A Large Dividend Yield Gives Added Appeal to High-Yield Corporate Bonds

By: Paul Dykewicz,

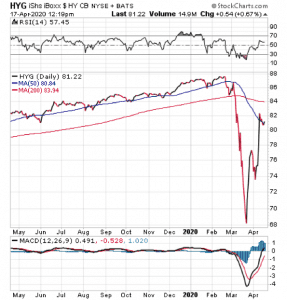

A large dividend yield gives added appeal to a high-yield corporate bond fund, iShares iBoxx $ High-Yield Corporate Bond ETF (NYSEARCA: HYG).

At a time when corporate America is sitting on a record-breaking $10 trillion dollars of debt due to historically low interest rates that reduce the cost of such financing, the phrase “junk bonds” may conjure up images of so-called “toxic debt,” which led to the 2008 global financial crisis. However, investors willing to take that risk can receive a reward in the form of a 5.69% dividend yield for holding a less volatile investment than stocks.

As an exchange-traded ETF with a large dividend yield, its payouts naturally fluctuate, but the most recent quarterly dividend amount of $0.385 per share came on April 1.

This risk includes the possibility of corporate default that is accepted when holding these bonds. For that reason, the suggestion to invest in these types of high-yield bonds that offer a large dividend yield probably sounds frightening enough to scare off many potential investors.

However, the various exchange-traded funds that deal with these types of bonds may offer an alternative and less risky way to obtain high-yield returns. Here’s an example.

The iShares iBoxx $ High-Yield Corporate Bond ETF (NYSEARCA: HYG) is an ETF that tracks a market-weighted index of U.S. corporate debt. HYG is also able to replicate much of the junk bond market successfully, albeit providing a shorter maturity, less interest-rate sensitivity and reduced yield than pure junk bonds.

The ETF’s holdings are primarily centered in the United States, with some in Europe, Canada and around the world.

Chart courtesy of www.StockCharts.com

This fund’s performance has been passable in the short run. The HYG is down only 7.65% this year, 4% less than the S&P 500. However, it performed worse over the past year, as it mostly remained stagnant while the market flew to new highs. However, these figures do not include the fund’s large dividend yield.

The fund currently has $15.36 billion under management and an expense ratio of 0.49%, meaning that it is more expensive to hold in comparison to other exchange-traded funds.

In short, while HYG does provide an investor with a chance to profit from the world of junk bonds, the sector may not be appropriate for all portfolios. Thus, interested investors always should conduct their own due diligence and decide whether even a large dividend yield offered in this fund that includes extra risk matches one’s personal investing goals.

The risk of corporate default in this fund’s holdings underscores the need for investors to use caution as the seek large dividend yield, especially if the economy weakens significantly in the months and possibly even the years ahead.

Connect with Paul Dykewicz

Connect with Paul Dykewicz