

- The stock market is a no-called-strike game. You don’t have to swing at everything — you can wait for your pitch.

- Buy into a company because you want to own it, not because you want the stock to go up.

- Never invest in a business you cannot understand.

- Read 500 pages like this every day. That’s how knowledge works. It builds up, like compound interest.

- All of you can do it, but I guarantee not many of you will do it.

- Half of all coin-flippers will win their first toss; none of those winners has an expectation of profit if he continues to play the game.

Buffett’s eccentricities have made him a beloved character in and out of the investment world

Shown below are a series of fun facts about the Oracle:

- Jimmy Buffett and Warren Buffett had a DNA test to prove they were NOT related.

- Warren Buffett learned to play the ukulele to serenade his high-school crush. Although she rejected him, he later went on to play with Bon Jovi and Glenn Close.

- Warren Buffett was rejected from Harvard Business School. It was this rejection that led him to Columbia Business School where he met his mentor, Benjamin Graham.

- The 90-year-old investor drinks five cans of Coca-Cola per day.

- Warren Buffett has lived in the same house since 1958.

- Roughly 95% of Buffett’s wealth was earned after he turned 60.

- The life-long learner reads for 80% of his day — approximately 500 pages.

- Warren Buffett switched from using a flip phone to a smart phone… in 2020.

And when markets decline, the billionaire turns to poetry

Buffett revealed in a 2017 letter to shareholders that when markets are down or his investments are losing money, he reads the 1895 Rudyard Kipling poem, “If.” His letter read:

“No one can tell you when these will happen. The light can at any time go from green to red without pausing at yellow. When major declines occur, however, they offer extraordinary opportunities to those who are not handicapped by debt. That’s the time to heed these lines from Kipling’s ‘If:’

- “If you can keep your head when all about you are losing theirs …

- If you can wait and not be tired by waiting …

- If you can think — and not make thoughts your aim …

- If you can trust yourself when all men doubt you …

Yours is the Earth and everything that’s in it.”

Warren Buffett is among the greatest investors who have ever lived.

No other investor has maintained his record of beating the market, and just as few have directed nearly all of the profit to noble causes. The “Oracle of Omaha” has and will continue to define a generation of investors and shape the whole of investing history to come.

Related Articles:

3 Best Dividend Stocks to Buy Now

3 Dividend Growth Stocks to Buy Now

Top 10 Best Screening Tools for Investors

25 High Dividend Stocks in 2020 to Consider Buying

10 High Dividend Stocks Under $20

Connect with Jonathan Wolfgram

Connect with Jonathan Wolfgram