Best Dividend Stocks: The Travelers Companies, Inc. (NYSE:TRV)

By: Ned Piplovic,

Despite a significant share price drop in 2018, Travelers Companies, Inc. (NYSE: TRV) delivered more than a decade of consecutive annual dividend hikes and continues its long-term asset appreciation, which makes the company one of the best dividend stocks over the past decade.

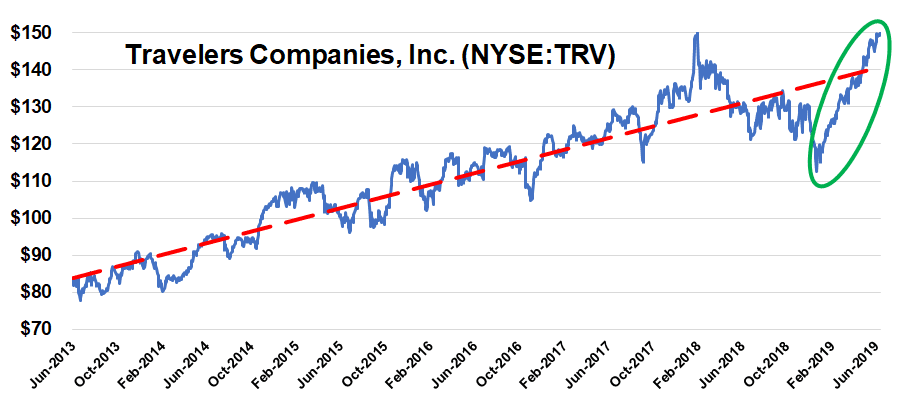

The company’s share price trend over the past five years is one of constant fluctuation. However, the long term trendline has a steady upward slope as indicated in the graph below. While most of the drops and recoveries over the past five years were generally in the single-digit percentages, the 2018 pullback was uncharacteristically larger due to the timing of the overall market correction in the fourth-quarter of the year.

The best dividend-paying stocks generally deliver long streaks of rising annual dividends and maintain a steady asset appreciation over extended periods. Therefore, a 20%-plus share price drop like the Travelers Companies experienced in 2018 is not characteristic for an equity deemed one of the best dividend stocks. However, the decline was only temporary. The share price has already recovered all losses from the previous year and technical indicators suggest that the uptrend might continue, at least over the near term.

The best dividend-paying stocks generally deliver long streaks of rising annual dividends and maintain a steady asset appreciation over extended periods. Therefore, a 20%-plus share price drop like the Travelers Companies experienced in 2018 is not characteristic for an equity deemed one of the best dividend stocks. However, the decline was only temporary. The share price has already recovered all losses from the previous year and technical indicators suggest that the uptrend might continue, at least over the near term.

The share price decline in 2018 drove the 50-day moving average below the 200-day moving average. After spending the first nine months of the trailing one-year period trailing its 200-day counterpart, the 50-day average broke above the 200-day average in a bullish manner by mid-March 2019 and continues rising driven by the share price’s current uptrend. Just three months after crossing above the 200-day moving average, the 50-day average has advanced to 9.2% above its longer-term counterpart.

Travelers Companies, Inc. (NYSE:TRV)

Based in New York and founded in 1853, the Travelers Companies, Inc. provides a range of property and casualty insurance products and services through three business segments. The Business Insurance segment offers various insurance products for commercial customers, including workers’ compensation, commercial automobile, property, liability and professional indemnity insurance. Furthermore, the Business Insurance segment provides marine, aviation, energy and construction insurance, as well as terrorism, personal accident, kidnap and ransom insurance products. This segment operates through select accounts for small businesses, commercial accounts for mid-sized businesses and national accounts for large companies. Additionally, national property and other accounts serve large and mid-sized customers in the commercial transportation industry and agricultural businesses. The Bond & Specialty Insurance segment provides surety, fidelity, management, professional liability and other property and casualty insurance products. The Personal Insurance segment offers property and casualty insurance covering personal risks, primarily automobile and homeowners’ insurance to individuals. Travelers Companies distributes its products primarily through 13,500 independent agents and brokers in the United States, Canada, the United Kingdom, Ireland and Brazil. As of March 31, 2019, the company had more than $107 billion in total assets, nearly $24 billion in shareholders’ equity and delivered a 13.5% return on equity.

Best Dividend Stocks: Travelers Companies Share Price

Over the past year, Travelers’ share price has experienced significant moves in both directions. The share price came into the trailing 12-month period riding a relatively steep downtrend that began in January 2018. Initially, the share price transformed the downtrend into sideways movement in the second half of 2018. However, the overall market correction in late 2018. pushed the share price down towards its 52-week low on December 24, 2018. The Christmas Eve low of $112.63 was nearly 12% lower than the $127.59 share price from the onset of the trailing 12-month period.

However, as soon as the market correction released its downward pressure, the Travelers Companies justified its status as one of the best dividend stocks by reversing its share price trend and heading higher. The share price regained all its losses since the beginning of the trailing 12-month period by mid-February 2019 and continued rising. By the end of trading on June 14, 2018, the share price had recovered fully from the 2018 pullback to close at $150.11. This closing price marked the stocks new all-time high. In addition to marking a new peak, the June 14 closing price was 17.7% higher than it was at the beginning of the trailing one-year period and 33.3% above the 52-week low from late-December 2018. Additionally, the June 14 closing price was nearly 60% higher than it was five years ago.

Best Dividend Stocks: Travelers Companies Dividends

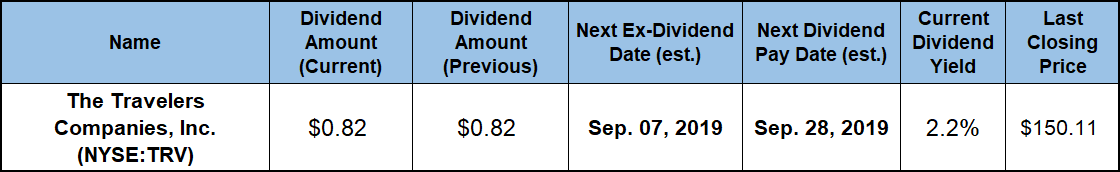

While the share price growth is significant, Travelers would not be among the best dividend stocks without a robust record of dividend income distributions. The company boosted its quarterly dividend payout 6.5% from $0.77 in the first quarter 2019 to the current $0.82 payout amount. This new quarterly distribution amount corresponds to a $3.28 annualized payout and a 2.2% forward dividend yield.

Travelers’ current yield is in line with the company’s own five-year yield average and 27% below the 3% simple average yield of the overall Financials sector. However, compared to the 1.46% simple average yield of the company’s peers in the Property & Casualty Insurance industry segment, the Travelers Companies’ current yield is nearly 50% higher.

The company has boosted its quarterly dividend payout amount at least once each year for the past 14 consecutive years. Over that period, the company enhanced its total annual distribution payout 260%, which corresponds to an average growth rate of 9.6% per year.

The combined benefits from the dividend income and asset appreciation rewarded the company’s shareholders with a total return of nearly 19% just over the trailing 12 months. The three-year total return was more than 41% and the total return over the past five years was almost 72%.

Related Articles:

3 Best Dividend Stocks to Buy Now

The 6 Best Dividend Stocks That Yield More Than 5%

Fidelity’s 5 Best Dividend ETFs

5 Best Dividend Mutual Funds to Buy Now

6 Best Dividend ETFs to Buy Now

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic