Three Dividend-Paying 5G Technology Stocks to Consider

By: Paul Dykewicz,

Three dividend-paying, 5G technology stocks to consider during a pullback in the sector feature a developer of digital telecommunications products and services, as well as two mobile voice and high-speed broadband service providers.

The rollout of fifth-generation network services, also known as 5G, enhances the appeal of each of these three dividend-paying, 5G technology stocks, despite the ongoing COVID-19 public health crisis. These stocks already have begun to capitalize on the rollout of 5G that experts describe as one of the fastest wireless technologies ever created.

The three dividend-paying, 5G technology stocks to buy in a pullback provide either products or services for fifth-generation cellular networks to users who increasingly need heightened bandwidth for video streaming, chatting, games and other purposes. With connected devices becoming commonplace, demand for such services is destined to grow quickly.

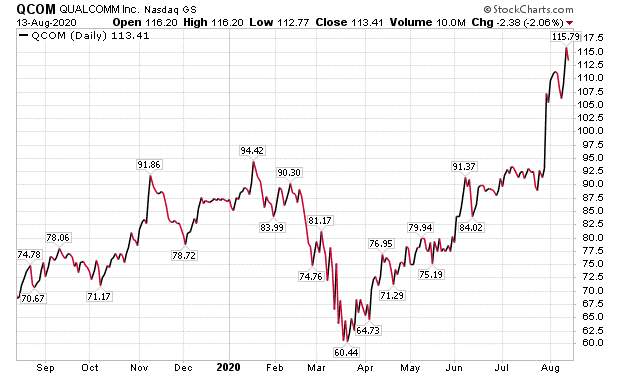

Qualcomm Rates as One of Three 5G Dividend-Paying Technology Stocks to Consider

San Diego-based Qualcomm, Inc. (NASDAQ:QCOM), is a developer, designer and provider of digital telecommunications products and services. It specifically is a key provider of technology solutions for connected devices to unlock the speed and capability advances of 5G.

Chart Courtesy of www.stockcharts.com

“The current yield isn’t huge at 2.3% after the stock’s recent rally, so I’d try to wait for a dip before I do a lot of buying,” said Hilary Kramer, host of a national radio program called “Millionaire Maker” and leader of the GameChangers and Value Authority advisory services. “A patient investor will probably get at least a brief opportunity to grab QCOM under $85 in the coming year. But even 2.3% today only locks in the dividend floor. Management here has been relentless about squeezing shareholder rewards out of the wireless boom.”

A decade ago, investors seemed content to capture 2% dividend yield on QCOM because they knew their income stream would expand with the business, Kramer continued. Those people who held on to their shares are earning a 6.6% yield today. As long as Qualcomm remains central to the wireless world, the income will keep flowing, she added.

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services included 2-Day Trader, IPO Edge, Turbo Trader, High Octane Trader and Inner Circle.

Let there be no doubt that Qualcomm is a technology leader in bringing 5G services to connected devices that include smartphones and mobile hotspots, fixed wireless products such as routers and telephones, as well as personal computers and automobiles. Qualcomm designs all the components of its 5G mobile platforms to deliver high cellular speeds, superior coverage and enhanced power efficiency.

Qualcomm’s P/E Ratio Is High Even for 5G Dividend-Paying Technology Stocks to Consider

The stock’s price-to-earnings (P/E) ratio of 47.94 is high even by technology industry standards, so prospective investors may want to wait for a further price drop before buying the shares, as Kramer suggested. Qualcomm’s total return of 70.42% during the last 12 months leaves room for a pullback with the rest of the high-flying technology sector.

On Aug. 5, Qualcomm announced that its latest premium tier Snapdragon 865 Plus 5G Mobile Platform will power Samsung Electronics Co., Ltd.’s latest flagship devices, including the Galaxy Note20 Ultra and Note20 in select regions, along with the Galaxy Z Fold2 and Galaxy Tab S7/S7+ globally. The Snapdragon 865 Plus is designed to deliver increased performance compared to the previous generation of technology for superior game playing, global 5G and “ultra-intuitive” artificial intelligence (AI).

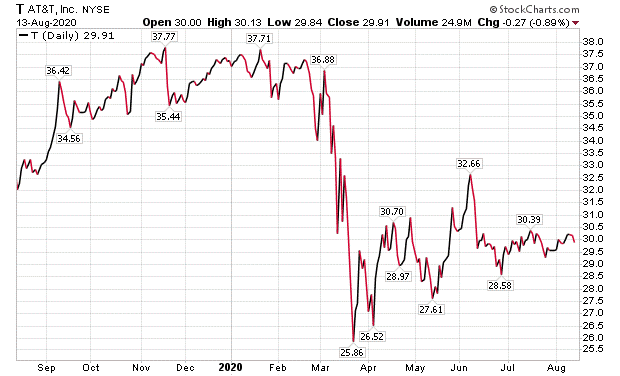

AT&T Joins List of the Three 5G Dividend-Paying Technology Stocks to Consider

In comparison to Qualcomm, Dallas-based AT&T (NYSE:T) has a modest P/E ratio of 18.26 and offers a hefty current dividend yield of 6.95% that income investors should like. The stock is recommended by the Intelligence Report investment newsletter of Jim Woods, who also leads the Successful Investing and Bullseye Stock Trader advisory services.

AT&T is not a pure play on 5G, since it has expanded heavily into media content in recent years. The company’s WarnerMedia business includes the new HBO Max streaming media service that has emerged as a corporate priority and recently spurred a leadership reorganization in that business unit.

The stock slipped after AT&T reported second-quarter results, ended June 30, when it did not meet several performance metrics of securities analysts. The company’s revenues of $40.95 billion fell short of estimates by $100 million due to weakness in Latin America and in Xandr, Inc. a digital advertising and analytics division of WarnerMedia. However, income investors will like that the stock has paid a dividend consistently since 1984.

AT&T’s Financial Results Show the Effects of the COVID-19 Crisis

AT&T’s earnings per share (EPS) of $0.83 beat analysts’ forecasts by $0.04 but included a hit of 9 cents due to COVID-19. However, $0.66 came from amortization, cost savings and merger integration. Nonetheless, the COVID-19 crisis proved to be a major headwind across AT&T’s varied business segments.

Mobile services net subscriber adds at AT&T fell short of expectations in the second quarter, while Video and Broadband Entertainment net losses topped scaled-back forecasts. Investors should remember that management did not provide guidance but did reiterate capital expenditures of roughly $20 billion and a dividend payout of about 60%.

Subscriber churn improved in the second quarter, just as analysts expected amid the pandemic when more people stayed home and used AT&T’s services. It also helped that live sports and production returned in the second quarter to become catalysts to keep customers.

Among the 28 sell-side analysts who track AT&T, 64% call the stock a hold, 29% consider it a buy and 7% advise selling, according to FactSet. At a reduced valuation than its current level, the stock could gain further appeal.

Chart courtesy of www.StockCharts.com

Paul Dykewicz meets with Jim Woods before COVID-19 to discuss investments.

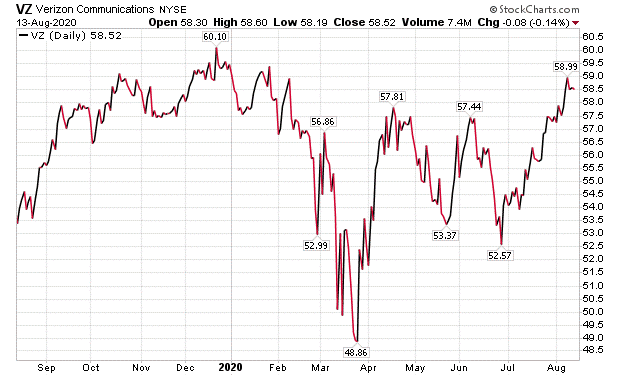

Verizon Becomes One of Three Dividend-Paying 5G Technology Stocks to Consider Buying

Bob Carlson, leader of the Retirement Watch advisory service, recommends big telecommunications provider Verizon Communications Inc. (NYSE:VZ) and its 4.20% dividend yield. As chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, Carlson seeks to protect the money of investors and he likes investments that pay dividends as one way to do so.

The New York-based conglomerate’s subsidiaries include well-known brands such as American’s largest mobile phone service Verizon Wireless, its Verizon Fios multi-channel video operation and AOL.

“I wouldn’t call Verizon COVID-19-proof, but I do think it’s a good stock to be holding now,” Carlson said. “The company has steady cash flow that increases over time. It also has a history of increasing its dividend. So, an income investor will see the annual income in dividends increase, regardless of what is happening with the stock price.”

A major negative, Carlson cautioned, is that Verizon carries substantial long-term debt of $106.56 billion and current debt of $11.18 billion, totaling $117.74 billion. After adjusting for $7.05 billion in cash-equivalents, Verizon’s net debt is $110.69 billion.

Right now, that debt load appears to be manageable and does not put Verizon’s dividend at risk, Carlson said.

Verizon’s Modest P/E and Dividend Could Gain Further Appeal in a Pullback

Verizon’s P/E ratio of 12.65 is only about one-third as high as that of rival T-Mobile USA, Inc. (NASDAQ:TMUS), giving investors a comparatively much better entry point than its competitor in mobile telecommunications. In addition, Verizon’s second-quarter earnings per share of $1.18 beat FactSet’s analysts’ consensus forecasts of $1.15. The company estimates that its Q2 EPS and adjusted EPS included a hit of about 14 cents due to COVID-19. The novel coronavirus held back wireless service revenue, advertising and search revenue of its Verizon Media business.

Verizon also recognized an aggregate tax benefit of $156 million from an internal reorganization that added 4 cents to second-quarter EPS and adjusted EPS. Its second-quarter revenues of $30.4 billion beat FactSet’s consensus estimate of $29.92 billion.

Chart courtesy of www.StockCharts.com

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz during an interview before social distancing became the norm after the outbreak of COVID-19.

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz during an interview before social distancing became the norm after the outbreak of COVID-19.

Descendant of Ben Franklin Sees Promise in 5G Technology

Mark Skousen, PhD, a Presidential fellow in economics at Chapman University who also leads the Forecasts & Strategies investment newsletter, is another fan of 5G technology who also loves dividend-paying stocks and funds. However, he recommended on June 16 that his TNT Trader advisory service subscribers buy shares in Qorvo Inc. (NASDAQ: QRVO), a Greensboro, North Carolina-based semiconductor maker and 5G network builder. In less than two months, the recommendation is up by double-digit percentages.

Since Skousen recommends options along with stocks, he also advised the purchase of QRVO call options. He recently recommended the sale of half the option position for roughly a 40% gain and informed his subscribers to hold the remainder for additional potential gains.

Skousen, who also heads the Home Run Trader, Five Star Trader and Fast Money Alert advisory services, pointed out that Qorvo already is profitable, despite not existing until 2015. The value of its stock rose sharply in 2019 but took a sharp downturn during the coronavirus scare. However, as a nascent growth company, Qorvo has yet to begin paying a dividend.

Mark Skousen, a descendant of Benjamin Franklin, meets with Paul Dykewicz

The advent of 5G will not be stopped by COVID-19, even though the dreaded infection has caused 20,919,243 cases and 759,582 deaths globally, along with 5,249,155 cases and 167,113 lives lost in the United States, as of Aug. 14. America has the most cases and deaths of any nation, including China, where COVID-19 first arose.

The three dividend-paying, 5G technology stocks each have pulled back slightly among with the sector recently and could retreat further as a new stimulus package continues to face delays in getting through a divided Congress. Income investors who want to profit from the advent and growth of 5G should have opportunities to do so in the days, weeks or even months ahead at reduced prices if they stay patient.

Connect with Paul Dykewicz

Connect with Paul Dykewicz