2 Equities Return 3.4%-Plus Dividend Yields

By: Ned Piplovic,

A Michigan-based office furniture manufacturer and a Virginia regional bank have been rewarding their investors with several years of rising dividends and currently pay dividends that yield more than 3.4%.

While share prices of both securities experienced only modest gains of 3.2% and 9.1% over the past 12 months, the asset appreciation for both investments is much better over a longer term. Over the past five years, share prices of these two companies rose more than 54%.

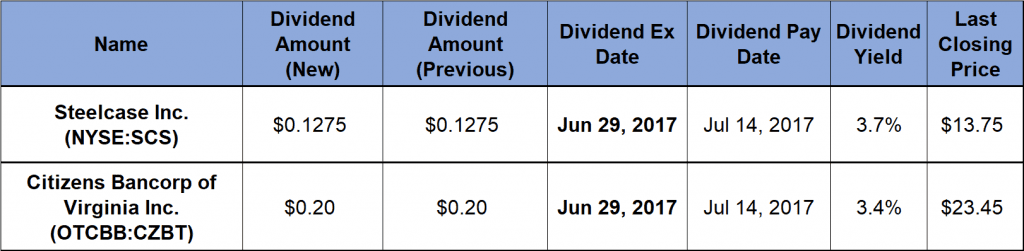

The long-term asset appreciation and the steady dividend distributions make these two equities potentially solid performers for the income portion of any investment portfolio. However, interested investors must act quickly, as the ex-dividend date for both stocks is on June 29, 2017, with pay dates of July 14, 2017, for both equities.

Steelcase Inc. (NYSE:SCS)

Founded in 1912 and headquartered in Grand Rapids, Michigan, Steelcase Inc. manufactures and sells an integrated portfolio of furniture settings, user-centered technologies and interior architectural products. The company manufactures and sells panel-based and freestanding furniture systems, storage, desks, benches, tables and complementary products, such as work tools. Steelcase’s interior architectural products consist of full and partial height walls and doors. In addition to product manufacturing, SCS provides workplace strategy consulting, lease origination, furniture and asset management, and hosted space services. The company markets and sells its products to corporate, government, health care, education and retail customers under the Steelcase, Coalesse, Designtex, PolyVision and Turnstone brand names.

The current quarterly dividend distribution of $0.1275 is equivalent to a $0.51 annual payout and a 3.74% dividend yield. That current yield is 32.5% higher than the company’s 2.8% five-year average yield. Additionally, the current 3.7% yield is more 117% above the 1.72% average yield for the consumer goods sector. The company has raised its annual dividend distribution by an annual average of 18% over the past seven years, effectively tripling the annual dividend amount compared to the $0.16 paid out in 2010

The share price traded in the $13.00 to $14.50 range between late June and the end of October 2016, when it reached its 52-week low of just below $13.00. In November and December 2016, the share price rose almost 40% and continued to trade around $16.50 until June 21, 2017.

After the company announced weaker-than-expected results for the first quarter on June 22, 2017, the share price lost 13.5% of its value in one day. The company also announced its outlook for the next quarter that is lower than analysts’ expectations. That underperformance is part of the reason for the price drop. However, the lower expectation might be easier to achieve next quarter, which means that this price drop – while bad for existing shareholders – could be a buying opportunity for those seeking a bargain.

Steelcase’s President and CEO Jim Keane said that the first-quarter results were consistent with company expectations. Additionally, Mr. Keane noted that the company expects to “launch more new products and enhancements over the balance of our fiscal year than in any of the past five years,” as customers are continuing to shift from traditional furniture applications to new solutions.

Citizens Bancorp of Virginia Inc. (OTCBB: CZBT)

Citizens Bancorp of Virginia, Inc. operates as the bank holding company for Citizens Bank and Trust Company and provides commercial banking products and services. In addition to the customary checking, savings and money market accounts, as well as certificates of deposit and individual retirement accounts, the company also offers various types of commercial and personal loans. Additionally. the bank offers merchant, investment and brokerage services. Founded in 1873, the company has its headquarters in Blackstone, Virginia and currently operates a network of 11 service locations in the Commonwealth of Virginia.

Its current $0.20 quarterly dividend converts to an $0.80 annualized payout and a 3.4% dividend yield. After boosting its dividend from $0.58 in 2004 to $0.69 in 2007, the company dropped its annual dividend to $0.68 and paid the same amount for the following five years. In 2013, the company resumed boosting its annual dividend and has done so at an average rate of 3.3% over the past five consecutive years.

The share price rose 16% from $20.46 to its 52-week high of $25.00 between late June and mid-December 2016. However, the share price dropped to about $22.00 in late February 2017 and has been trading around that level since then, with a slight rise in the last few trading sessions. As of the close on June 26, 2017, the $23.45 share price is still about 6% below the December 2016 peak, but it is 9.1% above the June 2016 share price and 54% above the price from five years ago.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic