Alpine Total Dynamic Dividend Fund Offers 7.2% Dividend Yield (AOD)

By: Ned Piplovic,

The Alpine Total Dynamic Dividend Fund (NYSE:AOD) rewarded its shareholders with asset appreciation of more than 20% over the past 12 months and a 7.2% dividend yield.

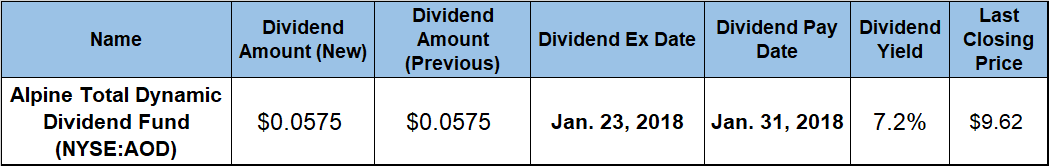

The fund lowered its annual distribution amount gradually each year from $4.68 in 2007 to $0.70 in 2013 and then continued to pay relatively steady annual dividends in the $0.68 to $0.70 range over the last five years. The fund’s next ex-dividend date occurs on January 23, 2018, with the dividend pay date following approximately one week later on January 31, 2018.

Alpine Total Dynamic Dividend Fund (NYSE:AOD)

The managers of the Alpine Total Dynamic Dividend Fund research equities from around the globe to find what they believe are the best dividend opportunities for investors, employing a multi-cap, multi-sector and multi-style investment approach. The fund’s managers use a combination of four research-driven investment strategies – Growth, Value, Special Dividends, and Dividend Capture Rotation – to maximize the amount of distributed income and to identify companies globally with the highest potential for dividend increases and capital appreciation.

As of November 30, 2017, the fund had almost $1.1 billion in total assets invested across 121 holdings. More than 98% of total assets were in common stocks and the remaining assets were in exchange-traded funds (ETFs). The fund’s U.S.-based investments accounted for 58.87% of the fund’s total assets. United Kingdom-based holdings represented 6.51% of total assets, with Switzerland at 4.47%, France at 3.94% and Japan at 3%, rounding out the top five countries by total assets for a combined 76.8% share of total assets. The fund invested the remaining assets in equities from Germany, Finland, Spain, Singapore and Italy.

The top three sectors — financials with 18.23%, industrial with 14.51% and information technology with 13.57% asset allocation — accounted for nearly half of the fund’s total assets. The investments in the remaining half of total assets comprised equities from various other sectors, including Consumer Discretionary, Health Care, Materials, Consumer Staples, Real Estate, Energy, Utilities and Telecommunication Services. No single holding accounted for more than 2% of total assets, and the top five holdings — Apple, Inc.; Broadcom, Ltd.; Intel Corp.; TE Connectivity, Ltd.; and Ferrovial SA — accounted for less than 7.5% of total assets combined. Even the top ten holdings combined accounted for less than 14% of the fund’s total assets. This indicates that the portfolio of holdings within the Alpine Total Dynamic Dividend Fund is well diversified, which minimizes investors’ risk.

The fund’s current $0.0575 quarterly dividend is equivalent to a $0.69 annualized distribution per share and a 7.2% dividend yield. This current yield is higher than the 3.97% average yields of all the companies in the financial sector by more than 80%.

The fund’s share price started its current trailing 12-month period from its 52-week low price of $7.84 on January 5, 2017. From that 52-week low, the price ascended 22.7% with negligible volatility for the subsequent 12 months. The share price capped this one-year uninterrupted rise by reaching its 52-week high of $9.62 on January 5, 2018.

The share price as of closing on January 5, 2018, was 15% above its price level from five years earlier and 22.7% higher than it was at the beginning of January 2017.

During the first half of the current five-year period, the fund traded sideways. It then fell more than 20% in the second half of 2015. Therefore, the three-year total return of 35% is just slightly higher than the shareholders’ total return of 32% over the past 12 months. The total return over the last five years is slightly more than 56%.

Dividend increases and decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic