Advanced Materials Manufacturer Offers 2% Rising Dividends

By: Ned Piplovic,

A manufacturer of advanced materials for use in precision instruments and technology offers its shareholders six consecutive years of rising dividends and currently pays a 2% forward dividend yield.

In addition to the rising dividends, the company’s share price rose more than 27% over the last year. The combination of rising dividends and asset appreciation provided investors with a 33.4% total return over the most recent 12-month period.

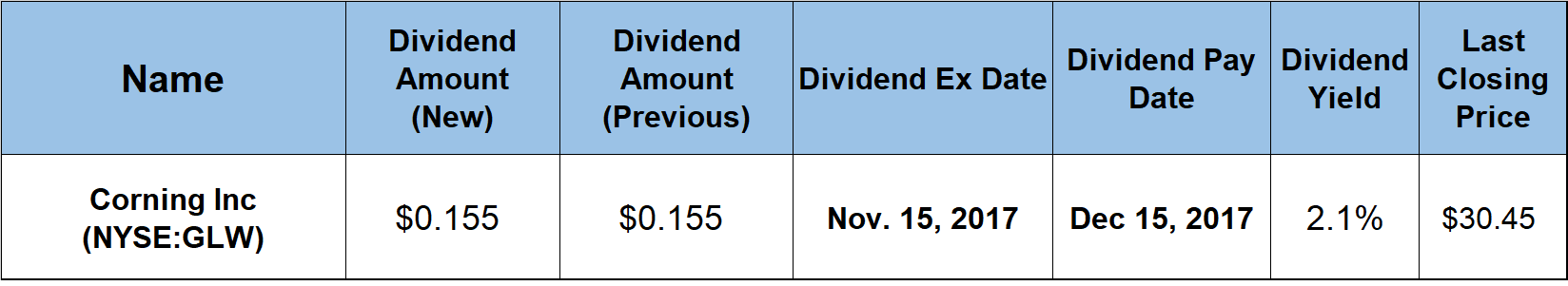

The company’s next ex-dividend date on November 15, 2017, is followed by the pay date a month later, on December 15, 2017.

Corning, Inc. (NYSE:GLW)

Corning Incorporated manufactures and sells specialty glass, ceramics and other advanced materials worldwide. The company operates through five segments: Display Technologies, Optical Communications, Environmental Technologies, Specialty Materials and Life Sciences. The Display Technologies segment manufactures glass substrates for liquid crystal displays (LCDs) used in LCD televisions, notebook computers and flat panel desktop monitors. The Optical Communications segment manufactures optical fiber and cable. Additionally, this segment makes hardware and equipment products that include cable assemblies, fiber optic hardware, optical connectors and other accessories for various carrier network applications. This segment also offers subscriber demarcation, connection and protection devices, passive solutions, outside plant enclosures and coaxial RF interconnects for the cable television industry and microwave applications. The Environmental Technologies segment manufactures ceramic substrates and filter products for emissions control in mobile and stationary applications. The Specialty Materials segment manufactures products that provide approximately 150 material formulations for glass, glass ceramics and fluoride crystals. The Life Sciences segment manufactures and supplies consumable scientific laboratory products. This segment’s product portfolio includes, plastic vessels and specialty surfaces, as well as general labware and equipment for cell culture research, bioprocessing, genomics, drug discovery, microbiology and chemistry. Founded in Somerville, Massachusetts, as the Bay State Glass Company in 1851, the company moved to Brooklyn, New York before settling in its current location. The company changed its name to Corning Glass Works and moved again in 1968 to Corning, New York, where it is still based. The company change its name to Corning Incorporated in April 1989.

The company’s current quarterly dividend payout of $0.155 yields 2% and converts to a $0.62 total annual distribution. While the current yield might not seem overly attractive compared to some other sectors, Corning’s 2% yield is on par with its peers in the Communications Equipment segment and tops the 1.34% average yield of its peers in the Technology sector by 52%.

After Corning Incorporated started paying dividends under its current name in 1990, the company paid varied annual amounts for a decade and then suspended dividend distributions after only two quarterly payments in 2001. The company resumed dividend payouts in the third quarter of 2007 with a $0.50 quarterly dividend, which was 17% lower than the last quarterly payout before suspension in 2001 of $0.60.

The company maintained the $0.50 distribution amount until 2011, when it resumed rising dividends. Since 2011, the company has rewarded its shareholders with seven consecutive years of rising dividends. Over that period, the dividend rose at an average rate of 17.5% per year and the total annual dividend amount has more than tripled since 2011.

The share price dropped 7% during October 2016 and reached its 52-week low of $22.23 on November 3, 2016. However, after the November low, the share price rose steadily, with only one 5%-plus drop, before hitting its 52-week high of $32.17 on July 25, 2017. Following its peak in late July, the share price dropped 13.4% in just three weeks and closed at $27.88 on August 18, 2017.

Since its August drop, the price has recovered 60% of the loss and closed at $30.45 on October 5, 2017, which is just 5.3% lower than the July peak and 27.6% higher than it was one year ago. In addition to the short-term total return of 33.4% over the past 12 months, the company provided investors with 70% and 146% total returns over the past three and five years, respectively.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic