3 Monthly Dividend Stocks to Buy Now 2017-11-09

By: Ned Piplovic,

While most dividend-paying equities distribute their payouts in quarterly increments, investors seeking more frequent income disbursements should consider taking advantage of securities that provide income monthly.

In addition to more frequent payments and a more consistent cash inflow, monthly dividends have a few additional advantages over their quarterly counterparts. The most significant advantage of monthly dividend distributions is that that the assets grow faster because of the compounding effect.

Instead of waiting full three months to receive the dividend distribution, monthly dividends allow investors to receive a portion of that income every month and reinvest the money right away. Many investors who reinvest their dividend distributions might be content with receiving their funds quarterly but people who rely on dividend income for living expenses, such as retirees, prefer monthly distributions, since those align with their monthly bills and expenses.

Investors could try to generate monthly dividend income by selecting three different equities that pay staggered quarterly dividends. However, that approach would limit the number of equities that meet the requirements, would lead to a less-than optimal portfolio strategy and, most likely, would reduce total returns. Even with this approach, the monthly income payments still would vary.

Additionally, many of the equities that pay monthly dividends are Real Estate Investment Trusts (REITs) and Master Limited Partnerships (MLPs), which take advantage of their favorable tax status and tend to pay higher-than average dividend yields.

Securities that pay monthly dividends are easy to find. Most investment advisory sites and brokerages have a section that separates equities paying monthly dividends from the other equities.

While some monthly-dividend equities have higher dividend yields or longer records of dividend payouts than the equities mentioned in this article, here are three equities that pay monthly dividends and offer their investors a triple benefit of high yields, multiple years of dividend hikes and asset appreciation.

*estimated dates are based on previous record.

Chatham Lodging Trust (NYSE:CLDT)

Chatham Lodging Trust (CLDT) is a real estate investment trust (REIT) that invests in upscale, extended-stay hotels and premium-branded, select-service hotels. The company owns a stake in 134 hotels under multiple brand names that include Homewood Suites by Hilton, Residence Inn by Marriott, Hyatt House, Courtyard by Marriott, Hampton Inn and Hampton Inn and Suites.

As of October 2017, the company wholly owned 39 hotels in 13 states and the District of Columbia with a capacity of more than 5,800 rooms and suites. Since the company operates as a REIT, it is not allowed to operate its own properties. Therefore, Chatham Lodging works closely with its third-party hotel managers to maximize return on their investment.

In addition to its wholly owned locations, the REIT owns minority interest in two joint ventures that operate 95 properties with aggregate capacity of approximately 12,500 rooms across 23 states.

The REITs current $0.11 monthly dividend is equivalent to a $1.32 annual payout and a 5.9% yield, which is 9% higher than the REIT’s own 5.4% average dividend yield over the past five years.

The REIT started paying dividends in late 2010. Until the end of 2012, the company paid quarterly dividends, before switching to monthly payouts in 2013. The REIT raised its total annual dividend amount every year since 2010 at an average rate of 9.5% per year and nearly doubled its annual dividend total over the past seven years.

The company’s current 5.9% yield outperformed the financial sector’s 3.27% average yield by 80% and the Hotel Industry REIT segment’s 3.83% simple average yield by 54%.

In addition to boosting its annual dividends, the REITs share price growth complemented the dividend income with a 31% asset appreciation over the last year. The share price began its trailing 12 months with its 52-week low of $17.24 on November 7, 2016, and rose progressively to reach its most recent 52-week high of $22.59 on November 6, 2017.

The combined effect of the above-average dividend income and asset appreciation rewarded shareholders with a 41.56% total return over the past 12 months.

LTC Properties, Inc. (NYSE:LTC)

Founded in 1992 and based in Westlake Village, California, LTC Properties, Inc. operates as a health care real estate investment trust (REIT). The company invests in senior housing and long-term health care properties, including skilled nursing properties, assisted living properties and independent living properties through mortgage loans, property lease transactions and other investments.

As of June 30, 2017, the company’s portfolio stretched across 28 states and consisted of 89 skilled nursing properties, 102 assisted living properties, 14 other senior housing properties, two schools and a parcel of land under development.

The company’s current $0.19 monthly dividend payout is 5.6% higher than the previous month’s $0.18 distribution. This current monthly dividend converts to a $2.28 annualized amount and a 4.9% dividend yield. The current yield is 0.7% higher than the company’s own five-year average yield of 4.8%. Additionally, the current yield is 47% higher than the 3.27% average yield of all companies in the financial sector.

Over the last eight years, the REIT boosted its annual dividend payout every year at an average annual growth rate of 4.9%. The company started paying dividends in 1992 and has not dropped its annual distribution amount since 2002. Since that last dividend drop in 2002, the company failed to raise its annual dividend only once and grew the annual amount at an average rate of 12.3% per year.

The company’s share price rose 19% from its $44.20 52-week low on November 10, 2016, to its July 3, 2017, 52- week high of $52.65. However, since the July peak, the share price dropped more than 10% and closed on November 6, 2017, at $47.19, which is 1.3% higher than it was 12 month ago and 6.8% above the 52-week high from November 2016.

STAG Industrial Inc. (NYSE:STAG)

Founded in 2010 and based in Boston, STAG Industrial, Inc. is a real estate investment trust (REIT) that acquires, owns and operates single-tenant, industrial properties throughout the United States. As of September 30, 2017, the company owned and operated 347 buildings with a total usable commercial area of almost 70 million square feet across 37 states. Just in 2016, the REIT invested almost $475 million to acquire 47 additional buildings. The additional 10.3 million square feet account for more than 14% of the company’s total space.

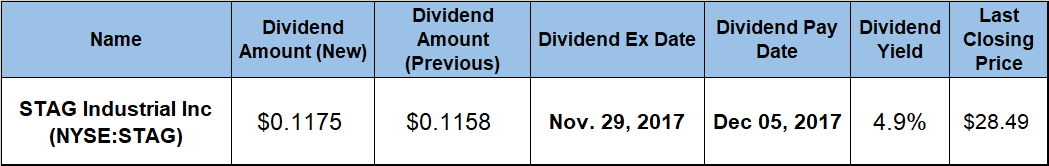

The current $0.1175 monthly dividend is 1.5% higher than the dividend amount from the same period last year and converts to a current $1.41 annualized payout. The current 4.9% dividend yield is 51% above the financial sector’s 3.27% average yield and 28% higher than the average yield of all the companies in the Industrial REITs segment.

Since its initial dividend distribution in 2011, the REIT boosted its annual dividend amount every year. Over the past seven years, the company grew the annual payout at an average rate of 6.1% per year.

The REIT’s share price rose 33% between its 52-week low of $21.54 on November 10, 2016, and its new 52-week high of $28.62 that it reached on November 3, 2017. On November 6, 2017, the share price closed slightly below the 52-week high at $28.49, which is 26.2% higher than it was one year ago.

The company’s dividend income and asset appreciation combined for total returns of 41% over the last year and 107% over the past five years.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic