Best Dividend Stocks: PepsiCo, Inc. (NASDAQ:PEP)

By: Ned Piplovic,

PepsiCo, Inc. (NASDAQ:PEP) has become one of the best dividend stocks by offering rising dividends for nearly five decades, as well as steady asset appreciation over the past decade for double-digit-percentage total returns.

As a component of the S&P 500 Index with a market capitalization of more than $3 billion and a streak of annual dividend hikes that is nearly double the 25-year minimum requirement, PepsiCo is one of just 57 companies currently designated as Dividend Aristocrats. Furthermore, with 47 years of consecutive dividend hikes, PepsiCo is just three more annual dividend hikes away from earning a Dividend King title. Dividend Kings is an even more exclusive group of just 13 Dividend Aristocrats that have boosted annual dividends for at least 50 consecutive years.

The company’s share price has nearly tripled since a 37% drop during the 2008 financial crisis. After rising steadily and with minimal volatility, the share price experienced significant fluctuations during 2018. However, the share price stabilized and has been rising without major instabilities since the beginning of 2019.

The share price decline in December 2018 pushed the 50-day moving average to the brink of dropping below the 200-day average in early March 2019. However, the price recovery in 2019 reversed the direction of the 50-day moving average. The 50-day average continued rise and is currently more than 9% above its 200-day counterpart.

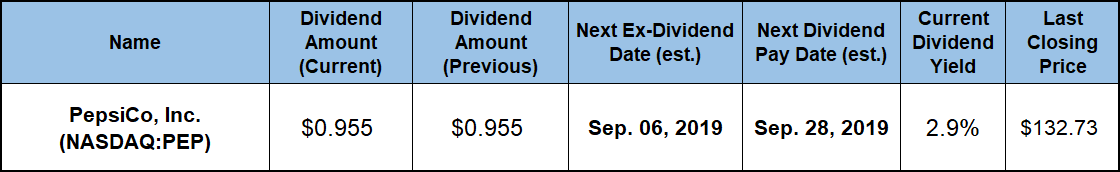

Investors interested in taking a new position — or extending their existing position — in one of the best dividend stocks should complete their own due diligence to ensure that the outlook of the PepsiCo stock aligns with their investment strategy. To claim eligibility for the next round of dividend distributions in late September, investors must establish stock ownership prior to the company’s next ex-dividend date. Based on the dividend distribution schedule over the past few years, the next ex-dividend date will most likely occur in early September.

PepsiCo. Inc, (NASDAQ:PEP)

Headquartered in Purchase, New York, and founded in 1898, PepsiCo, Inc. operates as a food and beverage company worldwide. The company’s beverage segment offers concentrates, fountain syrups, ready-to-drink tea and coffee, juices, bottled water and dairy products under multiple global and regional brands. In addition to its original beverage business, PepsiCo has been expanding its food business since the 1960s. By 2015, the company generated more than 50% of its global revenue from the food and snack business segment. On May 18, 2018, the company announced plans to delist its common shares from the Chicago Stock Exchange to eliminate costs associated with listings on two exchanges.

Best Dividend Stocks: PepsiCo Share Price

The company’s share price has been advancing steadily and with minimal volatility since losing more than one-third of its value in the aftermath of the 2008-2009 financial crisis. During the first 60 days of the trailing 12-month period, the share price gained more than 13%, but it gave back all those gains and hit its 52-week low of $105.38 by October 11, 2018. After bottoming out in early October, the share price attempted to resume its uptrend and gained 16% by the end of November but was unable to sustain the trend. Driven by the overall market correction in December 2018, the share price relinquished all gains again and dropped back to the level from the beginning of the trailing 12 months.

However, after entering the new year, the share price steadied its uptrend, recovered all losses and has been on a streak of setting new highs since mid-April 2019. The share price set its current all-time high of $133.59 on June 10, 2019, which marked a 24% gain since the onset of the trailing one-year period and a gain of more than 27% above the 52-week low from early October.

After reaching its new peak, the share price pulled back 0.6% and closed on June 14, 2019, at $132.73. This closing price was 23.3% higher than one year earlier, 26.3% above the October low and nearly 50% higher than it was five years ago.

Best Dividend Stocks: PepsiCo Dividends

While the share price growth is more moderate, PepsiCo’s dividend growth outperforms all but just a few of the best dividend stocks. Just over the past two decades, PepsiCo enhanced its annual dividend amount more than seven-fold. This advancement pace corresponds to an average annual growth rate of 10.3%. While dividend growth rates generally decline as the total payout amount rises, PepsiCo’s average annual growth rate over the past five years is still 9.7%.

PepsiCo’s most recent hike boosted the quarterly dividend amount nearly 3% from $0.928 in the previous period to the current $0.955 distribution. This new payout amount is equivalent to a $3.82 annualized amount and a 2.9% forward dividend yield. Despite steady share price growth, which pushes the yield lower, PepsiCo’s current yield is still slightly ahead of the company’s own 2.85% five-year average yield.

Furthermore, PepsiCo’s current yield is also marginally above the 2.87% simple average yield of the entire Consumer Goods sector, as well as 67% above the 1.72% yield average of all the PepsiCo’s peers in the Processed & Packaged Goods industry segment.

Some investors might see the company’s 70% dividend payout ratio over the past five years as threat to PepsiCo’s status as one of the best dividend stocks. However, the company has dropped its payout ratio to just 42% as of the June 2019 dividend distribution. The current payout ratio level is within the 30% to 50% sustainable range, which indicates that the company should be able to support continued dividend hikes over the near term

Best dividend stocks offer investors more than just long streaks of dividend hikes, and PepsiCo continues to deliver robust total returns on shareholders’ investment. Even with the share price pullback last year, the company rewarded its shareholders with a total return of nearly 30% over the trailing 12 months. The total return over the past three years is approaching 40% and the total return over the last five years exceeds 70%.

Related Articles:

3 Best Dividend Stocks to Buy Now

The 6 Best Dividend Stocks That Yield More Than 5%

Fidelity’s 5 Best Dividend ETFs

5 Best Dividend Mutual Funds to Buy Now

6 Best Dividend ETFs to Buy Now

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic