2 Financial Stocks Offer Six-Plus Years of Rising Dividends and 3%-Plus Yields

By: Ned Piplovic,

A regional bank and a dividend income fund have rewarded their shareholders with 3%-6.3% yields along with rising dividends for the last six and 16 consecutive years.

The fund’s 6.3% dividend yield is double the straight average yield for the financial sector. In addition to the rising dividend income, the two equities have returned 13%-plus share price boosts over the past 12 months.

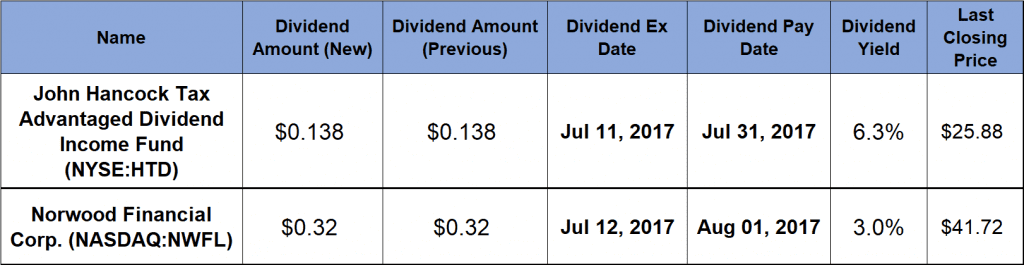

The ex-dividend dates on July 11, 2017, and July 12, 2017, with pay dates in late July and early August 2017.

John Hancock Tax Advantaged Dividend Income Fund (ME) (NYSE:HTD)

John Hancock Tax Advantaged Dividend Income Fund, a closed-end mutual fund from John Hancock Investments, seeks to provide growth income to its investors. Under normal market conditions, the fund invests at least 80% of its assets in dividend-paying common and preferred securities that the fund’s managers believe will pay qualified dividends, which should qualify for reduced U.S. federal income tax rates of no more than 20% for long-term capital gains. As of May 31, 2017, the fund’s top five holdings were Kinder Morgan, Inc. (NYSE:KMI), Vectren Corp. (NYSE:VVC), American Electric Power Company, Inc. (NYSE:AEP), Interstate Power & Light Company (NYSE:IPL) and Dominion Energy, Inc. (NYSE:D). More than half of the fund’s holdings – 54% – are utility companies. The financial sector represents 28.5%, the energy sector 9.75%, telecommunications 4.3% and health care 2.2% of the total holdings. Industrials, U.S. government agencies and real estate securities make up the remaining 1.25% of the fund’s holdings.

The fund’s monthly distribution of $0.138 is 14% higher than the monthly distribution from July 2016. This current monthly payout converts to a $1.656 annual distribution and a 6.3% dividend yield. The fund dropped its annual dividend three years in a row between 2008 and 2010 because of the financial downturn. However, since resuming rising dividends in 2011, the fund hiked its annual dividend amount by an average 6.1% per year for the past seven consecutive years.

Since dropping almost 60% amid the 2008-2009 financial crisis, the share price grew progressively with only three minor dips over past eight years. After a 9% drop between early July and early November 2016, the share price rose almost 30% to reach its all-time price high on June 1, 2017. The $25.88 share price as of its closing on July 5, 2017, is 13.1% above the share price from early July 2016 and double the share price from five years ago.

Norwood Financial Corp. (NASDAQ:NWFL)

Founded in 1870 and based in Honesdale, Pennsylvania, the Norwood Financial Corp. operates as the bank holding company for Wayne Bank. The bank accepts a range of deposit products, such as interest-bearing and noninterest-bearing transaction accounts, statement savings accounts, money market accounts and certificate of deposits.

The company also offers various loans, investment securities services, direct and remote deposit capture, automated clearing house, trust, investment products, title and real estate settlement, as well as internet and mobile banking services. Also, the company is involved in annuity and mutual fund sales, discount brokerage activities and operates as an insurance agency. As of March 30, 2017, the bank operated 26 branch offices and 28 automated teller machines in northeastern Pennsylvania and New York State’s Delaware and Sullivan Counties.

The current $0.32 quarterly dividend distribution is equivalent to a $1.28 annual payout and yields 3%. Since starting to pay a dividend in 1998, the bank has boosted its annual payout for the past 16 consecutive years. During that period, the bank hiked its annual dividend at an average rate of 8.4% every year, which resulted in a 362% enhancement of the annual dividend amount since 2001.

Since early July 2016, the share price rose steadily with only minor fluctuations and reached its new all-time high on June 20, 2017. At its closing on July 5, 2017, the $41.72 share price is 55.3% higher than it was one year ago and 102% higher than it was five years ago.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic