Three Dividend Stocks to Buy Highlighted by National Guard Response to Crises

By: Paul Dykewicz,

Three dividend stocks to buy are highlighted by the National Guard response to civil and COVID-19 crises in the United States that draw attention to companies likely to receive heightened demand for their goods and services.

The three dividend stocks to buy in the aftermath of National Guard activations occurring in 46 states and territories provide home improvement products and tools, as well as advanced communication and broadband devices. The crises have led to almost 13,000 citizen-soldiers in the National Guard answering the call just to assist with COVID-19 response nationwide until April 1, 2022.

In assessing recent devastation from the ferocious funnel clouds, Kentucky took the worst damage in the country from tornadoes on Dec. 10 as multiple twisters caused an estimated $5 billion in insured losses there and in nearby states, according to the New York-based Insurance Information Institute. Kentuckians also suffered the biggest loss of life with 76 deaths, the state’s Gov. Andy Beshear confirmed on Dec. 21, when he said that no people remained missing due to the storms and that related search and rescue efforts had ended.

Post-tornado search and rescue National Guard missions occur on Dec. 12 in Mayfield, Kentucky. Photo courtesy of Spc. Brett Hornback of the Kentucky National Guard.

Kentucky Tornadoes and National Guard Response Highlight Three Dividend Stocks to Buy

An estimated 69 tornadoes during Dec. 10-12 ripped across Kentucky and seven central and southern states: Missouri, Illinois, Arkansas, Tennessee, Georgia, Ohio and Indiana. The tornadoes, as well as thunderstorms, sometimes continued along their destructive paths for more than 100 miles, according to NOAA’s National Weather Service. The existence of such fierce storms in December rather than in the spring and summer is highly unusual.

The most severe tornado that blitzed Kentucky received a rating of EF-4 from the National Weather Service. That tornado pummeled western Kentucky with winds that reached 190 mph, while traveling 165 miles on the ground and causing widespread destruction.

Almost 500 members of the Kentucky National Guard reported for duty at the request of Gov. Beshear to augment law enforcement and assist with traffic control after the tornadoes passed through and left victims trapped in the rubble of flattened homes and buildings. In addition, a total of 15 tornadoes touched down in Middle Tennessee alone on Dec. 11 and 12, killing five people and injuring 10 others in the state.

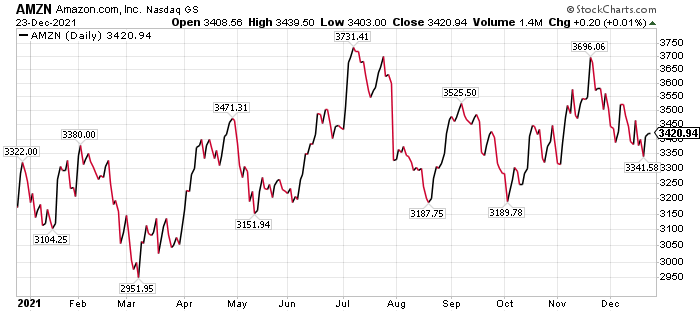

Six workers died when an Amazon.com Inc. (NASDAQ: AMZN) warehouse was struck and severely damage by a tornado in Edwardsville, Illinois. A Dec. 20 letter sent to Amazon’s CEO Andy Jassy and founder Jeff Bezos by Sen. Elizabeth Warren (D-Mass.) and several other Democrats in Congress claimed the Dec. 10 disaster at the warehouse fits a pattern of Amazon putting “worker safety at risk” in everyday situations and emergencies.

Three Dividend Stocks to Buy Gain Spotlight Amid Civil and COVID-19 Crises

The response of National Guard troops and airmen to the emergencies indicate investments to buy when wicked winds, pelting rain and building collapses decimate communities. Governors refrain from activating the National Guard unless a genuine emergency occurs, so such actions give investors an early sign of what to buy and sell.

“These incidents, plus global growth, mean the strong demand for commodities will be sustained,” said Bob Carlson, who heads the Retirement Watch investment newsletter. “Most people are underinvested in commodities. Yet, lumber and other commodities are approaching recent highs and are likely to continue rising.”

Pension fund and Retirement Watch chief Bob Carlson answers questions from columnist Paul Dykewicz.

One way to invest in commodities with a single purchase is to buy shares in an exchange-traded fund (ETF) that offers a diversified basket of such equities, counseled Carlson, who also serves as chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets.

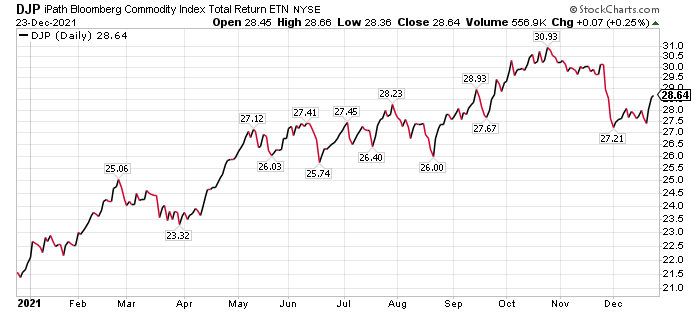

While there are many comparable ETFs and exchange-traded note (ETNs), Carlson recommends the non-dividend-paying iPath Bloomberg Commodity Total Return (DJP). That ETN is intended to track the performance of the Dow Jones-UBS Commodity Index Total Return.

DJP is about 50% allocated to energy commodities, which is typical of most commodity-focused funds, Carlson continued. The rest of the fund’s holdings are allocated to industrial and agricultural commodities.

Chart courtesy of www.stockcharts.com

Home Depot Headlines Three Dividend Stocks to Buy in the Wake of National Guard Activations to Cope with Crises

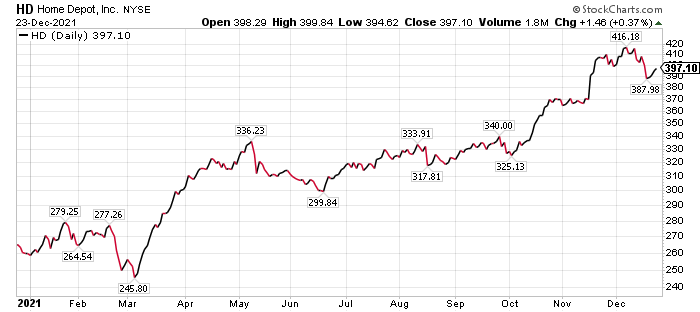

The Home Depot, Inc. (NYSE: HD), an Atlanta-based home improvement behemoth, is a major seller of lumber and other products to contractors and home owners in the United States. It also received a buy recommendation and a 12-month price objective of $440 from BofA Global Research, based on its 26x the 2022 earnings per share (EPS) estimate for the home-improvement company. BofA wrote that a multiple above the five-year hardline retail average of 20x and Home Depot’s five-year average of 20x is warranted due to the resilience of home-improvement retailers, their likely market share gains and the company’s consistent execution.

Risks to the price objective could come from a weakening in the housing market beyond BofA’s forecasts, deterioration in the competitive landscape, unfavorable weather and poor execution in supply chain upgrades. Outperformance could occur if a noticeable acceleration takes place in the housing market or in same-store sales as HD gains additional market share, BofA added.

Chart courtesy of www.stockcharts.com

Home Depot offers a current dividend yield of 1.7% and typically benefits from a surge of customers amid COVID-19 restrictions, and in the weeks and months after homes and buildings are damaged by severe storms. The double-whammy of both COVID and tornado emergencies should give the home-improvement giant a further financial boost.

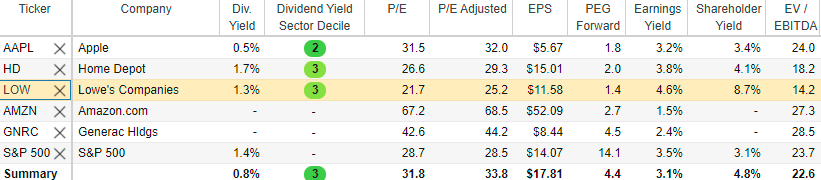

Source: Stock Rover. Click here to sign up for a free two-week trial.

Lowe’s Lands on List of Three Dividend Stocks to Buy During Emergencies

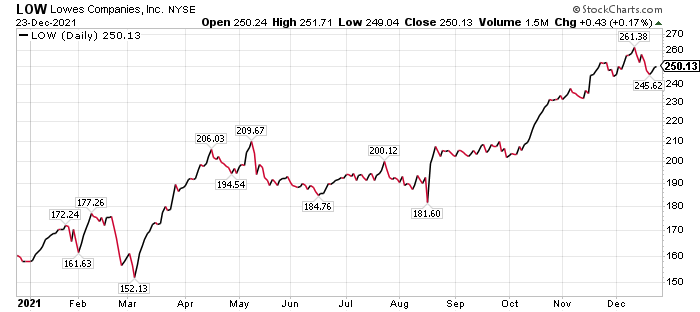

Mooresville, North Carolina-based home-improvement giant Lowe’s Companies Inc. (NYSE: LOW) also should gain additional business from the civil and COVID-19 crises, based on its past performance with the pandemic and hurricanes. Destroyed or damaged houses and buildings always need to be replaced or fixed, respectively.

Lowe’s sells the home-improvement supplies and tools that are needed to recover from calamities. Even before the tornado touchdowns, the potential of Lowe’s had been brightening, according to BofA.

The investment firm’s September 2021 survey about working from home reported that respondents intend to spend more on home improvement in the next 12 months than they did in the last 12 months. Therefore, even on top of 2020’s unprecedented growth, home improvement spending in 2021 is hitting even higher levels.

BofA Raises Price Objective on Lowe’s as One of Three Dividend Stocks to Buy Amid Crises

Following Lowe’s strong third-quarter results, BofA raised its estimates and price objective on the stock, as well as affirmed its “Buy” rating on the company. Lowe’s also currently offers a dividend yield of 1.3%.

BofA placed a $292 price target on Lowe’s, giving it a 22x 2022 earnings per share estimate. A valuation multiple above the five-year average of 15x is warranted for Lowe’s due to its solid fundamentals and the relatively defensive nature of the home-improvement industry, BofA opined.

“In addition, LOW has an opportunity to expand margins for several years through continued productivity improvements and product differentiation,” BofA wrote.

Chart courtesy of www.stockcharts.com

Jim Woods, a former Army paratrooper who heads the Successful Investing and Intelligence Report investment newsletters, as well as the Bullseye Stock Trader advisory service, recommends Lowe’s. He currently has the stock in the Income Multipliers Portfolio of his Intelligence Report investment newsletter and it has been a highly profitable pick by rising 57.4% in 2021 through Dec. 23.

Paul Dykewicz meets with stock picker and former Army National Guardsman Jim Woods in Washington, D.C.

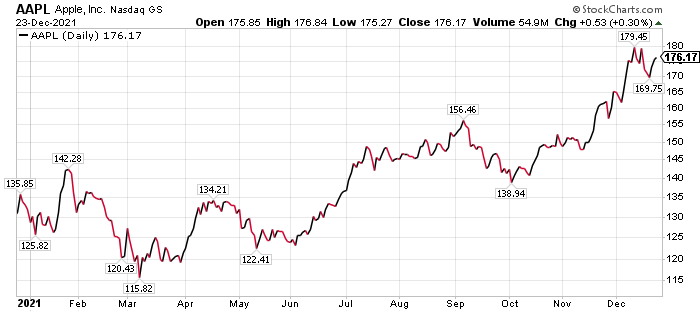

Apple is Included Among Three Dividend Stocks to Buy Due to Emergencies Addressed by the National Guard

For most of 2021, Cupertino, California-based Apple Inc. (NASDAQ: AAPL) underperformed the S&P 500 index. However, the trend changed last month when the stock started to beat the index. BofA recently wrote that the provider of iPhones, iPads and many other communication and broadband devices offers the safety of a large capitalization stock with good cash flow and a positive outlook for its planned augmented reality (AR) and virtual reality (VR) product.

The civil and COVID-19 emergencies addressed by the National Guard should only enhance the already strong appeal of existing and proposed Apple products. Plus, BofA wrote that some portfolio managers that had underweighted Apple may want to buy its shares before end-of-the-year holdings are finalized. The practice of fund managers selling underperforming stocks and replacing them with rising ones before the end of quarter is called “window dressing” by Wall Street professionals.

BofA forecasts that Apple will introduce an augmented reality/virtual reality headset either by the end of 2022 or early 2023. The investment firm predicts the technology will become an industry “game-changer,” enabling many new applications.

The product will require high-performance hardware and higher access speeds. The enhanced outlook for Apple recently caused BofA to upgrade its rating on the stock to “Buy” from “Neutral” and boost its price target on the company to $210 from $160. Apple also offers the added appeal of a 0.5% dividend yield.

Chart courtesy of www.stockcharts.com

Expect a stronger iPhone upgrade cycle in fiscal year 2023, driven by the need for higher connectivity where augmented reality becomes the “killer application” for 5G, the fifth generation technology standard for broadband cellular networks, BofA predicted.

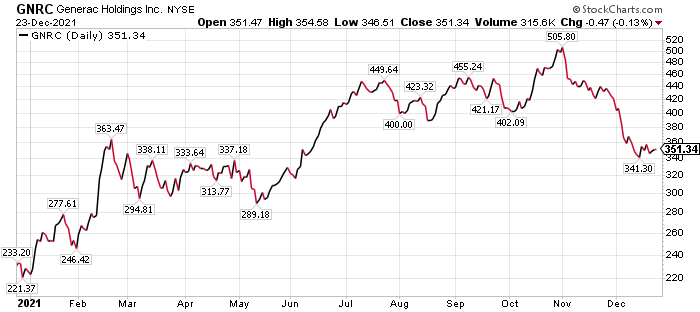

Generac Holdings Is a Non-Dividend-paying Stock that Missed Making the Trio of Three Dividend Stocks to Buy

Generac Holdings Inc. (NYSE: GNRC) is a Waukesha, Wisconsin-based provider of power generators, energy storage systems, grid services and other power-producing products that serve the residential, light commercial and industrial markets. The company is a new recommendation of BofA.

At times when local power sources go down, portable generators provided by Generac literally can save lives. The company holds an estimated 80% market share for North American residential standby generators.

Generac also recently has invested in a backup solar energy storage business that is growing rapidly, while also maintaining a large commercial and industrial business that accounts for about 40% of sales, BoA wrote in a recent research note. The company stands out for its clean energy strategy and benefits from extreme weather, growth in renewable energy and rising customer demand to protect their comfortable lifestyle like a sanctuary amid pandemics, hurricanes and wildfires.

BofA Gives Generac a Price Target of $475 as an Outsider to the Three Dividend Stocks to Buy During Emergencies

BofA’s $475 price objective on Generac is based on a 26.5x 2022 estimated enterprise value (EV) / earnings before interest, taxes, depreciation and amortization (EBITDA). The investment firm’s target multiple is at a premium to faster, secular growth of industrial peers that trade around 15-20x EBITDA, reflecting Generac’s dominant market position in home residential backup power.

However, Generac trades at a discount to clean tech alternatives that have similar growth trajectories and profitability characteristics. Such clean tech companies are valued at multiples above 30x consensus EBITDA.

Chart courtesy of www.stockcharts.com

Risks to Generac attaining BofA’s price target include supply chain inefficiencies and rising costs that could slow an expected first-half 2022 recovery in margins, BofA wrote. Additional risks entail a possible reduction in power outages, any disappointing home standby orders during the next six months, increased competition in the energy storage market, any large clean energy acquisition that requires the company to issue new shares, unfavorable regulatory changes and any mistakes in trying to penetrate new markets, BofA added.

Outperformance of the price target may come from another round of severe power outages, growing demand in California and Texas, faster-than-expected demand and margin upside in the clean energy business, stronger-than-expected demand recovery in key commercial and industrial (C&I) markets such as telecommunications and surprisingly strong growth of Enbala Power Networks, an October 2020 acquisition of Generac. The purchase fortified Generac’s smart grid technologies and expanded its opportunities to enhance its capabilities as a grid service provider. The combination puts Generac on the leading edge of a “remarkable transformation” of the electrical grid, moving from a dated and centralized power distribution model to one that will be digitized, decentralized and increasingly resilient, said Aaron Jagdfeld, chief executive officer, upon closing the transaction.

