2 Energy Companies Offer Decades of Rising Dividends and 3.5%-Plus Yields

By: Ned Piplovic,

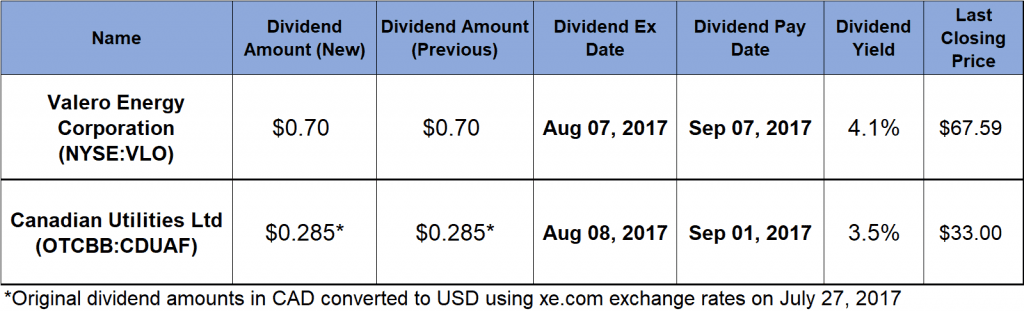

A large U.S. oil refiner and a Canadian utility have been paying rising dividends almost every year for decades and currently offer yields of 4.1% and 3.5%, respectively.

Both stocks complemented their long-term rising dividends, with asset appreciation. Over the last 12 months, their respective share prices rose 26.3% and 7.4%.

The ex-dividend dates are August 7, 2017, for Valero Energy Corporation (NYSE: VLO) and August 8, 2017, for Canadian Utilities Ltd., with pay dates six days apart in early September.

Valero Energy Corporation (NYSE:VLO)

Founded in 1955 and headquartered in San Antonio, Valero Energy Corporation operates as an independent petroleum refining and ethanol producing company in the United States, Canada, Ireland and the United Kingdom. The company operates mainly through its Refining and Ethanol business segments. Through the Refining segment, the company produces conventional and premium gasolines, gasoline meeting the specifications of the California Air Resources Board (CARB), diesel fuels, low-sulfur diesel fuels, jet fuels, asphalts, petrochemicals, lubricants and other refined products.

As of December 31, 2016, Valero Energy owned 15 petroleum refineries with a combined throughput capacity of more than 3 million barrels per day. VLO markets its refined products through wholesale rack and bulk markets, as well as through approximately 7,400 outlets under the Valero, Diamond Shamrock, Shamrock, Ultramar, Beacon and Texaco brand names.

The Ethanol segment produces and sells ethanol, distiller grains and corn oil primarily to refiners and gasoline blenders, as well as to animal feed customers. This segment owns and operates 11 ethanol plants with a combined ethanol production capacity of approximately 1.4 billion gallons per year.

In addition to the two primary business segments, Valero operates a 50-megawatt wind farm, convenience stores, gas stations, truck stop facilities and engages in the credit card business. The current $0.70 quarterly distribution converts to a $2.80 annual payout and a 4.1% yield. This yield is 48% higher than the company’s 2.8% average yield over the past five years.

Since starting to pay a dividend in 1997, Valero Energy failed to raise its annual dividend only four times. After paying a flat dividend for the first three years in a row, Valero hiked its dividend every year between 2001 and 2009. In 2010, the company cut the annual dividend by two-thirds. However, after the company resumed paying rising dividends in 2011, it boosted its annual payout amount above the 2009 level in just two years. Over the past seven consecutive years, the company hiked its annual dividend 14-fold by boosting the annual payout amount at an average growth rate of 45.8% every year.

The share price rose 33.5% between late July and early November 2016 when it reached its 52-week high. Between the November 2016 price peak and the end of March 2017, the share price dropped almost 14%. Since the close of March 2017, the share price has been rising and has regained some of the losses. The $67.59 closing price, as of July 27, 2017, is only about 5% short of the November 2016 peak and is 26.3% higher than the end of July 2016 price. The share price increased 137% over the past five years.

Canadian Utilities Ltd. (OTCBB:CDUAF)

Canadian Utilities Ltd. is a diversified global enterprise that delivers natural gas and electricity, provides modular housing and offers water infrastructure solutions. The company operates through three business segments.

The Electricity segment generates, transmits and distributes electricity in Canada and Australia using coal, natural gas, hydroelectric and wind resources. The Pipelines & Liquids segment offers integrated natural gas transmission and distribution, energy storage and industrial water solutions in Alberta, Saskatchewan, Western Australia and Mexico. In this segment, the company operates almost 6,000 miles of natural gas pipelines, 18 compressor sites, approximately 4,000 receipt and delivery points and a salt cavern storage facility in Alberta, Canada. Lastly, the Corporate & Other segment engages in commercial real estate, retail energy and natural gas businesses. This segment also provides billing, payment processing, credit collection and call center services. Incorporated in 1927 and headquartered in Calgary, Canada, Canadian Utilities operates as a subsidiary of ATCO Ltd. (TSX:ACO.X).

The company’s quarterly per-share dividend payout of $0.285 (CA$0.3575) is equivalent to a $1.14 (CA$1.43) and a 3.5% dividend yield. This yield is almost 40% higher than the 2.47% straight average yield of the entire utilities sector.

The company boosted its annual dividend distribution every year since it started paying a one in 1972. Since then, Canadian Utilities hiked its annual dividend amount at an average rate of 6.6% per year for 45 consecutive years.

While still about 17% below its all-time high from April 2013, the share price performed better recently. As of closing on July 27. 2017, the current $33.00 share price is 7.4% higher than it was 12 months ago. The share price rose 26.6% from its 52-week low of $26.06 at the end of November 2016. Technical indicators suggest that the uptrend could continue.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic