Western Digital Supplements Rising Share Price with Above-Average Dividend Yield (NASDAQ:WDC)

By: Ned Piplovic,

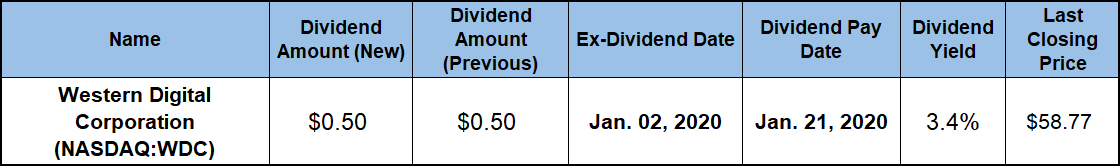

Despite a rising share price over the last year and paying flat annual dividends since 2016, the Western Digital Corporation’s current 3.4% dividend yield still outperformed average yields of the company’s industry peers.

Most companies in the Technology sector do not pay any dividends, as they funnel most of their earnings into research, development and expansion. However, as a large and established company in the sector, Western Digital has been distributing a portion of its earnings to shareholders in dividend payouts since 2012. The company doubled its total annual distribution in the first four years after initiating dividend payouts. However, Western Digital has been paying a flat annual dividend payout amount since 2016.

In addition to the dividend payout amount, the second metric that determines the dividend yield is the company’s share price. Because Western Digital’s share price has been fluctuating significantly over the last several years, so has the company dividend yield. During the past six years, the share price surged above the $110 level and subsequently dropped back below $36 twice.

The most recent of those significant share price drops began in the second-quarter 2018 and lasted through the remainder of that year. However, the share price has been gaining again over the trailing 12-month period. Some financial results, such as the reserved financial outlook for the next quarter, suggest continued headwinds. Alternatively, recent technical indicators imply that the current share price uptrend might sustain a little longer and extend at least into the near future.

While a continued share price uptrend would suppress the dividend yield further, investors seeking total returns from asset appreciation and dividend income, might consider taking a closer look at the Western Digital stock. However, as with all investing decisions, interested investors must conduct their own detailed analysis and due diligence before making their final choice. For the analysis, investors should take into consideration that the company’s dividend payout ratio over the past five years averages more than 150%. Generally, investors consider dividend payout ratios above 50% unsustainable.

Additionally, investors should watch closely the stock’s Relative Strength Index (RSI). Rising with the current share price uptrend, Western Digital’s RSI has reached 76%. While just one of many available indicators, an RSI above 70% generally indicates that the share price is “overbought”. Even if company’s fundamentals support further share price growth, some technical investors and automated trading systems might trigger a sell-off based solely on the perceived “overbought” status.

However, investors who determine that the company’s fundamentals offer a solid base for long-term growth, might look at such sell-off as a buying opportunity. However, to ensure eligibility for the next round of dividend distributions, investors must claim stock ownership before the January 2, 2020, ex-dividend date. Since the seller retains stock ownership until settlement at the end of the trading day, investors must buy stake in the company no later than the day before the ex-dividend date to receive the next quarterly dividend distribution scheduled for January 21, 2020.

Western Digital Corporation (NASDAQ:WDC)

Based in San Jose, California, and founded in 1970, the Western Digital Corporation develops, manufactures and sells data storage devices and solutions worldwide. The company offers client devices, including hard disk drives (HDDs) and solid state drives (SSDs) for computing devices. Furthermore, the company’s product portfolio includes flash-based embedded storage products for mobile phones, tablets, notebook personal computers and other portable devices. Moreover, Western Digital also offers hardware and applications for industrial, automotive, connected home and Internet of Things applications.

The company also provides data center devices and solutions comprising enterprise helium hard drives, enterprise flash-based SSDs and software solutions for use in servers, online transactions, data analysis, data center solutions and other enterprise applications. Also, Western Digital offers client solutions and removable cards used in consumer devices, including mobile phones, tablets, imaging systems, still and action video cameras, security surveillance systems, universal serial bus flash drives and wireless drive products. The company sells its products under the G-Technology, Upthere, SanDisk and Western Digital brands to original equipment manufacturers, distributors, resellers, cloud infrastructure players and retailers.

As already indicated, Western Digital doubled its annual payout amount in just four years after beginning dividend distributions in mid-2012. That rapid growth of dividend distributions is equivalent to an average annual growth rate of nearly 19%. Even including the last several years of flat annual dividend payouts in the calculation, Western Digital still maintains a double-digit-percentage dividend growth rate over the past seven years.

The current $0.50 quarterly dividend payout amount is equivalent to a $2.00 annualized distribution. This annual payout level corresponds to a 3.4% forward dividend yield. Because of a rapidly increasing share price over the last year, the current yield is 1.4% lower than the company’s own 3.45% dividend yield average over the last five years.

However, while trailing slightly its own average, Western Digital’s current yield is almost triple the 1.17% simple average of the entire Technology sector. Furthermore, Western Digital’s yield is also nearly 25% higher than the 2.73% yield average of the company’s peers in the Data Storage Devices industry segment.

Despite a steady flow of payouts, the income distributions at above-average dividend yield levels were not sufficient to offset the massive share price decline. The net effect of the positive dividend income distributions and share price decline was a total shareholder loss of more than 37% over the past five years. While the share price made more-positive contributions recently, the combined effect was still a 3% loss over the last three years. Losses for long-term investors over the past few years provided opportunities for new investors to take advantage of the share price falling almost to its five-year low last December. Investors who took a long position in the Western Digital stock one year ago realized a total return of 73% over the trailing 12-month period.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic