Air Products & Chemicals, Inc. Offers 35 Years of Consecutive Annual Dividend Hikes (APD)

By: Ned Piplovic,

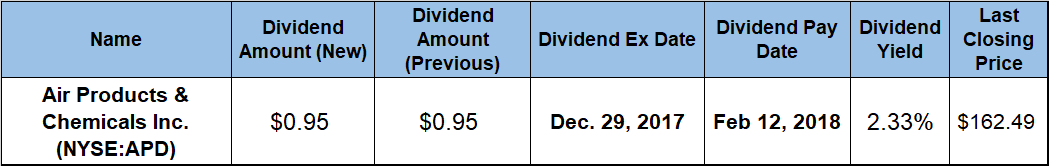

Air Products & Chemicals, Inc. has been rewarding its investors with consecutive annual dividend boosts for more than three decades and currently offer a 2.33% dividend yield.

Since December 2016, the combination of the annual dividend boosts and a significant share price growth over the past year provided shareholders of Air Products & Chemicals Inc. with a total return on investment of 12%.

The company will have its next ex-dividend date on December 29, 2017, with the pay date scheduled a little more than six weeks later, on February 12, 2018.

Air Products & Chemicals Inc. (NYSE:APD)

Founded in 1940 and headquartered in Allentown, Pennsylvania, Air Products and Chemicals, Inc. provides atmospheric gases, process and specialty gases, electronics and performance materials. While atmospheric gases include oxygen, nitrogen and argon, rare gases and process gases include hydrogen, helium, carbon dioxide, carbon monoxide and syngas. Additionally, APD produces specialty gases and equipment for the production or processing of gases, such as air separation units and non-cryogenic generators for customers in various industries, including metals, glass, chemical processing, electronics, energy production and refining, food processing, metallurgical, medical and general manufacturing. The company also designs and manufactures equipment for air separation, hydrocarbon recovery and purification, natural gas liquefaction, as well as liquid helium and liquid hydrogen transport and storage.

The company’s current quarterly distribution of $0.95 is equivalent to a $3.80 total annual dividend per share and yields 2.33%. This yield is just slightly below the company’s 2.5% average yield over the last five years. Additionally, the company’s current 2.33 yield is within 0.5% of the 2.35% average yield for the Basic Materials sector and 13.5% higher than the company’s peers in the Chemicals segment.

The company started paying a dividend in 1954 and it has rewarded its shareholders with 35 consecutive years of dividend boosts. Just in the past two decades, the company maintained an average dividend growth rate of 9.3% per year. After two decades of compounding annually at that rate, the current $3.80 total annual payout is six times bigger than the $0.64 annual dividend that was distributed in 1998.

This long record of consecutive rising dividends makes Air Products and Chemicals, Inc. a Dividend Aristocrat. Stocks that are Dividend Aristocrats are part of an exclusive group of 51 S&P 500 companies that have a market cap in excess of $30 billion and the distinction of having hiked annual dividend payouts for more than 25 consecutive years.

The share price fell nearly 9.4% from $148.18 on December 14, 2016, to its 52-week low of $134.30 by April 13, 2017. After hitting its low for 2017, the share price bounced right back and gained 9.6% by May 5, 2017, to reach $147.22, which was just 0.65% below where the price started on December 14, 2016. After trading sideways in the $142 to $148 range for the following four months, the share price took off and rose 12.6% between September 7, 2017, and November 28, 2017, when the share price reached its new all-time high of $163.24.

The share price pulled back marginally after the late November peak and closed on December 13, 2017, at $162.49, which was 9.7% higher than it was one year before and 21% higher than the 52-week low from April 2017.

Additionally, the share price more than doubled over the past five years. Because of the long-term rising dividends and a steady capital growth, the shareholders enjoyed a total return of 12% over the last 12 months, 36% over the past three years and 136% over the last five years.

Related Articles:

5 Best Dividend Aristocrats to Buy Now

The Dividend Aristocrats Investing Strategy and Stocks List

The Best Dividend Aristocrats ETFs

Why Invest in the Dividend Aristocrats?

The S&P 500 Dividend Aristocrats — Everything You Need to Know

What are the Dividend Aristocrats?

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic