Agribusiness Company Offers 2.7% Yields and 15 Years of Rising Dividends

By: Ned Piplovic,

An agribusiness company has been paying rising dividends for the past 15 years and currently offers its shareholders a dividend payout that yields 2.7%

In addition to the constant and rising dividends, the company rewarded investors with 8.7% share price growth over the past 12 months. The combined result of the asset appreciation and dividend payout is a 13.8% total return since October 10, 2016.

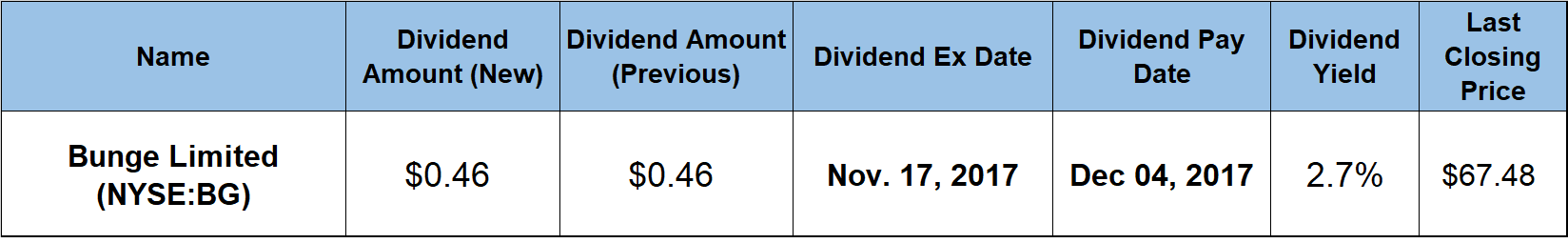

The company’s next ex-dividend date is November 17, 2017, and the pay date is scheduled for December 4, 2017.

Bunge Limited (NYSE:BG)

Founded in 1818 and based in White Plains, New York, Bunge Limited operates as an agribusiness and a food company worldwide. The company operates through five segments: Agribusiness, Edible Oil Products, Sugar and Bioenergy, Milling Products and Fertilizer. The Agribusiness segment is involved in the purchase, storage, transport, processing and sale of agricultural commodities and commodity products. These products include oilseeds and grains comprising soybeans, rapeseed, canola, sunflower seeds, wheat and corn for animal feed manufacturers, livestock producers, wheat and corn millers, oilseed processors and biodiesel industries.

The Edible Oil Products segment provides packaged and bulk oils, shortenings, margarines, mayonnaise, sauces, condiments and seasonings to baked goods companies, snack food producers, restaurant chains, food service distributors, food manufacturers, grocery chains and wholesalers. Additionally, the Sugar and Bioenergy segment produces sugar and ethanol, trades and merchandises sugar, and generates electricity from burning sugarcane bagasse. As of September 2017, the total installed cogeneration capacity of this segment is more than 320 megawatts.

The Milling Products segment produces and sells various wheat flours, bakery mixes and corn milling products, such as dry-milled corn meals, flours, flaking and brewer’s grits, soy-fortified corn meals, corn-soy blend products and rice products. Lastly, the Fertilizer segment produces, blends and distributes nitrogen, phosphate and potassium fertilizers. The company manufactures its products in its own facilities located in the Americas, Eastern Europe and Asia.

The company’s share price dropped initially more than 7% between October 10 and 17, 2016, to reach its 52-week low of $57.22. After bottoming out in mid-October, the price experienced some volatility but ascended 44.5% to its 52-week high of $82.71 on May 25, 2017. However, since peaking at the end of May, the price pulled back almost 19% and currently is trading in the $67 to $68 range. The share price closed on October 12, 2017 at $67.48, which is 12.1% higher than one year ago on October 12, 2016.

While the share price provided modest returns, the company’s rising dividends delivered a decisively rising income to its shareholders for a decade and a half. The current $0.46 quarterly dividend yields 2.7% and converts to a $1.84 annual dividend amount. This current yield is 37% above the company’s own 2.0% average yield over the past five years. Since 2001, the company has been hiking the annual dividend payout at an average growth rate of 10.4% per year, resulting in a near five-fold enhancement of the total annual dividend payout amount.

The current dividend yield is significantly higher than average yield of the company’s peers in the Consumer Goods sector and the Farm Products Industry segment. Compared to the 1.77% average yield of all the companies in the Consumer Goods sector, the Bunge’s 2.7% yield is 55% higher. The company’s current yield fares even better – 156% higher – in comparison to the 1.07% average yield of the Farm Products Industry segment.

The combination of the significant dividend income driven by rising dividends and modest capital gains over the past 12 months resulted in a 13.8% total return, which is substantially better than the 13.3% total loss over a three-year period and even the small 9% total return over the last five years.

Bunge Limited has a conference call scheduled for 8:00 a.m. on Wednesday, November 1, 2017 when it will announce the results for its third quarter, which ended on September 30, 2017.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic