Three Dividend-paying Space Stocks Aim for Profitable Orbits

By: Paul Dykewicz,

Three dividend-paying space stocks aim for profitable orbits as the industry seeks to launch past 2022’s weak performance amid Russia’s war in Ukraine.

The three dividend-paying space stocks offer income payouts and potential share price appreciation. Part of the reason many space stocks struggled in 2022 stemmed from weak results of special-purpose acquisition companies (SPACs) that operate as shell organizations to merge with private companies.

SPACs serve as an alternative to traditional initial public offerings (IPOs), and typically have no tangible assets other than the cash they obtain from investors. Transactions involving private companies going public through a combination with a SPAC are called de-SPACs.

Long Beach, California-based Rocket Lab (NASDAQ: RKLB) became the space industry’s top-performing de-SPAC last year among the stocks tracked by BofA Global Research. However, RKLB still underperformed the S&P 500, which dropped 19.44% in 2022. In fact, the S&P 500 endured its worst performance in 14 years. Astra Space (NASDAQ: ASTR), the poorest-performing stock in BofA’s space coverage universe, traded down 94% last year.

“We believe the strong underperformance of these names can be attributed to a multitude of factors — general de-SPAC discount, limited institutional ownership and pre-earnings nature of most businesses,” BofA wrote in a recent research note.

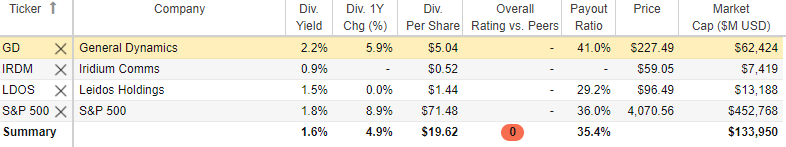

Courtesy of www.StockRover.com. Learn about Stock Rover by clicking here.

Three Dividend-paying Space Stocks Feature General Dynamics

General Dynamics (NYSE: GD), a global aerospace and defense company based in Reston, Virginia, is a recommendation of stock picker Jim Woods in his monthly Intelligence Report investment newsletter. He put the dividend-paying space and defense stock in his Income Multipliers portfolio.

Woods, a seasoned investor who also leads the Bullseye Stock Trader advisory service that features stocks and options, keeps a close watch on space and defense companies. Woods is a former Army paratrooper who has a track record of investing profitably in both space and defense stocks.

Paul Dykewicz meets with Jim Woods, head of Bullseye Stock Trader.

General Dynamics has worked closely on space missions for decades with NASA and the U.S. military. The company’s management boasts that General Dynamics currently has its telecommunications technology circling multiple planets.

Indeed, General Dynamics Mission Systems enabled Neil Armstrong, the U.S. astronaut who became the first man on the moon in 1969, to transmit back to Earth his famous words of “one small step for man, one giant leap for mankind.” General Dynamics also will serve a pivotal role when NASA heads back to the lunar surface as part of the Artemis program.

The first trip in the Artemis program featured Artemis I, which launched from the Kennedy Space Center in Florida on November 16, 2022. General Dynamics built the S-Band transponders and emergency radios for the Orion spacecraft.

Orion, the first spacecraft built for crewed deep space missions, will have two transponders for redundancy and an emergency radio built by the Space and Intelligence Systems team of General Dynamics. When Orion’s crew is launched on a rocket to take its first trip to space, General Dynamics’ transponders will keep the astronauts connected to mission command centers on Earth.

Three Dividend-paying Space Stocks Show Growth

Giant General Dynamics employs more than 100,000 people worldwide and generated $39.4 billion in 2022 revenue. The company also received a “buy” recommendation from BofA, which set a price objective of $305, based partly on a 5.0% 2025-2030 growth rate and 2.8% long-term growth rate, as well as increased federal government defense budget expectations. BofA wrote that the company’s defense program provides exposure to land and sea missions, in addition to its Gulfstream business jet manufacturing, offering near-term and medium-term organic growth.

Other pluses are the company’s strong balance sheet and solid cash generation, helping to sustain dividend growth and share repurchases, BofA wrote. Potential downside risks to reaching that price target, according to BofA, are a possible drop in business jet sales due to an exogenous factor and the pricing of business jets in dollars, making the company vulnerable to unexpected devaluation of the U.S. greenback that could significantly impact orders. Any adverse affect on margins for defense programs and unforeseen government budget cuts could limit the company’s growth.

On the defense side, General Dynamics produces combat vehicles, nuclear-powered submarines and communications systems to provide safety and security during military missions. Woods noted that the company pays a dividend that currently yields more than 2% annually.

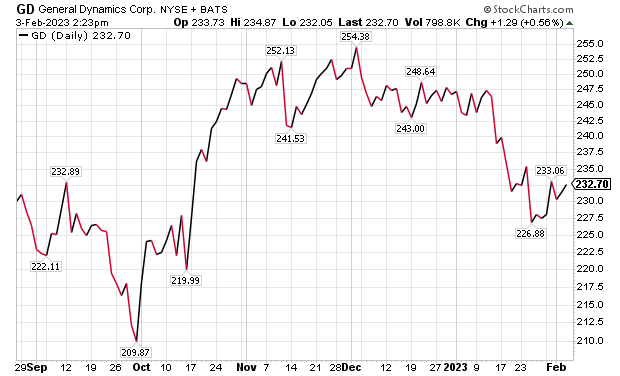

Chart courtesy of www.stockcharts.com

Iridium Has Been Rising as the Second of Three Dividend-paying Space Stocks

McLean, Virginia-based Iridium Communications Inc.’s (NASDAQ: IRDM) CEO Matthew Desch and Vice President of Investor Relations Ken Levy met with analysts at Chicago-based investment firm William Blair on Jan. 17 to discuss a Qualcomm Inc. (NASDAQ: QCOM) Snapdragon Satellite (QSS) partnership. The Iridium leaders emphasized that their company’s core business was growing 10% annually, before factoring in the new Qualcomm smartphone partnership.

William Blair’s analyst Louie DiPalma described the Qualcomm partnership as “net incrementally positive.” Iridium shares are up 14.88% year-to-date on top of its 25% return in 2022. Despite the increased valuation, the investment firm forecasts further potential share price gains in 2023 to a per-share range of $63 to $78, up from the investment firm’s prior projected range of $60 to $75 a share. Iridium’s stock closed at $59.03 on Jan. 27. But the fledgling Qualcomm smartphone partnership adds risk.

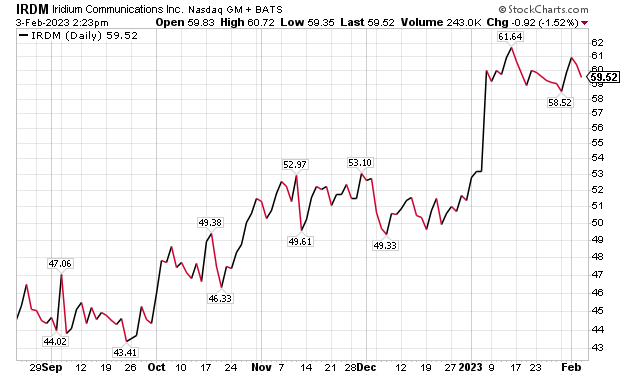

Chart courtesy of www.stockcharts.com

Iridium’s third in-orbit satellite constellation may cost less than the $3 billion required for Iridium NEXT. Iridium spent $3 billion to fund its current 66-satellite constellation from 2010 through 2019, before it likely will have another hefty capital expenditure from 2030 through 2037. The cost-effectiveness of SpaceX’s reusable Starship launch vehicle will slash by half the expense for Iridium to put its next-generation satellites in orbit, Desch said, in explaining why the company’s third-generation constellation should fall below the $3 billion it paid to put its Iridium NEXT system in orbit.

Iridium Shows Promise in Auto Applications

Iridium management voiced optimism about opportunities associated with the auto sector and machine-to-machine (M2M) data. The auto industry has the potential to generate significantly more usage fees per device than smartphones, DiPalma wrote.

Consumer internet of things (IoT) cannibalization should be mitigated by new features, DiPalma continued. Iridium has consumer IoT messaging partnerships with Garmin (NYSE: GRMN), Zoleo and Bixby.

These partners should unveil devices that will let users send and receive picture messages. The enhanced feature, along with an ecosystem of products, is intended to provide differentiation relative to the Qualcomm Snapdragon Satellite partnership and allow the consumer IoT segment to keep its momentum.

“Carrier subsidies could be a source of upside,” DiPalma wrote. “Cellular carriers or device OEMs such as Samsung may subsidize recreational messaging plans to drive customers.”

Iridium will continue to be valued on a sum-of-the-parts basis, DiPalma wrote. First, he estimated Iridium’s interest in Aireon is worth $4.35 per share. Second, he gave a free cash flow (FCF) multiple of 22 times to 28 times his 2024 FCF estimate of $63 to $78 per share for the next 12 months. The valuation estimates of William Blair do not factor in the smartphone partnership.

“We believe that this FCF yield is warranted due to Iridium’s strong competitive moat,” DiPalma wrote. “In our view, Iridium deserves this premium multiple due to its record of execution and new products and services in the pipeline.”

Iridium Rated ‘Outperform’ as One of Three Dividend-paying Space Stocks

For these reasons, William Blair reiterated an “outperform” rating on Iridium. The main risk for Iridium’s stock is that its smartphone technology experiences quality of service issues or Samsung does not initially adopt the satellite service, the investment firm wrote in its research note.

Iridium is the leading global provider of low-Earth-orbit L-band satellite services for customers across commercial, aviation, recreation, maritime and defense markets. Environmental, social and governance (ESG) considerations should be accounted for when assessing Iridium. The most important considerations for Iridium and the satellite sector generally relate to space sustainability and the risks associated with orbital debris and orbital collisions.

During the de-orbiting process for the original Iridium satellite constellation, working satellites were removed within 30 days of service being turned off. However, there are many nonworking Iridium satellites that remain in orbit.

Iridium reports that it has collaborated with the Combined Space Operations Center (CSpOC) to develop optimal practices for collision mitigation. In 2021, Iridium appeared on Newsweek’s “America’s Most Responsible Companies” list.

Three Dividend-paying Space Stocks: Leidos Holdings

Reston, Virginia-based Leidos Holdings (NYSE: LDOS), a science and technology company, has been awarded prime contracts by the U.S. Army. One example is the Geospatial Center’s (AGC) High-Resolution Three Dimensional (HR3D) Geospatial Information Operation and Technology Integration program. That single-award contract has an estimated value of $600 million, if all options are exercised.

The period of performance for the contract includes a one-year base, as well as three one-year options. Work will be performed predominantly in Virginia, as well as other locations.

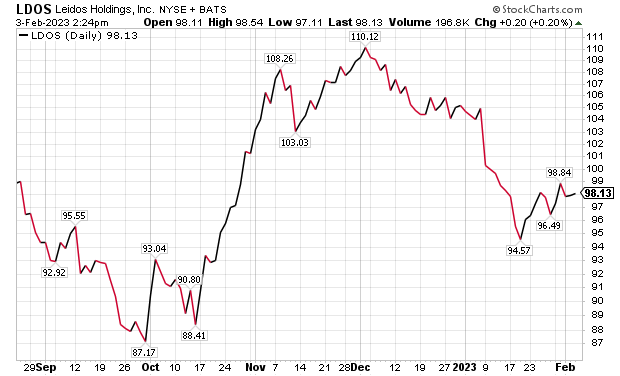

Chart courtesy of www.stockcharts.com

Leidos, previously known as Science Applications International Corporation, serves the U.S. defense, aviation, information technology and biomedical research industries. The company also provides scientific, engineering systems integration and technical services.

Three Dividend-paying Space Stocks: BofA Recommends Leidos

BofA set a price target of $130 on Leidos, forecasting that the company should trade in line in the defense prime contractors amid strong U.S. national security demand for innovative technologies and solutions. The company also has solid free cash flow, countered by a lumpy contract award environment, near-term supply chain pressures and mounting concerns about labor inflation.

Risks to reach the price target potentially include cuts to the U.S. government budget, compared to expectations, increased competition from non-traditional competitors, problems integrating mergers and acquisitions (M&As), hiring the right personnel, containing costs, estimating costs and executing on fixed price contracts. The company also could face reputational risk, BofA wrote.

Potential outperformance could come from a better-than-expected federal budget allocated to innovative technologies and modernization, inexpensive and well-integrated M&A activity, along with unexpected capital return to shareholders through dividends or share buybacks, market share gains, or better-than-forecast margins, BoA wrote.

Michelle Connell, who leads Dallas-based Portia Capital Management, recommends Leidos as a strong mid-cap defense stock that is not covered as prominently as the large-cap stocks in the industry. The company has a big domestic customer base that produces 90% of its revenues.

Michelle Connell heads Dallas-based Portia Capital Management.

LDOS has a record for beating earnings estimates, and it is likely to top estimates again on Feb. 15 when the company reports, Connell said.

“The options market has an interesting take on the stock,” Connell said. “When you break down the part of the premium that compensates for implied volatility, the compensation is high for the Feb. 17 calls.”

This means that the options market expects a big move one way or another for the stock, Connell said. Given that Leidos typically exceeds expectations, it would be logical for the stock to outperform estimates, she added.

With the company’s stock price down 8.27% so far this year through Friday, Jan. 27, maybe the market has been incorrect in its recent assessment, Connell continued.

Professor Questions SpaceX Chairman Elon Musk

Mark Skousen, PhD, the head of the Forecasts & Strategies investment newsletter, gained attention by asking a question of SpaceX Chairman Elon Musk at an investment conference. Skousen also is a leader of the Fast Money Alert trading service that invests in stocks and options. Skousen queried SpaceX and Tesla (NASDAQ: TSLA) founder Elon Musk at the annual Baron Investment Conference held in New York on Nov. 4. Skousen, who also is a Chapman University Presidential Fellow and recently was named the first Doti-Spogli Chair in Free Enterprise at its Argyros School of Business and Economics, recommended Tesla in Fast Money Alert this month due to the stock’s reduced valuation after it plunged 66.3% in the last year.

Mark Skousen, a scion of Ben Franklin and chief of Fast Money Alert, meets Paul Dykewicz.

Skousen and Jim Woods, co-leaders of the Fast Money Alert trading service, combined to produce a short-term gain of nearly 10% with their Oct. 3 recommendation of defense, space and cyber consulting firm Booz Allen Hamilton (NYSE: BAH), of McLean, Virginia. The call options they recommended soared 239.27% in just 28 days before they advised selling.

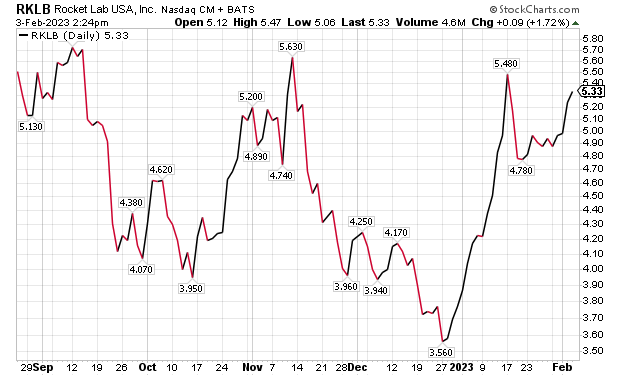

Non-Dividend-paying Rocket Lab Misses Qualifying for List

Non-dividend-paying Rocket Lab received a $13 price objective from BofA, based on a long-term discounted cash flow (DCF) of Base, Bull, and Bear cases for different revenue and cash generation scenarios between now and 2035. BofA’s DCF factors in a 13% discount rate and assigns 33.3% probability to the Base case, 33.3% probability to the Bull case and a 33.3% probability to the Bear case.

BofA uses a lower discount rate relative to peers to account for the company’s more mature launch capabilities. In its view, the equal weighting fairly reflects current investor risk appetite, momentum for new technology space stocks and the perceived viability of Rocket Lab’s business model compared to its peers.

Risks to BofA’s price objective are potential persistent COVID-19 restrictions in New Zealand, production delays, constellation launch market remaining captive to certain providers, setbacks to the economic recovery, inability to achieve mergers and acquisitions (M&A) synergies and uncertainty with its Neutron vehicle development. Possible outperformance could come from better-than-expected cost cutting and margin expansion, well-integrated M&A activity, market share gains in satellite components and services, improved reutilization levels and better-than-expected commercialization of the Neutron launch vehicle.

Chart courtesy of www.stockcharts.com

China’s COVID-19 News Reports Rising Deaths

Market risk is rising due to China recently reporting 13,000 COVID-19-related deaths in a single week. The death toll from that week is in addition to more than 60,000 deaths that the country has attributed to the virus since December.

With many people in China returning to their hometowns to celebrate the country’s most important festival, the Lunar New Year, risk mounts that elderly people may be infected by COVID-19 from those visiting from elsewhere. Government officials have cautioned about the risk to public health from the rise of COVID cases.

China has been accused by Western public health officials of lacking transparency since the virus emerged in late 2019. Critics contend China may not be sharing data about new strains that could spark fresh outbreaks in other countries.

The United States, France, Japan, India, South Korea, Taiwan and Italy have announced travelers from China need to test negative for COVID. An internal meeting of China’s National Health Commission estimated that up to 248 million people contracted the coronavirus during the first 20 days of December. COVID-19 still is raging through cities in China.

Three Dividend-paying Space Stocks Affected by COVID

Worldwide COVID-19 deaths soared to 6,741,826 people, with total cases of 670,075,077, Johns Hopkins University reported on Jan. 27. COVID-19 cases in the United States totaled 102,277,103, while deaths reached 1,107,634, as of Jan. 27, according to Johns Hopkins. China reported that it had 248 million cases of COVID-19.

The U.S. Centers for Disease Control and Prevention reported that 268,927,705 people, or 81.0% the U.S. population, have received at least one dose of a COVID-19 vaccine, as of Jan. 26. People who have completed the primary COVID-19 doses totaled 229,619,755 of the U.S. population, or 69.2%, according to the CDC. The United States has given a bivalent COVID-19 booster to 47,859,040 people who are age 18 and up, equaling 18,8% as of Jan. 26. It marks a jump from 18.5% as of Jan. 18, from 18.2% on Jan. 11, 17.7% on Jan. 4 and 17.3% for Dec. 28.

War Against Ukraine Fails to Ground Three Dividend-paying Space Stocks

As far as geopolitical risk, Ukraine’s President Volodymyr Zelensky’s secret Dec. 21 flight to Washington, D.C., let him to speak face-to-face with U.S. President Joe Biden to advocate for essential military equipment to defend against Russia’s continuing attacks. Zelensky’s address to a joint session of Congress that evening gained support from many U.S. lawmakers. The surprise visit marked Zelensky’s first international trip since Russia invaded Ukraine in February 2022.

Russia is sustaining its onslaught of intensified strikes that began in last October, targeting Ukraine’s energy and civilian infrastructure.

Even though Russia’s leaders describe their attack of Ukraine as a “special military operation,” its soldiers are escalating their assault of the neighboring nation, especially in the city of Bakhmut. News reports indicate Russia seized control of Soledar, a city near Bakhmut in eastern Ukraine.

Secretary of Defense Lloyd Austin cautioned that time is short for the United States and other Western countries to provide Ukraine with advanced tanks required to thwart a Russian offensive in the spring. Ukraine not only needs the tanks and other weapons, but the training to use them.

The Ukraine Defense Contact Group, consisting of U.S.-assembled defense ministers, announced major new commitments of weapons, including an additional $2.5 billion of Bradley fighting vehicles, Stryker vehicles and other important tanks and military equipment.

The three dividend-paying space stocks have many capabilities, including vital communications from space, that can aid military personnel. With Russia’s military releasing criminals to serve in the front lines of attacks to let its commanders identify Ukrainian forces offering resistance, the death toll is mounting for both sides.

Connect with Paul Dykewicz

Connect with Paul Dykewicz