Amazon’s Lack of a Dividend Knocks it off List of Three Dividend Stocks to Buy During Emergencies

Despite Seattle-based online retailer Amazon.com Inc. (NASDAQ: AMZN) recently receiving a critical letter from influential Democrats in Congress who claimed the company sacrificed worker safety in pursuit of profits when tornadoes torn apart the company’s warehouse in Edwardsville, Illinois, the company’s prospects still shine despite its recent dark days. In fact, Amazon is ranked by BofA as the top choice for 2022 among the FANG stocks of Meta Platforms Inc. (NASDAQ: FB), formerly Facebook; Amazon; Netflix Inc. (NASDAQ: NFLX); and Alphabet (NASDAQ: GOOGL). One reason is that Amazon unperformed in 2021 and could be poised for a bounce back.

BofA not only upgraded its rating on Amazon to a “Buy,” but the investment firm boosted its price target to $4,450 from $4,250. As the calendar moves to the summer and fall of 2022, expect strength in e-commerce as online penetration gains renewed momentum, BofA wrote.

The prospects for Amazon should improve during 2022 to allow the stock to finish much better than it starts the new year, BofA wrote. The investment firm predicts Amazon will gain a lift from supply chain improvements and infrastructure investments.

Chart courtesy of www.stockcharts.com

COVID-19 Crisis Spares Three Dividend Stocks to Buy During Emergencies from Big Financial Hit

The holiday season of 2021 marks the second straight year COVID-19 has disrupted the plans of families and their friends to gather. Scientists have found that the new Omicron variant of COVID-19 is spreading faster than other coronavirus strains but its severity compared to the highly infectious Delta variant may not be nearly as severe, according to initial studies.

Omicron recently has become the dominant variant of COVID-19 in the United States, accounting for nearly three-quarters of new infections last week.

Almost 42,600 people tested positive in New York City from Dec. 15 through Dec. 18, compared with fewer than 35,800 in the full month of November. It is the highest number of people to test positive in such a short period of time in New York City since testing became widely available.

In Britain, coronavirus infections have soared 60% in the past week. That led to Omicron bumping off the Delta strain as the dominant variant there.

COVID-19 Risk Remains a Big Worry as Cases and Deaths Climb

The new Omicron variant of COVID-19 and the highly transmissible Delta variant are causing continuing concerns in the United States and other parts of the world. Public health experts and government leaders keep advocating for increased vaccinations and booster shots, as well as indoor mask wearing.

Airman 1st Class Tenzin Dakar, an aerospace medical technician with the 104th Medical Group, and Spc. Michael Major, a unit supply specialist with the 125th Quartermaster Company, help with COVID-19 testing in Massachusetts on Nov. 17. Photo courtesy of Staff Sgt. Hanna Smith of the Massachusetts National Guard.

The Centers for Disease Control and Prevention (CDC) has data that show the variants are boosting the number of people receiving COVID-19 vaccinations. But close to 62 million people in the United States remain eligible to be vaccinated but have not seized the opportunity, said Dr. Anthony Fauci, the chief White House medical adviser on COVID-19.

As of Dec. 23, 241,520,561 people, or 72.7% of the U.S. population, have received at least one dose of a COVID-19 vaccine, the CDC reported. People who are fully vaccinated total 204,740,321, or 61.7% of the U.S. population, according to the CDC.

COVID-19 deaths worldwide, as of Dec. 23, exceeded the 5.3 million mark to reach 5,384,141, according to Johns Hopkins University. Worldwide COVID-19 cases have topped 278 million, climbing to 278,052,258 on that date.

U.S. COVID-19 cases, as of Dec. 23, hit 51,798,666 and caused 813,972 deaths. America has the dubious distinction as the nation with the most COVID-19 cases and deaths.

The three dividend stocks to buy amid the current civil and COVID-19 crises should be among the market’s 2022 successes. The National Guard activations can serve as an early warning that a crisis is raging and investors would be wise to pay attention to determine the best ways to benefit from the market’s next upturn.

Connect with Paul Dykewicz

Connect with Paul Dykewicz