2 Companies Offer 14-Plus Years of Dividend Boosts and Double-Digit Percentage Asset Appreciation in 12 months

By: Ned Piplovic,

Two companies in the materials and industrial sectors have been rewarding their investors with dividend boost for decades and currently offer dividend yields of more than 2.1%.

In addition to the long-term annual dividend boosts, share prices of both companies have risen double-digit percentages over the past year. Since September 2016, the combination of the annual dividend boosts and a significant share price growth over the past year provided shareholders of Republic Services Inc. (NYSE:RSG) and Air Products & Chemicals Inc. (NYSE:APD) a total return of 35% and 14%, respectively.

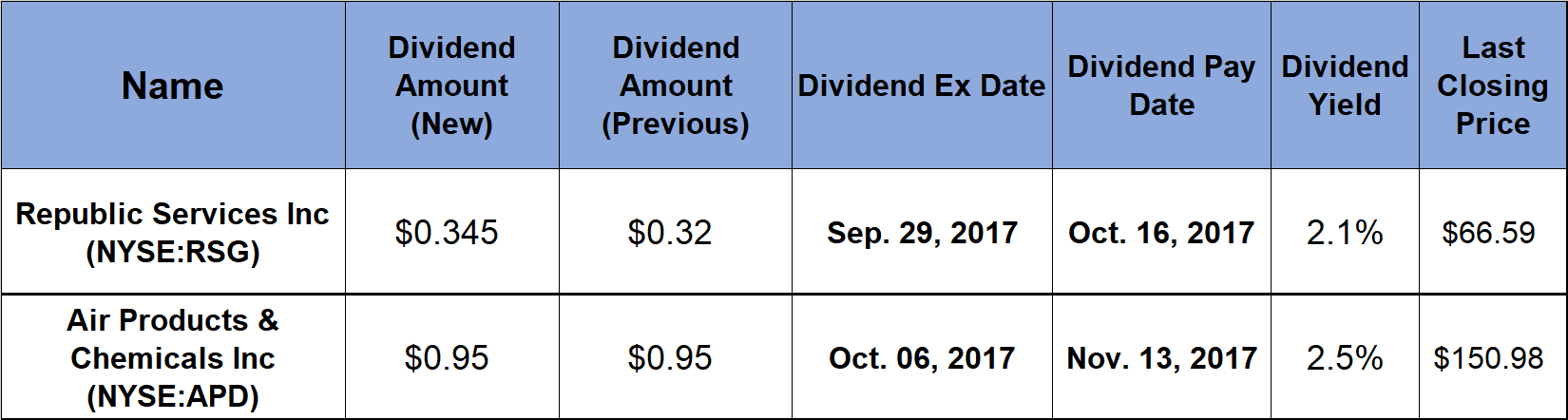

While RSG has an ex-dividend date next week on September 29, 2017, with an October 16, 2017 pay date, APD’s dates occur a bit later with the ex-dividend paid on October 6, 2017, and the pay date on November 13, 2017.

Republic Services Inc (NYSE:RSG)

Founded in 1996 and headquartered in Phoenix, Republic Services, Inc. provides non-hazardous solid waste collection, transfer, recycling, disposal and energy services for commercial, industrial, municipal and residential customers in the United States and Puerto Rico. The company’s services include curbside collection of waste, supply of waste containers and renting of compactors. Additionally, the company is involved in the processing and sale of old corrugated cardboard, old newspapers, aluminum, glass and other materials, as well as provision of landfill services. Through multiple subsidiaries, Republic Services owns and operates multiple hauling divisions and other waste and recycling operations in the United States and Puerto Rico. As of September 2017, the company owned 338 collection operations, 200 transfer stations, 193 active solid waste landfills, 66 recycling centers and 69 landfill gas and renewable energy projects across the country.

The current quarter’s $0.345 distribution is 7.8% higher than the previous quarter’s $0.32 payout. This new quarterly dividend amount converts to a $1.38 annual dividend distribution and a 2.1% dividend yield. The company has a 14-year record of consecutive dividend boosts, going back to 2003 when the company started paying a dividend. Over those 14 years, the annual dividend payout rose at an average rate of 16.6% per year. The cumulative dividend boost since 2003 is 736%.

The share price dropped 4.2% in the last two weeks of September 2016. However, after reaching its 52-week low of $49.18 on October 4,2016, the share price rallied more than 36% without any significant volatility and reached its all-time high closing price of $66.94 on September 18, 2017. While the share price reached another all-time high of $67.18 during trading on September 20, 2017, it closed 0.9% lower at $66.59 at end of the day, which is almost 30% above the share price one year ago.

Air Products & Chemicals Inc (NYSE:APD)

Air Products and Chemicals, Inc. provides atmospheric gases, process and specialty gases, electronics and performance materials and equipment worldwide. While atmospheric gases include oxygen, nitrogen and argon, rare gases and process gases include hydrogen, helium, carbon dioxide, carbon monoxide and syngas. Additionally, APD produces specialty gases and equipment for the production or processing of gases, such as air separation units and non-cryogenic generators for customers in various industries, including metals, glass, chemical processing, electronics, energy production and refining, food processing, metallurgical, medical and general manufacturing. The company also designs and manufactures equipment for air separation, hydrocarbon recovery and purification, natural gas liquefaction, as well as liquid helium and liquid hydrogen transport and storage. Founded in 1940, Air Products and Chemicals, Inc. is headquartered in Allentown, Pennsylvania.

The company’s current quarterly dividend of $0.95 yields 2.5% and is equivalent to a $3.80 total annual dividend per share. While the company started paying a dividend in 1954, it has rewarded its shareholders with consecutive dividend boosts for the past 34 years. This long record of consecutive dividend boosts makes Air Products and Chemicals, Inc a Dividend Aristocrat. Dividend Aristocrats are part of an exclusive group of 51 S&P 500 companies that have a market cap in excess of $30 billion and the distinction of having hiked annual dividend payouts for more than 25 consecutive years.

The share price rose 9.6% from $136.41 in mid-September 2016 to $149.55 by early December 2016, which was a new all-time high at the time. However, after reaching that new highpoint, the share price fell 10.2% by April 10, 2017, and then reversed trend to rise 12.7% and reach a new all-time high of 152.42 during trading on September 12, 2017. As of closing on September 20, 2017, the $150.98 price is 10.7% above its September 2016 level and 111% higher than it was five years ago.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic