2 Energy Companies Boost Dividends and Return Double-Digit Percentage Share-Price Growth

By: Ned Piplovic,

Two energy service companies boosted their annual dividend payouts between 1.4% and 2.5% to complement the double-digit percentage share-price growth each achieved in the last year.

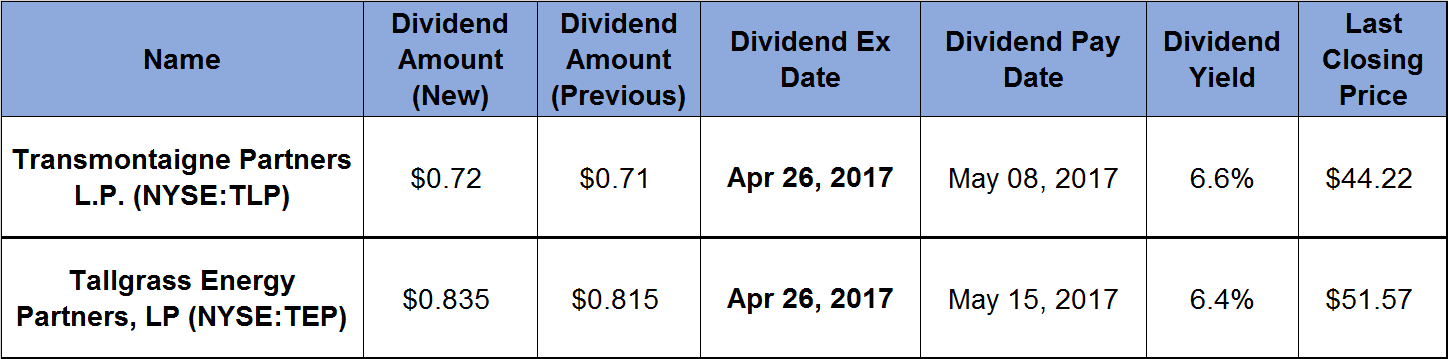

In addition to the dividend payout hike and strong stock performance, both equities rewarded their stockholders with 6%-plus dividend yields, which are almost three times higher than the 2.7% average yield for the basic material sector. Both equities have their ex-dividend date on April 26, 2017, with pay dates in early-to-mid May.

Transmontaigne Partners L.P. (NYSE:TLP)

TransMontaigne Partners L.P. provides integrated storage, transportation and related services to customers engaged in the trading, distribution and marketing of light and heavy refined petroleum products, crude oil, chemicals, fertilizers and other liquid products. The company operates around 50 product terminals with approximately 25 million barrels of storage capacity and approximately 300 miles of pipelines throughout Florida, Oklahoma, Missouri, Arkansas, Ohio and Louisiana. Additionally, TransMontaigne Partners operates a 7-million-barrel terminal and storage facility on the Port of Houston.

The quarterly dividend increased 1.4% versus the previous period to $0.72 per share. That quarterly payout is equivalent to a $2.88 annual distribution and a 6.6% dividend yield. The current annualized payout is 1.8% higher than the 6.4% five-year average yield. The company has been boosting its annual dividend for the past 11 consecutive years at an average annual rate of 5%. The current payout has grown 70% since 2006.

The share price rose 16.7% between April and mid-August 2016. However, after August, the share price gave back all those gains and dropped 18.5% to reach its 52-week low by early November. Since November 2016, the share price rose more than 33% and reached a 52-week high at the end of January 2017. After pulling back slightly, the current share is about 10% below the January peak and 14% higher than the April 2016 price.

Tallgrass Energy Partners, LP (NYSE:TEP)

Tallgrass Energy Partners, LP acquires, owns, develops and operates midstream energy assets in North America. Through its oil operation segment, the company operates the Pony Express System, a crude oil pipeline serving the Bakken Shale, Denver-Julesburg, Powder River Basins and other nearby oil producing basins. The company’s natural gas segment operates storage facilities and approximately 5,000 miles of pipelines in Wyoming, Colorado, Kansas, Missouri and Nebraska. This segment provides its services to on-system customers, including third-party local distribution companies, industrial users and other shippers. Additionally, TEP owns and operates natural gas processing and fractionation facilities that produce natural gas liquids and residue gas for sale in local wholesale markets, as well as facilities that provide water business services to the oil and gas exploration industry.

The current quarterly dividend is 2.5% higher than the previous period. The quarterly distribution of $0.835 per share converts to a $3.34 annual payout and a 6.4% yield. Since the company started paying a dividend in 2013, it has hiked its annual payout every year. Over the past three years, the distribution rose at an average annual rate of almost 33%. Consequently, the current annual dividend payout has more than doubled in just three years.

While the share price exhibited some volatility over the past year, it followed a general upward trend and it ended the 12 months with a double-digit percentage increase. The share price rose 47.4% between its 52-week low in April 2016 and its 52-week high in late February 2017. Since February, the share price lost about 7%. It is currently trading around $52, which is 7% below the 52-week price peak and almost 37% above its share price from April 2016.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox. In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic