Best Dividend Stocks: Lockheed Martin Corporation (NYSE:LMT)

By: Ned Piplovic,

After experiencing its largest share price decline last year, the Lockheed Martin Corporation (NYSE:LMT) stock has recovered almost all those losses. Furthermore, since its share price is supported by attractive dividend income distributions, it remains one of the best dividend stocks.

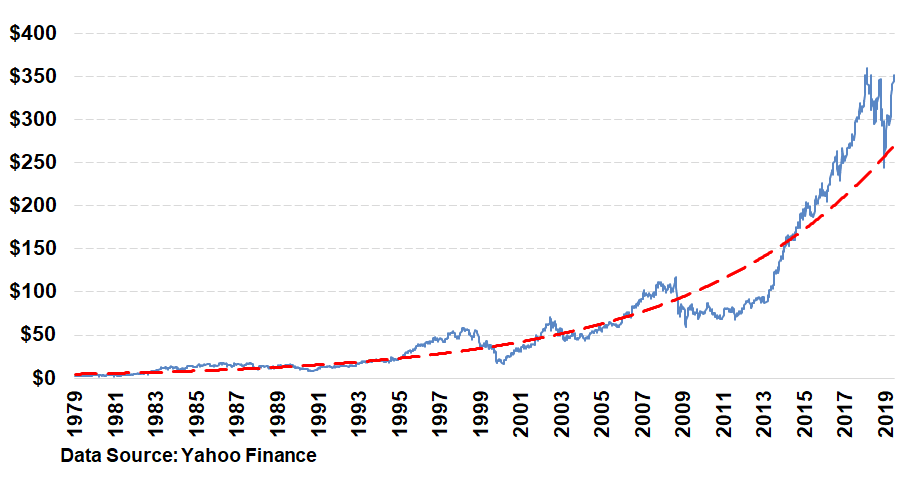

Lockheed Martin certainly meets the strong dividend requirement for the best dividend stocks designation. However, the company is also continuing to deliver long-term capital gains for investors who look at their investing goals through an extended time horizon strategy. While the extended time frame share price graph below shows the fluctuations that are suitable for momentum investors, the Lockheed Martin stock is better suited for buy-and-hold investors.

Like other best dividend stocks and most equities, the value of the Lockheed Martin stock dropped substantially during the 2008 financial crisis. Following that drop, the share price experienced a higher level of volatility and traded at a level that remained almost flat over the subsequent five years. However, the trend slope became much steeper at the beginning of 2013 and the share price would advance significantly faster over the next five years. Indeed, the share price advanced four-fold and reached its current all-time high by February 2018. It then suffered its largest pullback in the first half of 2018.

After Lockheed’s share price fell to its current 52-week low in December 2018, it relinquished nearly two years of gains and fell to its January 2017 levels. However, now free from the market’s downward pressure, the share price has regained nearly all its losses and might reach new highs before the year is over. Notwithstanding the growth signals that are provided by trendlines and technical indicators, the main drivers of Lockheed Martin’s share price growth are strong financial reports and steady corporate earnings.

Best Dividend Stocks: Lockheed Martin Financial Results

Influenced by the overall market correction and various other uncertainties, the company missed earnings expectations in the last quarter of 2018. However, the miss of just one penny was only 0.22% short of the $4.40 earnings per share (EPS) that analysts expected. Lockheed Martin’s first-quarter 2019 performance more than made up for the previous period’s near-miss.

On April 23, 2019, the Lockheed Martin Corporation reported a 23.2% year-over-year sales growth from $11.6 billion in the first quarter of 2018 to $14.3 billion for the current period. First quarter net earnings advanced nearly 42% to $1.7 billion, or $5.99 per share, compared to $1.2 billion, or $4.02 per share, from the same period last year. The $5.99 adjusted EPS beat analysts’ earnings estimates of $4.34 by 38%. Furthermore, the company’s cash from operations in the first quarter nearly tripled from $632 million in the first quarter of 2018 to more than $1.7 billion for the most recent period.

Based on the strong results so far, Lockheed Martin has revised its guidance for full-year 2019. The revised net sales expectations are between $56.8 billion and $58.3 billion. Additionally, the original EPS guidance of $19.15 to $19.45 was increased by $0.90 on both ends and the company now expects adjusted earnings to come in between $20.05 to $20.35 per diluted share for the full year.

Lockheed Martin Corporation (NYSE:LMT)

Headquartered in Bethesda, Maryland and founded in 1909, the Lockheed Martin Corporation engages in the research, design, development, manufacture and integration of technology systems, products and services worldwide. The company operates through four segments: Aeronautics, Missiles and Fire Control, Rotary and Mission Systems and Space Systems. The Aeronautics segment offers combat and air mobility aircraft, unmanned air vehicles and related technologies. The Missiles and Fire Control segment provides air and missile defense systems, tactical missiles and air-to-ground precision strike weapon systems, logistics and fire control systems, manned and unmanned ground vehicles and energy management solutions. Additionally, the Rotary and Mission Systems segment offers military and commercial helicopters, sensors for rotary and fixed-wing aircraft, sea and land-based missile defense systems, radar systems and simulation systems for training. The Space Systems segment offers satellites, strategic and defensive missile systems and space transportation systems. Also, this segment offers classified systems and services for the support of national security systems.

Best Dividend Stocks: Lockheed Martin Dividends

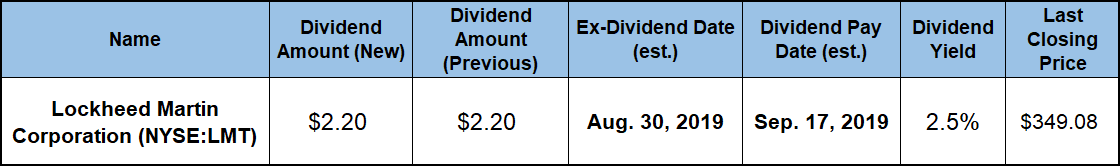

The current $2.20 quarterly payout is 10% higher than the $2.00 quarterly dividend distribution from the same period last year and corresponds to an annualized amount of $8.80. The company’s current 2.5% dividend yield is currently the highest yield in the Aerospace-Defense Products & Services industry segment and more than 220% higher than the segment’s 0.78% yield average.

Furthermore, the current yield is also more than twice the segment’s 1.22% average dividend yield of only dividend-paying companies as well the 1.2% simple average yield of the entire Industrial Goods sector. Over the past two decades, Lockheed Martin has enhanced its annual dividend payout amount 20-fold. This level of advancement corresponds to an average growth rate of 19.3% per year.

Best Dividend Stocks: Lockheed Martin Share Price

Despite an attempt to surge in the third quarter of 2018, the share price declined 21% between the beginning of the trailing 12-month period and the 52-week low of $245.22 on December 24, 2018. However, the share price changed direction immediately following its December low and embarked on its current uptrend. After recovering all its losses by the beginning of April 2019, the share price continued to rise for a total gain of 45% before reaching its new all-time high of $355.23 on June 10, 2019. The price pulled back over the next few trading sessions to close on June 13, 2019 at $349.08. This closing price was 12.4% higher than it was one year earlier, 42.4% above the 52-week low from Christmas Eve 2018 and more than double its level of five years ago.

The combined benefit of the rising dividend income and recovering share price has produced a total return of more than 15% over the past 12 months. Over the past three years, the total return has exceeded 53%. Lastly, with a total return of nearly 135%, shareholders have more than doubled their investment over the past five years.

Related Articles:

3 Best Dividend Stocks to Buy Now

The 6 Best Dividend Stocks That Yield More Than 5%

Fidelity’s 5 Best Dividend ETFs

5 Best Dividend Mutual Funds to Buy Now

6 Best Dividend ETFs to Buy Now

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic